Regional perspective: Canada

J. Stell, Contributing Writer

One hundred years ago, the success of Calgary Petroleum Products Co.’s Dingman No. 1 well in Alberta changed Canada’s economy and led to the nation’s first natural gas processing plant, marking the beginning of the modern era of Canadian oil and gas exploration and processing.

The plant, built in Turner Valley approximately 60 km south of Calgary, contributed to the successful development of the Turner Valley oil field, which became western Canada’s first commercial petroleum-producer well on May 14, 1914.

Despite Canada’s long history of successful oil and gas development and production efforts, the nation has been experiencing new challenges over the past several years.

Processing issues. Firstly, its major market for exports, the US, no longer needs as much imported natural gas or NGL as it has in the past, due to the nation’s increasing development of unconventional resources. In fact, the US is Canada’s only significant foreign market for oil and gas, comprising some 98% of its petroleum exports and 100% of its natural gas exports, according to the Canadian Chamber of Commerce.

Although new gas export markets can be found throughout Asia, Canada lacks the infrastructure to move its products to the region. The country reportedly loses billions of dollars each year due to its lack of energy export transport infrastructure. As a result, NGL production levels have declined during the past decade, according to a March report by the Canadian Energy Research Institute. Fortunately, that trend has leveled off during the past few years, with industry statistics showing a slight uptick in NGL extracted per unit of gas produced. Also, a larger percentage of gas is being processed in Western Canada.

The second challenge is that excess gas processing throughout Canada is squeezing profit margins as plants operate well below their nameplate capacities.

Thirdly, some historical gas plant configurations are not efficient for processing Canada’s new rich gas plays. Not all producers have deep-cut (or ethane/light NGL extraction) plants, so more ethane is now kept in the pipeline gas stream, which is showing up at export straddle plants. Meanwhile, pentanes-plus production is declining, ethane and butane output is flat, and propane production is increasing rapidly, according to recent reports.

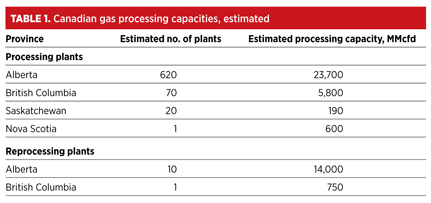

At present, Canada has ample processing capacity of approximately 30 billion cubic feet per day (Bcfd) (Table 1), along with a robust natural gas gathering and transportation pipeline network. Canada’s gas processing plants are running at a total aggregated average of 50% utilization after the 2014 spring gas plant turnaround season. Generally, gas plant turnarounds take place every four years, with operators staggering their facility turnarounds to ensure sufficient available capacity to serve upstream operators.

Specifically, Canada has more than 500 thousand barrels per day (Mbpd) of NGL extraction capacity and significant sales gas reprocessing/ethane extraction plant capacity of 14.7 Bcfd.

Meanwhile, in late 2012, Canada’s National Energy Board (NEB) released a study showing that gas production in Western Canada has fallen 15% from 2008–2012, to just over 13 Bcfd. However, the NEB forecast that production could rise to 18 Bcfd by 2035.

New projects in the pipeline. Despite these market and processing challenges, some new projects for processing Canadian gas are underway. According to David Smith, president and COO of midstream company Keyera Corp., one factor behind the buildout is that many plants in Alberta were originally built for a less-rich product blend and cannot handle today’s liquids-rich gas stream.

For example, sour gas production has been in steady decline, and the processing facilities that serve those plays are now underutilized, or, as in the recent case of the Balzac sour gas plant north of Calgary, closed down. As a result, Keyera plans to lay down new feeder pipe at its Rimbey gas plant in central Alberta and is constructing a $210-million (MM) turboexpander to enhance the recovery of ethane and other NGL.

Similar to Keyera, other Canadian gas processing companies are planning upgrades and expansions of their facilities. Not the least of these are the new liquefied natural gas (LNG) export facilities being proposed, planned or constructed at various locations. These new terminals, when completed, will present export opportunities for upstream operators and midstream gas processing companies alike, as detailed in the following sections.

AltaGas Services. This year, AltaGas Services Inc. made significant progress developing its LPG export business. The company’s AltaGas-Idemitsu joint venture (JV), which has a two-thirds ownership of Petrogas, is driving its LPG export initiative forward. Also contributing to AltaGas’ LPG portfolio is Petrogas’ acquisition of the Ferndale LPG export terminal in Washington.

AltaGas has a goal to reach 60 Mbpd of export capability through Ferndale and one other export facility by the end of the decade, according to its first-quarter 2014 operating highlights report. LPG shipments are planned to begin in the second quarter of 2014 and increase during the next few years. In addition to the Ferndale site, the JV continues the development of an LPG export terminal on the west coast of Canada. Terminal sites and refrigeration technology have been identified, and front-end engineering and design (FEED) studies are underway.

Meanwhile, AltaGas is continuing its LNG export initiative, the Triton LNG project, which received approval from the NEB on April 16 to export 2.3 million metric tons per year (metric MMtpy) of LNG.

AltaGas owns natural gas gathering and processing assets in southern Alberta, including working interests of 65% in the Parkland gas plant, 70% in the Mosquito Creek gas plant, and 5% in the Vulcan gas plant. These facilities have a gross throughput of 27 million cubic feet per day (MMcfd), 32 MMcfd and 43 MMcfd, respectively. The Parkland and Mosquito Creek sweet gas plants are interconnected through 70 km of gathering lines.

Overall, the company’s infrastructure handles more than 2 Bcfd of natural gas in Canada via its assets, which include six extraction plants, five natural gas transmission systems, three NGL pipelines, more than 70 gathering and processing facilities and a 6,500-km network of gathering and sales lines.

|

|

Fig. 1. The Dingman No. 1 well led to the development of Canada’s first gas |

Apache. In early 2013, Apache Canada Ltd. began a JV with Chevron Canada Ltd. to build and operate the Kitimat LNG project and develop shale gas resources at the Liard and Horn River basins in British Columbia. Apache and Chevron will each assume 50% ownership of Kitimat, the associated Pacific Trail Pipeline, and 644,000 gross undeveloped acres in the Horn River and Liard basins. Chevron Canada will operate the LNG plant and the pipeline, while Apache Canada will operate the upstream assets.

Kitimat LNG will be built on Bish Cove near the Port of Kitimat, about 640 km north of Vancouver, to reach LNG markets in the Asia-Pacific region (including South Korea, China and Japan), the largest importer of LNG in the world.

The Kitimat LNG project has undergone a number of ownership changes since it was first announced, and yet it remains the Canadian LNG project that is furthest along in development. Barring significant setbacks, first shipments of LNG are scheduled to begin in 2018. Once both phases of the project are completed, Kitimat will have an export capacity of 10 metric MMtpy of LNG. Going forward, Apache Corp. chairman and CEO Steve Farris suggests that the company would be open to a possible Chinese partner, such as Sinopec, joining the venture.

Additionally, after Apache’s recent success in the Glauconite play, the company’s West 5 team in the Alberta foothills is reviewing economic and production scenarios for full-field development of the formation. Such a development could lead to the drilling of more than 100 wells in the play and the expansion of Apache’s Leafland gas plant.

Arc Resources. The oil and gas company has completed construction of a new gas plant and liquids handling facility at its Parkland property in northeastern British Columbia. The plant has a design processing capacity of 60 MMcfd of gas and 8 Mbpd of liquids, including 5 Mbpd of oil and 3 Mbpd of NGL. Construction began in late 2012 and was completed in the fourth quarter of 2013. ARC will systematically bring on wells throughout 2014 to fill the new facility.

Aux Sable. Aux Sable Canada continues to be a significant contributor to Canada’s gas processing capacities. The company’s Heartland Offgas processing plant in the industrial area of Fort Saskatchewan, commissioned in September 2011, is a conventional cryogenic extraction plant that uses propane refrigeration.

The Heartland facility was the first processing plant in Alberta to produce valuable products such as hydrogen, ethane and other NGL from a refinery offgas stream supplied from Shell’s Scotford complex. The plant has a licensed capacity of 20 MMcfd.

Sited in Northeastern British Columbia, Aux Sables’ Septimus sweet gas processing facility, purchased in late 2009, was expanded from its initial capacity of 25 MMcfd to 60 MMcfd in 2011. In 2013, work began on the installation of an additional compressor to further expand the plant’s capacity.

Aux Sables’ Septimus pipeline transports sweet, liquids-rich gas from the Septimus facility to the Alliance Pipeline for downstream processing at Aux Sable’s Channahon NGL extraction and fractionation facility. The pipeline was constructed and sized to accommodate potential future volumes from the liquids-rich Montney gas play.

Encana. The company signed an agreement with a third party to invest $244 MM to expand its Resthaven plant’s gas processing and NGL extraction capacity by an additional 200 MMcfd in two phases. Completion of the first phase is expected in mid-2014. The plant is sited in west-central Alberta.

Encana Corp. has a 70% ownership interest in the Resthaven gas plant, which has a processing capacity of about 100 MMcfd (net 70 MMcfd to Encana). Encana has additional processing capacity of about 85 MMcfd at other gas processing plants in the area.

Also, Encana has a processing capacity of 235 MMcfd at its Musreau plant under an eight-year commitment. Musreau’s deep-cut facility was commissioned in February 2012, and it has a net liquids production of approximately 5.5 MMbpd after royalties.

In 2011, Encana began the initial steps to establish a strong position in Canada with its $1.1-B investment in the development of the Cabin gas plant in the Horn River basin in northeastern British Columbia, which has growth potential from future development.

Ferus Natural Gas Fuels. In late April, Ferus acquired Encana’s 50% share in the proposed Elmworth, Alberta LNG plant. The Elmworth plant is a 190,000-liter/day LNG production facility that will retain key Encana technical and management personnel. As a result of this transaction, Ferus is the 100% owner/operator of the largest merchant LNG plant in Canada, with plans for future expansion.

Phase 1 of the Elmworth LNG facility became operational in May 2014. The plant is in close proximity to the active Alberta-British Columbia Deep basin oil and gas region, and it will produce LNG for use in drilling rigs, pressure-pumping services and heavy-duty trucks.

Keyera. In January, Keyera Corp. began an expansion of its NGL fractionation and storage facility in Fort Saskatchewan. The project will involve more than doubling the facility’s existing C3+ fractionation capacity from 30 Mbpd to 65 Mbpd. The project, which will include new product receipt facilities, operational storage, and pipeline interconnections, has an estimated total gross cost of $220 MM. Detailed engineering work is ongoing, with completion targeted for the first quarter of 2016.

The new fractionator will process a C3+ mix stream of NGL (propane, butane and condensate) in addition to a deethanizer project that will fractionate 30 Mbpd of a C2+ mix stream (ethane, propane, butane and condensate).

|

|

Fig. 2. The sun rises over the Ricinus gas plant in Apache Canada’s West 5 |

Pembina. In mid-May, Pembina Pipeline Corp. reached binding commercial agreements to begin construction of a new 55-Mbpd propane-plus fractionator, called RFS III, at its existing Redwater fractionation and storage complex. It also began work on a new high-vapor-pressure pipeline lateral that will extend the gathering potential of its Brazeau Pipeline in the Willesden Green area of south-central Alberta.

The $400-MM RFS III fractionator, which is supported by long-term “take-or-pay” contracts with multiple producers, will be the third fractionator at Pembina’s Redwater complex and will leverage the design and engineering work completed for Pembina’s RFS I and RFS II fractionators.

RFS I, with an operating capacity of 73 Mbpd, will be debottlenecked to bring capacity to 82 Mbpd in the fourth quarter of 2015. When combined with RFS II, which is expected to come into service at the same time, the company’s fractionation capacity will nearly double to 155 Mbpd. With the addition of RFS III, Pembina’s fractionation capacity will total 210 Mbpd, making the Redwater complex the largest fractionation facility in Canada.

The site will be designed to accommodate a deethanizer tower, which will allow a capacity of 73 Mbpd and bring the total capacity at Redwater to 228 Mbpd. Subject to regulatory and environmental approval, Pembina expects RFS III to be in service by the third quarter of 2017.

At present, Pembina’s Redwater West NGL system includes the Younger extraction and fractionation facility in British Columbia; a 73-Mbpd fractionator, 6.8 MMbbl of cavern storage and terminal facilities at Redwater, Alberta; and third-party fractionation capacity in Fort Saskatchewan, Alberta. Also located at the Redwater facility is Pembina’s rail-based condensate terminal, which serves the heavy oil industry’s need for diluent. Pembina’s condensate terminal is the largest of its size in western Canada.

Elsewhere, Pembina’s Empress East NGL system includes a 2.1-Bcfd interest in the straddle plants at Empress, Alberta, along with 20 Mbpd of fractionation capacity and 6 MMbpd of cavern storage in Sarnia, Ontario. The Empress East system extracts NGL mix from natural gas at the Empress straddle plants. NGL mix is also purchased from other producers and suppliers. Ethane and condensate are generally fractionated out of the NGL mix at Empress and sold into Alberta markets.

The remaining NGL mix, consisting primarily of propane and butane, is shipped on Pembina’s 50%-owned Kerrobert pipeline to third-party pipelines for transport to Sarnia, Ontario, where it is then fractionated into specification products.

Petronas and Japex. The two companies plan the Pacific NorthWest LNG complex on Lelu Island in Port Edward, British Columbia. At its completion, the three-phase project will have a cumulative capacity of 18 MMtpy, requiring a feedrate of 2 Bcfd. First shipment is expected in 2018.

Shell Canada. In March, Qatar Petroleum International and Centrica Plc formed a partnership, known as CQ Energy (CQE) Canada Partnership, to acquire a package of natural gas assets from Shell Canada in the Foothills region of Alberta. As part of the transaction, Shell will receive CQE’s interest in the Burnt Timber gas processing plant and its interest in the Waterton undeveloped lands in southwest Alberta.

Shell Canada is the major owner and operator of the Burnt Timber complex, which includes a gas processing plant, six compressor stations, and operations for seven gas fields. Burnt Timber is one of four Shell gas complexes in southern Alberta, contributing to a combined overall production average of 300 MMcfd of gas.

Elsewhere, Shell’s Groundbirch venture includes five gas processing plants, more than 250 wells, and more than 900 km of pipeline. Groundbirch is still being explored, so the current drilling program includes a mix of single-well and multiple-well pads. Eventually, most of the wells will be drilled on pads containing up to 26 wells, with two such pads for every 3 square miles of land.

Future prospects. Despite the challenges faced by Canada’s gas processing operators, the industry segment continues to expand and to supply its nation, and the US, with much-needed oil and gas products. Going forward, as proposed and planned LNG export capacities come onstream, Canadian gas processors are expected to see an uptick in both expansions and future profits. GP

Comments