Boxscore Construction analysis

L. Nichols, Director, Data Division

Lee.Nichols@GulfPub.com

Papua New Guinea sits atop vast, untapped reserves of natural gas. These fields are located mainly in the western and southern highlands of the country. Exploration and production activities are taking place to monetize these vast reserves. Oil and gas companies, such as ExxonMobil and Total, are in the midst of extracting these resources and working to develop major LNG terminal projects for export to Asian markets.

Australian oil and gas company Horizon Oil, along with partners Talisman Energy, Mitsubishi Corp. and Osaka Gas, will develop natural gas resources in the country’s Western Province. In April, the group’s Stanley gas condensate development project was approved by the Papua New Guinea National Executive Council.

The $300 million (MM) development will produce 140 MM cubic feet per day (MMcfd) of gas from two wells, enable the extraction of over 4,000 bpd of condensate, and facilitate the potential production of 40 tpd of liquefied petroleum gas (LPG).

Additional exploration activities will reveal if ample natural gas exists to warrant the construction of an LNG facility. First production from the Stanley field was expected in early 2014.

Other companies, such as Indonesia’s state-owned oil and gas corporation, Pertamina, have announced investment studies for exploration activities in the country. In June 2013, Pertamina signed a memorandum of understanding (MOU) with Papua New Guinea’s National Petroleum Co. of PNG (NPCP) for joint cooperation in the oil and gas sector. Pertamina will conduct studies on the potential to develop oil and gas resources near the two countries’ shared border.

Cott Oil and Gas Ltd. and Talisman are looking into the use of a floating LNG (FLNG) vessel to develop their offshore Pandora gas and condensate field. The Pandora gas fields are located approximately 200 km west of Port Moresby in the Gulf of Papua. Onshore, Cott Oil and Gas has ownership in multiple oil and gas exploration activities in the country’s Western Province.

Talisman is targeting 2 trillion cubic feet (Tcf)–4 Tcf of gas in Papua New Guinea’s Western Province. In 2014, Talisman plans to complete drilling on its Manta-1a well, drill an additional two exploration wells, drill two development wells related to the Stanley development, and continue seismic acquisition across various blocks to identify prospects for future drilling.

Additionally, two major LNG projects will add almost 15 million tons per year (MMtpy) of new LNG processing capacity to the island nation. The ExxonMobil PNG LNG project, which will be completed in June, and Total-InterOil’s Gulf LNG project, are integral in transforming Papua New Guinea into a major LNG-exporting country.

PNG LNG. The mega-project is being developed by ExxonMobil. Additional project stakeholders include Oil Search Ltd., National Petroleum Co. PNG, Santos, JX Nippon Oil and Gas Exploration Corp., Mineral Resources Development Co. and Petromin PNG Holdings Ltd.

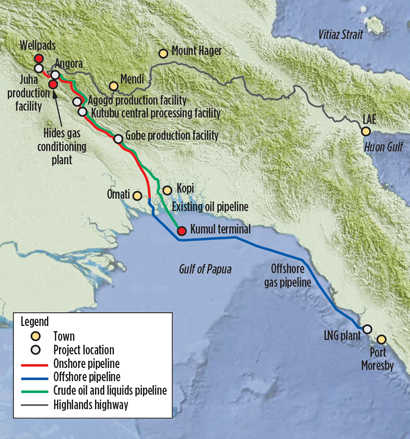

The $19 billion (B) integrated project aims to commercialize large natural gas resources located in the western and southern highlands of the country. Natural gas from the Hides, Angore and Juha fields, as well as associated gas from the operating oilfields of Kutubu, Gobe, Agogo and Moran, will supply feedstock for the 6.9-MMtpy Port Moresby LNG terminal.

The project began to materialize in 2007 when a 3,000-km pipeline to customers in Australia was deemed not to be feasible. ExxonMobil then turned to the concept of LNG exports. In early 2008, a joint operating agreement was signed by the project partners, and, by June of that year, the project moved into the front-end engineering design (FEED) phase.

After 26 supporting studies that took two years to complete, the 6,000-page environmental impact statement was approved by the Papua New Guinea government. In December 2009, the project was greenlighted for construction.

The large-scale, capital-intensive project includes not only upstream exploration and production installations, but also the construction of more than 700 km of pipeline, a gas conditioning plant, an LNG terminal and an airstrip, among other facilities (Fig. 1).

|

|

Fig. 1. The PNG LNG project will include upstream installations, more than 700 km |

Gas and condensate from the Hides and Angore fields will be sent to the newly built Hides gas conditioning plant. The plant has the ability to process up to 960 MMcfd of gas. The Hides plant will separate the gas and condensate and export them via separate pipelines. The condensate will travel 109 km to the Kutubu central processing facility. There, it will be mixed with oil and transported through an existing pipeline to the Kumul terminal for delivery to oil tankers for export.

The conditioned gas will be transported 292 km to the Omati River, where it will be loaded into an offshore pipeline. The gas will then travel an additional 400 km to the Port Moresby LNG plant, which lies 20 km northwest of Port Moresby.

The gas will be converted to LNG via two 3.45-MMtpy parallel processing trains. First LNG was originally expected to be produced in June, but ExxonMobil announced in April that Train 1 was ahead of schedule and already in production. First cargo is expected to be shipped mid-year 2014. Train 2 is expected to be fully operational by early June.

The LNG will be stored in two 160,000-m3 tanks. From storage, the gas will be piped along a 2.4-km marine jetty before being loaded onto tankers for export to the LNG-thirsty Asia-Pacific region. Long-term supply contracts have already been signed with China Petroleum and Chemical Corp. (Sinopec), Osaka Gas Co., Tokyo Electric Power Co. and Chinese Petroleum Corp. Combined, these companies’ contracts account for nearly 95% of PNG LNG’s total output.

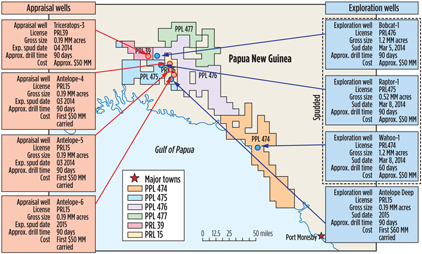

Gulf LNG. InterOil’s exploration activities include nearly 4 MM acres in the south of the country (FIG. 2). The area is divided into four petroleum prospecting licenses (PPLs) and two petroleum retention licenses (PRLs). This exploration activity is one of the largest drilling programs in the history of Papua New Guinea.

|

|

Fig. 2. InterOil’s exploration activities in southern Papua New Guinea. |

The $7 B Gulf LNG project has the potential to become Papua New Guinea’s second mega-scale LNG project and a direct rival to ExxonMobil’s PNG LNG project. Total, InterOil and Oil Search will develop the project. Gulf LNG calls for the development of the giant Elk and Antelope gas fields (PRL 15) and the construction of Papua New Guinea’s second LNG export terminal. With estimated gas reserves of over 5 Tcf and over 75 MM barrels of associated liquids, these fields collectively represent one of the region’s largest gas discoveries in 20 years.

Gas and condensate from the fields will be sent to a central processing facility. From there, the products will be sent via pipeline to the Gulf LNG plant, which will be located directly north of Port Moresby. The terminal will initially include two 4-MMtpy LNG trains. Total capacity could rise to 12 MMtpy if a third train is added in the future. The terminal will consist of liquefaction facilities, a storage tank farm, an LNG export terminal, an offloading system, offsites and utilities.

Just two years ago, Gulf LNG’s future looked dim. InterOil almost lost the project due to a dispute with the Papua New Guinea government over the project’s export capacity. The original 2009 project agreement plan required InterOil to develop a multi-train LNG terminal with a processing capacity of 7.6 MMtpy, with the option to expand capacity to 10.6 MMtpy.

However, InterOil’s plans eventually shifted toward two LNG projects instead of one. The new plan called for the construction of a 2-MMtpy FLNG vessel and a 2-MMtpy onshore LNG plant. The Papua New Guinea government argued that the new export contract was a breach of the 2009 project agreement.

The dispute was eventually resolved under new conditions calling for the construction of two separate LNG trains, but with a minimum processing capacity of 3.8 MMtpy. InterOil was also required to involve an experienced operator to run the upstream installations. The company found that operator in December 2013 when it signed a deal with French oil and gas major Total. The agreement shot a breath of life into the project, allowing it to continue.

Negotiations between the two companies were finalized in April. The final financial decision is expected to come in 2016, with first sales and operations scheduled to begin in 2020. GP

Comments