Boxscore Construction Analysis

A. Blume, Managing Editor

Adrienne.Blume@GulfPub.com

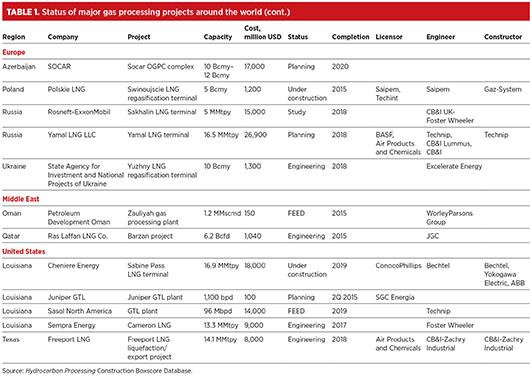

Major gas processing and LNG projects are in progress in every world region, as shown in Table 1. Growing gas markets, such as Africa and Asia-Pacific, will benefit from additional processing capacity and new infrastructure. Meanwhile, mature markets, like the US, Canada and Europe, will see construction of new processing projects to capitalize on shale gas volumes from North America and new conventional gas resources elsewhere. Several LNG and floating LNG (FLNG) facilities are in development around the world, as discussed below.

In Africa, Eni SpA and Anadarko Petroleum Corp. are developing the world’s second-largest LNG plant in Cabo Delgado, Mozambique. The initial plan includes four liquefaction trains consisting of 5 million tons per year (MMtpy) each. The project has the potential to expand to 10 trains with a total export capacity of 50 MMtpy.

In Tanzania, Ophir Energy originally planned to construct an onshore LNG terminal in 2012, but it has switched its focus to a floating facility after it found additional reserves in its offshore blocks.

Floating LNG in Asia-Pacific is at a head start, with Petronas planning two FLNG vessels offshore Malaysia. PFLNG 1 is designed for a lifespan of 20 years and will enable Petronas to monetize its upstream stranded gas assets and eliminate substantial costs required in the construction of fixed infrastructure, such as subsea pipelines to shore. The project is expected to be completed in the fourth quarter of 2015. PFLNG 2 will be moored at the Rotan gas field offshore Sabah and is scheduled to produce 1.5 MMtpy of LNG from early 2018.

In Canada, the Kitimat LNG project is undergoing front-end engineering and design (FEED) and early site works. Environmental approvals are in place, as is a 20-year export license from the Canadian government. The proximity of Kitimat LNG to the existing natural gas transmission infrastructure is one of the advantages of this project and ensures supply is readily accessible to the facility. Kitimat features a deep, active port and easy access to both the West Coast energy corridor and the Asia-Pacific LNG market.

Elsewhere in Canada, the Pacific Northwest LNG project will process shale gas produced from British Columbia’s North Montney region into LNG from 2019, making it the first planned LNG export facility on the country’s east coast.

In Europe, Poland’s Swinoujscie LNG terminal will enable the regasification of 5 billion cubic meters per year (Bcmy) of gas. In the next stages, it will be possible to increase the dispatch capacity up to 7.5 Bcm, without the need to increase the area on which the terminal will be constructed. Poland hopes this terminal will become a future natural gas trading hub for central and northern Europe, and that it will diversify its sources of energy away from Russia.

However, Russia has LNG aspirations of its own. The country and ExxonMobil have agreed to jointly study the possibility of building an LNG export terminal from their joint Sakhalin 1 oil and gas project off Russia’s Pacific coast. The project’s significance is that it could challenge Gazprom’s monopoly on Russian gas exports. If built, production could start in 2018.

In Ukraine, the in-progress Yuzhny LNG regasification terminal could accept deliveries of gas from several suppliers, including the US. Support is building for exports of gas from the US’ growing shale resources to Ukraine, which normally receives gas imports by pipeline from Russia.

The Middle East will see the construction of a new LNG terminal within the next two years—Ras Laffan LNG Co.’s Barzan project in Qatar. The project includes onshore and offshore developments. The first train is scheduled to come online this year, and the second train is planned for 2015.

Lastly, the US has a number of planned LNG projects in the works to capitalize on robust shale gas resource development. Among these projects, Cheniere Energy Inc. has filed with the Department of Energy for two additional LNG trains (trains 5 and 6) at its Sabine Pass LNG project in Louisiana. Together, the two trains would add 9 MMtpy of capacity. Total capacity will be 25 MMtpy–27 MMtpy if all applications are approved; the project is scheduled to be commissioned in 2015.

Also in Louisiana, Sempra Energy’s Cameron LNG project will make use of existing facilities, including two marine berths capable of accommodating Q-Flex-sized LNG ships, three LNG storage tanks with a combined storage capacity of 480 Mcm, and regasification capacity of 1.5 Bcfd. The completed facility will have three liquefaction trains with a nameplate capacity of approximately 4.5 MMtpy each. In addition, a 21-mile natural gas pipeline, a compressor station and modifications to existing pipeline interconnections have been proposed. GP

Comments