Boxscore Construction Analysis

L. NICHOLS, Director, Data Division

Lee.Nichols@GulfPub.com

As natural gas becomes the fastest-growing fossil fuel, the world has entered a “golden age” for gas. Growth on both the supply and demand sides has resulted in the announcement of billions of dollars of capital investment across the globe. This includes the construction of LNG export and receiving terminals, pipelines and storage facilities, and large investments in the exploration and production sector.

These capital investments are necessary to supply forecast demand for natural gas. The US Energy Information Administration (EIA) forecasts that global gas consumption will increase annually to 185 trillion cubic feet (Tcf) by 2040. This increase is led by strong growth in non-OECD countries, which collectively account for more than 70% of the total growth in natural gas production to 2040.

With the sharp increase in natural gas demand over the next 30 years, countries are taking the necessary steps to monetize this valuable resource. Australia has invested over $160 billion (B) on LNG export terminal construction. However, spiking labor costs and project cost overruns have threatened Australia’s position.

The US, meanwhile, is planning the construction of over 210 million tons per year (MMtpy) of LNG export capacity. Five LNG export terminals have been approved by the US Department of Energy as of the time of publication.

Russia, which holds the world’s largest natural gas reserves, has announced plans to capitalize on its abundant resource. Russia aims to produce at least 40 MMtpy of LNG by 2020. This would raise Russia’s global LNG market share from 5% to 11% in just six years. Over $70 B will be spent on the construction of domestic LNG export terminals at Pechora, Sakhalin, Vladivostok and Yamal. Canada is also developing its LNG export portfolio, with multiple LNG export terminals planned on the country’s west coast in British Columbia.

Lastly, major offshore finds in East Africa have the potential to change the dynamics of the African gas market. These future development plans have the ability to create the largest LNG export terminal in the world, as well as to establish a new African global gas hub.

Africa

Gas production in Africa surpassed 210 billion cubic meters (Bcm) in 2013, and production is expected to double to over 400 Bcm by 2040. Even with increased production, natural gas consumption in Africa accounts for a little over half of the region’s supply. With hefty development and production plans in place, exports will play a vital role in the African gas industry. Installed LNG export capacity equals just over 70 MMtpy.

However, most of Africa’s liquefaction terminals are under-utilized, with many terminals exporting only half of the production from their total installed capacity. Despite this fact, new offshore discoveries have boosted the need for new LNG facilities. These discoveries, however, are not in North Africa or West Africa, which have traditionally been the frontiers of gas production in Africa, accounting for more than 90% of the continent’s overall production.

Major finds in East Africa, specifically in Mozambique and Tanzania, have opened a new chapter in Africa’s gas industry. From exploration and production activities to onshore mega-LNG export terminals, East Africa has become a hotbed for large capital investments. With both countries accounting for nearly 90 Tcf of recoverable gas resources, East Africa has the potential to become a major global gas hub.

Mozambique

The country is one of two (the other being Tanzania) in East Africa that produces natural gas. Hydrocarbon resources are located in large sedimentary basins onshore at Pande, Buzi and Temane, and offshore in the Rovuma basin. The Rovuma basin holds the key to unlocking the countries’ gas exporting future.

The Rovuma basin began attracting attention in 2010, after several major gas discoveries were made. Traditionally, the majority of natural gas produced in Mozambique has been exported to South Africa via the 535-mile Sasol Petroleum International Pipeline. The remainder, approximately one-tenth of total production, was consumed domestically. However, the new, large gas discoveries and proposed LNG export terminal will provide Mozambique with the ability to export its abundant gas resources to Europe or Asia.

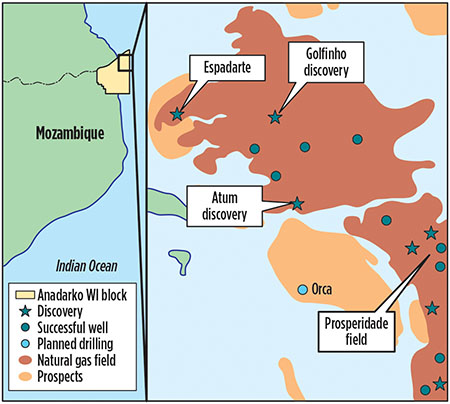

Exploration of the Rovuma basin is led by US-based Anadarko Petroleum Corp. and Italian oil and gas company Eni. Both entities have offshore activities in license areas dubbed Area 1 and Area 4. Anadarko, in partnership with Mitsui E&P, Mozambique’s Empresa Nacional de Hidrocarbonetos (ENH), BPCL Ventures, ONGC Videsh, Videocon and PTT Exploration and Production, operates in Area 1. Offshore Area 1 encompasses approximately 2.6 MM acres in northern offshore Mozambique. The first major discovery was made by Anadarko in the Windjammer exploration well in February 2010. This find spurred multiple exploration activities to locate additional recoverable reserves. The Prosperidade field holds approximately 17 Tcf to 30 Tcf of natural gas, and the Golfinho-Atum complex holds 15 Tcf to 35 Tcf of recoverable gas resources (FIG. 1). Since 2010, these locations have resulted in some of the world’s largest gas discoveries.

|

|

Fig. 1. Major fields and discoveries in offshore Mozambique Area 1. |

Eni, in partnership with China National Petroleum Corp. (CNPC), Galp Energia, Kogas and ENH, operates in Area 4. This area contains the Mamba and Coral fields. Together, both fields account for roughly 75 Tcf of gas in place. With the addition of Anadarko’s discoveries, Mozambique presently has enough gas to support the construction of major LNG infrastructure projects. This scenario has spurred Mozambique to develop East Africa’s first LNG export facility.

Anadarko and Eni are in the early stages of designing the onshore LNG export terminal. The Mozambique LNG project will be located in the Afungi peninsula area of Cabo Delgado province. The location was recommended after the completion of a pre-front-end engineering and design (pre-FEED) study conducted by KBR and Technip. The 20-MMtpy terminal will consist of four 5-MMtpy liquefaction trains. The total cost is expected to reach $15 B. Phase 1 of the project is expected to be completed in 2018; however, due to infrastructure constraints, a more realistic timetable for operation is sometime after 2020.

Future expansion plans call for the construction of a total of 10 trains. Sendout capacity could reach 50 MMtpy if all trains are built. Total capital expenditures for drilling and the onshore LNG export facility could eclipse $50 B. If the 10 trains are completed, the Mozambique LNG project would become the world’s largest LNG export terminal.

Competitive FEED contracts are scheduled to be awarded in early 2014. A joint venture (JV) of CB&I and Chiyoda, along with a JV of JGC and Fluor, and Bechtel are in competition for the contract. The winner of the contract will be awarded the engineering, procurement and construction (EPC) contract for Trains 1 and 2. The contract award will require approval by the Mozambique government.

Eni is also considering the use of a floating liquefied natural gas (FLNG) vessel. This alternative plan would consist of a 2.5-MMtpy FLNG project to process gas from Eni’s Area 4 operations. The smaller-scale processing plan for monetizing gas assets would be more cost-effective than building an onshore terminal, and it would avoid onshore logistical hurdles. Eni is considering this alternative route with project partners CNPC and Galp Energia. A final investment decision is expected to be made in 2014.

Tanzania

As in Mozambique, major offshore gas discoveries in Tanzania have spurred multiple intensive capital expenditure exploration and production activities. Major gas fields include onshore and offshore Songo Songo Island, located off the coast of Tanzania, and the Mnazi Bay Concession located in southeastern coastal Tanzania in the Rovuma basin. Gas production from this field fuels 70% of Tanzania’s electricity generation. Gas is transported via pipeline to the Mtwara power plant to be used in electricity generation for local communities.

Recent gas discoveries have boosted Tanzania’s potential to become a major natural gas exporter. The BG Group, in partnership with Ophir Energy, along with Statoil, in partnership with ExxonMobil, are leading exploration activities in offshore Tanzania. BG Group and Ophir have made several discoveries totaling more than 15 Tcf of recoverable gas resources. ExxonMobil and Statoil have made their own finds of more than 12 Tcf of recoverable gas.

To capitalize on this resource, BG and Statoil are planning to construct a 10-MMtpy LNG export terminal. The $15 B Tanzania LNG project’s location and concept are expected to be finalized in the third quarter of 2014. Tanzania has rejected all proposals for offshore terminals, as government officials want the terminal to be built onshore to benefit the domestic economy. The most likely location is the southern Lindi region.

After the location is finalized, the project is scheduled to move into FEED by the second quarter of 2015. A final financial decision is expected by the third quarter of 2016; EPC contract awards are expected within that year as well. The facility is anticipated to export its first LNG cargo by 2021.

Africa goes for the gold

Recent gas discoveries in Mozambique and Tanzania are changing the dynamics of the East African gas sector in this “golden age of gas.” Development plans are propelling the region into the global LNG exporting sector—a place it has never been before.

Both countries will have stiff competition from suppliers like Australia, Canada, Qatar, Russia and the US—all of which are investing to monetize their domestic gas resources. As the race for global LNG market share quickens, Mozambique’s and Tanzania’s ability to compete on the global stage will soon be tested. GP

|

LEE NICHOLS is director of Gulf Publishing Company’s Data Division. He has five years of experience in the downstream industry and is responsible for market research and trends analysis for the global downstream construction sector. At present, he manages all data content and sales for Hydrocarbon Processing's Construction Boxscore Database, as well as all corporate and global site licenses to World Oil and Hydrocarbon Processing.

Comments