Boxscore Construction Analysis

Natural gas is the world’s fastest-growing fossil fuel. The US Energy Information Agency (EIA) forecasts that global gas consumption will increase annually to 170 trillion cubic feet (Tcf) by 2035. This increase is led by strong growth in non-Organization for Economic Cooperation and Development (OECD) countries. To meet expected consumption rates, gas producers will need to increase supplies by almost 60 Tcf by 2035. In response to this surging demand, new project development and major capacity expansions are underway in all parts of the globe.

Part 1 of this outlook reviewed major gas processing projects in the US, Canada, Africa and Latin America. Part 2 examines notable construction activities in Europe, Asia-Pacific and the Middle East.

Europe. This region is the second-largest gas market in the world, but it may be overtaken by Asia-Pacific by 2015. Natural gas production in Europe’s OECD countries is in decline, and development of unconventional gas reserves is not likely to happen in the near future. This has forced European nations to become more dependent on liquefied natural gas (LNG) imports. Conversely, non-OECD countries, primarily Russia, will see a dramatic rise in LNG terminal construction.

Russia. Russia contains nearly 21% of all proven natural gas reserves in the world. With the emergence of global LNG trade, Russia is keen to develop its LNG export capacity. Four major LNG terminal projects have been planned—Vladivostok, Yamal, Pechora and Sakhalin.

The Vladivostok, Yamal and Pechora LNG projects are being developed by Russian state-owned energy company Gazprom. Combined, these projects represent over 27 million tons per year (MMtpy) in LNG capacity expansions totaling more than $14 billion (B) in investment. The Vladivostok plant is part of Gazprom’s Eastern Gas Program. Gas from Russia’s Far East fields will be transported via pipeline to the plant. Development of the new fields and construction of the pipeline are expected to cost $40 B.

The $1.5 B Yamal LNG project will be developed in three phases, each consisting of 5.5 MMtpy. The feasibility study for the $4 B Pechora LNG project was completed in 2Q 2013. The Pechora project consists of the development of the Kumzhinskoy and Korovinskoye fields, the development of a gas transport infrastructure, and the construction of the Pechora LNG terminal and a gas treatment plant. A final investment decision is still being made. One plan explores the possibility of using a floating liquefied natural gas (FLNG) vessel instead of an onshore terminal.

|

|

Fig. 1. Aerial view of Sakhalin. Photo courtesy of Gazprom. |

Sakhalin is home to Russia’s only LNG terminal, owned by Gazprom (Fig. 1).

A new, $15 B Sakhalin LNG terminal is being developed by ExxonMobil and Russian state-owned energy company Rosneft. The 5-MMtpy terminal might be the most significant LNG project in the country since Gazprom is the only state firm legally allowed to sell gas supplies abroad; the Sakhalin project directly challenges Gazprom’s gas export monopoly. Russian President Vladimir Putin has announced a gradual end to Gazprom’s gas export monopoly by allowing LNG exports from other companies, but the government has expressed no movement on Gazprom’s monopoly via gas pipelines. If approved, the Sakhalin LNG terminal will begin operations in 2018, the same year as Vladivostok’s commissioning. This would put state agencies in direct competition for market share in China, Japan and South Korea.

Ukraine and Poland. Both countries are constructing LNG terminals to reduce dependency on Russian gas imports. The $2 B Ukraine LNG terminal will be located on the Black Sea near Odessa. The 10-billion-cubic-meters-per-year (Bcmy) terminal will be constructed in two phases, each consisting of 5 Bcmy. Ukraine will use Excelerate Energy’s 5-Bcmy FSRU while the onshore terminal is being constructed. Completion of both phases is scheduled for 2016. Once operational, the terminal will reduce by 20% the price Ukraine pays for imported gas from Russia.

The Swinoujscie LNG terminal is Poland’s first LNG project. The $1.2 B project is located at Swinoujscie on Poland’s Baltic coast. The 5-Bcmy terminal is being constructed by a Saipem-led consortium, and completion is scheduled for 2015.

Uzbekistan. Uzbekneftegaz National Holding Co. and a Korean consortium are constructing the $4 B Ustyurt Gas Chemical Complex (GCC). The deal has the largest project financing in Central Asia, and it is the largest gas chemistry project in the Commonwealth of Independent States. The complex will process 4 Bcmy of gas and gas condensate extracted from the Surgil field. Ustyurt GCC will produce 4 Bcmy of marketable gas and petrochemicals. Completion is scheduled for 2016.

France. EDF is constructing the largest regasification facility in continental Europe. The $1.3 B Dunkirk LNG terminal will have a capacity of 13 Bcmy. Located in northern France, the terminal will supply EDF’s nuclear plants with gas. The project is led by Dunkerque LNG, a consortium of EDF (65%), Fluxys (25%) and Total (10%). Completion is slated for 2015.

Asia-Pacific. Asia is forecast to become the world’s second-largest gas market by 2015. The International Energy Agency (IEA) expects Asian LNG consumption to annually increase to 790 Bcm in the same year. Within that time, Southeast Asia is scheduled to construct a dozen import terminals, resulting in over 35 Bcm of additional capacity.

India. According to India’s 12th five-year plan, domestic natural gas demand should triple by 2017. At present, Indian gas production meets only half of domestic demand. Coupled with this scenario, Reliance Industries Ltd. and Oil & Natural Gas Corp. have reported falling output from their offshore blocks. This comes at a time when demand from gas-consuming industries, such as power and fertilizer, is rising steadily. Consequently, India must import gas, mainly as LNG, to meet domestic demand.

LNG demand is forecast to grow 5%–6%/yr until 2020. India has only three LNG terminals—Shell’s Hazira, Petronet’s Dahej and GAIL’s Dabhol. All three have announced plans to increase capacity by 2020. India has also proposed over a dozen LNG terminal projects in the next five years. These plans include floating storage and regasification units (FSRUs), such as Shell and Reliance’s FSRU, and AP Gas Distribution Corp. and GDF Suez’s FLNG vessel offshore of Kakinada. By 2014, LNG is anticipated to account for 50% of India’s total gas consumption.

Malaysia. The first construction phase of the $1.3 B Pengerang Independent Deepwater Petroleum Terminal (PIDPT) is set for completion in 1Q 2014. This bidirectional LNG terminal will be the second constructed in Asia. Singapore LNG commissioned Asia’s first bidirectional LNG terminal in 2Q 2013.

Additionally, Petronas is constructing a ninth LNG production train at its Bintulu complex. The new LNG train will add 3.6 MMtpy of capacity. Once completed, the Petronas LNG complex will have a combined capacity of over 27 MMtpy, creating one of the world’s largest LNG production facilities at a single location. Petronas has also announced plans to construct two FLNG vessels to extract natural gas from wells located offshore of Sarawak.

Malaysia is also set to commission the world’s first LNG regasification unit located on an island jetty. The 3.8-MMtpy Melaka terminal is located approximately 3 kilometers offshore of Sungai Udang Port. Two floating storage units will receive and store LNG; the facility has subsea and onshore pipelines connected to the Peninsular Gas Utilization pipeline network. Melaka is expected to receive its first LNG cargo in August 2013.

Indonesia. Indonesia is striving to increase LNG export capacity with BP’s Tangguh LNG expansion project and Mitsubishi Corp., Pertamina and Medco’s joint-venture (JV) Donggi-Senoro LNG project. Combined, these projects will add 6 MMtpy of LNG capacity by 2018, at a cost of $15 B. However, the Tangguh expansion project’s third train has been delayed due to environmental concerns and a conflict in revenue-sharing.

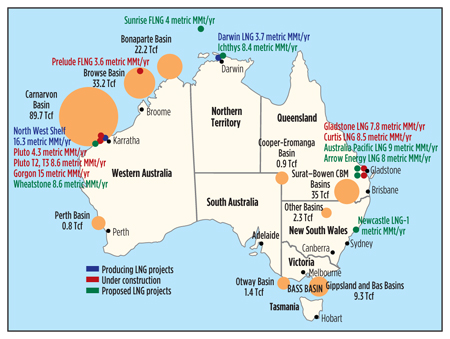

Australia. The country is focusing on large gas projects such as Gorgon, Prelude, Wheatstone, Ichthys, Scarborough, Queensland Curtis LNG, Gladstone LNG and Australia Pacific LNG (Fig. 2). Downstream investments total about $180 B in LNG terminal construction and an additional $85 B in floating processing projects, such as FLNGs. Almost 20 LNG export terminals are either planned or under construction, with estimated completion by 2017. This development has put Australia on track to overtake Qatar as the world’s leading LNG exporter by the end of the decade.

|

|

Fig. 2. Overview of Australian LNG projects. |

The cost of doing business in Australia is a growing challenge, however. Labor costs alone have increased by 30%–50%, and many LNG projects have seen major cost overruns. This could have a dramatic effect on whether additional projects are greenlighted, delayed or canceled.

Japan. As the world’s largest importer of LNG, Japan has a great need for natural gas to fuel its power requirements. LNG has played a major role in supplying energy to the country as it weans off of nuclear power following the March 2011 earthquake and tsunami and resulting Fukushima nuclear disaster. LNG imports to Japan reached 87 MMt in 2012, although the volume has declined in 2013. Imports could fall even further if Japan agrees to restart a dozen nuclear reactors, or if it adds coal-fired power plants to produce electricity more cheaply than gas-fired plants.

China. LNG imports reached 15 MMt in 2012 and are expected to double by 2015. To prepare for this increase, China has planned 15 new import terminals for completion by 2020. However, these predictions could change if China develops its domestic shale gas reserves. According to the US EIA, China has greater shale gas reserves than does the US, although exploiting them will not be an easy task since extraction is more difficult in Chinese shale plays due to low organic content. Producers will need to drill additional and deeper wells to equal US production.

Due to the looming threat of supply shortages, China is investing over $13 B to construct two dozen underground gas storage (UGS) tanks by 2015. To date, China’s gas storage capacity equals about 2% of the nation’s consumption, which is much lower than the global average storage capacity of 12%. China will also focus on LNG storage expansion where UGS construction is not feasible.

Papua New Guinea. ExxonMobil will complete the $19 B PNG LNG project in 2014. Located at Port Moresby, the project will consist of a two-train LNG plant able to produce 6.9 MMtpy of LNG for export. The integrated project includes gas production and processing facilities in the Southern Highlands Province and Western Province of Papua New Guinea, two 160-thousand-cubic-meter (Mcm) LNG storage tanks and associated facilities.

Middle East. This region holds more than 40% of the world’s proven natural gas reserves, and the US EIA expects the Middle East to boost production by 15 Tcfy by 2035. Regional demand is expected to double through 2035 on increased power needs and industrial use.

Qatar. Qatar is the world’s largest producer and exporter of LNG. In 2011, the country exported 77 MMt of LNG, representing 31% of the global LNG export market. Qatar Gas and ExxonMobil are developing the Barzan Gas Project in Ras Laffan Industrial City. The $10.4 B project will consist of both onshore and offshore developments. Onshore facilities include the construction of a gas processing unit, a sulfur-recovery unit and natural gas liquids-recovery unit. A six-train LNG plant will be constructed in multiple phases. The first and second trains will begin operations by 2015. The facility will produce 1.4 Bcfd of gas for domestic industrial consumption.

Saudi Arabia. Shell and Saudi Aramco are constructing the largest residue gasification unit in the world. The Jazan integrated gasification combined cycle project will produce syngas from low-value residue feedstocks. The syngas will be used for power generation for the Jazan refinery and the domestic market.

Israel and Cyprus. Israel is expected to become both an LNG importer and exporter in the next few years. Large gas reserves are being developed at the Dalit, Leviathan and Tamar offshore fields. Gazprom has signed a deal to market the LNG from the Tamar field. The Tamar project is an FLNG vessel that will liquefy gas for sale to Asia. The 3-MMtpy FLNG is scheduled to begin operations in 2017.

Adjacent to Israel’s Dalit, Leviathan and Tamar offshore fields is the recently discovered Cyprus A field. Owned by the country of Cyprus, the 7-Tcf field is being developed by Noble Energy. Noble plans to construct a 5-MMtpy LNG terminal on Cyprus to export natural gas. The onshore terminal is expected to take up to four years to construct.

Iraq. Iraq’s natural gas production is forecast to reach 90 Bcm by 2035. Domestic demand is expected to exceed 70 Bcm within the same time frame. Shell, Mitsubishi Corp. and Iraqi state-run South Gas Co. have launched the $17.5 B Basra Gas JV. The JV will capture gas from three of Iraq’s southern oil fields. The gas will be used for domestic power and heating needs and for exporting. Basra Gas will construct an FLNG plant and terminal off the coast of Basra. The $3 B facility will export 600 MMcfd of LNG by 2020. GP

LEE NICHOLS is director of Gulf Publishing Company’s Data Division. He has five years of experience in the downstream industry and is responsible for market research and trends analysis for the global downstream construction sector.

Comments