Viewpoint

The liquefied natural gas (LNG) supply market increased to nearly 237 million metric tons (metric MMt) in 2012, or around a third of the global gas trade. Despite this impressive long-term growth history, global LNG trade declined by about 2% in 2012—the first dip in global LNG commerce since 1981. LNG trade decreased due to supply constraints, despite growing demand throughout most of Asia and parts of the Americas.

Global LNG supply in 2012

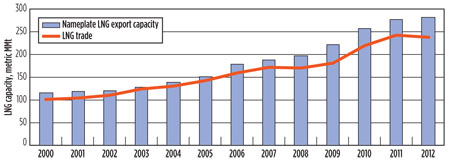

Anticipated and unanticipated LNG supply constraints resulted in strong competition for available volumes in 2012. This is partly because actual liquefaction capacity additions in 2012 failed to meet expectations. Only one new project entered service during the year and startup delays at other new facilities contributed to the dearth of new supply. Scheduled shutdowns at existing liquefaction facilities and unexpected outages at other terminals—the latter largely attributable to feedgas constraints—resulted in even less global LNG supply availability. The aggregate nominal capacity of all liquefaction plants in 2012 just exceeded 281 metric MMtpy, to be compared with a worldwide LNG consumption of almost 237 metric MMtpy. As shown in Fig. 1, the global utilization rate declined from 87.3% in 2011 to 84% in 2012.

|

|

Fig. 1. Nameplate LNG export capacity vs. actual trade volumes. |

Global LNG demand in 2012

The dip in supply was rendered all the more significant due to higher demand by many countries, which includes virtually all of Asia and some South American nations. This yielded what can only be described as a “tight” global LNG market in 2012. Asian LNG demand grew 8% on the year to just under 165 metric MMt, spurred in no small part by Japan’s hunger for natural gas to compensate for the considerable offline nuclear power generation capacity. Meanwhile, higher year-on-year (y-o-y) demand by the Americas also acted as a powerful magnet for available cargoes. Indeed, increased deliveries to Mexico and South America, especially Brazil, effectively nullified the US’ significant slump in LNG demand during 2012. With both Asia and parts of the Americas recording appreciable demand increases, it was all but inevitable that Europe—parts of which continue to struggle with the European sovereign debt crisis—should act as the “swing” LNG demand province and divest cargoes to high-demand centers both east and west of the Suez.

Outlook for 2013

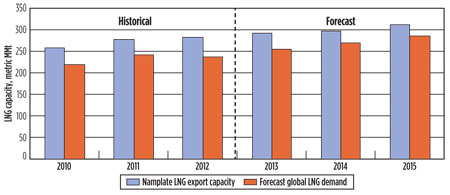

With global LNG demand expected to increase over the next two years, market tightness will intensify. Competition for available cargoes will grow on the back of increased Asian requirements as well as higher y-o-y demand by the Americas and parts of the Middle East. The startup of new supply capacity will help meet the forecast rise in demand, but supply availability will continue to be an issue until the next “wave” of new liquefaction capacity comes onstream in 2015, as illustrated in Fig. 2.

|

|

Fig. 2. Historical and forecast global LNG supply vs. demand. |

Regional natural gas markets; whether they be served by pipelines and/or LNG, are going through a major change. Consequently, there is pronounced uncertainty about future supply/demand balances and price. In this context, a rapidly expanding LNG market is poised to play a more prominent balancing role across regional markets:

- LNG supply growth in 2013 is not expected to keep up with increased demand. The 2013–2015 period will see demand come up against global liquefaction capacity with very little surplus. It is hoped that the problems experienced by operating plants in 2012 will not be repeated, and that any unexpected outages will be few and of short duration to keep global LNG trade flows smooth.

- Less than 10 metric MMtpy of new LNG export capacity is expected to come online in 2013, all of which will be located in the Atlantic Basin. Algeria’s Sonatrach has a 4.5-metric MMtpy Skikda rebuild that underwent commissioning in 1Q 2013, whereas Angola’s 5.2-metric MMtpy Angola LNG project may enter service in 2013.

- The world will be deprived of new liquefaction capacity until the next wave of new liquefaction capacity now under construction in Australia, Indonesia and Papua New Guinea enters the market beginning in 2015. An influx of Atlantic Basin volumes is also expected around 2015 and 2016, respectively.

- Given the outlook for increased demand through 2015, market conditions will be tight. By 2015, global utilization rates could reach 92%, which is comparable to rates recorded in the early 2000s.

- The remainder of this decade will be characterized by a widening differential between oil and gas prices. GP

NELLY MIKHAIEL is a senior consultant for gas/LNG with FACTS Global Energy (FGE) Group at its offices in New York City. She concentrates primarily on Atlantic Basin markets, namely North American gas/LNG markets. Prior to joining FGE, Dr. Mikhaiel was an LNG consultant with Nexant Inc., an energy and chemicals consulting company. Her research encompassed the hot-button issue of global shale gas development, with a special focus on North American plays. Prior to that, she was a member of Poten & Partners’ LNG consulting team between 2000 and 2009. During her tenure at Poten, she acquired LNG regasification terminal expertise with special regard to regulatory issues, terminal use agreements, and market entry strategies. Dr. Mikhaiel earned a BA degree with honors in 1996 and a PhD in history in 2002. Her 100,000-word history thesis dealt with the US Strategic Petroleum Reserve during the Reagan and Bush administrations. Both degrees were awarded by the University of Western Australia.

Comments