Boxscore Construction Analysis

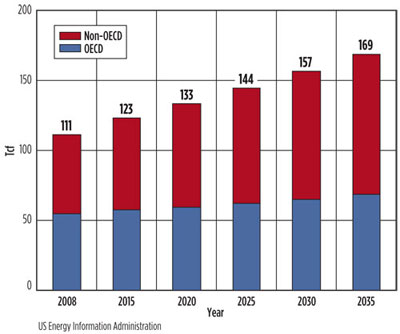

Natural gas is the world's fastest-growing fossil fuel. The US Energy Information Administration (EIA) forecasts that global gas consumption will increase annually to 170 trillion cubic feet (Tcf) by 2035 (Fig. 1). This increase is led by strong growth in non-OECD countries. To meet expected consumption rates, gas producers will need to increase supplies by almost 60 Tcf by 2035. In response to this surging demand, new project development and major capacity expansions are underway in all parts of the globe.

|

| Fig. 1. World natural gas consumption to 2035. |

United States

In the US, the downstream construction sector is benefiting from the recent boom in shale gas production. In its Annual Energy Outlook 2013, the EIA projects that US gas production will jump from 21.6 Tcf in 2010 to 31.1 Tcf–36.1 Tcf in 2040. The shale gas phenomenon has established the US as the world's top gas producer; positioned it to become one of the world's leading exporters of liquefied natural gas (LNG); and provided cheap ethane feedstock to fuel additional project activity for natural gas liquids (NGLs), fractionators, gas-to-liquids (GTLs), ethylene crackers and petrochemical infrastructure construction.

LNG. The US is primed to become a dominant LNG-exporting powerhouse within 10 years. US companies aim to construct over 210 million tpy (MMtpy) of LNG export capacity over the next several years. Due to recent market changes, many previously planned US LNG import terminals have either been canceled or will be converted or expanded into export terminals. Over a dozen LNG export facilities are awaiting approval from the US Department of Energy (DOE). US LNG-exporting companies must seek approval from the DOE to export LNG to other nations, regardless of whether or not they hold a free trade agreement (FTA) with the US.

The most advanced of these projects is Cheniere Energy Inc.'s Sabine Pass Liquefaction Project. This project has been approved by the DOE to export LNG both to countries with and without FTAs. Located in Cameron Parish, Louisiana, the $12 billion (B) project will be the first LNG export terminal constructed in the US in 50 years. In March 2013, Cheniere filed applications with the federal government to construct two additional LNG trains. Trains 5 and 6 will add 9 MMtpy of extra capacity. If approved, total export capacity at Sabine Pass will exceed 25 MMtpy. Completion of Train 1 is scheduled for 4Q 2015, while Train 2 will commence operations in 2Q 2016.

In May 2013, Freeport LNG's liquefaction and export project (Fig. 2) became the second LNG export terminal to receive approval from the US DOE to export LNG to non-FTA countries. The $10 B project is located on Quintana Island near Freeport, Texas. The 13.2-MMtpy facility was approved to export LNG at a rate of up to 1.4 billion cubic feet per day (Bcfd) for a period of 20 years.

|

|

Fig. 2. Digital rendering of proposed liquefaction facilities at |

The advantage of cheap gas feedstocks has fueled the US petrochemical industry to announce over $100 B in new project construction. This includes the construction of more than 10 MMtpy of ethylene production capacity by 2020. Exporting too much LNG could raise the price of natural gas to a point where petrochemical producers lose their cost advantage. Consequently, petrochemical producers might have to rethink their construction plans. Further developments will ensure that both the gas processing and petrochemical industries benefit from this abundant energy source.

GTL. Sasol will construct the first GTL plant in the US. The $11 B–$14 B project advanced into the front-end engineering and design (FEED) stage in December 2012. The 96,000-barrels-per-day (bpd) facility, located in Westlake, Louisiana, will convert low-cost natural gas into clean-burning diesel. It will be constructed in two phases of 48,000 bpd each. Phase 1 is scheduled to come online in 2018. Phase 2 will be completed in the following year. A $5 B–$7 B ethane cracker will also be constructed at the site. The 1.5-MMtpy unit will be commissioned in 2017. The overall project cost for Sasol's Lake Charles GTL and ethane cracker complex could top $20 B.

In the vicinity of Sasol's GTL project, G2X Energy plans to construct a $1.3 B GTL facility. Located at the Port of Lake Charles, G2X Energy will use natural gas to produce methanol. The methanol will then be converted into gasoline, which will make up about 90% of production. The other 10% of output will comprise liquefied petroleum gas (LPG) or propane. A feasibility study is being conducted, and a final investment decision will be made by the end of 2013. If approved, construction will begin in early 2014, and completion will be achieved by 2017.

Primus Green Energy plans to break ground on its first commercial GTL plant in 2014. The plant is designed to produce 25 MM gallons per year (gpy) of transportation fuels by 2016. Primus' GTL process utilizes STG+ technology, which is an improved, proprietary version of ExxonMobil's methanol-to-gasoline process. Unlike the Fischer-Tropsch process, which yields a synthetic crude that must be cracked or processed (adding considerable expense), the STG+ process produces gasoline directly. STG+ technology can process natural gas into other products such as diesel and jet fuel, and aromatic chemical feedstocks such as toluene and xylene. To date, a final location for the plant has not been selected.

Furthermore, Shell is conducting a feasibility study for the construction of a GTL plant in Louisiana. The US GTL plant will mirror Shell's $19 B Pearl GTL facility in Ras Laffan, Qatar. The Louisiana GTL facility is estimated to cost $10 B and have a capacity of between 50,000 bpd and 70,000 bpd. However, an investment decision is not likely to be made for another two years. If greenlighted, construction could span an additional 4–5 years, which would see operations beginning in 2019 or 2020.

Canada

Due to the recent shale gas boom, the US no longer needs to import excess natural gas from Canada. To offset this financial hit, Canada has planned a number of LNG liquefaction terminals to export LNG to Asian markets. These LNG export facilities are located primarily on British Columbia's Pacific Coast. Three projects in Kitimat, British Columbia are Apache and Chevron Canada Ltd.'s $15 B Kitimat LNG project; Shell Canada, Korea Gas Corp. (KOGAS), Mitsubishi Corp. and PetroChina's 12-MMtpy LNG Canada project; and the Haisla Nation and LNG Partners LLC's 1.8-MMtpy LNG project.

BG Group recently filed its Prince Rupert LNG export project with the Canadian Environmental Assessment Agency. The 21-MMtpy export terminal will consist of three LNG trains constructed in two phases. Construction on the first two trains will begin in 2016. The construction of the third train will depend on future market conditions. Completion is scheduled for 2019. Further south, Petronas, with newly acquired Progress Energy, is planning the $9 B–$11 B Pacific Northwest LNG project on Lelu Island, British Columbia.

Four additional LNG export terminal proposals have been submitted to the British Columbian government. All four are located on government land at Grassy Point, near Prince Rupert. An expression of interest (EOI) was submitted by a consortium consisting of Nexen, China National Offshore Oil Corp. (CNOOC), and Japan's Inpex Corp. and JGC Corp. Other EOIs were submitted by Woodside Petroleum Ltd., an Imperial Oil Ltd. and ExxonMobil joint venture (JV), and Korea-based SK E&S. These proposals are undergoing further evaluation by the provincial government to determine how many projects the Grassy Point site can accommodate.

On the Atlantic side, Pieridae Energy Canada has submitted plans for its Goldboro LNG project for environmental assessment. The $5 B–$10 B project will be located at the Goldboro Industrial Park on Nova Scotia's east coast. The 10-MMtpy facility plans to export LNG to markets in Europe, South America and Asia in 2019. FEED will take place simultaneously with the environmental assessment. A final investment decision is expected in 2014.

Also, H-Energy is conducting a feasibility study for an LNG export terminal in Melford, Nova Scotia. The $3.18 B project will be constructed in three phases. The first liquefaction train, with a capacity of 4.5 MMtpy, is scheduled for completion by 2020. H-Energy plans to target markets in Asia, Europe and Latin America.

Africa

Estimated recoverable gas reserves of over 65 Tcf in offshore Mozambique have spurred one of the largest LNG developments in the world. Anadarko and Eni plan to construct the $15 B Mozambique LNG project in the Afungi Peninsula area of Cabo Delgado Province. The initial plan includes four liquefaction trains consisting of 5 MMtpy each. The project has the potential to expand to 10 trains, with a total export capacity of 50 MMtpy. A Fluor Corp. and JGC JV will conduct the FEED study. The first LNG cargo exports are expected to begin in 2018.

Mozambique's state-owned distributor of petroleum products, Petromoc, is conducting a feasibility study for a 40,000-bpd GTL plant. The $1 B project will be constructed with South Africa's state-owned oil company, PetroSA. If greenlighted, the project will increase the supply of diesel to meet the region's burgeoning demand. PetroSA has also contracted WorleyParsons to conduct both the feasibility study and FEED for an LNG import facility in Mossel Bay, South Africa. The project will help supplement dwindling gas reserves at PetroSA's Mossel Bay GTL facility.

Riddled with delays, Chevron and Sasol are scheduled to commission their $8.4 B Escravos GTL plant in 2013. Located 60 miles southeast of Lagos, Nigeria, the 33,000-bpd plant will convert natural gas into premium, environmentally friendly diesel and GTL naphtha. Once completed, Nigeria will join countries such as Qatar, Malaysia and South Africa that operate commercial GTL plants.

Latin America

Latin America largely relies on natural gas for power generation. The International Energy Agency (IEA) forecasts that South America's gas demand will surge 29% between 2011 and 2017. Transportation networks comprise pipelines and LNG terminals. Argentina, Brazil, Chile and Mexico are the region's major LNG importers, with Peru being the only LNG exporter. Peru LNG commissioned South America's first gas liquefaction plant in 2010.

Brazil. The majority of Brazil's natural gas reserves are contained in the offshore Campos, Espírito Santo and Santos basins. Sizable reserves also exist in the country's interior states of Amazonas and Bahia. To meet rising demand for natural gas, Brazil's state-owned oil company, Petrobras, is planning several LNG projects, including the construction of the world's largest FSRU. This construction, along with Brazil's central location, could make Brazil a Latin American LNG hub.

Petrobras will commission its third offshore terminal this August. Located in the Bay of All Saints, the $425 MM Bahia Regasification Terminal project will supply the northeastern state of Bahia with 14 MM cubic meters per day (MMcmd) of natural gas. Once completed, Brazil's regasification capacity will exceed 35 MMcmd. In 2Q 2014, Excelerate Energy will deliver to Petrobras the largest FSRU vessel in the industry. The VT3 vessel will operate at Rio de Janeiro's Guanabara LNG terminal. It will have a storage capacity of 173,400 cm and deliver 20 MMcmd of natural gas to Brazil's southeast region.

Petrobras is also working with HRT Participacoes to deliver LNG to remote inland destinations using small LNG river barges. The Bolivian government is funding a feasibility study for a similar project. Bolivia is looking to export LNG to Paraguay and Uruguay using the Paraguay-Parana river system. If adopted, this concept could be utilized throughout South America to ensure that LNG cargoes reach isolated areas.

Argentina. Argentina is South America's largest natural gas producer and consumer. However, its highly regulated energy sector has enacted policies to discourage foreign and private investment. Consequently, demand for energy continues to outpace supply. This has led Argentina to increasingly depend on energy imports by pipeline from Bolivia and on LNG cargoes from Trinidad and Tobago and Qatar. LNG cargoes are received through the Bahia Blanca GasPort and Escobar LNG terminal.

To increase imports, Argentina is partnering with Uruguay to construct the GNL Del Plata LNG regasification plant. Located off the coast of Uruguay's capital, Montevideo, the $800 MM project will supply both Uruguay and Argentina with 15,000 cmd. It is rumored that Argentina may pull out of the project; if so, the government of Uruguay will continue the development on its own.

Additionally, Argentina and Qatar are exploring the possibility of constructing an offshore LNG FSRU. If constructed, the 5-MMtpy Southern Cone LNG Hub will meet 16% of Argentina's natural gas demand.

Chile. Most of Chile's natural gas is imported as LNG from Trinidad and Tobago, Qatar and Yemen. LNG is received through Chile's two regasification terminals—Mejillones, located in the north, and Quintero, located northwest of Santiago. The 5.5-MMcmd Mejillones LNG project will see the completion of Phase 2 construction in 4Q 2013, which will include a 175,000-cm onshore storage tank. Phase 1, completed in 2010, included a single offload jetty and a regasification train. The project will provide 20% of northern Chile's total annual consumption.

Mexico. Natural gas consumption is outpacing production in Mexico, forcing it to rely more on imports from the US. According to the US EIA, US natural gas exports to Mexico grew by 24% to 1.69 Bcfd in 2012. Due to the lack of pipeline capacity from the US, Mexico has stepped up imports of LNG from Nigeria, Qatar, Indonesia, Peru and Yemen. This has forced Mexico to pay LNG spot prices as high as $19/MMBtu. This short-term solution is necessary until new pipeline projects are constructed. Mexico is investing $8 B to expand pipeline capacity from the US. The two main projects are the Los Ramones and Northwest pipelines. These pipelines will supply Mexico with an additional 3.5 Bcfd of natural gas by 2016.

Mexico receives imported LNG at three locations. The vast majority of LNG imports are received at the Altamira plant in Tamaulipas. Two other regasification facilities are located in Costa Azul and Manzanillo. Two proposals to expand capacity at the Altamira and Costa Azul facilities have been on hold for some time. Proposals for two greenfield LNG plants at Lazaro Cardenas and on the Yucatan Peninsula have seen little movement to date.

Part 2

Gas Processing's global gas processing construction outlook, covering Europe, the Middle East and the Asia-Pacific, continues in October 2013. GP

LEE NICHOLS is director of Gulf Publishing Company’s Data Division. He has five years of experience in the downstream industry and is responsible for market research and trends analysis for the global downstream construction sector. At present, he manages all data content and sales for Hydrocarbon Processing's Construction Boxscore Database, as well as all corporate and global site licenses to World Oil and Hydrocarbon Processing.

Comments