Realize the full potential of stationary gas engine oil with used oil analysis

Used oil analysis is widely considered a vital tool for operators of stationary gas engines. While the extent to which different operations are able to commit resources to used oil analysis may vary, many recognize its importance as a maintenance and reliability tool that enables operators to monitor and optimize the life of an engine and its lubricating oil.

Major lubricant manufacturers advise making used oil analysis a central part of a gas engine’s maintenance schedule, and most original equipment manufacturers (OEMs) recommend it as part of best maintenance practices. It may also be a condition of maintaining engine warranty, but realizing the full potential of the oil relies on a holistic approach. Used oil analysis does not replace, but rather complements, other recommended practices such as monitoring and trending daily engine oil consumption and performing combustion chamber borescope inspections (FIG. 1).

|

| FIG. 1. Technical services advisor performing a critical gas engine borescope inspection. |

Simply put, used oil analysis involves gathering usable data from the engine’s oil and analyzing it to make informed decisions. When carried out correctly, it is a reliable and cost-effective way to extract greater value from a lubricant investment and an effective tool in monitoring the health of both the lubricating oil and a stationary gas engine.

A suite of standardized, industry-accepted test methods are needed to analyze the oil. These test methods allow the engine’s overall condition to be trended through wear metal analysis and provide an evaluation of the lubricant’s condition.

What can be analyzed? The sheer number of tests that can be carried out on used oil can be overwhelming, especially if maintenance staff are not experienced in used oil analysis. It is important to monitor the physical and chemical properties, contaminants and modes of degradation commonly seen in stationary gas engine oils so that those involved in the process can best understand the condition of equipment.

Most engine OEMs list specific limits on these properties. It is crucial that operators are aware of the OEM limits and proactively compare their data to these limits. To retain a margin of safety, the oil must be replaced to maintain performance levels and engine protection prior to the outer limits being reached. It is advised to trend and forecast the data to proactively plan when the oil needs to be changed, rather than reacting to the limits being surpassed and then planning for a maintenance event.

The most important physical property of a lubricating oil is viscosity—the fluid’s thickness or resistance to flow. The oil’s viscosity is what primarily provides separation of metal surfaces in relative motion to each other, meaning any significant change could lead to increased wear and compromise protection, potentially leading to engine failure.

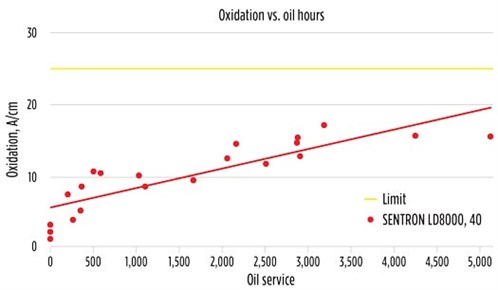

Stationary gas engine oils naturally experience eventual chemical degradation over time, from processes such as oxidation or nitration. Oxidation occurs when the lubricating oil is exposed to high temperatures and oxygen and can be accelerated by wear metals that can act like catalysts. Nitration, on the other hand, is caused by the oil’s exposure to nitric oxides (NOX), as found in gas engine exhaust gases. All gas engines will have some level of nitration in the used oil, but it is more pronounced in stoichiometric gas engines, as they produce high levels of NOX in the exhaust gas (FIG. 2).

|

| FIG. 2. Oxidation increases with oil service. |

Both forms of degradation can cause the oil to thicken or produce sludge, varnish and deposits, as well as cause the formation of acids, which can lead to corrosive wear. Oxidation can also form carbon deposits in piston ring grooves and on the backside of piston rings. Nitrated sludge is very difficult to remove from an engine and can send oil service life into a downward spiral. Most engine oil OEMs set limits on oxidation and nitration, so it is important for operators to measure the levels of degradation and replace the oil if it approaches those limits.

Fourier transform infrared spectroscopy (FTIR) is an efficient test method that identifies these forms of degradation, as well as certain contaminants. FTIR compares the spectrum of used oil to that of new fluid. The difference between the used and new fluid spectrums indicate what form of degradation is ongoing and to what degree it has occurred.

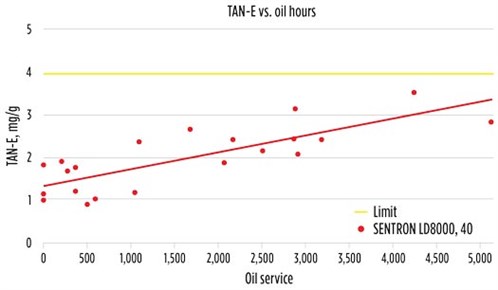

Tests also exist to measure the levels of acidity and alkalinity of the oil, both of which can be influenced by oxidation and nitration. Total acid number (TAN) measures the level of corrosive acids that have formed in the oil from oxidation and nitration and is especially required when extending oil drain intervals. TAN values typically start off lower and then gradually increase over the life of the fill as oxidation and nitration occur (FIG. 3). The initial pH (ipH) of a fluid complements TAN measurements and can identify the formation and level of strong acids even earlier, which is particularly important in landfill and biogas applications.

|

| FIG. 3. TAN increases with oil service as a result of fluid oxidation. |

Total base number (TBN) measures the fluid’s reserve alkalinity. Over-based detergent additives contribute to this alkalinity, and the fluid’s TBN value decreases as these detergents neutralize harmful acids. This test is most relevant to diesel engine oils, which have higher amounts of detergents but can, and should, be used in stationary gas engine oils as required by the manufacturer for extended oil drain intervals.

Focusing on proper sampling. Used oil analysis is conducted by most gas engine operators, but some aspects may be overlooked that prevent an operator from realizing the full value of the analysis. For example, a program can be compromised if proper oil sampling techniques are not followed. Several steps should be used to take a representative sample:

- Samples should be taken from the same location and at the same interval.

- The sample valve should be installed after the engine oil pump but before the oil filters.

- Samples should be taken while the engine has been running at normal operating temperatures and load for at least 1 hr.

- The sample valve and related tubing/piping should be purged before filling the oil sample container. The sample container must be kept clean prior to taking samples.

- All relevant engine and oil information should be included during sample registration, including the brand name of the oil in use, total engine hours, oil service hours and whether or not the fluid was changed after the sample was taken.

- The sample should be sent to the lab as soon as possible.

After these steps have been taken and the used oil has been sampled, operators should focus on reviewing and trending the data. A new oil reference sample must be listed on the analysis report to compare the properties of the used fluid with those of the new fluid.

The rate at which an engine consumes oil is also an important factor to consider, as higher consumption rates (and subsequent higher fresh oil makeup rates) have a sweetening effect on the fluid’s health, whereas an engine with minimal consumption may degrade the oil sooner.

Large gas engines should typically be sampled monthly, but this can vary depending on the manufacturer, so it is important to adhere to the engine OEM sampling frequency (FIG. 4). When analysis results indicate the development of an abnormal condition, it is also prudent to re-sample more frequently to closely monitor increased wear rates and fluid degradation.

|

Realizing the full value. While almost all operators conduct some form of used oil analysis, some use it strictly as a tool to identify mechanical failure. Operations focused on efficiency and best practices also monitor the fluid’s physical properties and chemical degradation, contaminants and equipment health in stationary gas engine oils. Gas engines are of significant value, so the investment in monitoring the aforementioned items is simply good business.

By doing this, operators can gain a clearer picture of the oil’s condition and overall engine health and realize the true value of used oil analysis. For example, water is a catalyst for oxidation, and the presence of water in an engine increases the rate of corrosive wear and can contribute to hydrolysis. The presence of water in the oil can be screened by the crackle test, but the Karl Fischer test method can more accurately identify how much water is present. Excess water contamination can actually increase the oil’s viscosity, but it also reduces the load-carrying capability of the fluid film as it forms an emulsion.

Elemental analysis is also standard testing and uses a method known as inductive coupled plasma (ICP). ICP identifies and quantifies elements found in additives, contaminants and wear metals. It is important to trend additive elements, such as calcium, zinc, magnesium and phosphorus, as they can help identify a mixture of fluids, and an increase in their concentration can also be indicative of overextended oil drains, oil evaporation loss or high oil consumption rates. Contaminant elements, such as silicon, can be extremely detrimental. For example, in landfill gas applications, silicon enters the engine via fuel gas in the form of organo-silicon compounds. Coolant contamination can be identified by rising levels of sodium and/or potassium.

Wear metals such as iron, copper, tin and lead should also be trended over time to establish what is normal for a particular engine. Where the trend deviates from normal or if wear metal levels exceed the OEM listed limits, further action should be taken. When an increase in wear metal is observed, it is always good to see where oxidation, nitration and TAN are trending as a more degraded fluid can contribute to corrosive wear. Due to particle size detection limits of the ICP test method, oil filter analysis greatly complements wear metal analysis and is recommended as a best practice.

Other elements are likely to be found in a stationary gas engine oil, so it is important for operators to consult their OEM manual and lubricant specialists, both of which can provide advice specific to an operation. If operators can leverage the analysis data as a whole, then it can provide clear insight into the lubricant’s condition. This enables operators to make more informed maintenance decisions.

Using the data. Once the data from the used oil analysis is in hand, the next step is to manage and interpret it quickly to enable effective and informed decision-making. Reliability and maintenance teams are increasingly taking advantage of online lab diagnostic tools and customized asset management reporting, which supports efficient and effective data analysis.

Such tools can allow rapid sample registration and sample results to be accessed from tablets or mobile devices, so maintenance and reliability professionals can access the latest insights at any time. Dashboard graphs help prioritize critical results and detect abnormalities within the results—e.g., an increase in wear metals or reduction in fluid viscosity. Utilizing oil diagnostics helps keep an operation one step ahead by using the latest technology to proactively track where maintenance is needed now and predict where it will be needed in the future.

Making informed decisions. A successful used oil analysis program can enable operators to determine the mechanical condition of the engine. The trending and analysis of wear metals allows the identification of problems in their infancy. This is a significant value proposition, as issues can be dealt with before they escalate (FIG. 5). For example, it is known that oxidation and nitration are inevitable in stationary gas engines, but by trending the rate of degradation, the oil can be replaced before it becomes too acidic, which could otherwise lead to corrosive wear.

|

| FIG. 5. Reliable fluid analysis is critical to protecting critical, high-performing engines. |

Analysis of used oil data can also provide insight into why problems are occurring in the engine and can provide clues to help pinpoint the source of certain wear and degradation modes. As an example, in lean-burn gas engines, the rate of oxidation is usually at least two times that of nitration (model dependent). If the rate of nitration becomes even with or exceeds the rate of oxidation, this can indicate an overly rich air-to-fuel ratio. Digging deeper into this data allows operators to address the causes of certain conditions, as correlations are often present. It can also enable more informed lubricant choices to be made to optimize the operation. Analysis could show that operating conditions are detrimental to the lifecycle of the oil and that a different stationary gas engine oil, specially designed for certain conditions, would be more suitable for the operation.

Carrying out a successful used oil analysis program can put operators in a good position to extend the lifecycle of the oil, but it cannot be the only factor. Physical inspections of mechanical components must supplement used oil analysis, and only then can operators make an informed, holistic decision. That being said, OEMs should be consulted before extending drain intervals, as this can void warranty if not managed correctly. When effectively using all of this data to make informed decisions, operators can also begin to make changes that add to the long-term protection of their equipment.

Used oil analysis may be common practice, but operators can always find additional efficiencies. It is important to know what should be analyzed and why, as well as to possess a deeper understanding of what is causing the results and what that means. Combined with proper oil sampling techniques, this can provide the opportunity to realize the full value of used oil analysis to produce a clear picture of what is happening to the oil and the engine.

This combination enables operations to make proactive, informed decisions to identify issues before they become too expensive to repair and to optimize their operation. Combined with physical inspections and oil consumption rate trending, it provides users the opportunity for efficiencies, improved performance and the ability to get the most out of the oil being used in the engine. GP

|

CLINTON BUHLER is the Senior Technical Services Advisor at HollyFrontier Lubricants and Specialties, which includes the Petro-Canada Lubricants brand. With more than 17 yr of gas engine experience, he specializes in working with customers in realizing the full potential and value of their lubricants in critical gas plant and power generation equipment.

Comments