Gas Processing News

Scotland launches biomethane refueling

CNG Fuels has started building Scotland’s first public access renewable biomethane heavy goods vehicle (HGV) refueling station, which will allow fleet operators to run their vehicles on low-carbon fuel, support net zero plans and save money.

The station, located at the Eurocentral industrial estate off the M8 near Bellshill, will refuel up to 450 lorries per day when it opens in November 2021, enabling HGVs to make low-carbon deliveries across Scotland. Most of England and Wales is already within a 300-mi round trip of a biomethane refueling station, and the new facility will put Inverness and Aberdeen within this range.

Renewable biomethane is the lowest-carbon, most cost-effective alternative to diesel for HGVs—it is 35%–40% cheaper and cuts vehicle greenhouse gas emissions by up to 85%. From 2021, CNG Fuels will dispense fully carbon-neutral fuel by sourcing biomethane from manure.

Excelerate, ExxonMobil, Albania study LNG terminal

Excelerate Energy LP, ExxonMobil LNG Market Development Inc. and the Republic of Albania have agreed to conduct a feasibility study for the potential development of an LNG project at the Port of Vlora in Southern Albania.

Under the MOU, Excelerate will conduct a study to explore the potential of an integrated LNG-to-power solution that includes developing an LNG import terminal, converting and/or expanding the existing Vlora thermal power plant, and establishing small-scale LNG distribution to Albania and the surrounding Balkans region.

Albania relies on hydropower plants, which can become unreliable during times of drought. LNG would bring reliable, affordable, and cleaner energy to the region and complement Albania’s hydropower-based electricity production. ExxonMobil will identify opportunities to support the supply of LNG into Albania. The project pre-feasibility report is expected to be delivered in Q3 2021, while the targeted startup for the LNG import project could be as early as 2023.

India welcomes first FSRU

|

India’s first floating storage and regasification unit (FSRU), the Höegh Giant, arrived at H-Energy’s Jaigarh Terminal in Maharashtra on April 12, sailing from Keppel Shipyard in Singapore. The arrival of the FSRU marks a new chapter in India’s mission for accelerated growth of LNG infrastructure. The country aims to increase the share of natural gas in its energy mix from the present 6% to 15% by 2030.

The 2017-built Höegh Giant has storage capacity of 170,000 m3 and installed regasification capacity of 750 MMft3d (equivalent to about 6 MMtpy). H-Energy has chartered the FSRU for a 10-yr period. Höegh Giant will deliver regasified LNG to the 56-km-long Jaigarh-Dabhol natural gas pipeline, connecting the LNG terminal to the national gas grid.

The facility will also deliver LNG through truck-loading facilities for onshore distribution and is capable of reloading LNG onto small-scale LNG vessels for bunkering services. H-Energy intends to develop a small-scale LNG market in the region, using the FSRU for storage and reloading LNG onto smaller vessels.

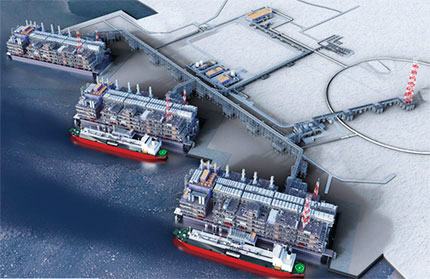

Novatek to offer 60% stake in Arctic LNG 2

|

Russian independent LNG producer Novatek is offering up to a 60% stake in its Arctic LNG 2 project as collateral for long-term financing of the project. Novatek seeks to raise $11 B in external financing and aims to secure the funds by the first half of 2021.

The $21-B project, which received final investment approval in 2019, is expected to be launched in 2023 and to reach its full capacity of almost 20 MMtpy in 2026. The project’s equity partners include Total, China National Petroleum Corp., China National Offshore Oil Corp., Mitsui & Co. and Japan Oil, Gas and Metals National Corp. In January 2021, Russia’s Sberbank approved financing of up to €3 B ($3.5 B) for the Arctic LNG 2 project.

Australia’s gas supply gap delayed to 2026

Plans by billionaire Andrew Forrest to ready an LNG import terminal by 2022 mean that Australia will not suffer a gas supply shortfall until 2026—2 yr later than previously forecast, according to Australian Energy Market Operator (AEMO). AEMO also noted that existing Victorian production is declining faster than previously projected.

Gas producers’ forecasts for maximum daily capacity from existing, committed and anticipated southern fields in 2023 are nearly 20% lower at present than they were 1 yr ago. Gas fields in the Gippsland Basin, which largely supplies the southern states, are becoming exhausted and losing flexibility to ramp up output during peak winter demand. LNG imports and gas storage will be needed to cover peak demand.

Forrest’s privately owned Squadron Energy won state approval to build an LNG import terminal at Port Kembla in New South Wales, with a startup target of late 2022. AEMO’s forecast did not include a controversial LNG import terminal proposed by AGL Energy, which is awaiting approval from the Victorian government. If approved, AGL expects to start importing gas by mid-2023. AEMO also highlighted growing uncertainty in its demand forecasts as manufacturers switch away from carbon-based fuels to renewable power and hydrogen.

Ghana’s Tema LNG terminal to receive first cargo

Tema LNG terminal in Ghana, the first offshore LNG receiving terminal in sub-Saharan Africa, was scheduled to receive its first LNG cargo at the end of May. Tema LNG, consisting of separate regasification and storage vessels, is backed by Helios Investment Partners and Africa Infrastructure Investment Managers.

A long-term supply deal between Royal Dutch Shell and Ghana National Petroleum Corp. supports the project. As of the time of publication, the terminal was ready for operation and

was awaiting an agreement between Shell and Ghana National Petroleum Corp. on

the first delivery date.

The terminal received its floating regasification unit (FRU), built by Jiangnan Shipbuilding, in January. The LNG FRU is designed for a regasification capacity of around 1.7 metric MMtpy of LNG and will be in operation for approximately 20 yr.

The FSU will work in conjunction with an upgraded, 127,500-m3 LNG carrier to deliver 250 MMsft3d of natural gas. It will also provide facilities to bunker, reload or breakbulk LNG. Spanish LNG terminal operator Reganosa will run and maintain the terminal.

Occidental unit to transport CO2 from Texas LNG project

Oxy Low Carbon Ventures, a subsidiary of Occidental Petroleum, will offtake and store the CO2 captured from NextDecade Corp.’s planned Rio Grande LNG export plant at the Port of Brownsville, Texas. Oxy will move CO2 from the Rio Grande LNG project and permanently sequester it in an underground geologic formation in the Rio Grande Valley.

NextDecade expects the carbon-capture-and-storage (CCS) project at Rio Grande to reduce permitted CO2 emissions at the plant by more than 90%. The company also anticipates achieving a final investment decision (FID) on a minimum of two trains at Rio Grande LNG in 2021 and the CCS project soon after the FID is taken on the plant.

Rio Grande is one of 14 North American projects awaiting FID in 2021. Most of the FIDs were carried over from 2020, postponed by the COVID-19 pandemic. Another project at Brownsville, Annova LNG, decided in March to halt development of its proposed LNG export terminal due to changes in the global LNG market.

Woodfibre LNG signs second BP deal for LNG plant

Canadian LNG developer Woodfibre LNG has signed a second agreement to sell LNG from its proposed export plant in British Columbia to a unit of oil major BP. That puts the plant a step closer to getting built in a market that has seen some cancellations in recent months, but not many new projects.

Woodfibre will sell 0.75 MMtpy of LNG to BP Gas Marketing Ltd. over 15 yr on a FOB basis. The agreement will increase BP’s total LNG offtake to 1.5 MMtpy from Woodfibre’s proposed 2.1-MMtpy plant. Woodfibre could take a final investment decision in 2021, which would put the plant on track to produce first LNG in 2025 at a cost of around C$1.6 B–C$1.8 B.

Over the past two months, Annova, another LNG developer, stopped work on its export plant in Brownsville, Texas, and Pembina paused development of its Jordan Cove project in Oregon.

Sempra likely to delay Texas Port Arthur LNG decision to 2022

|

U.S. energy company Sempra Energy will likely move its planned final investment decision (FID) on the Port Arthur LNG export plant in Texas from 2021 to 2022, according to company executives. The Port Arthur project is one of 13 North American LNG export projects that was expected to take an FID in 2021. Most of those were carried over from 2020, and several were also carried over from 2019.

In addition to Port Arthur, Sempra, which owns part of the operating Cameron LNG plant in Louisiana, is building an export plant at its Costa Azul LNG import facility in Mexico and is developing second phases for Cameron and Costa Azul.

Global LNG demand has increased every year since 2012 and hit record highs every year since 2015, mostly due to fast-rising demand in Asia. However, in recent years, global gas buyers have been slow to sign new long-term contracts needed to finance the multibillion-dollar projects due to overbuilding of LNG export terminals in 2019, COVID-19 demand destruction and the collapse of global natural gas prices in 2020, as well as the U.S.-China trade war during former U.S. President Trump’s administration.

Analysts expect global LNG demand to grow by about 3%–5% each year between 2021 and 2025. That projected growth rate, however, is much lower than the 11%–12% yearly increases seen from 2017–2019.

Cheniere, Shell deliver carbon-neutral LNG to Europe

|

U.S. LNG company Cheniere Energy supplied a carbon-neutral cargo of LNG to Royal Dutch Shell as part of a long-term agreement, joining a list of sellers neutralizing emissions as more buyers commit to environmental targets. The carbon-neutral LNG cargo was supplied from Cheniere’s Sabine Pass facility in Louisiana and delivered to Europe in early April, with offsets bought from Shell’s global portfolio of nature-based projects.

Consumers are increasingly paying a premium to have emissions neutralized from the wellhead through consumption. In March, Russian energy giant Gazprom said it had delivered its first carbon-neutral shipment to Europe. Pavilion signed a long-term contract with Chevron Corp. earlier this year and one with Qatar Petroleum in late 2020 requesting data on greenhouse gas emissions. Last year, China National Offshore Oil Corp. bought from Shell its first cargoes with offset carbon emissions.

Cheniere exported a record of 133 cargoes of LNG in Q1, despite having part of its facilities down for a few days during the winter storm in February. The company operates five LNG processing units at its Corpus Christi terminal. A sixth train at Sabine Pass is almost 1 yr ahead of schedule and could start production before the end of 2021.

Total presses ahead with Papua LNG, sees 2023 decision

French energy group Total has agreed with the Papua New Guinea government to proceed with an LNG project in the country, which had been delayed due to the pandemic, with a final investment decision due in 2023.

Total added in a statement that it would re-mobilize teams involved in the project. Total and its partners, ExxonMobil Corp. and Oil Search Ltd., had initially planned to develop Papua LNG in tandem with an expansion of ExxonMobil’s PNG LNG terminal in a $13-B project adding three new production units at the PNG LNG plant, to help save billions of dollars.

However, Exxon has not agreed to terms sought by the Papua New Guinea government for the P’nyang gas development that would help feed the expansion, as Papua New Guinea Prime Minister James Marape pushed for bigger benefits for the country from the deal. Instead, Total’s Papua LNG project will go ahead with two new production units to be built

at the PNG LNG site, fed by the Elk Antelope gas fields. GP

Comments