Evolution and innovation for an increasingly dispersed LNG market

The LNG industry must adapt to changing market conditions to grow, thrive and reach its full potential. LNG consumption and commercial patterns are in a state of change, yet the production facilities and systems supplying the markets—as well as the financing institutions that underpin their existence—are proving glacial in their speed to react.

The advent and opportunities for the use of LNG as a fuel for factories, off-grid power plants, long-haul road transportation, locomotives, harbor and nearshore service vessels, ferries and international marine shipping are creating a market that is more diverse and dispersed than the traditional, large-volume, point-to-point structure forming the basis for much of the existing global LNG value chain.

This new market also exhibits greater elasticity in demand than contemplated in traditional sales-and-purchase agreements and financing conditions. LNG must overcome some challenges to achieve its potential as the preferred clean hydrocarbon fuel and a complementary solution to increased renewables penetration. One hurdle is that LNG production and loading, product transportation and delivery infrastructure must introduce systems that enable LNG to reach this increasingly diverse and dispersed market, or else energy consumers will turn to other sources out of necessity. Additionally, financing of these projects must consider the increased variability/seasonality of demand, as well as offtake by multiple smaller customers with corresponding smaller balance sheets and less established (if any) credit credentials.

Despite these challenges, significant opportunities exist. Typical (non-pandemic) global diesel fuel prices are on the order of $20/MMBtu–$30/MMBtu, while current large-bulk LNG deliveries are available at well under half that price, proving a strong economic basis for growth as a replacement for diesel and other distillate fuels, in addition to the reduced emissions incentive delivered by LNG. The total global marine fuel energy consumption alone approaches the global LNG production volume energy, which itself is less than 3% of total global energy consumption. A growing market for smaller LNG ships, transport barges, ISO containers and LNG distribution trucks has emerged, and additional innovative development is necessary in the future. A substantial growth market exists for LNG, but only if the industry can develop and finance a supply infrastructure to meet this evolutionary opportunity.

LNG market discussion. The size of the prize available to the LNG industry for expanding into a broader slice of the global energy market is substantial. Total global energy consumption in 2019 was 583.9 exajoules1 (an exajoule is 1,018 joules, an unimaginably large number—2019 usage was the energy equivalent of 4.431 T gal of gasoline), which was a nominal 1.3% increase from 2018. This represents the total of natural gas, oil, nuclear, coal, hydropower and renewables. Of this amount, natural gas provided 24% of global energy in 2019, in third place behind oil and coal.

LNG itself represents nominally 12% of global natural gas, or under 3% of global energy—i.e., while LNG garners a lot of attention, it actually represents a very small fraction of the world’s energy consumption, providing an excellent opportunity for significant growth.

The unique characteristics of LNG must be considered when seeking to capture these growth opportunities. First, the volumetric energy density of LNG is low. Compared to diesel or fuel oil, LNG carries only about 58% of energy per unit volume. Consequently, to carry the equivalent amount of diesel fuel, a vehicle would require a substantially larger LNG fuel tank or be faced with the need to make more frequent refueling stops.

Using compressed natural gas (CNG) in lieu of LNG worsens the situation, since the energy density of CNG (3,600 psi) is only about 25% of that for diesel, or less than half of LNG’s energy density. However, on a weight basis, the energy density of LNG is actually double that of diesel, so when weight is critical, LNG may provide advantages.

Fuel temperature and metallurgy are also important considerations; at –160°C (–256°F), LNG must be stored in insulated containers suitable for cryogenic conditions (stainless steel or aluminum), and the LNG must be vaporized and heated prior to use. Fuel storage duration is another consideration; conventional liquid fuels (diesel, fuel oil, gasoline, aviation fuels) can be stored indefinitely with suitable care. LNG storage will eventually need to vent boiloff gas, as LNG cannot be maintained in the liquid state without external or internal refrigeration. The amount of time that LNG can be stored prior to venting depends on the container, and ranges from 70 d–80 d for large ISO containers2 to as little as 4 d for small cylinders.

In addition, LNG is generally not a pure component fluid, and the lightest of its components (nitrogen, methane) tend to selectively boil off first, causing the remaining liquid to concentrate the heavier components (ethane, propane, butane). In time, this can cause the composition of the LNG to go off-spec compared to user requirements, and must be carefully managed.

LNG has long been a “big-time” business: big owners (national and international oil companies), big plants (millions of metric tons of production yearly), big ships (1,000-ft long), big users (public utilities) and big money enable it to happen. More recently, a few entrepreneurial companies have tried a different approach to the LNG market, building much smaller, fuels-scale projects and shipping their product in small containers to the end users, with good success. Some projections3 are that more than one-third of global LNG production growth over the next 4 yr will come from U.S.-based small-scale (< 2 metric tpy) newbuild facilities.

However, despite this initial and projected success, these small operations have grown slowly. Challenges faced by producers and distributors of small quantities of LNG include:

- Energy efficiency—Modern, full-scale LNG production plants consume nominally 8% of their feed gas as fuel. Small-scale plants have been required by economic necessity to minimize CAPEX and, as a result, tend to be much less energy efficient, consuming 12%–20% of feed gas as fuel (or equivalent imported power).

- GHG signature—With lower energy efficiency comes higher carbon dioxide (CO2) emissions (whether directly or indirectly, via imported power). The world is increasingly focused on achieving best available technology with regard to CO2 emissions. The CO2 savings for the end user are substantial, but production emissions are relatively high compared to achievable values.

- Material handling—It is challenging to move substantial quantities of liquids in relatively small containers. A small, 2-MMtpy LNG production facility shipping in conventional 155,000-m3 carriers would require 28 ships/yr, or about one every 2 wk. Moving this same small plant capacity in the biggest ISO containers [nominally 40-ft (43-m3) long] would require more than 100,000 containers/yr to be filled, transported, emptied and returned, or 280 containers/d.

- Shipping costs—A significant portion of shipping costs are independent of volume. Moving LNG long distances in small quantities disproportionately increases the unit cost, making the small-scale product economically unattractive outside of regional deliveries. Many small-scale facilities would be unable to shoulder the burden of infrastructure costs to accommodate large-scale ship-loading operations and are restricted to regional markets.2,3

- Export port priorities—Large export facilities needing to move substantial quantities of LNG may be unable to make sufficient loading windows available for small-scale ships and barges and still load their annual commitment of cargoes.

- Security of supply—Today, LNG in small quantities is not widely available from multiple parties. With diesel or fuel oil, production issues at one supplier can readily be accommodated by others. In the present LNG market, if a single, dedicated, small LNG ISO container or barge-loading facility were to become temporarily unavailable (i.e., due to weather, maintenance or unplanned outages), the receiving facility could be seriously challenged to access replacement suppliers in the short term.

- Financing—This is a significant issue; historically, funding for the substantial costs to underpin the development of LNG liquefaction infrastructure has been underpinned by long-term (20-yr), take-or-pay contracts with credit-worthy buyers. The small-scale market can be much more diverse, seasonal, variable in demand and comprise buyers without access to investment credit ratings. Financing for small-scale facilities will require a different, more flexible model.

The key to success for small-scale LNG lies in finding a pathway that alleviates these substantial challenges while still being positioned to take advantage of the growing, and increasingly diverse and dispersed LNG consumer market opportunities. This pathway will focus on logistics—finding the solution that enables the capture of big-project economies of scale on the production and transportation end, coupled with small-project innovation and flexibility on the consumer end through the evolution of the LNG value chain, supported by financial backing that can enable the development.

Economic drivers. On a fundamental energy basis, classic, large-scale LNG competes commercially with coal. Despite the substantial environmental advantages that natural gas provides compared with coal (e.g., 50% lower CO2 emissions per unit volume of energy, lower NOX and SOX, vastly reduced particulate emissions, elimination of Hg emissions, much less invasive production), coal remains in high demand due to low cost and previously invested capital, representing 27% of global energy production in 2019.1

The challenge is that as renewables grow rapidly in the market, they tend to push out the more expensive fuels first, regardless of the environmental profile. Small-scale LNG competes more directly with oil, specifically with diesel fuel, fuel oil and ship bunker. In this market, LNG holds the economic advantage. Even in a low-oil-price market, such as that seen during most of the ongoing COVID-19 pandemic, global average diesel prices are higher than global average natural gas and LNG prices.4 This makes the small-scale LNG market an attractive economic opportunity, if the challenges can be effectively solved.

Market opportunities. Renewable energy is now emerging as the energy source of choice in a world increasingly concerned with greenhouse gas emissions and climate change. As noted above, in many markets including Europe and Japan, renewables have had more success in displacing natural gas than coal, driven more by economics than by environmental concerns, despite the better fit of natural gas in reacting to variations and sudden changes in renewable energy production.1,4

Going forward, the growth of LNG and natural gas in the traditional markets of large power generation facilities, industry, commercial and residential heating will be increasingly challenged by the accelerating growth of wind and solar power. Small-scale LNG operating in different market dynamics that compete more directly with liquid fuels is less challenged by renewables in some key markets—this generates opportunities. Considerations associated with these market opportunities are discussed here.

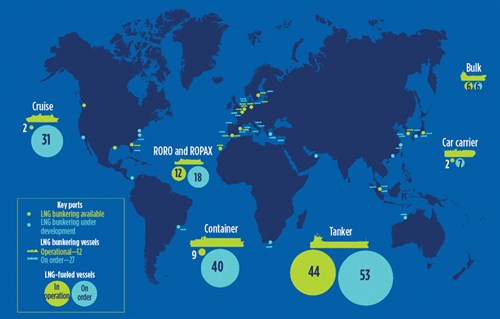

Marine. The global shipping industry consumed 4.36 MMbpd of fuel oil/bunker fuel in 2019,5 equivalent to 200 MMtpy LNG (56% of 2019 LNG production volume). Although low in absolute numbers, an increasing number of ships capable of burning LNG as fuel are under construction and entering operations, led by the cruise ship industry, European manufacturers and container ships. There are nominally 90,000 total ships in the global fleet, with 60,000 plying international routes. Ships consume 20 metric tpd–80 metric tpd of fuel oil; for a very large crude carrier (VLCC) traveling from the Middle East to Japan, this typically amounts to $2 MM–$2.5 MM for the 25-d voyage.6 The global average very-low-sulfur fuel oil (VLSFO) price for early-November 2020 delivery was $355/metric t, or $9.60/MMBtu. Even at COVID 19-induced depressed fuel prices, LNG is economically attractive.

Availability of LNG at ports to support bunkering is growing, but still limited in a classic “chicken-or-egg” scenario. A total of 96 global ports claim to have access to LNG, but only 12 presently have operational LNG bunkering ships, with another 27 of these ships on order.5 FIG. 1 shows global ports with bunkering access.7

|

| FIG. 1. Global ports with bunkering access.7 |

Regional shipping/port services. LNG bunkering for regional shipping is more straightforward to manage, as the ships can return to the home port for refueling and not be dependent on the availability of infrastructure at other locations. Potential users include passenger and car ferries, offshore service vessels, regional barge shipping and harbor/river tugs. Port service vessels with tight quarters below the waterline (i.e., tugboats) may be challenged for fuel tank space in retrofit designs. Economics strongly favor diesel conversions based on the relative cost of marine liquid fuels vs. LNG.

Long-haul trucking. LNG is a premium fuel for long-haul trucking. On a heat basis, it is less than half the price of diesel (see above) and enables reduced maintenance costs per numerous published reports. Trucks generally have the room to accommodate the larger volumetric storage space requirement, while the weight of the fuel itself is lower. Daily usage is high, such that heat leak and boiloff management are not an issue.

The primary limiting issue for conversion is limited access to LNG, which is not universally available, and the installation of more truck filling stations has been stymied by the lack of converted trucks to purchase the LNG. Steps are being taken to improve this—for example, Louisiana has established an Alternative Fuels Corridor program in support of such efforts.7

Commercial transportation. The city of Houston, Texas experimented extensively with the use of LNG-powered city buses in the early 1990s, but reverted to diesel due to design flaws in the fueling system. Houston is now successfully increasing its use of compressed natural gas (CNG) in the city bus fleet. Any type of regional commercial transportation (metro buses, school buses, package delivery fleets, consumer beverage delivery trucks, etc.) that return to a home base daily are well suited for utilization of LNG or CNG, as fuel can be made available at their home base and the vehicles are large enough to adequately store the needed volumes of fuel.

Personal vehicles. Smaller, personal vehicles do not lend themselves to direct use of LNG or CNG due to the limited space available and the lower fuel volumetric energy. Globally, the personal vehicle fleet is moving in the direction of electrification, rather than gasification.

Trains. Locomotive use of LNG is presently very limited, with one application in the U.S. on the Florida East Coast Railway. Locomotives are well-suited to LNG use, with space available for long-haul storage and a near-continuous use profile. Availability of the fuel at terminal locations is the most significant challenge.

Off-grid power stations. These stations represent a prime potential area of growth for LNG if the logistics associated with fueling them reliably can be established. These stations range from micro-scale power plants (as small as 100 kW to feed a remote village or a large ranching operation) through small-scale (5 MW) up to moderately large-scale facilities (> 250 MW). These types of facilities tend to be sited in relatively isolated locations, on islands (the Caribbean, Asia) and upriver, and presently operate on diesel oil delivered by truck or barge. The favorable economics outlined in shipping also apply here, provided that cost-effective fuel supply transportation can be established.

Off-grid manufacturing/farming. Similar to off-grid power stations, and sometimes integrated with them, large industrial and agricultural energy consumers generally use diesel oil, with some global regions (particularly China) using coal, and others (U.S. farms) making extensive use of propane or LPG. Most diesel and coal facilities represent potential conversion to LNG, but they tend to be small consumers (challenging logistics) and intermittent consumers (challenging storage of LNG). Supplying LNG into common, local/regional, short-pipeline distribution systems may be part of a workable solution.

Home heating/cooking, others. This market is not viewed as prime for expanding LNG usage. Small storage systems have been developed and distribution models have been tested, but unless a regional/neighborhood piping system is utilized, it is impractical to achieve this small of a scale for distribution and usage of LNG, primarily due to the limited storage life of LNG before boiloff gas must be managed.

Aircraft. The CO2 greenhouse gas signature of aircraft has generated significant attention, with 1,000 metric tpy of CO2 emissions and up to 5% of global warming attributed to the aviation industry (2018 figures8). Russia, Boeing and MIT have performed research on the topic of using LNG and natural gas to fuel aircraft.8 A 2015 study9 determined that, in addition to environmental and fuel cost advantages, LNG as a fuel increases airframe space needed for fuel but decreases fuel system weight. LNG also provides a means to support thermal management of sophisticated electronics systems. Overall, aircraft looks like an opportunity for 2050 and beyond.

The LNG value chain. Solving the small-scale logistics value chain puzzle will be key to maximizing access to markets for LNG in the future. The classic, large-scale LNG value chain developed in the 1960s is well known. It involves extraction and liquefaction of stranded gas assets in large-scale export facilities; large, dedicated LNG carriers delivering the gas to land-based receiving terminal ports; regasification; and the use of pipelines to carry the gas to nearby, large-scale power plants and into national grids.

The massive infrastructure development costs associated with the elements of this chain are underpinned by long-term, take-or-pay contracts with highly credit-worthy offtakers to enable financing. In today’s markets, these investments can run into the tens of billions of U.S. dollars and, subsequently, require substantial economies of scale to create favorable economics. Most recent initial launch capacities of projects have generally been in the range of 10 metric tpy–15 metric tpy (i.e., Cameron, Freeport, Sabine Pass, Calcasieu Pass, Gorgon, Ichthys, Wheatstone, Asia-Pacific LNG, Gladstone, Queensland Curtis) with a couple of smaller facilities at brownfield U.S. import sites at 2.5 metric tpy–5 metric tpy (i.e., Elba Island, Cove Point).

A classic LNG value chain is shown in FIG. 2. The value chain needed to support a small-scale dispersed market is substantially different and more complex, both logistically and economically. The ideal small-scale production facility may not need to be small, but it must still be capable of supporting the small, dispersed delivery market.

|

| FIG. 2. A classic LNG value chain.10 |

Built large, such a facility can take advantage of the economies of operational and energy efficiencies inherent in bigger facilities. A large-scale production plant linked into multiple logistics chains, or multiple branches of a single initial chain, can be positioned to serve all markets efficiently and still leverage traditional financing.

Small scale. Small-scale LNG trucking from source to consumer has been demonstrated as economic if good roads are available and the transport distances are in the range of up to 300 mi each way. If markets are relatively close in distance (nominally 500 mi–1,000 mi or less), point to point, at or near ocean ports, and the intervening seas are not frequently subject to rough conditions, then barge transport of LNG is feasible. The advantage to barges is that they are relatively inexpensive, have a shallow draft, and LNG ISO containers can be carried safely on deck or dedicated LNG barges can be utilized. Small-scale U.S. exports have been following this route for services to the relatively close Caribbean region.10

Alternately, small (nominally 30,000-m3) shuttle tankers are also used, requiring deeper draft and more sophisticated loading systems but accommodating heavier seas and multiple port stops. This approach has been used for distribution of small quantities of LNG to Scandinavian ports. Rail transport has been used successfully in Japan for 20 yr11 and is just now emerging as a permitted means in the U.S.

Large-scale/small-scale integration of traditional, large-scale LNG production and/or receiving facilities with smaller regional demand locations is expected to represent an efficient way to service this growing market without many of the constraints present in the emerging small-scale production market (e.g., energy efficiency, limited market reach).

This integration can be accomplished in at least two basic ways. The first way is the addition of small-scale export facilities (trucks, ISO tanks, barges, small carriers) to traditional, large-scale export plants. These facilities must be segregated from the primary, large ship loading docks to enable the plant to benefit from the small-scale sales without impeding the major volume shipments. The second way is the addition of small-scale redistribution facilities at the large-scale receiving facilities to enable re-export into regional markets. The potential to see transition exists, with a small, dedicated import market developing initially, eventually growing into a regional redistribution hub.

Overall, this integration of the successful and financeable large-scale export and import facilities with ongoing small-user supply at both ends, coupled with hub-and-spoke systems, represents a viable future to reach the increasingly diverse and distributed consumer market potential.

A final word—safety first. Traditional LNG projects throughout the industry maintain an excellent safety record as part of the backbone of reliable energy supply. To maintain this excellence into a more diverse and dispersed market will require purposeful effort. Smaller facilities may not have the focus on training and maintenance that has been embedded into world-scale facilities. Revenue levels may not support dedicated safety staffing, and the nature of the transport, storage and use means a greater degree of manual handling (truck movements, hose connections and disconnects, large numbers of small containers).

NFPA 59A does a good job of addressing both small-scale and large-scale LNG. The parties responsible for design and operations must ensure that adequate hazard identification, analysis and mitigation steps are applied. Design elements, remote operations and other digital supported solutions can minimize risk exposure and incident severity. With the transition of the retail gasoline market to self-service in the late 1960s and early 1970s, millions of motorists were able to demonstrate that properly designed fueling systems could be used safely,11 despite initial concerns.

Takeaway. The global energy market is expanding, and natural gas/LNG can play a significant role in meeting these growth needs with a clean-burning fuel that can support expansion, displace other hydrocarbon fuels with a higher emissions profile, and support the transition to a greater penetration of renewables while maintaining security and stability of supply. Much of this growth will happen in a more diverse and dispersed market than has traditionally been served by LNG.

Consequently, market parties must adapt their operations and logistics profiles to align with the changing market to capture the greatest market share available. Developing methods of delivering LNG that benefit from the best attributes of both large- and small-scale facilities will be a key element in this success. GP

LITERATURE CITED

- BP, “Statistical review of world energy,” 2020.

- Data from Chart Industries.

- GlobalData, “Global small-scale LNG liquefaction capacity and capital expenditure outlook, 2020–2024,” September 2020.

- “Retail energy price data,” online: www.globalpetrolprices.com

- International Energy Agency, “Marine bunkers product demand, 2015–2024,” IEA, Paris, France, online: https://www.iea.org/data-and-statistics/charts/marine-bunkers-product-demand-2015-2024

- George, L. and A. Ghaddar, “New rules on ship emissions herald sea change for oil market,” May 17, 2018, online: https://www.reuters.com/article/us-shipping-fuel-sulphur/new-rules-on-ship-emissions-herald-sea-change-for-oil-market-idUSKCN1II0PP

- Sea LNG, “Bunkering,” 2020, online: https://sea-lng.org/why-lng/bunkering/#:~:text=The%20bunkering%20infrastructure%20to%20support,LNG%20bunkering%20investments%20and%20operations

- Terpitz, J., “LNG for aircrafts,” TGE Gas Engineering GmbH, LNG 19 Shanghai, Shanghai, China, April 1–5, 2019, online: https://www.gti.energy/wp-content/uploads/2019/10/152-LNG19-03April2019-Terpitz-Julian-presentation.pdf

- Roberts, R., S. R. Nuzum and M. Wolff, “Liquefied natural gas as the next aviation fuel,” Propulsion and Energy Forum, Orlando, Florida, July 27–29, 2015, online: https://www.researchgate.net/publication/280925005_Liquefied_Natural_Gas_as_the_Next_Aviation_Fuel

- International Gas Union, “IGU world LNG report,” 2018.

- Japan Petroleum Exploration Co. Ltd., “Our Business: Infrastructure & utility business: LNG satellite system,” online: https://www.japex.co.jp/english/business/japan/lng.html

|

JOHN G. BAGULEY is Chief Operating Officer for Magnolia LNG LLC, a Glenfarne Group/Alder Midstream company. His involvement in international LNG project development and delivery spans 40 yr and includes project management, engineering, construction and commissioning roles. He holds a BS degree in chemical engineering from Michigan State University in East Lansing, Michigan and is a registered Professional Engineer in Texas.

|

RICHARD WHEELER formerly served as Process Technology Manager for the Magnolia LNG project, with more than 30 yr of experience in LNG process engineering, project management and process safety management. He has a history of delivering innovative solutions to challenging LNG projects, as well as demonstrated leadership in process safety design and delivery. Mr. Wheeler holds a BEng degree in chemical engineering from the University of Swansea in the UK and is a Chartered Engineer with the Institute of Chemical Engineers.

Comments