Gas Processing News

Compressor Controls awarded Arctic LNG 2 contracts

|

Compressor Controls Corp. (CCC), a manufacturer of LNG turbomachinery controls and a division of Roper Technologies Inc., has been awarded multiple contracts for Novatek’s Arctic LNG 2 project in Russia. A major LNG development located in the Yamal-Nenets Autonomous Region’s Gydan Peninsula, the Arctic LNG 2 project boasts an expected production capacity of 19.8 MMtpy.

The contracts represent the latest collaboration between Novatek and CCC, which previously worked together on turbomachinery optimization and standardization for the Yamal LNG project. Under the new contracts, CCC will oversee the turbomachinery controls and optimization for the centrifugal compressors and expanders of the three 6.6-MMtpy LNG trains.

In addition to spearheading anti-surge, performance, quench and other advanced controls, CCC will provide an emulator for use during the plant simulation and its eventual operator training similar. The company will leverage specialized local and global teams, and collaborate with the field’s leading OEMs to execute and deliver state-of-the-art control algorithms.

The Arctic LNG 2 project includes construction of three LNG trains, using gravity-based structure platforms. The project is based on the hydrocarbon resources of the Utrenneye field. As of December 31, 2018, the Utrenneye field’s 2P reserves under PRMS totaled 1,138 Bm3 of natural gas and 57 MMt of liquids. Under the Russian classification, reserves totaled 1,978 Bm3 of natural gas and 105 MMt of liquids.

Excelerate Energy takes delivery of 10th FSRU

|

On June 10, Excelerate Energy LP took delivery of its 10th floating storage and regasification unit (FSRU), the Excelerate Sequoia, from Daewoo Shipbuilding and Marine Engineering (DSME) shipyard in South Korea. The vessel has a storage capacity of 173,400 m3 and is capable of operating as both an FSRU and a fully tradable LNG carrier.

In September 2019, Excelerate and Maran Gas Maritime Inc. signed a 5-yr bareboat charter agreement for the FSRU. Excelerate will have the option to purchase the Excelerate Sequoia during the 5-yr charter agreement.

According to Excelerate Energy, since the delivery of the industry’s first FSRU in 2005, the technology has allowed the quick and reliable opening of new natural gas markets around the world. The FSRUs connect communities to gas infrastructure that would otherwise be locked out.

The Excelerate Sequoia completed its first gas-up and cooldown operations at POSCO Energy’s Gwangyang LNG terminal in Jeonnam, South Korea, on June 21. The terminal is South Korea’s first private LNG terminal and has carried out gas trial and gas-up/cooldown operations for more than 150 vessels since 2005.

Excelerate Sequoia joins Excelerate’s existing fleet of nine FSRUs, all built by DSME. Excelerate Technical Management, a wholly-owned subsidiary of Excelerate, will provide ship management for the vessel.

Hyundai invests in liquid hydrogen technology

|

Hydrogen will play an important role in the low-carbon energy demand of the future. Storing hydrogen by using an oil type fluid as the liquid organic carrier enables safe and efficient handling within the existing fuel infrastructure.

Hydrogenious’ Liquid Organic Hydrogen Carrier (LOHC) technology enables the storage of hydrogen produced in geographic locations with a surplus of renewable energy. It also enables the efficient transportation of hydrogen to consumers that require renewable energy or demand hydrogen as feedstock.

Hyundai Motor Co.’s investment in Hydrogenious LOHC Technologies GmbH in May is the beginning of a comprehensive cooperation between the two companies. The investment is connected with a joint technology and business development agreement for stationary and onboard LOHC systems.

With its participation in Hydrogenious LOHC Technologies, Hyundai Motor Co. plans to deploy and market LOHC technology. The joint marketing and business development activities will initially focus on South Korea. The stated goal is to establish LOHC as a hydrogen vector within the broader South Korean ambitions of building a national hydrogen infrastructure. After an initial phase, both parties plan to extend the cooperation and to merge with Hyundai’s hydrogen activities in Europe.

Hyundai is a driving force for the development of hydrogen refueling infrastructure in both Asia and Europe. The South Korean company considers LOHC as a promising technology for hydrogen logistics and storage at refueling stations.

ExxonMobil eyes LNG-to-power projects in Vietnam

ExxonMobil Corp. is exploring the possibility of investing in new projects to develop LNG-to-power plants in Vietnam. The company has long been engaged in the development of the Blue Whale gas field in Vietnam, but no progress has been seen in recent years. One possible project is for a 4,000-MW LNG-to-power plant in the northern port city of Haiphong. The plant could start generating power between 2025 and 2030. Another project could be for a 3,000-MW LNG power plant in the Mekong Delta province of Long An. The plants would use LNG imported from the U.S. or other countries.

Japan hydrogen pilot project marks first fuel

Japan’s Chiyoda Corp. and its partners said that their pilot hydrogen project, using imported hydrogen from Brunei, has begun providing clean fuel for the gas turbine power generators of Toa Oil Co. in Kawasaki, near Tokyo.

The move marks the first consumption of foreign-produced hydrogen for power generation in Japan, as well as the world’s first successful international hydrogen supply chain. Chiyoda, Mitsubishi Corp., Mitsui & Co. and Nippon Yusen have been working on the hydrogen demonstration project since 2015, using the organic chemical hydride method, with an aim to import 210 tpy of hydrogen from Brunei to Japan.

The JV’s research unit has built a hydrogenation plant in Brunei and a dehydrogenation plant in Japan. The JV transports hydrogen, extracted from gas piped directly from LNG plants, from Brunei in liquefied form at an ambient temperature and pressure. The gas is then dehydrogenated in Japan and hydrogen is extracted to be used as fuel at gas power generators.

The pilot project will continue through November 2020. Toa’s Kawasaki plant can generate 80 MW of electricity. The JV aims to transport 350,000 tpy of hydrogen to power a 1-GW power plant.

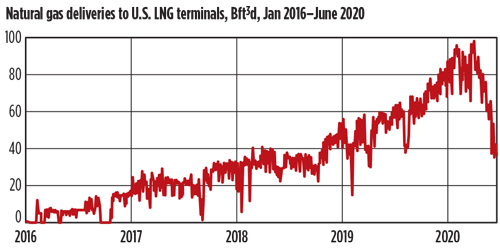

U.S. LNG exports take a tumble—but look to recover in H2

|

Daily natural gas deliveries to U.S. LNG export facilities were at a record 9.8 Bft3d in late March of this year, but deliveries fell to less than 4 Bft3d in June. A mild winter and COVID-19 mitigation efforts have led to declining global natural gas demand and high natural gas storage inventories in Europe and Asia, reducing the need for LNG imports.

Historically low natural gas and LNG spot prices in Europe and Asia have affected the economic viability of U.S. LNG exports. Trade press reports indicate that more than 70 cargoes were canceled for June and July deliveries, and more than 40 cargoes were canceled for August deliveries. In comparison, 74 cargoes were exported from the U.S. in January 2020.

In 2019, the U.S. became the world’s third-largest LNG exporter on an annual basis; only Qatar and Australia exported more LNG. Several U.S. LNG export facilities became operational in 2019.

Most recently, in May, the third train at Freeport LNG in Texas began commercial operations. Later this summer, the third train at Cameron LNG and three of Elba Island LNG’s small-scale, modular liquefaction units are expected to come online, bringing U.S. total liquefaction capacity to 8.9 Bft3d of baseload LNG export capacity and 10.1 Bft3d of peak export capacity.

In January, 74 LNG export cargoes were loaded in the U.S., and LNG exports totaled 8.1 Bft3d—both record highs. LNG exports were only slightly lower from February through April, but they started to decline in May. The U.S. Energy Information Administration (EIA) estimates that 62 cargoes were loaded in April and 52 cargoes were loaded in May. The EIA also estimates that gross U.S. LNG exports in April and May totaled 7 Bft3d and 5.8 Bft3d, respectively. The EIA forecasts that gross U.S. LNG exports will fall to a low of 3.2 Bft3d in July 2020 before increasing in each of the remaining months of the year.

Global spot and forward LNG prices in Asia and natural gas prices in Europe have been at historical lows in recent months, which has affected the economic viability of U.S. LNG exports. U.S. LNG exports are priced at a premium to Henry Hub, in addition to tolling fees and transportation costs to destination markets.

Higher spot and futures prices at Henry Hub compared with TTF prices in Europe since early May contributed to some cargo cancellations from the U.S. this summer. Based on the number of canceled cargoes, the EIA expects U.S. LNG export capacity to be utilized at less than 50% during June, July and August.

Thyssenkrupp expands green hydrogen capacities

|

Green hydrogen is gaining in importance worldwide as an energy carrier and CO2-free feedstock for the chemical industry. As a result, demand is rising for industrial electrolysis plants that can produce green hydrogen cost-efficiently.

Thyssenkrupp has significantly expanded its manufacturing capacities for such electrolysis plants and can now produce electrolysis cells with a total power consumption of up to 1 GW, together with its strategic supplier and JV partner De Nora. These production capacities will be extended continuously in the future.

Sami Pelkonen, CEO of thyssenkrupp’s Chemical & Process Technologies business unit, noted, “Many countries around the world are currently planning to enter the hydrogen economy. Water electrolysis is increasingly emerging as a key technology for building a sustainable, flexible energy system and carbon-free industry. This opens up new markets.”

Green hydrogen, which is produced by electrolysis using renewable electricity, is essential for a successful energy transition and for meeting international climate targets. Hydrogen is not only a clean energy carrier and fuel; it is also a CO2-neutral feedstock for the production of green chemicals.

As a specialist in the engineering and construction of chemical plants, thyssenkrupp can realize entire value chains, from the large-scale production of hydrogen to the subsequent manufacture of sustainable base chemicals, such as ammonia and methanol. In corresponding industrial processes, this makes it possible to dispense with fossil raw materials and reduce CO2 emissions directly at the source.

In energy- and resource-intensive industries such as fuel, chemical or steel production, green hydrogen opens the way to climate neutrality. For this, water electrolysis is needed on a GW scale. Desirable regulatory conditions and fair market opportunities for green hydrogen are also needed to make the technology successful. In addition to the further expansion of renewable energies, a focus exists on adjusting tax systems and crediting the CO2-reducing effect of green hydrogen in the target markets.

To simplify the construction of new hydrogen plants and keep costs down, thyssenkrupp offers its electrolyzers in prefabricated, skid-mounted modules. One module produces 4,000 m3/hr of hydrogen. The units are easy to transport and install, and can be combined to realize projects of several hundred MW or GW. Due to their high reaction speed, the plants can be operated flexibly for the production of green hydrogen for industrial power-to-x applications, as well as for grid stabilization.

The patented design of the electrolysis cells, equipped with proprietary anodic and cathodic coatings developed by De Nora, allows high system efficiencies of up to 80%. The design is based on leading electrolysis technologies from thyssenkrupp. So far, the company has realized more than 600 projects and electrochemical plants worldwide, with a total rating of more than 10 GW.

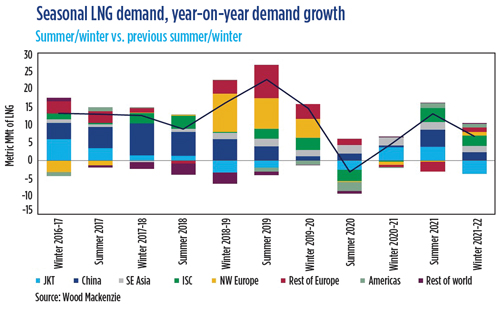

Global LNG demand sees first seasonal contraction in 8 yr

|

The global LNG industry is about to face its first seasonal demand contraction since 2012, with demand in summer 2020 expected to fall 2.7%, or 3 metric MMt, year-on-year, according to Wood Mackenzie data.

Lockdown measures and a negative economic outlook stemming from the COVID-19 pandemic have taken their toll on Asian LNG-importing countries, resulting in the second consecutive year of sluggish LNG demand growth.

COVID-19 is expected to drive a global contraction in LNG deliveries through summer 2020, compared to the previous year. The coming winter season (2020–2021) could see a modest, 5-metric-MMt improvement in global LNG demand compared to the previous winter season.

Pricing dynamics between both seasons are also likely to be similar, with the cross-basin spread set by the economics of U.S. LNG. Some downside risk to Asian prices could emerge this winter if buyers lift a portion of the deferred volumes from this summer. In general, a return to stronger growth is not expected until mid-2021.

Japan’s demand dented by lockdowns. Japan, the world’s largest LNG importer, saw LNG demand decline in 1Q 2020, and imports continued to fall through April as the coronavirus outbreak continued to spread. Although full-scale lockdowns have not been implemented, school closures, strict social distancing, work-from-home guidance and partial sectoral shutdowns dampened LNG demand in 1Q and will continue

to have an impact through 2Q.

The slowdown in 1Q LNG demand was further exacerbated by high storage levels. Like 2019, Japan entered 2020 with above-average inventory levels due to a mild winter, although inventories are now within seasonal norms. The country’s 2Q 2020 LNG demand is expected to fall 3%, to 15.8 metric MMt, compared to 2Q 2019.

China eyes economic recovery. Fresh out of winter heating season, China is shifting focus to industrial demand recovery. Although none of the force majeure notices were formally confirmed on LNG contracts, China reduced pipeline import growth in 1Q 2020 to just 1% year-on-year, with imports from the largest supplier, Turkmenistan, down 12%. Coupled with a low spot price environment, the temporary waiver of U.S. LNG import tariffs and industrial recovery, China managed to increase LNG imports in 1Q 2020.

Moving into summer, China is now faced with the difficult task of economic recovery. While the country’s Blue Sky pollution-reduction program will continue, it is unclear whether the government will set specific targets for coal-to-gas switching in 2020. Any moderation could reduce gas demand during the heating season. Near-term gas-to-power demand is risked to the downside as power demand recovery faces macro uncertainty and more coal-fired power plants are being approved. As a result, China’s 2Q 2020 LNG consumption is expected to rise 12%, to 15 metric MMt, year-on-year.

The other engine of LNG demand growth, India, saw 1Q 2020 LNG consumption growing at record levels at 19% year-on-year, driven by low spot prices. This is expected to reverse as 3 mos of lockdown materially reduces LNG consumption. The country’s LNG demand is expected to decline 24%, to 4 metric MMt, in 2Q 2020 compared to the same period last year.

Europe at record-high gas inventories. Lockdowns across Europe have been just as severe as in Asia, but the total impact on gas demand is expected to be proportionally less due to the smaller share of gas used in the industrial sector, as well as the resilience of gas burn in the power sector and largely unaffected demand from residential use.

Although Europe’s total gas demand is down in comparison to last year, reductions in domestically produced gas and Russian pipeline imports have created more room for LNG to be absorbed. However, the largest fundamental difference from 2019 is Europe’s vast gas inventories, which sit at record seasonal highs and will reduce the continent’s ability to absorb the global surplus of LNG in 3Q 2020.

Low market prices are impacting LNG supply, with downward revisions seen across all basins and regions. If this continues heading into 2021 and a robust rebound in LNG demand is seen from Japan, South Korea or India, then a price correction could begin earlier than previously anticipated and reduce the risk of further U.S. supply reductions next year.

Strong gas demand expected post-COVID-19

The natural gas industry sees no change to the strong long-term outlook for demand following the COVID-19 crisis, but expects a supply shortfall in the next 4 yr as the pandemic lockdowns and oil price collapse lead to delays on gas projects. Gas producers, buyers, LNG developers and a major contractor said in the long run the fuel will be needed to back up wind and solar power, replace coal-fired power and produce hydrogen globally.

However, lingering uncertainty following a crash in LNG prices to record lows this year below $2/MMBtu means only the lowest-cost LNG projects will go ahead. More than 140 MMtpy of projects worldwide have been deferred.

Research firm Rystad Energy said that with gas prices around the world still trading near $2/MMBtu as of the time of publication, LNG developers with all but the lowest costs will hold off on new projects. However, this will again cause a shortfall for the LNG market within 4 yr–5 yr.

Technology to convert CO2 to renewable natural gas

Southern California Gas Co., Pacific Gas and Electric Co., and Opus 12 have demonstrated further advancement of a new electrochemical technology that converts the CO2 content in raw biogas to pipeline-quality renewable natural gas, a critical improvement in the science of upgrading waste emissions to renewable gas.

The single-step process is designed to use renewable electricity, and also provides

a way for long-term storage of excess wind and solar power.

Raw biogas is produced from the anaerobic breakdown of waste from sources like landfills, sewage and dairy farms. It contains roughly 60% methane and 40% CO2. While current biogas upgrading technology removes the CO2 from biogas, this new technology captures the CO2 and converts it into additional renewable fuel.

The new demonstration shows that improved catalyst activity could speed reactions by five times and nearly double conversion efficiency, making the technology commercially competitive with other new biogas upgrading methods. The core technology was scaled up and tested using commercially available electrolyzer hardware. The next step will be to test this technology for longer periods at an existing biogas facility.

According to Opus 12, the vision for deploying the technology in California is to recycle CO2 emissions from industry and agriculture before they reach the air. Valuable products can be created from these emissions, such as renewable natural gas and feedstocks for everyday materials, chemicals and even liquid fuels. When produced with renewable electricity, the fuels are expected to have significantly lower lifecycle emissions than conventional products.

Opus 12 has created a proprietary Polymer Electrolyte Membrane (PEM) electrolyzer

that uses electricity to convert water and CO2 into renewable natural gas in one step.

The research is part of Southern California Gas’ and Pacific Gas and Electric’s respective development of cutting-edge technologies for storing excess renewable energy. GP

Comments