Gas Processing News

A. Blume, Editor

Total sells 4% of Ichthys to INPEX for $1.6 B

|

French energy company Total has agreed to sell a 4% stake in its Australian Ichthys LNG project to Japanese partner INPEX for $1.6 B, following cost overruns. Many of the new Australian LNG projects have experienced cost overruns and delays during construction.

Total remains committed to the Ichthys project and will hold on to its remaining 26% stake in Ichthys.

INPEX has a majority stake of around 66% in the $40-B project in northwestern Australia, which has seen multiple delays and significant cost overruns due to technical problems.

The project’s other minority shareholders include CPC, Tokyo Gas, Osaka Gas, Kansai Electric, JERA Corp. and Toho Gas.

At full operational capacity, Ichthys is expected to produce 8.9 metric MMtpy of LNG, along with approximately 1.7 metric MMtpy of LPG and around 100,000 bpd of condensate.

EXMAR’s Tango FLNG sets sail from China to Argentina

EXMAR announced that its floating LNG unit (FLNG), to be renamed Tango FLNG, has left China to the destination of its liquefaction operations: Bahia Blanca, Argentina.

Tango FLNG was on the move in early January, just one month after contract signing, and the voyage to Argentina is expected to take approximately 45 days.

Upon its arrival, Tango FLNG will be put in operation for EXMAR’s customer, YPF SA, and is expected to start LNG production in 2Q 2019.

Tango FLNG is designed for a liquefaction capacity of approximately 0.5 MMtpy of LNG and is to play a central role in YPF’s efforts to export the Vaca Muerta gas reserves from Argentina’s Neuquén basin to the international markets.

World’s largest FLNG platform starts production

Royal Dutch Shell has begun output at its Prelude FLNG facility in Australia, the world’s largest floating production structure and the last of eight LNG projects built in the country over the last decade. The project is expected to further cement Australia’s lead as the world’s biggest LNG exporter, after the country took the crown from Qatar in November 2018.

Wells have been opened at the Prelude facility, located 475 km northeast of Broome in western Australia. Prelude is expected to have an LNG production capacity of 3.6 metric MMtpy, 1.3 metric MMtpy of condensate and 400,000 metric tpy of LPG.

RWE signs second LNG supply deal with Woodside

Australian oil and gas group Woodside Petroleum will supply more LNG to RWE under a new deal signed with the German utility.

Under the deal, the second with Woodside, deliveries will run from 4Q 2020 to December 2022 and will be sold under a free-on-board basis.

Woodside agreed last year to deliver up to 12 cargoes of LNG between April 2018 and March 2020 to RWE. The primary source of LNG for the new agreement will come from volumes that Woodside has contracted from the Corpus Christi LNG project in Texas.

German utilities, gas suppliers and logistics companies are reviving years-old plans to build an LNG import terminal as part of a bid to diversify away from pipeline gas arriving from Russia, Norway and the Netherlands.

Eni’s Indonesia gas project to start up in 2021 under new contract

Italy’s Eni aims to start output of natural gas from its offshore Merakes project in Indonesia in 2021. Initial production at Merakes would be 155 MMft3d of natural gas, rising to a forecast peak output of 391 MMft3d.

The targets are part of an amended development plan for the East Sepinggan block in the Makassar Strait under a new production-sharing contract. As part of the revision, the contractors have agreed to adopt a gross split scheme, whereby Eni and its partner, Pertamina, would take 67% of crude oil and 72% of natural gas production from the project, and the Indonesian government would take the rest. The amendment would be the first time a conventional cost-recovery production-sharing contract in Indonesia is converted to use the gross split scheme.

Indonesia recently adjusted its gross split mechanism for new and expiring oil and gas production-sharing contracts, whereby contractors shoulder the costs of exploration and production, rather than being reimbursed by the government. The changes are intended to attract investment amid tepid interest in Indonesia’s energy tenders and after the industry pointed to more attractive opportunities in other countries.

Tahar said the Merakes project has an estimated 814 Bft3 of natural gas reserves and an economic lifetime of around 9 yr.

Eni holds an 85% participating interest in the contract via its local unit, Eni East Sepinggan Ltd., while Indonesia’s Pertamina holds 15%. With the revision, the contract duration up to July 19, 2042 will not change.

ExxonMobil shelves Canada LNG export project

|

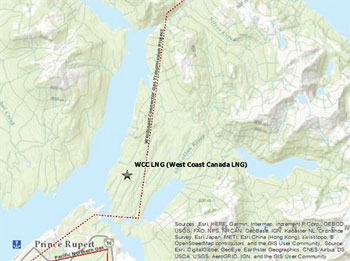

US oil major ExxonMobil Corp. has withdrawn its West Coast Canada (WCC) LNG export project in Canada from an environmental assessment, signaling that the project has been shelved.

The company's decision to pare its LNG project portfolio follows the decision by a Royal Dutch Shell-led group to build a giant LNG project in British Columbia to supply Asian customers, and ExxonMobil's focus on LNG projects in Asia, the Middle East and the US.

ExxonMobil's WCC LNG export project in British Columbia was expected to produce around 15 metric MMtpy of LNG, with plans for further expansion up to 30 metric MMtpy.

British Columbia rules require large projects to obtain an environmental assessment certificate before they can be developed. An examination of the project by the Canadian Environmental Assessment Agency has been ongoing since February 2015.

ExxonMobil's decision signaled it is concentrating on LNG projects with Qatar Petroleum and a proposed expansion of its chilled gas operation in Papua New Guinea. The US company has been capitalizing on available opportunities to invest, restructure or divest assets to strengthen its long-term competitive position and provide the highest return to shareholders.

LNG demand is growing, but environmental groups say exports will boost carbon emissions in Canada, both through gas extraction and the liquefaction process.

The WCC LNG export project was planned to have liquefaction and storage facilities for natural gas, loading facilities and third-party pipeline facilities.

Area 4 co-venture parties secure commitments for Rovuma LNG

Area 4 co-venture participants have secured LNG offtake commitments from affiliated buyer entities of the partners, a key milestone enabling the participants to move toward a final investment decision in 2019 on the first phase of the Rovuma LNG project. Area 4 participants are ExxonMobil, Eni, China National Petroleum Corp. (CNPC), Empresa Nacional de Hidrocarbonetos, Kogas and Galp.

The commitments are subject to the conclusion of fully-termed agreements and the approval of the government of Mozambique. In July 2018, Mozambique Rovuma Venture submitted the development plan to the government of Mozambique for the first phase of the Rovuma LNG project.

The project will produce, liquefy and market natural gas from the Mamba fields, located in the Area 4 block in the Rovuma basin offshore Mozambique. ExxonMobil will lead construction and operation of natural gas liquefaction and related facilities on behalf of the Area 4 JV, and Eni will lead construction and operation of upstream facilities.

The development plan for the first phase of the Rovuma LNG project specifies the proposed design and construction of two LNG trains, each of which will produce 7.6 MMtpy of LNG.

Sempra Energy unit to export US LNG to Europe

|

Port Arthur LNG LLC, a subsidiary of Sempra Energy, and the Polish Oil & Gas Co. (PGNiG) announced they have entered into a definitive 20-yr sale-and-purchase agreement for LNG from the Port Arthur LNG liquefaction-export facility under development in Jefferson County, Texas.

The announcement is an important milestone, as Sempra Energy pursues its long-term goal of exporting 45 metric MMtpy of North American LNG.

While financial terms were not disclosed, the agreement is for the sale and purchase of 2 metric MMtpy, or approximately 2.7 Bm3y (after regasification)—enough natural gas to meet about 15% of Poland’s daily needs. The agreement is subject to certain conditions, including Port Arthur LNG making a final investment decision.

Under the agreement, LNG purchases from Port Arthur LNG will be made on a free-on-board basis, with PGNiG responsible for shipping the LNG from the Port Arthur terminal to the final destination. Port Arthur LNG will manage gas pipeline transportation, liquefaction processing and cargo loading, giving PGNiG flexibility in cargo management. PGNiG plans to deliver cargoes to domestic customers in Poland or trade LNG on the global market, once operations commence.

In addition to the PGNiG agreement, Sempra Energy signed a memorandum of understanding (MOU) with Korea Gas Corp. last year for potential participation in the Port Arthur LNG project.

Sempra Energy has partnered with Mitsubishi, Mitsui & Co. Ltd. and Total on the construction of the Cameron LNG project in Hackberry, Louisiana. The first phase of this project is being commissioned, with the expectation that LNG will be produced from all three liquefaction trains in 2019.

Sempra Energy also has an MOU with Total SA for some export capacity at Cameron LNG Phase 2 and heads of agreements (HOAs) with Mitsui & Co. Ltd., Tokyo Gas Co. and Total for all of the export capacity at Energía Costa Azul Phase 1 in Baja California, Mexico. An MOU and HOA define terms and conditions of contracts to be negotiated and do not commit any party to enter into a definitive agreement.

The Port Arthur LNG export facility is proposed to include two natural gas liquefaction trains capable of processing approximately 11 MMtpy of LNG, up to three LNG storage tanks, two marine berths and associated facilities.

The Port Arthur facility is scheduled to receive its final environmental impact statement from the Federal Energy Regulatory Commission in early 2019. In 2018, Bechtel was selected by Port Arthur LNG to serve as the engineering, procurement, construction and commissioning contractor for the facility, subject to reaching a definitive agreement.

Development of the Port Arthur LNG liquefaction facility is contingent upon obtaining additional customer commitments; completing the required commercial agreements; securing all necessary permits; obtaining financing, incentives and other factors; and reaching a final investment decision (FID).

Western Gas selects McDermott, BHGE for Equus project

|

McDermott International Inc. and Baker Hughes, a GE Company, have signed a memorandum of understanding (MOU) with Western Gas Corp. Pty. Ltd. to be the exclusive development partners for the Equus Gas Project in Western Australia. The companies were also awarded a contract to support the planning phases of the project.

As part of the initial contract, McDermott and BHGE will work with Western Gas to advance the pre-front end engineering design (pre-FEED) and front-end engineering design (FEED) to final investment decision (FID). McDermott and BHGE's JV, io Oil & Gas Consulting, will provide the pre-FEED support to deliver a technically robust and cost-efficient development plan.

Pre-FEED work will commence immediately and is estimated to be complete by Q2 2019. McDermott and BHGE will continue with FEED work thereafter.

Upon FID, McDermott and BHGE are expected to undertake the engineering, procurement, construction, installation and commissioning (EPCIC) of the entire field development scope under a separate contract. The scope will cover reservoir evaluation, drilling and completions, subsea, production facilities, an export pipeline, an LNG facility and a domestic gas connection facility.

The Equus gas fields are located about 124 mi (200 km) northwest of the Western Australian town of Onslow. The fields' water depth ranges from 3,280 ft (1,000 m) to 3,937 ft (1,200 m), with an anticipated downstream nearshore LNG facility and pipeline connection to the Western Australian gas market.

The Equus Gas Project is a development-ready asset with an extensive history of exploration and appraisal activities and development studies.

McDermott and BHGE participated in the exploration appraisal drilling program and FEED studies with the previous owner, Hess, before Western Gas acquired the asset in November 2017.

The io JV has also performed a number of technical studies for Western Gas to assess development options. The MOU and the expected scope of work for the EPCIC were built on these past studies.

ADNOC awards OMV stake in ultra-sour gas concession

|

The Abu Dhabi government and Abu Dhabi National Oil Co. (ADNOC) have awarded Austria’s OMV a 5% stake in the Ghasha ultra-sour gas concession that comprises the Hail, Ghasha, Dalma, Nasr, Sarb and Mubarraz sour gas fields.

OMV, which joins Italy’s Eni and Germany’s Wintershall as ADNOC’s partners in the concession, will contribute 5% of the project capital and operational development expenses. Eni was awarded a 25% stake and Wintershall a 10% stake in the Ghasha concession in November 2018.

The awards for the Ghasha concession, which has a term of 40 yr, follow Abu Dhabi’s Supreme Petroleum Council’s approval of ADNOC’s integrated gas strategy. The strategy will see the development, in phases, of Abu Dhabi’s substantial gas reserves, as the UAE moves toward gas self-sufficiency and aims to transition from a net importer of gas to a net gas exporter.

The project is expected to produce more than 1.5 Bft3d of gas when it comes onstream around the middle of the next decade, enough to provide electricity to more than 2 MM homes. Once complete, the project will also produce more than 120,000 bpd of oil and high-value condensates.

Over the project’s lifetime, ADNOC expects substantial benefits to flow back into the UAE economy under its in-country value program, which is intended to stimulate commercial opportunities for local businesses, catalyze socioeconomic development and create additional employment opportunities for UAE nationals.

Sour gas is defined by its significant hydrogen sulfide content; in the past, this has made processing the natural gas more complex. This is the reason why the resource has lain beneath the surface in some fields for decades after its initial discovery. However, the combination of rising demand and technological advances has now made extraction and processing viable.

In developing the Hail, Ghasha, Dalma and other ultra-sour gas fields in the concession, ADNOC will capitalize on its expertise and successes in ultra-sour gas development. The company gained this experience from the development of the Shah reservoir, creating an ultra-sour gas center of excellence for the region.

In addition to developing the Ghasha concession area, ADNOC also plans to increase production from its Shah sour gas field to 1.5 Bft3d and move forward to develop the sour gas fields at Bab and Bu Hasa. ADNOC also plans to tap gas from its gas caps and unconventional gas reserves, as well as new natural gas accumulations, which will continue to be appraised and developed as the company pursues its exploration activities.

OMV, which has significant experience in the treatment of sour gas, collaborates with ADNOC in a number of areas. In April 2018, it was awarded a 20% stake in Abu Dhabi’s Sarb and Umm Lulu offshore concession. Since 2016, it has also been leading on a 4-yr seismic, drilling and engineering work program to explore and appraise areas that include the fields in the Ghasha concession.

OMV is also a shareholder in Borealis, ADNOC’s partner in Borouge, a leading global provider of innovative plastic solutions. In May 2017, ADNOC and OMV agreed to work together to explore potential opportunities in support of ADNOC’s downstream growth ambitions.

North America to lead next wave of global LNG projects

|

North America will lead the next wave of global LNG projects in 2019, with three US Gulf Coast developments—Sabine Pass Train 6, Golden Pass and Calcasieu Pass—expected to reach final investment decision (FID) in the first half of 2019, according to Wood Mackenzie.

With FID imminent on three US Gulf Coast LNG projects, North America is set to lead an expected record year for LNG project sanctions.

After a lull in investment prior to 2018, the North America LNG market has sprung back to life. Since September, Cheniere, Venture Global, Sempra, Tellurian, Freeport and Woodfibre all announced long-term agreements with offtakers. In the same period, 13 metric MMtpy in sales were announced, totaling more than 20 metric MMtpy for the year.

The construction and expansion of the three Gulf Coast LNG facilities, totaling up to 30 metric MMtpy of capacity, will also inject billions of dollars of investment in the region. According to Wood Mackenzie, $20 B could be invested in the three projects over the next 4 yr.

The Gulf Coast remains the key growth region for North America LNG, although projects in Canada and Mexico are also progressing and attracting interest. Additional west Canadian capacity could help further open Canadian supply to global markets, and momentum is building around Mexico as an alternative export route for US production.

According to Wood Mackenzie, Canada’s planned Woodfibre LNG project (pictured) could reach FID in 2019, contingent on the execution of an engineering, procurement and construction (EPC) contract.

Mexico’s Costa Azul Phase 1 LNG export terminal still needs to finalize an EPC contract, binding offtake agreements, permitting and financing arrangements. However, progress is being made, and it could reach FID in 2019.

Poland seeks contractor for LNG terminal expansion

The operator of Poland’s only LNG terminal has tendered for a contractor to oversee a 50% expansion of its capacity by 2021, as demand for natural gas in central and eastern Europe continues to increase.

Capacity at the terminal at Swinoujscie on the Baltic Sea is to be expanded to 7.5 Bm3y from 5 Bm3y and will cover around half of Poland’s domestic gas consumption.

The terminal is used by state-run energy firm PGNiG, which presently consumes almost all of its capacity. Poland opened the terminal in 2016 in line with its plan to reduce its reliance on imported Russian gas, which accounted for more than half of Poland’s gas consumption at the time.

Tokyo Gas, First Gen to build LNG terminal in Philippines

Philippine power company First Gen Corp. and Tokyo Gas Co. have signed a preliminary agreement to jointly develop an LNG import terminal project in the Philippines. Tokyo Gas will take a 20% interest in the project, which will be located in First Gen's LNG complex in Batangas province, south of the capital Manila.

First Gen operates four of the country's five gas-fired power plants, with total capacity of about 2,000 MW, all of them in Batangas.

The Philippines is expected to start importing LNG to feed its gas-fired power plants as domestic gas supply from its Malampaya field is set to run out in 2024.

State-owned Philippine National Oil Co. (PNOC) was seeking a JV partner to build and run an LNG hub in Batangas Bay, but has twice postponed a meeting with potential investors. PNOC rejected First Gen's unsolicited proposal to PNOC to be part of First Gen's LNG terminal project in Batangas. Three different groups, including the First Gen-Tokyo Gas team, had been shortlisted to build and operate the Southeast Asian country's first LNG import terminal.

China National Offshore Oil Corp (CNOOC) is also in the running. In June 2018, CNOOC signed an agreement to develop an LNG terminal project in the Philippines with fuel retailer Phoenix Petroleum.

Comments