Gas processing news

LNG carrier sets Northern Sea Route record

On August 17, the Sovcomflot-owned icebreaking LNG carrier Christophe de Margerie completed its first commercial voyage, transporting LNG through the Northern Sea Route (NSR) from Norway to South Korea.

During this voyage, the vessel set a new time record for an NSR transit of just 6 d, 12 hr and 15 min. Moreover, Christophe de Margerie has also become the world’s first merchant vessel to travel the full length of the NSR without any icebreaker escort.

During the record-setting voyage, the LNG carrier covered 4,060 km from Cape Zhelaniya of the Novaya Zemlya archipelago to Cape Dezhnev at Chukotka, Russia’s easternmost continental point. The average speed during the passage exceeded 14 knots, even though the Christophe de Margerie had to sail through ice fields 1.2 m thick in some areas.

The total time of the voyage from Hammerfest in Norway to the port of Boryeong in South Korea was 19 d, approximately 30% faster than the regular southern route through the Suez Canal. The speed achieved demonstrates the economic potential of using the NSR for large-capacity vessel transits.

Christophe de Margerie is the world’s first (and, at present, the only) icebreaking LNG carrier.

The vessel was built to order for Sovcomflot to serve the Yamal LNG project and transport LNG year-round through the difficult ice conditions of the Kara Sea and the Gulf of Ob. The vessel was delivered to Sovcomflot on March 27, following successful ice trials in the Kara and Laptev Seas.

The LNG carrier is capable of sailing independently through ice of up to 2.1 m thick. Christophe de Margerie has been assigned an ice class of Arc7, the highest ice class among existing merchant vessels.

The ship’s propulsion system has a power of 45 MW, which is comparable to the capacity of a modern nuclear-powered icebreaker. Christophe de Margerie also became the world’s first vessel with a high ice class to have three Azipod units installed, providing the vessel with a high ice-breaking capability and pronounced maneuverability.

Gas to be primary energy source by 2035

|

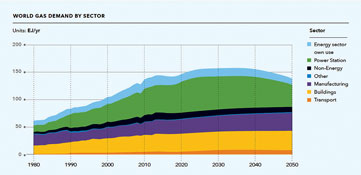

DNV GL’s Energy Transition Outlook (ETO), a forecast that spans the global energy mix to 2050, predicts that global demand for energy will flatten

in 2030, then steadily decline over the next two decades, thanks to step changes in energy efficiency. The fossil fuel share of the world’s primary energy mix will decrease from 81% at present, to 52% in 2050.

Demand for oil is expected to peak in 2022, driven by expectations for a surge in the use of light-duty electric vehicles, which are expected to account for 50% of new car sales globally by 2035.

However, the stage is set for gas to become the largest single source of energy to 2050, and the last of the fossil fuels to experience peak demand, which DNV GL expects will occur in 2035.

Gas will continue to play a key role alongside renewables in helping meet future, lower-carbon energy requirements. Major oil companies intend to increase the share of gas in their reserves, and DNV GL expects an accelerated shift by 2022 as companies decarbonize their business portfolios.

While demand for hydrocarbons will peak over the next two decades, significant investment will be needed to add new oil and gas production capacity and to continue operating existing assets safely and sustainably.

However, the results of DNV GL’s model reinforce the need to maintain strict cost efficiency to achieve the margins necessary for future capital and operational expenditures.

Shell to monetize gas via Egypt LNG

|

Royal Dutch Shell is considering options to bring gas from Noble Energy and Delek Drilling’s giant Leviathan gas field offshore Israel and Cyprus to market.

Under discussion is a proposal wherein Shell would buy natural gas from Leviathan, combine it with gas production from the Aphrodite field (in which Shell owns a 35% stake) offshore Cyprus, and then send it to Shell’s Idku LNG export terminal in Egypt.

Combining the production from the two fields could serve to improve the economics of the projects. Noble Energy and Delek Drilling have cited an estimated development cost for Leviathan of $3.75 B.

If the partners strike a deal with Shell, then they will need to secure additional funds for development to increase Leviathan’s output.

Noble Energy remains in negotiations to supply natural gas to the Egyptian market.

If settled, the multi-partner, multi-field deal could go a long way toward fulfilling the Eastern Mediterranean region’s aspirations to become a major gas-exporting hub.

Egypt was a net exporter of LNG until 2014, when dwindling gas production and power shortages resulting from political uprising forced the country to reserve the fuel for domestic use.

Cyprus is also eager to develop its gas sector. The concept of building floating LNG (FLNG) vessels to process the Aphrodite gas may be a viable option if regional politics prevent the construction of cross-border gas pipelines.

Gazprom: Sanctions will not stop pipeline

The $11-B Nord Stream 2 expansion project to add a second Russian trans-Baltic gas export pipeline will be implemented, regardless of how new US sanctions related to the Ukraine crisis and the 2016 US presidential elections are interpreted, according to Gazprom.

Earlier this year, Uniper, Wintershall, Shell, OMV and Engie agreed to each loan 10% of the cost of the pipeline. Gazprom will remain the sole shareholder in Nord Stream 2, shouldering 50% of the cost. The conduit will have the capacity to carry 55 Bcmy of gas to a terminal in Germany, and is due to start operating in 2019.

Petronas eyes pipelines for Canada gas

|

Malaysia’s state-owned oil and gas company, Petroliam Nasional Berhad (Petronas), is considering investing in a pipeline to market its Canadian gas assets, after scrapping plans for an LNG project in Canada. Petronas would use the pipeline to connect and market natural gas from an area of western Canada that holds 22.3 Tcf of proven unconventional gas to the rest of Canada and North America. Petronas scrapped its proposed $29-B LNG export terminal in western Canada last month due to weak global prices, in a blow to its ambitions to expand its LNG portfolio beyond Malaysia.

However, industry analysts said the decision was expected and would bring the company long-term benefits, as it frees up funds for other domestic projects. Petronas is working diligently on its Refinery and Petrochemical Integrated Development (RAPID) project in Malaysia’s southern state of Johor.

Comments