Shale asset development—An integrated design plan to minimize supply cost

Around the world, shale plays have emerged as a significant source of hydrocarbons. The ongoing development of these resources requires innovation to drive down the supply cost. Continuous improvement in horizontal drilling and hydraulic fracturing is only part of the story, however. Generating an integrated design plan (IDP) from the reservoir, through the gathering system and facilities, to the sales pipelines—and across the asset lifecycle—is essential for further innovation. This capability demonstrates opportunities to improve the entire infrastructure design, reduce capital costs and maximize production efficiencies.

The development of shale assets is a costly undertaking, due to its inherent complexity. This complexity stems from the numerous, dynamic variables involved in engineering design across the production infrastructure, from the reservoir through to the sales pipelines.

For the most part, variable analysis and design development are carried out by engineering disciplines within their own areas of specialization. However, all of these design variables form an interdependent system of equations across the entire production infrastructure. Therefore, an IDP that incorporates the system of equations provides a comprehensive viewpoint from which to identify opportunities for reducing supply cost.

Minimizing supply cost. Historically, reservoir engineering and petroleum engineering have provided access to unconventional resources through horizontal drilling and hydraulic fracturing. Subsurface engineering and science teams have conducted significant variable analysis and developed rigorous tools to drive continuous improvement. Along the way, facilities engineering and pipeline engineering have analyzed numerous variables to implement elements of standardization, repeatability and modularity from well pads to booster stations and gas plants, as well as all of the interconnecting pipelines, to optimize engineering design and ensure field construction cost certainty.

This approach to infrastructure development, with each discipline functioning relatively independently, has benefits; however, it can also result in engineering design gaps between disciplines and a loss of overall fidelity compared to an IDP. These factors are compounded with changes in production conditions across the asset lifecycle relative to the production infrastructure. However, with an IDP, innovation and optimization can be conducted to investigate if cost reductions are positive—not only for an individual focus area, but also for the entire production infrastructure.

Success in minimizing supply cost requires the insight to identify the value drivers or predominant design variables, as well as their influences throughout the interdependent system of equations. An IDP provides the visibility to optimize the production infrastructure design according to the drivers of each resource play and the business development strategy. Furthermore, operations can be optimized throughout the asset lifecycle to maximize production efficiencies.

A case study has been developed for a production infrastructure based on design variables from the reservoir through the well pads, gathering system and facilities to product pipelines. The IDP has been built from the corresponding system of equations that incorporates both geographical and scheduling dimensions. The results presented include both planning and select engineering design specifications.

For decision-makers, specific insights have been presented that include supporting data for optimizing production infrastructure capacity, along with alternatives for evaluating economics to support decision analysis.

Characteristics of shale asset development. The engineering design effort for the production infrastructure is typically characterized by complexity and uncertainty. Due to the inherent complexity of a multivariable engineering problem, several basic assumptions are often locked down to initially reduce the overall complication.

Commonly, the engineering design process consists of assimilating design variable data that is important to each engineering discipline, and progressing through design iterations on a segregated basis. Data exchange between engineering disciplines is based on interfaces defined by project phase maturity and decision points, and is sometimes marred by confusion. The degrees of freedom, and the importance of specific design criteria for each discipline, can challenge overall convergence.

This scenario can be further compounded when the engineering design effort is split, with limited overlap among one or more producers, midstream firms, pipeline firms, end users, EPC firms, independent consultants, vendors, fabricators, construction leads, operators, environmental advisors and other stakeholders.

The uncertainty in engineering design emerges when design variables change geographically across the asset map and over time. The potential permutations and combinations can result in an intractable design challenge. The production infrastructure design would entail a list of high-level variables, such as:

- Reservoir composition, pressure and decline curve

- Rig count, drilling schedule and

- production forecast

- Number of wells per pad, and well pad facility design conditions

- Landscape topography, ground type, infrastructure, utilities and environmental considerations

- Pipeline phase type, materials, configuration options, and inlet and outlet conditions

- Facility design conditions for each package, such as inlet separation, compression, stabilization, refrigeration and storage

- Product destination planning

- Commodity prices, exchange rates and cashflow.

In some cases, changes in a single variable can have a “butterfly effect” across the production infrastructure. For example, a large enough change in composition, pressure or flowrate from the wells can increase operational risk and impact many features:

- Well pad separation and metering

- Pipeline erosion, hydrate formation and liquid holdup

- Facilities slug handling, stabilizer overhead compression requirements and product storage

- Commercial product commitment agreements.

At the same time, designing for one scenario by one party, and for one segment of the production infrastructure, may be optimal for those specific conditions. However, when the conditions change, design risks may increase in other segments. For example, selecting a large pipe diameter for the peak flow may, at lower future flowrates, result in higher liquid holdup. This holdup would subsequently result in an undersized gas plant slug catcher, process upsets and potential rework, all of which impact supply costs.

These uncertainties would ultimately lead to an impact in asset development performance across the asset lifecycle, specifically with regard to the following:

- Infrastructure design flexibility, standardization and equipment repurposing

- Implementation efficiencies, budget and schedule

- Operations reliability, capacity flexibility and equipment utilization.

The complexity and uncertainties can impact the production infrastructure design, execution planning and long-term economics.

Objectives. The overall objective is to demonstrate how an IDP can be applied to reduce the supply cost of the production infrastructure. In more detail, the solution must also answer a variety of potential questions that each of the engineering disciplines and stakeholders may ask, such as:

- How big should the gas plant be?

- What impact will a change in composition have on the system-wide production infrastructure?

- What is the rig count, drilling schedule and well pad order?

- Where should compression be located, and how much is needed?

- Should the gathering system be multiphase hydrocarbons; raw, single-phase hydrocarbons; or treated, single-phase hydrocarbons?

- Should a common pipeline diameter be applied to the gathering system? If so, what should it be?

- How should pipeline erosion velocities and pipeline liquid holdup be handled?

- What is the best location for the gas plant and compression stations to minimize the overall gathering system distance?

- How are environmental considerations integrated into the engineering design plan?

- What is the optimal artificial lift technology?

- Which economics best define the business drivers and decision analysis?

- What equipment sparing and relocation philosophies should be applied?

- What equipment would best be standardized and modularized?

- What is the minimum condensate-to-gas ratio required for successful asset development?

- How should each module within the gas plant be optimized with respect to the predominant design variables?

The IDP solution was developed to achieve the overall objective and answer the detailed questions. The design basis is the interdependent system of equations generated through experience-based methodologies and techniques. The result is a living model that further digitizes and automates variable modification for efficient evaluation of alternatives. The output integrates planning, engineering design and economics, with key deliverables that include:

- Rig count and drilling schedule

- Production forecast curves

- Location and engineering design for well pads, junctions, booster stations and gas plants

- Gathering system configuration and design

- Integrated, system-wide production infrastructure heat and material balance

- Integrated execution schedule for all equipment along the production infrastructure

- Capital and operating costs generated from the production infrastructure engineering design

- Economics with decision-supporting data.

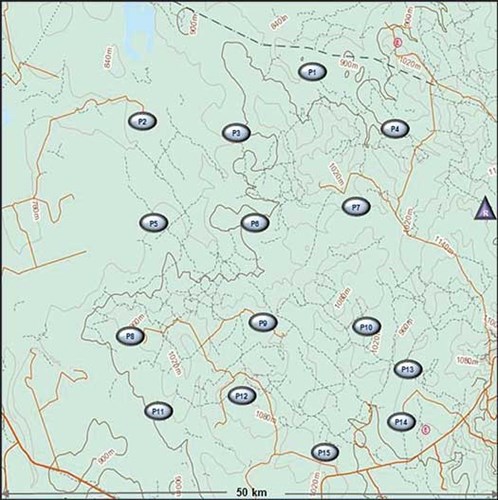

General scope of the IDP study. The presented case study is based on a new shale gas play in Alberta, Canada’s Duvernay zone, with the engineering design boundaries for the production infrastructure ranging from the reservoir through the production equipment to the product delivery point. The input data forming the design basis starts with the topographical map in Fig. 1, in which the pad locations with prefix P have been determined based on production data from a limited number of appraisal wells. The product receipt point has been identified with prefix R. Other relevant design criteria include:

- Established 20-yr planning horizon

- Desired products are sales gas, sales NGL and sales condensate

- All well pads utilize the same flowing pressure, decline curve and composition

- Production composition is expected to yield 34 bbl NGL/MMcf and 85 bbl condensate/MMcf

- Established 15 pads with 16 wells per pad

- Maximum of five rigs dedicated throughout the planning horizon

- Four wells drilled, completed and brought online per pad within a six-month period

- The estimated ultimate recovery per well is assumed to be the same, regardless of production constraints

- Each pad requires gas lift at some stage early in the production life

- The gathering system entails two single-phase lines for raw gas and raw liquid hydrocarbons

- A single gas plant utilizes refrigeration and condensate stabilization to produce the desired products

- Capital cost of product pipelines is included in gas plant capital costs

- Product prices are $2.80/Btu for gas, $20/bbl for NGL and $55/bbl for condensate

- Capital and operating costs used to generate the economics have an accuracy of –25%/+35%

- Operating costs take into account chemical, fuel gas, power and staffing requirements

- Net present value (NPV) is calculated based on 10% discount and 1.5% escalation

- Water supply and handling is out of scope.

|

|

Fig. 1. Greenfield map of well site. |

Analysis and results. The results are presented in order of the key design criteria, followed by the optimized solution utilizing five rigs and a comparison to three rigs. Fewer than three rigs did not produce an economically viable solution. For both rig count cases, supporting data is presented for selection of the optimized production infrastructure capacity, and economic data is presented to demonstrate alternative approaches in decision analysis. While a variety of different variable comparisons and perspectives can be examined, these items have been selected for the sake of brevity.

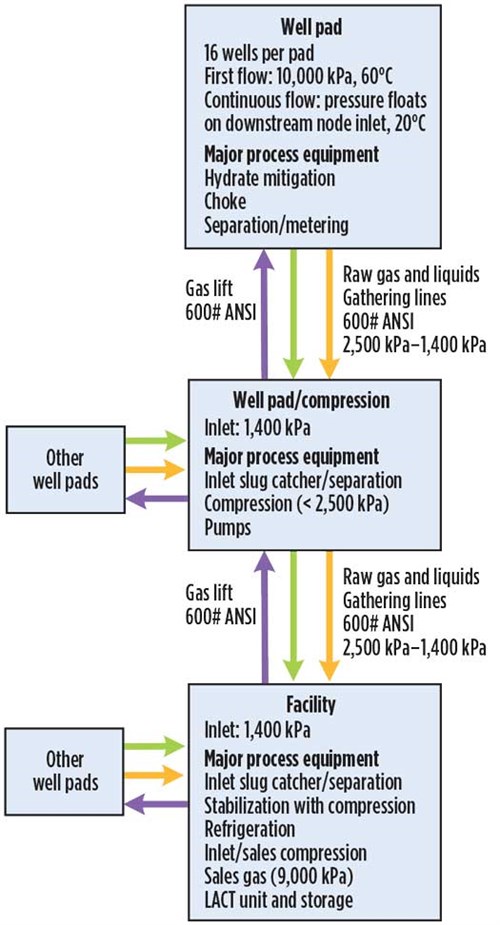

A block flow diagram in Fig. 2 outlines the key design criteria and technology selection that were determined for each of the well pads, the well pads combined with compression, the gas plant and the gathering system. These design criteria provide a certain range of flexibility within which the optimized infrastructure production solution can be generated.

|

|

Fig. 2. Block flow diagram for case study outlining key design criteria and technology selection for the well site and processing, compression and gathering infrastructure. |

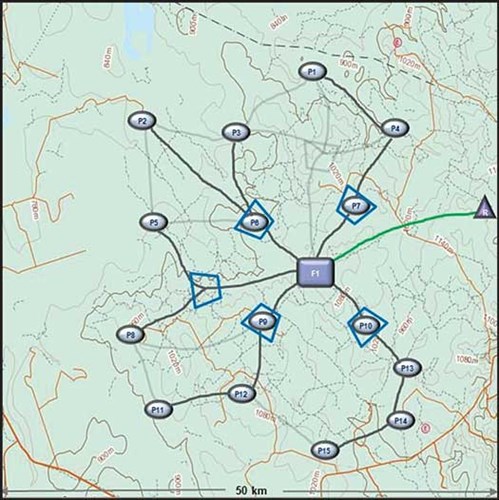

The system map is shown updated in Fig. 3, with a gathering system layout that displays an optimized pipe segment configuration and a gas plant location for the five-rig option. Fig. 3 includes the pipe segment configuration alternatives that were considered (light gray color). Field compression is required to service the well pads that are farther away from the gas plant. These compression stations are indicated by blue trapezoids.

|

|

Fig. 3. Gathering system configuration options. |

The IDP for the production infrastructure generated optimized key design criteria. While more details can be provided, these have been selected for consistency of discussion with the rest of the results:

- Well pad facilities

– 21 MMscfd

- Gathering system

– 33 mi, 12-in. inside compression radius

– 105 mi, 10-in. outside compression radius

- Field compression

– 2,370-bhp–2,530-bhp gas compression engine with six 2,590-hp reciprocating gas compressors

- Gas plant with refrigeration and stabilization

– 210-MMscfd inlet

– Sales gas production of 182 MMscfd

– Sales NGL production of 7,226 bpd

– Sales condensate production of 17,959 bpd.

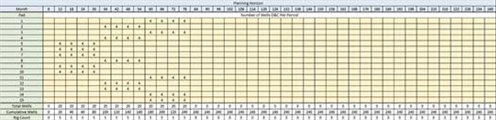

The drilling and completions schedule is provided in Fig. 4, with a breakout over the 20-yr planning horizon. The gas plant was assumed to be brought online in the first half of the second year, thereby requiring drilling initiation 6 mos prior to optimize cashflow.

|

|

Fig. 4. Drilling and completions schedule for five-rig option. |

The optimized drilling and completions schedule initiates drilling of the pads close to the gas plant, and branches outward from that point. Both the modeling and economic results showed that this plan would allow relatively higher pressure early in production to push the fluids to the gas plant, thereby delaying field compression installation and the building out of the gathering system. This program maximizes capital efficiencies while the resource proves itself.

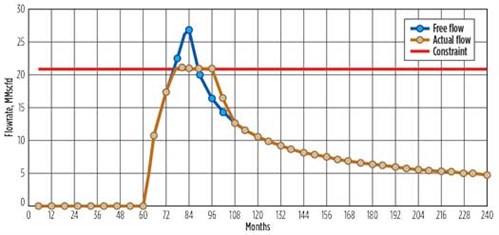

Fig. 5 shows a representative well pad production decline curve based on the drilling and completions schedule. The free-flow curve represents the fluid production from well head to well pad outlet into the gathering system, assuming no constraints. The actual flow is the optimized constraint on the production flowrate that is imposed by the equipment design capacity, which is a result of optimizing the production infrastructure according to the interdependent system of equations. If the well pad equipment capacity was either smaller or larger, then the final economics of the production infrastructure would be negatively impacted.

|

|

Fig. 5. Well pad production decline curve for five-rig option. |

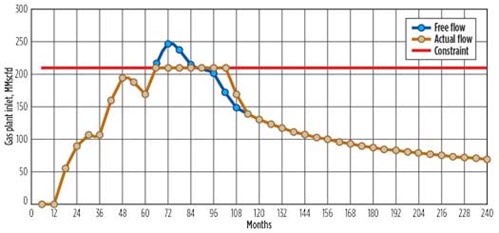

Fig. 6 shows the representative gas plant inlet flowrate. The modeling takes into account the decline curves from all 15 well pads, depending on the drilling and completions schedule, gathering system design and compression station design. For the five-rig option, this is the optimized plant capacity. Similar to the well pads, a larger or smaller capacity would negatively impact the economics.

|

|

Fig. 6. Gas plant inlet flowrate curve for five-rig option. |

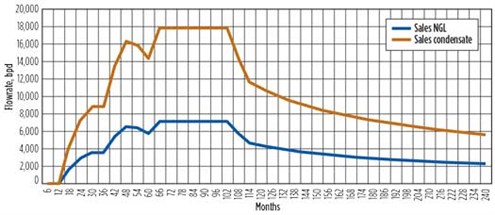

Fig. 7 shows the sales NGL and sales condensate production summary. The product flowrate curves for the sales NGL and sales condensate naturally match the shape of the inlet flowrate in Fig. 6.

|

|

Fig. 7. Gas plant product flowrate curve for five-rig option. |

|

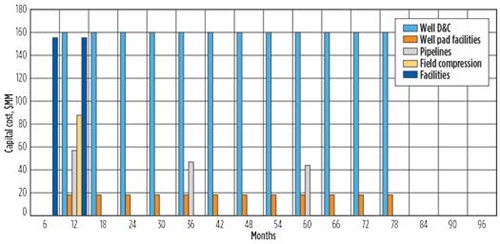

| Fig. 8. Capital spend schedule for five-rig option. |

A high-level capital spend schedule is another automated result of the IDP. Fig. 8 shows the breakdown of the major capital categories for which engineering design and cost estimates have been generated without escalation. From this breakdown, a detailed capital spending schedule can be easily generated.

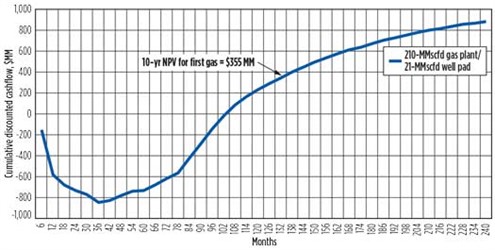

Optimized capacity. A typical NPV curve is shown in Fig. 9. The curve displays the initial impact of capital costs followed by operating costs, which are overtaken by production revenue. Breakeven is 7.5 yr, and the 10-yr NPV is $355 MM. However, this chart shows only one limited perspective. It begs the question: What insight can be generated from an IDP?

|

|

Fig. 9. Typical NPV curve for five-rig option. |

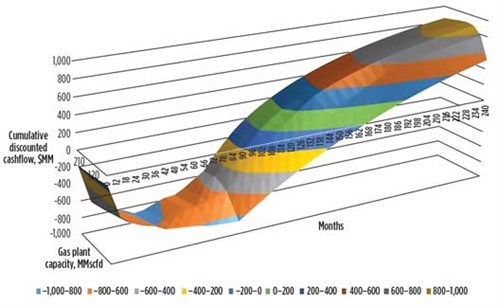

A three-dimensional (3D) NPV curve is shown in Fig. 10. This curve incorporates a third axis in which the gas plant capacity is shown. The curve shows that when the gas plant is too small, the product revenue is reduced and the NPV eventually drops off. The curve also shows that when the gas plant is too large, capital is increasingly wasted since the gas plant is not fully utilized relative to the rest of the production infrastructure design capacity. Alternatively, 3D curves with focus on other segments of the production infrastructure could be generated and analyzed in more detail.

|

|

Fig. 10. Three-dimensional NPV curve with gas plant capacity for five-rig option. |

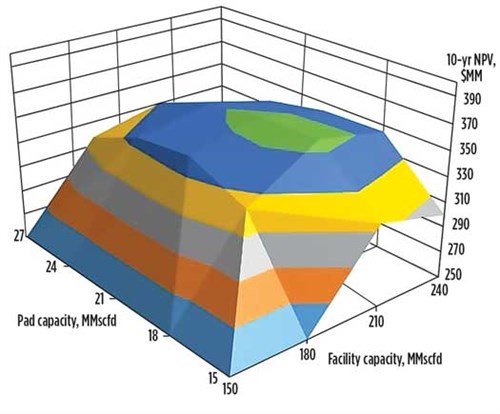

Expanding on the insights of the IDP, both the well pad and gas plant capacity have been plotted based on a 10-yr NPV in Fig. 11, with the time dimension excluded. While the gathering system costs are not directly visible, they are reflected in the NPV since they are optimized accordingly. The results clearly show an optimal capacity zone for the production infrastructure, along with capacities that result in either rapidly declining NPV values or gradually declining NPV values.

|

|

Fig. 11. Three-dimensional NPV curve with gas plant and well pad capacity for five-rig option. |

Fig. 11 shows that when the design capacity of the well pads or gas plant become too small, it pinches the production revenue stream relative to capital costs, thereby impacting profitability. When the capacity of the well pads, the gas plant or both are too large, they become less utilized, and capital spending is not optimized.

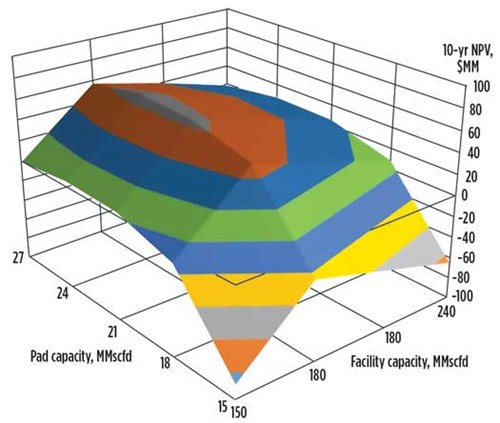

Fig. 12 shows the well pad and gas plant capacity based on a 10-yr NPV for three rigs. The directional results are the same as for the five rigs in Fig. 11. However, the NPV is considerably lower, and the optimal capacity zone has shifted to a relatively larger well pad capacity and a relatively smaller gas plant capacity.

|

|

Fig. 12. Three-dimensional NPV curve with gas plant and well pad capacity for three-rig option. |

Both the five-rig and three-rig results provide insight into not only capacity selection for the production infrastructure, but also into how to de-risk that decision. Capacity for either the five-rig or three-rig option would naturally be selected with a buffer from the precipitous areas. Alternatively, if the potential for repurposing rigs to a better-performing play is an option later in the asset development, then the optimal capacity zone between the two cases can be merged with a final production infrastructure capacity that is selected according to that probability and the time of repurposing.

Fig. 12 also provides early information on what generates a successful execution. For example, if actual production per well rises above the original forecast, then a reduction in rig count could be investigated to realign production with the optimized production infrastructure, thereby maintaining efficient CAPEX.

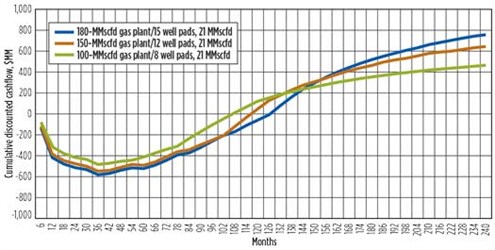

The difference in economic metrics, based on different gas plant capacity and number of well pads completed, are provided in Fig. 13. On the basis of both the payback period and a 10-yr NPV, the largest gas plant and highest number of well pads completed comes in third place. However, should the economics of a longer planning horizon be the main decision criteria, then it would be the first choice. Fig. 13 shows that the economic metrics set by the business strategy can be investigated, and appropriate adjustments made to determine a successful implementation.

|

|

Fig. 13. Infrastructure NPV for different gas plant capacity and number of pads completed |

Alternatively, these results indicate that another option for investigation is the establishment of two smaller gas plants, with each serving half of the well pads. Alternatively, the gas plant could be staged in two trains, with one train repurposed to another play at a future date.

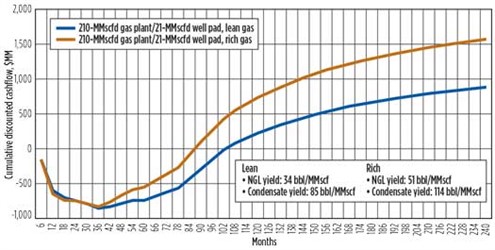

A variety of different design variables can be investigated across a range of values. Individual focus areas can be investigated to greater depth, and sensitivity analysis carried out. One example is different compositions, which can be examined as shown in Fig. 14. The rich curve shows that, in 6 mos–12 mos, larger capital costs are associated with the larger-designed separation equipment at the well pads, as well as with the larger slug catcher, stabilizer, recycle compression and storage at the gas plant. However, the higher revenue stream of the richer fluid quickly demonstrates a faster payback and a higher 10-yr NPV.

|

|

Fig. 14. Infrastructure NPV for different compositions for five-rig option. |

An IDP can accommodate modification and analysis of a variety of design variables. Sensitivity analyses can be conducted, and results can be generated, for the drivers that are most important to the given resource play.

Recommendations. An IDP was generated for a shale asset development case study that demonstrated the capability to minimize supply costs. This approach generated key supporting design data and optimized capacity for the major process equipment, from the well pad through the gathering system, compressor stations and gas plant. When the production infrastructure design data was integrated with the drilling schedule and capital planning across the asset lifecycle, a more complete design picture emerged. From this picture, different economic perspectives were generated for decision analysis and risk reduction.

The development of shale assets is a complex and expensive task. Success will be determined by ongoing innovation—not only in reservoir extraction, but also in how the entire production infrastructure is designed, implemented and operated over the asset lifecycle. This process depends on the effective use of the interdependent system of equations from engineering design, scheduling and economics. An IDP identifies the key drivers, according to each resource play and business strategy, to formulate an execution roadmap for asset development that minimizes supply cost. GP

Acknowledgments

The author would like to acknowledge Doug Mackenzie and Jim Maddocks for their support in developing the capability under discussion, and for their supervision in preparing this article.

|

Kevin Bonde has more than 20 years of international experience in the oil and gas industry. He has held technology management and project management roles for gas processing projects in natural gas plants, enhanced oil recovery facilities, cryogenic plants and refineries in North America, Asia-Pacific and the Middle East. In recent years, his focus has been on feasibility assessment, technology selection and process design for unconventional plays in small to world-class projects, including multibillion-dollar asset development programs. Mr. Bonde holds a P. Eng. in chemical engineering and is a Senior Project Manager with Gas Liquids Engineering Ltd.

Comments