LPG plant revamp to increase capacity, produce commercial-grade propane—Part 2

S. Ammar, El-Wastani Petroleum Co., Cairo, Egypt, and F. Khalifa, Suez University, Suez, Egypt

Part 2 of this article continues an evaluation of the different modifications needed to retrofit the El-Wastani LPG plant in Egypt to enhance LPG recovery percentage and to produce an additional product—commercial propane—with high propane recovery percentage. The retrofit also seeks to increase the plant’s handling capacity from 160 MMscfd to 200 MMscfd. To accomplish these two goals, a change in the existing process configuration and in several operating conditions and equipment sizing have been studied.

A debottlenecking study showed that the proposed modifications to the plant can increase butane recovery from 80% to 95% and propane recovery to 92.5%. Furthermore, the modified process can handle 200 MMscfd of raw gas, up from 160 MMscfd. The last section of this study considers the economic point of view and the return on investment (ROI) calculated for both options:

- Revamp the plant to produce commercial propane, keeping the same design handling capacity and improving the butane extraction percent. ROI will be paid back within 4.5 months (mos), as calculated using the ROI score method

- Modify the plant to handle 200 MMscfd of raw gas and increase the LPG recovery from 80% to 94%. ROI will be paid back within 5 mos.

LPG plant retrofit: Option 1. Several options were considered to maximize LPG recovery and produce commercial propane at the El-Wastani LPG plant in Egypt. Process design was examined first.

Two situations can be encountered in process design. The first is the design of a new plant—i.e., a grassroots or greenfield plant. In the second, the design is carried out to modify an existing plant via retrofit or revamp (i.e., a brownfield plant). The motivation to retrofit an existing plant can come from several factors, including:

- Desired capacity increase

- Different feed or product specifications

- Need to reduce operating costs

- Safety improvement

- Need to reduce environmental emissions.

When carrying out a retrofit, it is desirable to try to make the most effective use of the existing equipment as possible. Although the design of existing equipment may not be ideally suited to its intended new role, reusing equipment avoids unnecessary investment in new equipment. Even if it is not ideally suited to the new duty, the connections between items of equipment can be reconfigured, perhaps adding new equipment where necessary. Alternatively, if existing equipment differs significantly from that required by the retrofit, then the equipment itself can be modified in addition to reconfiguring the connections between the equipment.

As plant capacity increases, different items of equipment will reach their maximum capacity. Thresholds in plant capacity will emerge. All equipment with capacity lower than the threshold must be modified in some way, or the plant must be reconfigured to overcome each limitation. Capital investment will be required. However, it will likely be cost-prohibitive to overcome every single design threshold. A design limit will be established.

Retrofit objectives. Two targets will be achieved from retrofitting the existing LPG plant:

- Production of commercial propane, with propane recovery of more than 90%, ready for shipment to the Egyptian market as an additional product from the existing LPG plant

- Increase in butane recovery from 80% to 99%.

All percentage recoveries reported are calculated as shown in Eq. 1:

Percentage recovery = (Total component flow in the LPG, propane and condensate product) × 100 (Component flow in the total feed to the inlet separators)

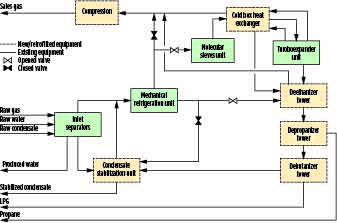

Fig. 1 illustrates the unit operations that have been modified or added during the retrofit of the existing LPG plant.

|

|

Fig. 1. Block diagram for modified El-Wastani plant. |

Maximize LPG production and add propane extraction. The model for the retrofitted plant offers an advantage to maximize LPG production when local market demand increases. Changes to depropanizer tower operating conditions can increase LPG production rates. For example, if the depropanizer tower bottom reboiler temperature gradually decreases, then a greater propane fraction will be withdrawn from the depropanizer tower to the debutanizer tower, where it is evaporated to the top of the tower. Accordingly, LPG product from the top is maximized, and the propane product from the top of the depropanizer tower decreases.

After the aforementioned changes were implemented (Fig. 2), the LPG production increased from 164.8 tpd to 274.4 tpd, while butane recovery remained high at 99%. Propane production decreased from 186.1 tpd to 71.28 tpd, with a propane recovery percentage of 90%. Commercial propane was produced in accordance with pipeline and storage specifications. The results of the simulation model were evaluated by studying an economic analysis similar to that used for the existing plant.

|

|

Fig. 2. Process flow of the proposed plant revamp model (Option 1). |

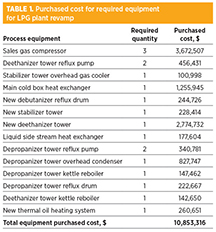

Process equipment cost estimate. The six-tenths rule was used as an example for the new depropanizer tower cost estimation. The new tower design inlet flowrate was determined to be 3,490.858 ft3/hr, vs. the old debutanizer tower design inlet flowrate of 9,304.5 ft3/hr. The old debutanizer tower purchase cost was $172,877. As shown in Eq. 2 and Table 1, the cost capacity exponent 0.63 was used to estimate the cost of the new depropanizer tower.

New depropanizer tower cost = $172,877 (3,490.858 ÷ 9,304.5) × 0.63 = $93,219.74

The existing deethanizer tower has a design inlet gas flowrate of 5,225.6 ft3/hr (Table 1), which is higher than the required design inlet gas flowrate for the new depropanizer tower. From an economic point of view, the existing deethanizer tower will be used as a depropanizer tower to save additional costs for the new depropanizer tower.

|

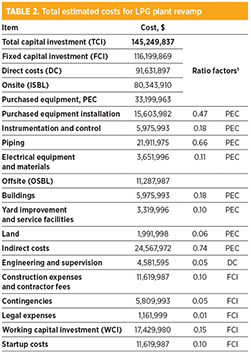

Capital investment and product cost estimate. The capital for designing and building the plant represents the fixed capital and includes both direct and indirect costs (Table 2).

|

Total costs related to the products manufacturing process were calculated at $95,579,843 using a simplified model,1 as shown in Eq. 3:

Total operating cost (TOC) = 1.11 (raw material + utility cost) + 0.183 (total fixed cost) + 0.028 (sales cost)

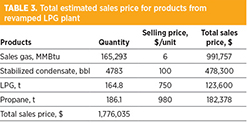

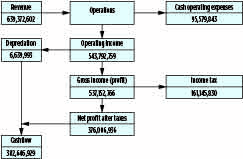

Total revenue and profit estimates. The total sales revenue was estimated using the present product sales cost and the sales gas higher heating value (Btu/scf) calculation (Table 3). Gross profit before depreciation ($543,792,759) is equal to total sales revenues ($639,372,602) minus total product cost ($95,579,843).

|

The straight-line and declining-balance methods, in which a fixed-percentage factor, f, on the property value each year is used to calculate the depreciation cost for the process equipment for the first year. Total purchased equipment cost (PEC) is $33,199,963. After n years, the salvage value (shown in Eq. 4) becomes:

Vs = Vi (1 – f) n (4)

where f is the depreciation factor (f = 0.2). The value for the process equipment after one year = $33,199,963 (1 – 0.2) = $26,559,970. Using the straight-line method, D (depreciation cost) can be calculated as shown in Eq. 5:

(Vi – Vs ) ÷ n1 (5)

Depreciation cost for process equipment ($6,639,993) after 1 yr is equal to $33,199,963 minus $26,559,970. Gross profit ($537,152,766) is equal to gross profit before depreciation ($543,792,759) minus depreciation costs ($6,639,993). Assuming local taxes of 30%, the annual net profit after taxes is $376,006,936.

The ROI can be calculated as shown in Eq. 6:

ROI = net profit after taxes × 100

Total capital investment (TCI) = 376,006,936 ÷ 145,249,837 = 259% (payback period = TCI)

Net profit after taxes = 145,249,837 ÷ 376,006,936 = 0.39 yr = 5 mos.

Cash flow estimates. The proposed modification promises great economic value (Fig. 3) and high profitability, as the revamped plant has a rapid ROI since the TCI will be paid back within 5 mos.

|

|

Fig. 3. Cash flow model for revamped LPG plant, $USD. |

Debottlenecking to increase capacity and LPG recovery: Option 2. As a result of Wastani Co.’s enhanced drilling activities, the number of gas wells in production have expanded from 20 to 35. The company aims to increase the number of total wells to 40, with a production of 220 MMscfd.

The increased output provided the stimulus for the El-Wastani plant’s revamp and capacity expansion beyond its design capacity of 160 MMscfd of feed gas. The project was also designed to maximize LPG production at maximum plant capacity of 200 MMscfd of raw gas.

Wastani Co. aims to process all new raw gas volumes from the new wells through the El-Wastani plant. A detailed study was performed for each skid to verify that the design margin for each piece of equipment was capable of handling the new gas quantity. As part of the study, the following actions were carried out:

- Adequacy checks for the main process equipment:

- Expanders and compressors

- Pumps

- Air coolers and heat exchangers

- Vessels and towers

- Ethylene glycol regeneration package

- Cold box (thermal check).

- Adequacy checks for all process lines.

Modeling the retrofitted plant to increase handling capacity. The model for the retrofitted plant can be used as a basis to calculate projected performance with higher gas, condensate and water rates, after checking every pump and vessel to pinpoint potential weak spots in design.

Adequacy checks for the El-Wastani plant were performed to evaluate plant performance and bottlenecking at a gas feed throughput of 200 MMscfd. The results validated the higher feed gas throughput.

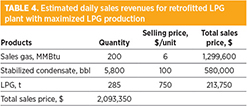

Profit calculation. A profit calculation was performed for the plant. Gross profit before depreciation ($596,896,229) minus depreciation costs ($6,639,993) equals ($590,256,236). Assuming local taxes of 30%, the annual net profit after taxes was $413,179,365. ROI was calculated as 266%, and the estimated payback period was found to be 0.375 yr (4.5 mos). Therefore, total annual sales revenue is estimated at $764,072,750 (Table 4).

|

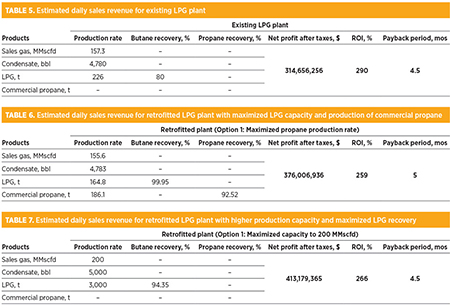

Summary. The results of the study are summarized in Tables 5–7. The data shows estimated production volumes and revenues from modeling the existing LPG plant, the retrofitted LPG plant with maximized commercial propane production and the retrofitted LPG plant with higher LPG production capacity.

|

Takeaway and recommendations. All results were obtained from modeling the existing LPG plant and the retrofitted plant using a commercial process simulation program. In response to these results, the following modifications were made to the El-Wastani plant:

- The LPG production rate was increased using the retrofitted plant model, as butane recovery was increased from 80% to 99.9%. Also, the commercial propane product, which has great value for the local market as a petrochemical feedstock, was added to the existing LPG plant and to the Egyptian market, with a high propane recovery percentage of > 90%.

- The LPG production rate was increased using the retrofitted plant model, as butane recovery was increased from 80% to 94.35%. New gas production wells allowed plant production capacity to reach 200 MMscfd.

- From an economic point of view, Option 1 (retrofitting the existing LPG plant) has great economic value and high profitability, as the retrofitted plant has a rapid ROI; TCI will be paid back within 4.5 mos. The retrofitted plant has high net profit compared with the existing LPG plant. The disadvantage of Option 1 is the high capital cost of the retrofit ($37 MM).

- From an economic point of view, Option 2 (revamping the existing LPG plant) has great economic value and high profitability, as the revamped plant has rapid ROI; TCI will be paid back within 5 mos. The revamped plant has high net profit compared with the existing LPG plant. One of the advantages of revamping the original plant to a higher LPG capacity is the lower capital cost of the retrofitting ($10 MM).

The authors recommend further study, based on this work, of increasing gas processing capacity and LPG recovery. The production of liquid ethane, a vital feedstock to the petrochemical industries, is also recommended for study.

End of series. Part 1 appeared in the November/December 2016 issue of Gas Processing. GP

Literature cited

1 BP, Statistical Review of World Energy, June 2011.

2 Ranter, M., “Implications of energy turn on global oil and natural gas supply,” Congressional Research Service, 2011.

3 Poe, W. A. and S. Mokhatab, Handbook of Natural Gas Transmission and Processing, 2nd Ed., Gulf Professional Publishing (Elsevier), 2012.

4 Kidnay, A. and W. R. Parrish, Fundamentals of Natural Gas Engineering, 2006.

5 Beggs, H. D., Gas Production Operations, Gulf Publishing Company, Houston, Texas, 1984.

6 Balchen, J. G. and W. D. Baasal, Preliminary Chemical Engineering Plant Design, 2nd Ed., Springer Science and Business Media, Berlin, Germany, 1987.

7 Sinnott R. K., Chemical Engineering Design, Vol. 6, 4th Ed., Butterworth Heinemann, UK, 2005.

8 Randall Gas Technologies, “Gas processing with cryogenic turboexpander technology,” Houston, Texas, January 2011.

9 Gas Processors Suppliers Association, “Engineering Data Book, Section 14: Refrigeration,” 12th Ed., Tulsa, Oklahoma, 2004.

10 Mokhatab, S., W. A. Poe and J. G. Speight, Handbook of Natural Gas Transmission and Processing, Elsevier, Amsterdam, the Netherlands, 2006.

11 Lynch, J. T., D. W. John, M. H. Hank and N. P. Richard, “Process retrofits maximize the value of existing NGL and LPG recovery plants,” Ortloff Engineers, Midland, Texas.

12 Aspen Technology, “Jump start: activated economics in Aspen Plus V8.4,” 2013.

13 Engriquez A. H. and J.-K. Kim, “Techno-economic design and optimization of NGL plant: A retrofit study,” AICHE spring Meeting, 9th Topical Conference on Natural Gas Utilization, Tampa, Florida, April 26–30, 2009.

Sayed Ammar has worked as a process engineer at WASCO in Egypt since 2009. He has participated in the design review, commissioning and startup of several gas processing projects. He holds a BSc degree in petroleum engineering from Suez Canal University in Egypt.

Fatma Khalifa is a professor of chemical engineering at Suez University, in the chemical engineering and petroleum refinery department. She teaches courses on natural gas processing and production, conversion processes, petrochemicals and unit operation. Dr. Khalifa has supervised several MSc degree and PhD theses, and she is the author of more than 100 technical papers on oil and gas. She holds a PhD in chemical engineering from Suez University in Egypt.

Comments