Gas processing news

B. Andrew, Technical Editor

Transport fuels from waste gas

New Zealand’s LanzaTech has been awarded $4 MM by the US Department of Energy (DoE) to design and plan a 3-MMgpy demonstration-scale facility in the US. The facility will use industrial waste gases to produce low-carbon jet and diesel fuels. The DoE award is part of a total of $12.9 MM of funds announced for six pilot and demonstration-scale bioenergy projects. The facility will make a low-cost ethanol intermediate called Lanzanol from offgases from steel manufacturing. Lanzanol will then be converted to jet fuel through the “alcohol-to-jet” process developed by LanzaTech and the Pacific Northwest National Laboratory (PNNL). To demonstrate process versatility, ethanol from other waste gas streams will be converted, including cellulosic ethanol produced via fermentation of biomass syngas by Aemetis. Illinois-based Ambitech will be LanzaTech’s engineering partner, with additional engineering contributions from Aemetis. Other project partners include PNNL; technology providers Petron Scientech, CRI Catalyst Company, Nexceris and Gardner Denver Nash; Michigan Technological University, which will evaluate the environmental footprint of the fuels being produced; and Audi, which will evaluate diesel and gasoline fuel properties. The demonstration project has also received support from Airlines for America (A4A) and the Commercial Aviation Alternative Fuels Initiative (CAAFI), an aviation industry consortium focused on the near-term development and commercialization of sustainable alternative jet fuel.

API standards for PHMSA rule

|

The Pipeline and Hazardous Materials Safety Administration (PHMSA) recently recognized the American Petroleum Institute’s (API’s) new underground natural gas storage rule. The adoption is part of PHMSA’s efforts to promote safety through adopting API Recommended Practices (RPs) 1170 and 1171. The API’s midstream director, Robin Rorick, issued a statement on the adoption. “The adoption of API Recommend Practices in this new rule for underground natural gas storage is the latest example of how our industry works proactively and cooperatively to advance safety efforts,” Rorick said. “However, while we are encouraged that the new rule adopts API’s rigorous safety management practices, we fear that the new rule’s unrealistic compliance timeline will prevent operators from effectively implementing the requirements of the rule, and could potentially undermine the very safety efforts the rule is trying to promote. While we will continue to review the impacts of this rule, we hope that PHMSA will work with our industry to ensure that the rule can be implemented in a fashion that both improves safety and ensures that clean and reliable supplies of natural gas from the US energy renaissance are consistently available to the country.”The standards address the proper storage of natural gas underground. RPs 1170 and 1171 specifically outline how to safely design, store and operate natural gas in salt caverns and depleted oil and gas reservoirs, respectively. The two standards discuss proper construction methods, materials and maintenance practices for ensuring safe operations, and were finalized in 2015.

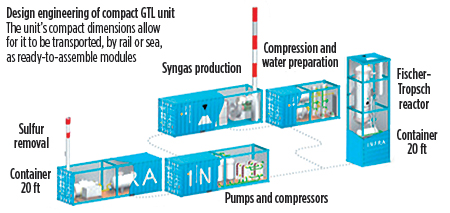

Commercial-sized modular GTL plant

|

INFRA Technology hosted a grand opening ceremony for its first commercial-size plant, Mark 100, in Wharton, Texas. The Mark 100 transportable, modular GTL plant is designed to convert 1 MMcf of natural gas into 100 bpd of clean-burning liquid synthetic crude oil. INFRA’s GTL technology makes the production of synthetic crude oil from natural gas economically feasible, ensuring that the GTL process is profitable even for small-scale units. Transportability is achieved with Mark 100’s compact, 4,000-ft2 footprint and standard, container-size design. Construction activities have created more than 50 new jobs, 20 of them permanent. The project was made possible with assistance and coordination from the City of Wharton and Wharton County.

Deals in gas-heavy exploration areas

BP has agreed to buy stakes in gas-heavy exploration areas off the coast of Mauritania and Senegal from Kosmos. The combined deals are worth approximately $3.4 B and will add valuable oil and gas reserves to BP’s books, which have seen resources shrink on the back of divestments for the 2010 Gulf of Mexico oil spill. The acquisitions follow BP’s purchase of a stake in Eni’s giant Zohr gas field offshore Egypt for $375 MM, and come at a time of rising oil prices. BP said it had agreed to buy a 62% stake and operational control of Kosmos’ Mauritania exploration blocks, which include the Tortue discovery, estimated by Kosmos to contain more than 15 Tcf of gas. In comparison, Eni’s Zohr field, the largest discovery ever made in the Mediterranean, is estimated to contain 30 Tcf. Gas from the Tortue field is planned to be exported from an LNG facility, giving BP an opportunity to grow in a highly competitive sector, in which rival Shell took the lead earlier this year with its $54-B acquisition of BG Group. BP also agreed to buy a 32.5% stake in Kosmos’ Senegal blocks, spending approximately $1 B on the Kosmos deal. In addition, BP has closed the renewal of a 40-yr-long participation in Abu Dhabi Co. (ADCO) for onshore petroleum operations after 2 yr of negotiations, taking a 10% stake in return for a 2% share in BP. Concessions included in the deal have total resources of 20 B bbl of oil equivalent (boe)–30 Bboe.

Freeport LPG fully operational

|

Phillips 66 loaded its first contracted cargo on the gas carrier Commander, which departed the terminal on December 16, 2016. The startup of the Freeport LPG export terminal is the culmination of a 4-yr effort to develop a new US Gulf Coast (USGC) NGL market hub. The project also includes Phillips 66 Partners’ 100-Mbpd Sweeny fractionator and 7.5-MMbbl Clemens storage facility. The storage terminal is connected by pipeline to the Mont Belvieu hub. The new LPG export terminal gives customers the ability to place multi-grade LPG products directly into global markets through Port Freeport, which provides immediate blue water access with minimal congestion. The Freeport LPG export terminal can load two ships at the same time with refrigerated propane and butane, at a collective rate of 36 Mbph. The export facility will help satisfy growing international demand for affordable US NGL. Phillips 66 expects US production to continue growing, and it is evaluating additional NGL fractionation and infrastructure alternatives along the USGC.

Comments