North America’s top gas processors consolidate in 2015

J. Stell, Contributing Writer

By year-end 2015, activities by independent US gas processing companies proved to be nearly as volatile as oil and gas prices. Mergers, dropdowns, acquisitions and divestitures were planned, announced and completed, or scheduled for completion during the 2015 to mid-2016 time frame.

Among the slate of activities, upstream players sold off midstream assets, midstream players expanded or contracted and, in at least one event, a downstream player acquired a major midstream company. In another move, a gas processor was forced to shut down a plant because the local gas producer shut in its wells due to economics. Also notable was a midstream operator’s move to export one of the first shipments of crude from the US, thanks to new legislation passed in late 2015.

The sector’s trend of moving service-contract agreements away from percent-of-proceeds and into fee-based contracts is continuing. Going forward, industry watchers predict more changes in the midstream sector in 2016.

Here, a selection of the most notable deals and projects by some of the top independent gas processors in the US is presented, in alphabetical order by company.

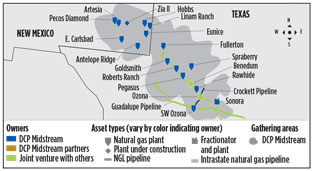

DCP Midstream Partners LP. DCP, co-owned by Phillips 66 and Spectra Energy Partners, continues to be the top-ranked gas processor and liquids producer in the US. The company gathers and processes more than 7.1 trillion BTUs of gas daily, and its NGL production is approximately 410 Mbpd, representing more than 17% of all of the NGL produced in the US and more than 12% of the nation’s gas supply. DCP’s asset base includes 63 plants and 66,400 mi of pipeline.

In late 2015, its owners gave the company a boost when Spectra dropped down ownership interest in the Sand Hills and Southern Hills NGL pipelines, and Phillips 66 contributed $1.5 B in cash. The transactions will help DCP pay down its credit revolver and support its efforts to convert some of its percent-of-proceeds processing contracts to fee-based agreements—a critical step to reduce exposure to gas and NGL price declines.

Also in 2015, DCP completed construction of its 200-MMcfd Zia II sour natural gas processing plant (Fig. 1) in Lea County, New Mexico, to serve producers in southeast New Mexico and the West Texas regions of the Permian Basin. In addition to the Zia II plant, the project includes front-end treating for sour gas; two acid gas injection wells; a 50-mi, 20-in. high-pressure trunk line that will intersect DCP Midstream’s existing New Mexico gathering system; and new, high-pressure pipelines and compression assets in West Texas.

|

|

Fig. 1. DCP completed construction of its 200-MMcfd sour |

After startup, DCP signed a 10-year renewal contract with one of its largest producer-clients in the Delaware Basin. The contract has been converted from percent-of-proceeds to 100% fee-based, and covers approximately 1 MM dedicated acres. The Zia II plant and new gathering systems add to DCP’s existing footprint in the Permian basin, where the company owns and operates 18 gas processing plants.

Energy Transfer Equity LP. At press time, Energy Transfer Equity is moving to acquire The Williams Cos. Inc., with a proposed $37.7 B of financial transactions. In 2015, Energy Transfer Partners merged with Regency Energy Partners in an $18-B deal. The company owns and operates roughly 6,700 mi of gas and NGL gathering pipelines, four natural gas processing plants, 15 natural gas treating facilities, and two natural gas conditioning facilities.

EnLink Midstream LLC. During late 2015, EnLink announced plans to acquire gathering and processing assets in the West Texas Delaware Basin from a subsidiary of Matador Resources Co. for $143 MM. This move by Matador, an upstream producer, is an effort to gain cash in light of low oil and gas prices. As a result, Matador will become a customer of the midstream facilities on 15-year fixed-fee agreements.

EnLink plans to spend up to $500 MM during 2016 to expand its Delaware Basin processing and gathering systems, including the installation of a 120-MMcfd processing plant and more gathering lines. Also, the company plans to expand its processing capacity in the Cana-Woodford play in Oklahoma.

Enterprise Products Partners LP. In 2015, Enterprise Products Partners signed an agreement with Occidental Petroleum to jointly develop a new 150-MMcfd cryogenic processing plant pipeline in the Delaware Basin. The JV, Delaware Basin Gas Processing, is targeting a mid-2016 startup date.

On December 23, 2015, Enterprise Products Partners announced that it had agreed to provide pipeline and marine terminal services to load its first crude oil export cargo of oil produced in the US (believed to be the first significant oil export shipment from the Gulf Coast in 40 years), now allowable under a law enacted earlier that month. The 600-Mbbl cargo of domestic light crude oil loaded at the Enterprise Hydrocarbon Terminal on the Houston Ship Channel during the first week of January 2016.

Keyera Corp. In November 2015, Keyera announced that it will suspend operations at its Caribou gas plant due to a producer’s decision to shut in gas production wells on December 1, 2015. The Caribou gas plant is Keyera’s only gas plant located in northeast British Columbia, where producers receive NGX Spectra Station No. 2 pricing that has been affected by low North America natural gas prices and regional sales gas pipeline constraints. As a result, gas production in the area has become uneconomical, and several producers have chosen to shut in production until pricing improves.

The Caribou gas plant was constructed in 1997 and purchased by Keyera in 2004. In 2015, due to declining throughput, the plant’s contribution to Keyera’s adjusted earnings before interest, taxes, depreciation and amortization became unsustainable.

Kinder Morgan Inc. The company gained processing capacity in 2015 with its $3-B acquisition of Hiland Partners. The deal included fee-based gathering and transportation pipelines, as well as processing assets in the Bakken shale play in North Dakota.

Marathon Petroleum. In an unusual move, downstream player Marathon Petroleum acquired midstream assets in an effort to move up the value chain. In December 2015, MPLX LP and MarkWest Energy Partners LP completed a merger by which MarkWest became a wholly owned subsidiary of MPLX.

The deal combines the nation’s fourth-largest crude oil refiner and one of the Appalachian Basin’s largest gas processors, creating the fourth-largest MLP in the country based on a market capitalization of $21 B. The transaction provides Marathon with increased vertical integration and a direct supply of NGL for its refining business.

The new business combination will help Northeastern upstream producers place the overabundance of NGL into the ready market of Marathon downstream operations, as well as remove the wet gas drilling constraints, thereby allowing producers to support drilling down to a lower price deck.

MarkWest plans $1.5 B of annual investment through 2020 to expand its cryogenic processing, fractionation and other midstream assets in Ohio, West Virginia, Pennsylvania, Kentucky, Texas and Oklahoma (Fig. 2). MarkWest is the nation’s second-largest natural gas processor and fourth-largest fractionator, with 34 processing facilities representing around 6.8 Bcfd of processing capacity and 380 Mbpd of fractionation capacity, and more than 7,500 mi of pipeline. The company plans to construct an additional 18 plants in the coming years, including the new Hildalgo plant in the Delaware Basin that will be operational in 2Q 2016.

|

|

Fig. 2. MarkWest, which was acquired by Marathon |

Meritage Midstream Services. Meritage Midstream’s Canadian affiliate, Meritage Midstream Services III LP, entered into definitive agreements with Canadian International Oil Corp. (CIOC) to build natural gas gathering, compression and processing assets, and crude oil gathering assets, to support the development of CIOC’s Montney and Duvernay shale play positions in west-central Alberta.

Meritage III will provide 75 MMcfd of gathering and processing capacity, which will be expandable to 225 MMcfd. Construction of both systems began in May 2015. The 42-km high-pressure gas gathering system will deliver rich gas to the new processing plant to be built approximately 60 mi south of Grand Prairie, Alberta. The plant is expected to come into service in April 2016 and will offer connections for residue gas to the TransCanada Pipeline and other delivery points.

Navitas Midstream Partners LLC. In September 2015, Navitas Midstream Partners LLC acquired gas gathering and processing assets serving Martin, Midland and Glasscock counties in Texas, from a subsidiary of DCP Midstream LLC. The assets include more than 1,000 mi of pipeline and a 60-MMcfd processing plant in Midland County, Texas.

ONEOK Partners LP. By year-end 2016, Oneok plans to construct its 100-MMcfd Bronco processing plant in southern Campbell county, Wyoming, which will take gas produced from the liquids-rich Turner, Frontier, Sussex and Niobrara shale formations in the Powder River basin. The $305-MM facility will include a 65-mi NGL pipeline to connect the facility to Oneok’s Bakken NGL pipeline lateral. Oneok’s Williston basin gas processing capacity is expected to increase to 1.2 Bcfd in 3Q 2016.

Paramount Resources. In late 2015, Paramount Resources commenced activities to seek a buyer for its midstream assets. The Calgary-based company is working with the Royal Bank of Canada on possible sales or partnerships for facilities that include gas processing plants. First-round bids were submitted in 2015.

Potential interest has been discussed, but not formalized, with the Canada Pension Plan Investment Board and Wolf Infrastructure, as well as with Apollo Global Management’s CSV Midstream Solutions.

When completed, the deal will serve as another example of upstream companies shedding midstream assets to manage cash flow in the low-commodity-price environment.

PennTex Midstream Partners LLC. In September 2015, PennTex began operations at its new 200-MMcfd Mount Olive gas processing plant (Fig. 3) and related residue gas and NGL pipelines, increasing the partnership’s processing capacity to 400 MMcfd in the Terryville complex in northern Louisiana. Sited near Ruston, the facility consists of the processing plant with onsite liquids handling facilities for inlet gas, as well as for additional residue gas and NGL pipelines.

|

|

Fig. 3. PennTex began operations at its new 200-MMcfd |

The 14-mi residue gas pipeline has throughput capacity of approximately 400 MMcfd and provides market access for residue natural gas from PennTex’s processing plants. The 41-mi NGL pipeline has throughput capacity of more than 36 Mbpd and provides transportation to downstream markets for NGL. It also marks the completion of the second phase of the company’s Terryville complex assets.

The first phase of development, which was completed in May 2015, included the 200-MMcfd Lincoln Parish cryogenic natural gas processing plant and 31 mi of related natural gas gathering and residue gas transportation pipelines. PennTex provides midstream services under long-term, fee-based agreements.

Phillips 66. At year-end 2015, Phillips 66 began operations at its new 100-Mbpd NGL fractionator at the company’s Sweeny complex in Old Ocean, Texas. Sweeny Fractionator One supplies purity ethane and LPG to the petrochemical industry and heating markets, and is supported by 250 mi of new pipelines and a multimillion-barrel storage cavern. The company will have the capability to place the LPG into global markets upon completion of its 150-Mbpd Freeport LPG export terminal in 3Q 2016.

Tall Oak Midstream LLC. Early in 2015, Tall Oak Midstream reported that initial gas gathering operations were underway on the Tall Oak STACK (which stands for the Sooner Trend, the Anadarko basin, and Oklahoma’s Canadian and Kingfisher counties) systems system. Tall Oak gathers gas on its STACK system for multiple customers, and it commissioned the system’s first processing plant, named the Chisholm plant, in 3Q 2015. The system is anchored by long-term gathering and processing agreements with Felix Energy LLC and PayRock Energy LLC.

Targa Resources Partners LP. In November 2015, Targa Resources Corp. (TRC) announced plans to roll up its limited midstream partnership, Targa Resources Partners LP (TRP), into the corporation. When completed, all of the outstanding common units of TRP will be owned by TRC and will no longer be publicly traded, and the incentive distribution rights of TRP will be eliminated. All of TRP’s outstanding debt and Series A preferred units will remain outstanding. GP

Comments