Haynesville gas processors consolidate amid production slump

J. Stell, Contributing Writer

North American upstream companies drilled tens of thousands of uneconomic wells due to an unprecedented access to debt capital—especially high-yield debt—from 2009 to 2014. At the same time, midstream and downstream organizations began an epic infrastructure building boom to process all of the new oil and gas production. The boom was also easily financed as investors reached for yield during a period of 0% interest rates.

Now, pipeline and processing operators are victims of their own success as billions of dollars of cheap capital that were previously raised for infrastructure have resulted in worsening overcapacity in many basins. According to financial analysts, too much capacity is chasing declining production in nearly every shale basin. The prevalence of gas processing fixed- and fee-based contracts, for those who have them, can be a lifesaver in a leaking boat; however, challenges remain, as evidenced by drops in stock and unit prices and the corresponding rise in yields. The challenge arises as financially distressed exploration and production companies that are desperate to cut costs begin to renegotiate existing contracts at far lower rates.

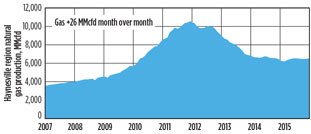

For example, in the Haynesville shale play, gas processors are witnessing falling production and a glut of processing capacity (Fig. 1). During the play’s heyday, regional midstream operators invested hundreds of millions of dollars in gathering and processing infrastructure because they were confident of receiving the standard 30% of a producer’s gas as the fee for processing and selling the gas. However, the northern Louisiana portion of the Haynesville shale already has a huge gathering infrastructure in place to service conventional production that was expanded to accommodate more than 8 Bcfd of new shale gas from the formation. After peaking at approximately 7 Bcfd in late 2011, Haynesville production is approximately 3.5 Bcfd and falling fast.

|

|

Fig. 1. Haynesville gas production has fallen significantly |

Some financially distressed upstream companies will be forced into restructuring business units or balance sheets, while others are facing prepackaged bankruptcies, allowing existing contracts to be renegotiated at potentially much lower rates.

Azure Midstream Energy LLC recently reduced its 2015 adjusted EBITDA guidance by 10%, given that producer drilling activity will remain below expected levels for the balance of 2015. With falling production levels from its operations in both the Texas and Haynesville portions of the Haynesville shale play, and with little hope of a rebound in activity at current commodity prices, Azure is looking to reduce debt.

In August, Azure Midstream Energy LLC, the 100% owner of the general partner of Azure Midstream Partners LP, announced the contribution of the equity interests of Azure ETG LLC, including $80 MM in cash and an additional 255,319 common units in the partnership, to reduce indebtedness, create financial flexibility and gain access to additional liquidity. Azure committed to reducing indebtedness by $195 MM to $250 MM.

The company announced a growth expansion project for its core Holly Gas Gathering System to reduce line pressures and increase the utilization of the 2.1-Bcfd system. Reducing pressure on Holly from more than 1,200 lb/in.2 to 500 lb/in.2 enhances volume deliverability from new and existing production.

The Holly system is primarily located within the DeSoto, Red River and Caddo parishes of north Louisiana and serves the Haynesville and Bossier shale formations and the liquids-rich Cotton Valley formation. As of late June, the Holly system consists of approximately 335 mi of high- and low-pressure pipeline, with approximately 69,000 dedicated gross acres. The system also includes four amine treating plants with a combined capacity of 920 MMcfd and two 1,340-hp compressors with connections to eight downstream access points.

At present, Azure Midstream Partners focuses on fee-based contracts for its 750 mi of gathering lines in east Texas and north Louisiana, its two gas processing facilities in Panola County, Texas, and a processing facility in Tyler County, Texas. The company also has two NGL transportation pipelines that connect its processing facilities to third-party NGL pipelines capable of transporting 21 Mbpd, and three crude oil transloading facilities containing six crude oil transloaders with loading capacity of 22,528 bpd.

Last spring, Azure completed construction and started up its 10-MMcfd Fairway gas processing plant in San Augustine County, Texas, to process rich gas production from the Haynesville shale. The plant recovers NGL and returns residue gas into Azure’s East Texas gathering system for delivery into interconnections, with pipelines operated by Gulf South, CenterPoint Energy Gas Transmission and Natural Gas Pipeline Co. of America.

DCP Midstream Partners LP has executed a reduction in force, affecting approximately 20% of its employees in corporate staff functions. With this corporate restructuring, DCP Midstream will close its Oklahoma City, Oklahoma, regional office and reduce workforces at its Tulsa, Oklahoma, and Midland, Texas, offices, relocating functions in those locations primarily to its Denver, Colorado, headquarters and its Houston, Texas, regional office.

Last year, DCP Midstream acquired the Crossroads processing plant and associated gathering system, serving the Haynesville play, from Penn Virginia Resource Partners. The $63-MM Crossroads system includes an 80-MMcfd cryogenic processing plant, gathering assets, approximately 20 mi of NGL pipeline and a 50% ownership in an 11-mi residue gas pipeline.

Enbridge Energy Partners LP completed construction of its 150-MMcfd cryogenic processing plant near Beckville in Panola County, Texas, this year. The Beckville plant expands the company’s processing capacity to 820 MMcfd in the Cotton Valley and Haynesville shale regions (Fig. 2). The company’s East Texas system, which serves Haynesville shale gas production, includes an average capacity of 885 MMcfd, 3,900 mi of pipeline, seven processing plants, 11 treating plants and one fractionation facility.

|

|

Fig. 2. Enbridge’s Beckville plant |

EnLink Midstream Partners LP recently acquired the remaining 25% equity interest in EnLink Midstream Holdings LP (EMH) from EnLink Midstream LLC for $900 MM of newly issued partnership common units. The partnership now holds 100% of EMH, which owns the assets that Devon Energy Corp. contributed to EnLink Midstream in 2014.

These assets include gathering and processing systems in North Texas and Oklahoma that are supported by long-term, fixed-fee contracts with minimum volume commitments, as well as an economic interest in Gulf Coast fractionators.

EnLink Midstream was formed in 2014 when Devon Energy agreed to combine substantially all of its midstream assets with Crosstex Energy to own the Plaquemine gas processing plant in Iberville County, Louisiana, which processes Haynesville gas, along with production from other plays.

MarkWest Energy Partners LP, Enterprise Products, Anadarko Petroleum and DCP Midstream have formed a JV under which Enterprise will assign 45% ownership interest in its wholly owned Panola Pipeline Co. LLC. The interest will be evenly divided among DCP Midstream, MarkWest and Anadarko’s affiliate, WGR Asset Holding Company LLC.

Enterprise will continue to serve as operator of the Panola Pipeline and own the remaining 55% interest. MarkWest’s East Texas operations are located in Panola, Harrison, and Rusk counties and serve the Haynesville play area. The company has 400 MMcfd of processing capacity at its Carthage facilities in East Texas, which support liquids-rich gas production from the Haynesville shale and Cotton Valley formation.

Marlin Midstream Partners LP changed its name from Marlin Midstream GP LLC to Azure Midstream Partners GP LLC, effective May 19. Marlin Midstream owned and operated two cryogenic processing plants with design capacity of 220 MMcfd, as well as an NGL pipeline with 10-Mbpd of takeaway capacity and 65 mi of gathering lines, including the 54-mi Lake Murvaul gathering system that crosses Panola and Rusk counties with a capacity of 100 MMcfd, and the 11-mi Oak Hill Lateral with a capacity of 100 MMcfd. The Panola County assets primarily serve the Cotton Valley and Haynesville shale plays.

Regency Energy Partners LP and Energy Transfer Partners closed on their previously announced merger on April 30, and Regency is now a wholly owned subsidiary of ETP. Regency’s North Louisiana assets dehydrate, compress, treat, gather, process and transport natural gas and NGL from the Cotton Valley, Haynesville and Bossier shale plays and the Smackover formation.

The assets include the Dubach and Lisbon processing plants, the Elm Grove and Dubberly refrigeration plants, the Dubach/Calhoun/Lisbon gathering system, the Logansport gathering system, and the Logansport and Sharon treating plants.

Williams Cos. On September 8, Chesapeake Energy renegotiated its gathering contracts for its Haynesville and Utica project areas with the Williams Cos. In exchange for extending the length of the agreement between the two companies and providing higher volumes in future years, the companies converted a variable-rate agreement to a fixed-rate agreement.

Chesapeake’s expected gathering fee for 2016 has dropped from approximately $0.88/Mcf to $0.65/Mcf, a 26% reduction under the new agreement. This reduced fee includes a minimum volume commitment penalty. In 2018, the fee for gas gathering drops to only $0.53/Mcf.

Williams likely would not have converted its existing gathering contracts to fixed-rate agreements at reduced rates if it could have replaced Chesapeake’s volumes with volumes from other operators. Production is falling because the 26 rigs now operating are fewer than needed to maintain production. GP

|

Jeannie Stell is an award-winning freelance writer and editor focused on the upstream, midstream and downstream energy industry. Her articles have been published in several languages and referenced in white papers, and her photographs have been featured on industry magazine covers and in feature editorials. Ms. Stell is the founder of Energy Ink, and can be reached at jstell@energyink.biz.

Comments