Small-scale methanol technologies offer flexibility, cost effectiveness

U. Turaga, ADI Analytics LLC, Houston, Texas

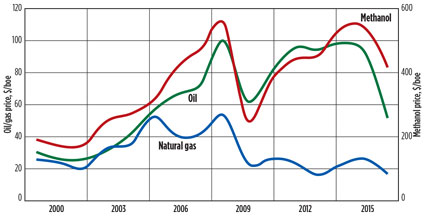

Gas monetization through the production of methanol using small-scale plants could be a promising option. In principle, small-scale methanol plants offer a number of advantages. The first advantage is that methanol prices track those of oil (Fig. 2), thereby providing a significant arbitrage to exploit if the gas feedstock is available as cheaply as it is in the US.

|

|

Fig. 2. North American methanol and oil prices move together, and natural gas |

Second, small-scale methanol plants have lower capital costs in comparison to traditional large plants, making them attractive to a wider range of investors, including small businesses, entrepreneurs, and project developers.

Third, methanol is a liquid chemical product that can be transported easily and cost-effectively, offering the ability to monetize natural gas from fields that are remote, have limited pipeline connectivity or have relatively poor production and/or economics. Finally, methanol is a versatile chemical with multiple applications and end uses.

Given these advantages for methanol and its small-scale production, the Shale Gas Innovation and Commercialization Center (SGICC) commissioned ADI Analytics to conduct an independent assessment of the technical and economic viability of small-scale methanol plants. Although oil prices have dropped quickly and significantly since this study was commissioned, the research and analysis presented here are relevant as capital projects are designed to operate for 20 to 30 years and witness multiple commodity price cycles.

Furthermore, the findings of this study are based on analysis over a wide range of gas feedstock cost and methanol product pricing scenarios. As a result, this white paper assessing the feasibility of small-scale methanol production plants as an option to monetize gas from basins like the Marcellus should find relevance across a wide range of stakeholders.

Methanol and its applications. Methanol is the simplest alcohol and is a light, volatile, colorless and flammable liquid with a distinctive odor.

Today, methanol is produced mainly through a two-step catalytic chemical process. Catalytic reforming is the first stream during which natural gas is converted to synthesis gas. In the second step, synthesis gas is converted to methanol. A number of other feedstocks—including coal, biomass and municipal waste—could also be converted to synthesis gas for further conversion to methanol, and are used in several regions based on their availability and cost.

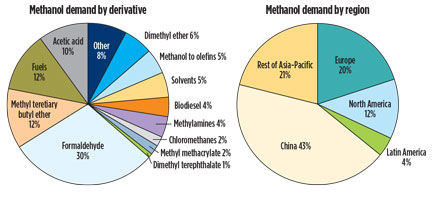

Methanol is an important chemical with a wide range of applications and end uses. Each of these applications and end uses can be segmented into three major categories. The first category, which accounts for more than half of methanol demand, is the use of methanol as a chemical feedstock. The second category relates to the use of methanol in fuels and accounts for more than one-third of methanol demand. Finally, methanol is used for a number of fragmented applications, such as solvents, antifreeze, wastewater denitrification and ethanol denaturing. Each of these categories is described in further detail below.

Methanol as a chemical feedstock. Methanol is used to produce a number of chemicals, with formaldehyde and acetic acid being the largest chemical derivatives. Each of these derivatives is further converted into a wide range of products, including fibers, paints, resins, adhesives, insulation and dyes. Methanol use for these traditional chemical derivatives is growing at a slow to moderate pace. However, another chemical derivative application—cracking methanol to produce olefins, such as ethylene and propylene—is growing rapidly due to its widespread adoption in China. Economic growth in China has accelerated demand for plastics, which are produced from olefins. China lacks traditional olefin feedstocks, such as naphtha or NGL. However, it has relied on its vast coal reserves to produce methanol via syngas produced through gasification.

Methanol in fuels. With some modifications to engines, methanol can be used as a fuel for transportation. Several countries are using methanol as an automotive fuel, including China. Another transportation segment is marine vessels, where methanol could be a cost-effective and environmentally friendly fuel that complies with new international environmental regulations. In addition, methanol can be converted to ethers, such as methyl tertiary butyl ether (MTBE) and dimethyl ether (DME).

Although the US had mandated, and later banned, the use of MTBE as a fuel additive, its use as an octane-enhancing gasoline additive has continued in several countries. A smaller application is the use of DME as a fuel to power engines that run on diesel. Finally, methanol is also used to produce biodiesel, which is typically blended with diesel in several regions, including the US and Europe.

Other applications. Methanol is also used in a number of fragmented applications that individually do not consume large volumes but that collectively account for approximately 10% of total demand. These uses include municipal and private wastewater treatment facilities that use methanol to facilitate nitrogen removal from effluent streams. Similarly, methanol could be used as a carrier for hydrogen for both large and small fuel cells. Finally, several high-horsepower engines—e.g., those used to produce distributed power—also use methanol.

Fig. 3 provides a breakdown of methanol demand by application. Although not shown graphically, nearly 60% of methanol demand is from traditional segments that are growing slowly, while 40% of demand is from rapidly growing applications, such as methanol-to-olefins and fuel uses.1 Fig. 3 also shows methanol demand by region. It is clear that China and Asia drive global methanol demand, followed by Europe and North America.

|

|

Fig. 3. Chemical derivative production and fuel use account for most methanol |

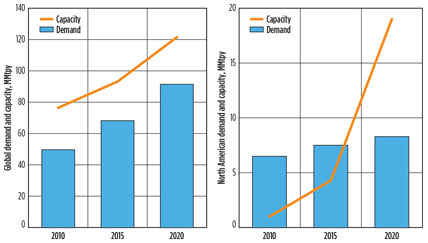

Methanol supply and demand. Thanks to rapidly growing applications like olefins production and fuel use, global methanol demand is expanding at a robust 6%/yr (some analysts believe the growth rate could be as high as 8%/yr) and is forecast to be more than 90 MMtpy by 2020, as shown in Fig. 4. In comparison to 2015, this translates into more than 23 MMtpy of additional methanol demand over the next five years.

|

|

Fig. 4. Estimated global and North American demand and capacities for methanol |

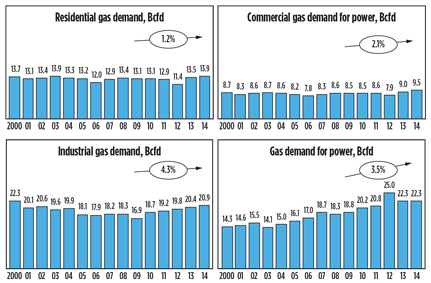

China drives most of this demand growth, as it uses methanol for a wide variety of applications and, in particular, as a fuel and as a feedstock for olefins. Other regional economies, such as India, account for additional growth in Asia. Furthermore, the new supply of NGL in North America (also facilitated by the unconventional gas boom) has led to the announcement of petrochemical cracker projects. These projects seek to crack NGL into ethylene and propylene, which will be converted into polymers and other chemicals, some of which may require methanol as a raw material. Therefore, new petrochemical crackers in North America may lead to additional demand growth for methanol in North America. North American demand and production capacities for methanol are also shown in Fig. 1, which reflects the slower pace of demand growth relative to global demand.

|

|

Fig. 1. Most segments accounting for natural gas demand in the US are stagnant |

Although North American demand is increasing at a slower pace than global demand, production capacity is forecast to grow rapidly, as methanol production has traditionally gravitated to regions with a cheaper supply of feedstocks, such as coal and natural gas. As a result, new supply is more likely to come up in China and North America, driven by coal and natural gas, respectively, than elsewhere. Several new gas-fed plants have been announced in North America, while new plants based on coal have been coming up in China. Most of these new plants will have large capacities of 1 MMtpy to 2 MMtpy, since many of the rapidly growing applications (e.g., methanol to olefins) require large volumes.

Growing global demand for methanol and low natural gas prices in North America have attracted a wide range of investors, including oil refiners and entrepreneurs, in large-scale methanol plants. Furthermore, some of the new methanol plants announced in North America are being developed by Chinese companies that are seeking methanol for olefins production.

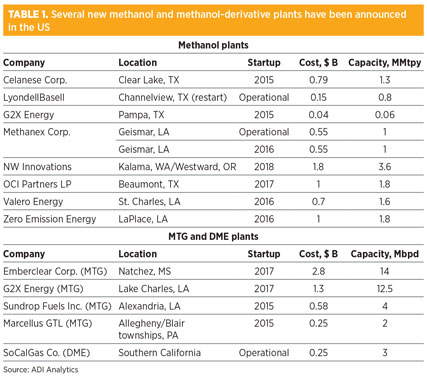

Table 1 shows a representative list of new methanol and methanol derivative plants that have been announced in the US, collectively totaling more than 30 MMtpy of capacity. However, only a few of these plants are likely to be constructed and completed for a variety of reasons, including global commodity prices, worldwide methanol demand and investor appetite. Projects proposed by leading methanol, chemical and refining companies, such as Methanex, Celanese, Valero and LyondellBasell, are most likely to be completed, given their developers’ strong balance sheets and/or active presence across the methanol value chain.

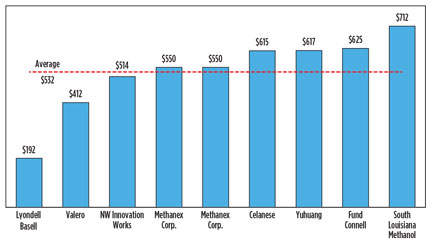

|

Financing and total investment likely will be challenging, given the high capital costs as well as the large capacities planned for these projects. Fig. 5 shows normalized capital costs for large-scale methanol plants. Capital costs for large-scale methanol plants vary from $200/tpy of capacity to $700/tpy of capacity, although the average is approximately $530/tpy of capacity. Collectively, the largest of these projects are anticipated to cost as much as $750 MM to $2 B.

|

|

Fig. 5. Estimated capital costs for most large-scale methanol plants planned in the |

Small-scale methanol plants. Although most new announcements have been for large methanol plants with capacities ranging from 1 MMtpy to 2 MMtpy, there may be potential for small-scale—i.e., 15,000 tpy of capacity to 20,000 tpy of capacity—methanol plants in North America. The primary driver for small-scale methanol plants is the supply of cheap natural gas across shale plays in North America.

In several shale plays, numerous wells produce small or economically immaterial volumes of gas and/or are located in regions with limited pipeline connectivity. For example, wells in the Bakken, where the primary goal is to produce crude oil, routinely flare natural gas. In others, such as the eastern part of Marcellus, several gas wells have been shut down due to low natural gas prices, the lack of higher-priced liquids production or the absence of pipelines.

In such cases, small-scale methanol plants could be attractive due to several conceptual advantages:

- Oil-correlated prices for methanol provide a significant arbitrage to exploit if gas is as cheap as it has been recently in the US

- Lower capital costs in comparison to traditional large plants

- Production of a liquid chemical product that can be transported easily and cost-effectively and which has multiple applications and end uses.

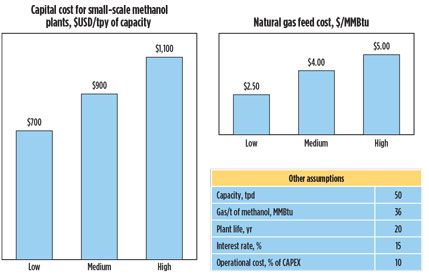

Economics drives commercial adoption of new technologies. Fig. 6 lists the key assumptions for capital costs, feedstock prices and other financial metrics for small-scale methanol plants. Capital costs were assumed to range from $700/tpy of capacity to $1,100/tpy of capacity based on primary and secondary research, including interviews with technology developers.

|

|

Fig. 6. Estimated capital costs for small-scale methanol plants range from $700/tpy |

Most technology developers acknowledge that small-scale methanol plants will cost more than large-scale methanol plants on a normalized basis because of the lack of economies of scale. However, reliable capital cost estimates are not available because there are no commercially operating small-scale methanol plants. Even so, total capital costs and investment for small-scale methanol plants will be significantly lower than those for large-scale plants, making them accessible to a wider range of investors.

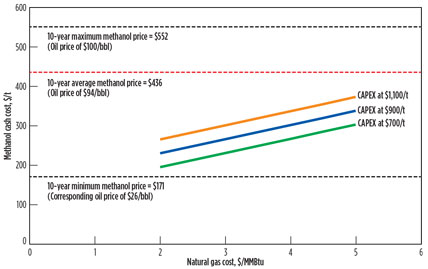

Fig. 7 shows how the cost of producing methanol from small-scale plants varies as a function of natural gas feedstock price as well as normalized capital costs. In general, cash costs are well below the historical 10-year average price for methanol (corresponding to an oil price of $9/bbl) in North America, across the entire range of natural gas costs of $2/MMBtu to $5/MMBtu. However, methanol production costs from small-scale plants are higher than the lowest methanol price (corresponding to an oil price of $26/bbl) seen over the past 10 years. These economics suggest that small-scale methanol plants would be able to deliver a competitive return to investors unless methanol prices fall into the lower range seen over the past decade.

|

|

Fig. 7. Cash cost of methanol produced from small-scale plants are quite competitive |

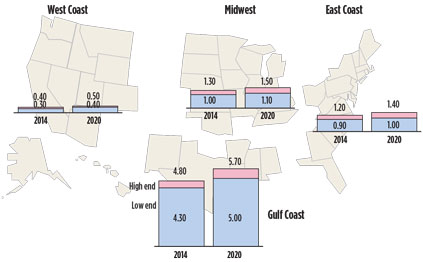

Another factor that potential investors in small-scale plants will consider is methanol demand in their markets and the competitive landscape. Fig. 8 provides an estimate of methanol demand across the four major US regions. Most of the country’s methanol demand is on the Gulf Coast, followed by the Midwest and the East Coast. The extensive chemical industry on the Gulf Coast drives methanol demand in the region, and new ethane crackers proposed in the Midwest or on the East Coast may spark further demand for methanol. Even without additional chemical plants in the Midwest or on the East Coast, both regions will have methanol demand in excess of over 1 MMtpy by 2020, which may be sufficient to support several small-scale methanol plants.

|

|

Fig. 8. The US Gulf Coast dominates US methanol demand, followed by the Midwest |

However, small-scale methanol plants supported by gas from the Marcellus, Utica or Bakken shale plays would still have to compete with methanol imports from the Gulf Coast. The cost of methanol transportation by railcar from the Gulf Coast to the Midwest or the East Coast will likely range from $40/t to $70/t, based on estimates gathered from a major railroad. These railcar-based transportation costs should be added to the cash costs of methanol from large-scale plants, thereby potentially impacting some of the competitiveness of large-scale plants in comparison to small-scale plants. Even so, investors should carefully evaluate methanol cost curves from different plants and locations as they consider small-scale plants in the Midwest or on the East Coast.

A third factor that will play an important role in the commercial deployment of small-scale methanol plants is the availability of process technology. At present, no process technology has been commercially proven for small-scale methanol plants. However, a number of startup companies are pursuing the development of small-scale methanol technology. Although a number of companies are active in this area and are investing significant time and effort through a variety of approaches, it is too early to establish the technological viability of small-scale methanol plants. Similar to cost curves, investors will need to evaluate process technology availability, maturity and costs before considering small-scale methanol plants.

Key risks. A wide range of stakeholders, including but not limited to investors, entrepreneurs, project developers, oil and gas producers, technology developers and government agencies, are likely interested in the technical and commercial viability of small-scale methanol plants. These stakeholders should carefully consider a number of risks associated with small-scale methanol plants:

- Commodity pricing risk. The economic viability of small-scale methanol plants depends heavily on natural gas feedstock and methanol product pricing. High volatility or commodity prices beyond those assumed in the analysis presented in this report should be carefully evaluated for impacts on costs and economics.

- Technology risk. A number of companies are developing small-scale methanol technologies, but none of them has deployed a commercial plant. Although methanol production is mature at larger scales, small-scale methanol plants may pose unknown or unanticipated risks, mainly because existing technologies have not been scaled up to commercial levels as of the time of publication. Careful evaluation of technical viability with emphasis on scale-up risk should be conducted before investing in small-scale methanol plants.

- Capital cost risk. Given the lack of commercially operating plants, capital costs for small-scale methanol plants were assumed for the economic analysis in this report. These capital costs should be verified and validated through careful cost estimation and planning.

- Market and competitive risk. Finally, methanol demand and supply should be monitored carefully for implications on small-scale methanol plants. As several large-scale methanol plants are likely to be built in North America, it is possible that some of them will be able to produce methanol at costs much lower than those of small-scale plants. Furthermore, the scale of some of these companies would allow them to discount transportation costs and provide significant competition in the market. GP

ACKNOWLEDGMENTS

This research was supported by Ben Franklin Technology Partners’ Shale Gas Innovation and Commercialization Center and by the Pennsylvania Department of Community and Economic Development.

|

Uday Turaga is CEO of ADI Analytics LLC, a boutique energy and chemical consulting firm based in Houston, Texas. Through more than 15 years of experience at ConocoPhillips, ExxonMobil, Booz & Co. and ADI, Dr. Turaga brings deep commercial and technical expertise in oil and gas, coal, renewables and chemicals. Dr. Turaga has led the ADI team in advising Fortune 500 companies, cleantech startups, government agencies, and investors on market entry, strategic planning, competitive positioning and technology assessment. Over the past six years, ADI Analytics has completed more than 150 projects for more than 70 clients, including BP, Shell, Chevron, BASF, Mitsui, Honeywell, KKR and the US Department of Energy. Dr. Turaga holds a PhD in fuel science from Pennsylvania State University in State College and an MBA degree from the University of Texas at Austin. He has been recognized by the US National Academy of Engineering, the American Chemical Society and the Penn State Alumni Association. Dr. Turaga is a frequent speaker at conferences globally and has been featured on National Public Radio, Bloomberg and the Australian Financial Review.

Comments