Niobrara/DJ gas processing buildout slows, despite continued service expansion

J. Stell, Contributing Writer

The Niobrara/Denver-Julesburg (DJ) basin has been one of the fastest-growing gas producing areas in North America during the past few years. However, some industry insiders believe that production would have grown even faster if not for a historical lack of gas processing capacity in the region.

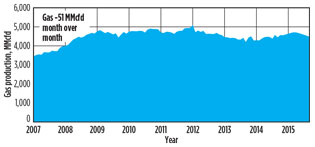

The good news is that midstream companies, such as DCP Midstream Partners, have been expanding their gas processing assets in the area into service. The bad news, however, is that the new processing and takeaway capacity might not be fully utilized in the near term if crude oil prices curtail drilling activity and, in turn, associated gas production in the play. In fact, the Niobrara gas processing buildout has conspicuously slowed since 2014 (Fig. 1).

|

|

Fig. 1. Niobrara gas production falls slightly in 2015. |

In addition to gas processing plants, the existing gas takeaway pipelines serving the play include the Cheyenne Hub, Cheyenne Plains, Colorado Interstate Gas (CIG), Public Service Co. (PSCo), Rockies Express, Southern Star, Tallgrass and Wyoming Interstate Co. (WIC) systems. NGL takeaway systems include the Bakken NGL, Front Range, Overland Pass, Rocky Mountains and Wattenberg pipelines.

A review of gas processing companies active and expanding in the Niobrara/DJ basin shows the present state of development in the region’s shale plays.

Alpha Natural Resources. In 4Q 2014, Alpha announced plans to build an LNG processing plant in Wyoming, to be known as the Plum Energy plant, which would operate near Gillette, Wyoming. The company also announced the Eagle Butte Mine project, planned to help provide fuel for trucks used for mines owned by Alpha Coal West, a subsidiary of Alpha Natural Resources.

The Plum Energy plant would produce an estimated 28.5 Mgpd of LNG. Of this output, 6.4 Mgpd would be used to fuel trucks, with the rest being sold to other LNG users in the Powder River basin.

At last report, the plant was meant to be completed in March. However, on August 3, Alpha Natural Resources and several of its wholly owned subsidiaries filed voluntary petitions with the US Bankruptcy Court for the Eastern District of Virginia in Richmond to reorganize under Chapter 11 of the US Bankruptcy Code, putting the final completion and commissioning date for the plant in question.

Anadarko Petroleum Corp. Anadarko completed and commissioned Phase II of its Lancaster cryogenic gas plant in 2Q 2015. The 300-MMcfd expansion increases Anadarko’s processing capacity at the Lancaster complex to 600 MMcfd.

However, Anadarko expects to intentionally defer the completion of approximately 120 wells in the area during 2H 2015. This move is anticipated to result in a plateau in Wattenberg production for the remainder of the year, thereby reducing its previously projected gas production and potentially impacting the gas plant’s throughput.

Also, the company added 90 MMcfd of field compression in 2Q, for a total of 180 MMcfd in 1H 2015. The additional compression enables Anadarko to lower the average pressure to less than 100 psi in the field, which enhances system efficiency and improves the base production profile, according to the company.

Crestwood Midstream Partners LP. Crestwood continues its work in the Niobrara shale. In February, Crestwood and Williams Partners commissioned the Bucking Horse gas processing plant in Converse County, Wyoming, adding 120 MMcfd of processing capacity in the Powder River basin of the Niobrara shale play. The Bucking Horse plant is owned through a 50/50 JV between Williams Partners and Crestwood Midstream Partners.

The gathering and processing facilities provide services under a long-term, fee-based agreement with Chesapeake Energy Corp. The Jackalope system includes 184 mi of low-pressure gathering pipelines spread across a 311,000-acre area under production by Chesapeake.

The JV expects volumes through the Bucking Horse plant to significantly increase as rich gas production is redirected from other third-party processing facilities, and also as previously curtailed volumes along the Jackalope system resume flow.

In addition to the Bucking Horse plant, the companies’ facilities include the Jackalope gathering and processing system, comprising 146 mi of gas gathering pipeline and 15,600 hp of gas compression, which support the gas processing plant. The assets provided Crestwood with an early-stage entrance into the emerging Powder River basin of the Niobrara shale play and have positioned it for “significant future infrastructure development opportunities across the rich gas and crude oil midstream value chain,” according to the company.

The Jackalope system is being developed to gather and process rich natural gas produced from a 311,000-acre area of dedication operated by Chesapeake Energy and RKI Exploration & Production. The two companies have collectively accumulated the largest acreage block in the Powder River basin play, now spanning over 750,000 acres, and they are developing the acreage under a joint agreement. The existing assets and future development are supported by a 20-year gathering-and-processing fee-based agreement with Chesapeake and RKI.

DCP Midstream Partners. In June, DCP Midstream brought online its new, 200-MMcfd Lucerne 2 gas processing plant. The plant increases DCP’s processing capacity in the Niobrara/DJ basin to 400 MMcfd. The Lucerne 2 plant is the largest of the company’s nine-plant system in the region and is both owned and operated by DCP.

The new gas plant is supported by a 10-year, fee-based processing agreement providing a fixed demand charge, along with a throughput fee on all volumes processed. Lucerne 2 is a deep-cut cryogenic plant, built for a total estimated price tag of $250 MM.

The Lucerne 2 plant connects to the Front Range Pipeline for NGL takeaway to Mont Belvieu, Texas. The DCP partnership holds a one-third ownership interest in the pipeline.

Lucerne 1 is a 35-MMcfd cryogenic processing plant. With nearly 800 MMcfd of total regional processing capacity, the DCP enterprise has increased gathering and processing capacity in the basin by 80% during the past 24 months.

Williams Partners LP. Williams co-owns the Bucking Horse plant with Crestwood Midstream, which expands the existing Williams footprint in Wyoming that includes more than 2.2 Bcfd of combined processing capacity at Opal and Echo Springs.

The company’s Opal gas plant system includes approximately 3,500 mi of gathering pipelines with a capacity of more than 1 Bcfd and more than 3,500 receipt points serving the Wamsutter and southwest Wyoming areas (Fig. 2). Combined, the Opal and Echo Springs processing plants in Wyoming have a daily inlet capacity of more than 2.2 Bcfd of gas and nearly 125 Mbpd of NGL production capacity.

|

|

Fig. 2. Williams’ Opal gas plant serves regional Niobrara |

Also, Williams’ Willow Creek processing plant in Western Colorado has a processing capacity of 450 MMcfd and an NGL production capacity of 30 Mbpd.

Elsewhere, the company’s Parachute plant complex and three other treating facilities in western Colorado have a combined inlet capacity of 1.4 Bcfd. These facilities are connected to more than 3,300 wells via a gathering system with approximately 300 mi of pipeline, ranging up to 30-in. trunk lines.

Williams’ Four Corners system in Colorado and New Mexico comprises five natural gas processing and/or treating plants with 3,800 mi of gathering lines and nearly 6,500 receipt points. The plants have the combined inlet capacity of 1.8 Bcfd of natural gas and can produce 41 Mbpd of NGL.

Williams’ takeaway systems include the Parachute Lateral, a 38-mi, 30-in. line that transports gas from the Parachute area to the Greasewood and White River hubs in northwest Colorado; the PGX Pipeline, which transports NGL from the Parachute area to a major NGL transportation pipeline system; and the Overland Pass, which includes a 760-mi NGL pipeline from Opal to the Midcontinent NGL market center in Conway, Kansas, along with 150-mi and 125-mi extensions into the Piceance and DJ basins in Colorado.

Whiting Petroleum Corp. Whiting Petroleum, which is basically an upstream oil and gas producer, completed its Redtail gas plant and takeaway system in northeast Colorado. Within the gas plant complex, Train 1 has a capacity of 20 MMcfd and Train 2, completed in 2Q 2015, has a capacity of more than 50 MMcfd.

The company plans further processing capacity at the site, including Train 3 with a capacity of more than 70 MMcfd, to be completed in 2017, and Train 4 with a capacity of more than 60 MMcfd to be completed sometime in 2020. The company also plans to build pipeline takeaway infrastructure to move around 200 MMcfd of gas by 2020.

Future buildout. If—or perhaps it is better to say when—oil and gas prices return to pre-2014 levels, the Niobrara/DJ basin can expect to see a resurgence of gas processing expansions and new capacity construction. Until then, however, gas processing activity is expected to remain steady or fall off slightly as oil and gas drillers continue to take a wait-and-see stance in their operations, planning and budgets. GP

|

Jeannie Stell is an award-winning freelance writer and editor focused on the upstream, midstream and downstream energy industry. Her articles have been published in several languages and referenced in white papers, and her photographs have been featured on industry magazine covers and in feature editorials. Ms. Stell is the founder of Energy Ink, and can be reached at jstell@energyink.biz.

Comments