Gas-to-power networks expand global opportunity for gas

M. Farina, GE Global Gas to Power, Denver, Colorado

New gas discoveries, in combination with advances in technology, are making it possible to address previously insurmountable energy challenges in underserved regions of the world. These developments are raising hopes and expectations of improving the lives of 20% of the world’s population that still lives without access to electricity. Industry experts and policymakers alike see the potential of harnessing the ever-expanding world gas supply to drive economic growth and improve basic living conditions in many countries.

The expansion of global gas networks and the opening of new markets for natural gas are mutually reinforcing, further enhanced by the natural gas advantages of cost-competitiveness, flexible operating characteristics and reduced environmental impact. Advanced and wide-ranging power generation systems are available for everything from mega-cities to isolated villages, and from industrial sites to municipal grids.

Technology offerings can serve projects that scale to each community’s needs, and that are in alignment with whatever indigenous resources may be available. While gas is already addressing some of the most challenging generation problems in the global energy sector, more can be done to bring these resources online faster. International companies are willing to take on significant financial and operational risks to develop resources, build infrastructure and link markets if governments create a stable environment for business—especially for gas supply projects that have investment horizons of 20 to 30 years.

Gas-to-power networks offer solutions. One approach to bring power resources online faster involves convening stakeholders along the power generation value chain, including governments, developers, fuel suppliers, construction firms, equipment providers and financiers. Ultimately, the goal is to deliver—in a holistic, cost-effective way—gas-fired power generation to underserved markets through the creation of “gas-to-power” energy networks.

Government officials, regional trade associations, international development organizations, industry leaders and other stakeholders are key components of the strategic partnerships necessary to bring more power to local communities. In tandem, these stakeholders can work together to restructure inefficient legacy markets and replace them with clear and consistent regulatory regimes. In so doing, they will increase access to risk-shared financing, reinvigorate long-planned (but dormant) regional infrastructure projects, and encourage investment in each stage of the project value chain. As a result, more households will see the benefit of reliable and affordable power.

Gas-to-power networks offer new opportunities now and in the future. Policymakers should examine their country’s energy mixtures in light of emerging trends, amend and develop regulations to support new gas-to-power projects, and seek out opportunities for regional cooperation.

Where it makes sense, industry should develop centers of excellence around gas-to-power networks to seek the strategic alliances needed to bring these complex projects onstream faster. Development and financial institutions can also take a fresh look at their objectives and priorities to ensure that resources and lending policies reflect emerging trends, and are fully aligned with efforts to increase energy access in the developing world.

Robust natural gas forecast. Gas is anticipated to take on a much larger role in the global energy landscape in the future, delivering economic and sustainability benefits. Led by the power sector, global gas consumption is projected to grow by 33% by 2025.

The oil and gas industry is evolving with new complexities and ongoing volatility. Shale-based resources and massive offshore discoveries are reshaping pricing dynamics, trading patterns and business models. The international trade of LNG is expected to more than double over the next 10 years and will feature a variety of new buyers and sellers and more flexible contracting terms. Furthermore, the increasing divergence between gas and oil prices is creating economic and environmental benefits leading to the displacement of high-cost, oil-fired power in isolated locations and for emergency power.

In the power generation sector, the world will require electricity to be generated from every possible source. Renewables will be a major part of future growth as generation costs fall and development is prioritized, but renewables are only part of the solution. There is a growing need for cost-effective flexible power that can follow loads and back up intermittent wind and solar. The world will also continue to rely on large baseload resources like hydropower, nuclear and coal.

Large, centralized power plants capture economies of scale in power production and involve fuel choices that are reflective of local conditions and resource distribution. These plants are typically sponsored by sovereign entities or large utilities with costs spread out over many customers and paid off over many years. However, multibillion-dollar projects, particularly those for coal and nuclear power generation, have long development timelines and can be difficult to build if institutional structures are weak and/or electric grids are insufficiently robust. These conditions create an important role for faster, flexible natural gas projects, especially in emerging markets.

By 2025, 60% of global electricity consumption is anticipated to occur in emerging markets, up from 52% today. Moreover, emerging markets will represent more than 80% of actual growth in electricity consumption between 2013 and 2025. China will represent about half of this growth, but, even if the so-called “BRIC” nations (Brazil, Russia, India and China) are excluded, developing countries will account for approximately 25% of power demand growth to 2025. Southern and Southeast Asia represent an epicenter of this growth, but other large growth centers can be found throughout Sub-Saharan Africa, the Middle East, Latin America and the Caribbean.

The challenge is to adapt the development models for power to these new geographies. Gas-to-power initiatives support electricity development around the world. With a focus on private-sector participation, the effort targets areas where traditional development has stalled or is too slow. Opportunities exist to bring technology and capital in an integrated approach for deeper engagement in early-stage projects, to help them move forward. The basic concept is to efficiently convert gas into electricity for households and businesses, although variations exist depending on local dynamics.

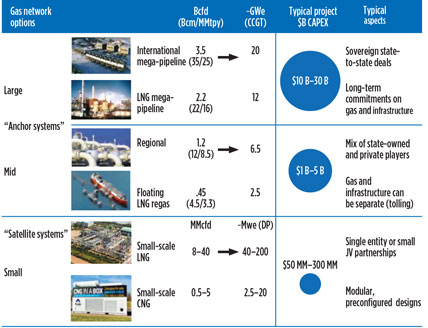

Options for different scales of development. To understand gas-to-power networks, an examination of the options for different scales of development is required. Gas-to-power initiatives have strong advantages in many regions, and the modularity and flexibility of the concept allows for its application to the full range of energy needs—from mega-projects to micro-grids.

Fig. 1 shows scales of gas-to-power development. At the largest scale, mega-gas pipeline and LNG projects will continue to anchor gas networks. These multibillion-dollar projects are critical to advancing gas use on a global scale, linking large gas supply reserves to critical demand centers.

|

|

Fig. 1. Scales of gas-to-power development. |

Medium-sized, regional gas transit projects (e.g., pipelines) are typically built to unlock domestic gas supplies. Projects of this scale also include large regasification terminal projects (onshore or floating technology) to enable access to global LNG markets to feed multi-gigawatt power markets.

While these larger networks are critical and will continue to advance, more opportunities for dynamic growth in smaller-scale gas-to-power networks are foreseen.

These distributed power-based “satellite” systems can be developed faster and are expected to increasingly augment, rather than displace, traditional power generation development. Distributed gas-to-power networks can serve many types of consumers, from small power generation plants to light industry to fleet fueling stations. They can also be built adjacent to large, existing gas networks, or in isolation. Gas-to-power technology options, from mega-projects to distributed systems, create powerful options for countries seeking to overcome the full range of energy challenges.

The oil and natural gas industry is evolving with new complexities and ongoing volatility. Shale-based resources and massive offshore discoveries are reshaping price dynamics, trade patterns and business models, creating significant opportunities for the establishment of gas-to-power networks.

Emerging markets will represent more than 80% of actual growth in electricity consumption between 2013 and 2025. China will represent about half of this growth, but, even if the BRIC countries are excluded, developing countries will still account for about 25% of power demand growth to 2025.

Gas-to-power advantages. In many places, gas-to-power initiatives have key advantages, including speed of development, access to new and diverse gas supply options, lower capital intensity, flexibility to support the expansion of renewables in the power mix, and increasing price competitiveness.

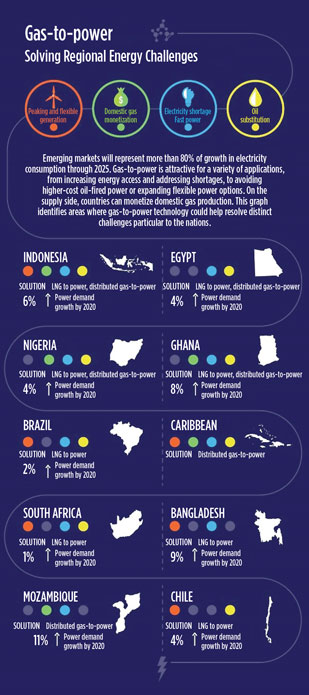

Rapid access to energy is needed across much of the developing world; yet, traditional development models have struggled to deliver in many of these regions, as large-scale developments are often delayed by a myriad of technical, political, environmental and financial hurdles. The speed and flexibility of gas-to-power projects hold tremendous promise for communities, countries and regions willing to take a fresh look at how gas can play a larger role in their energy mixtures (Fig. 2).

|

|

Fig. 2. A number of solutions within gas-to-power networks |

The complexities of these projects, although smaller than traditional models, still present challenges that will require more concerted efforts by stakeholders to build strategic alliances to bring these projects onstream faster. GP

|

Michael Farina is responsible for early-stage gas-to-power project development and concept validation in support of regional commercial teams. He develops fuel strategies and advises on market issues for gas-to-power projects. He has been a market intelligence leader at GE Oil & Gas for nearly seven years, including leading the Fuels Center of Excellence within GE Energy and, most recently, serving as strategy and analytics leader for GE Oil & Gas. Previously, he served as a director of natural gas consulting at Cambridge Energy Research Associates (IHS-CERA) and has worked on LNG, pipeline, and gas-fired power plant development around the world. He holds a BA degree in economics from Colorado State University and an MA degree in economics from the University of Colorado.

Comments