Catalyst development enables innovative OCM technology application

J. Wood and R. Black, Siluria Technologies, Houston, Texas

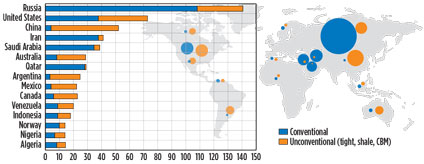

Access to shale reserves and advances in hydraulic fracturing technology have created an abundance of recoverable natural gas and lightweight NGL in various regions of the world (Fig. 1), but nowhere has the impact been more pronounced than in the US.

|

|

Fig. 1. Global recoverable natural gas reserves. Sources: IEA (Advanced Resources |

During the past six years, US dry natural gas production increased significantly, from a low of 50 Bcfd in 2008 to more than 70 Bcfd to date. According to the US Energy Information Administration’s (EIA’s) Annual Energy Outlook 2014, natural gas production in the US is expected to climb by 56% between 2012 and 2040, to an estimated 37.6 Tcfy (103 Bcfd). Similar trends are expected to occur in other geographies.

The geographical diversity of shale reserves across the country, including abundant resources in areas such as the Northeast, has constrained natural gas prices and reduced basis spreads.

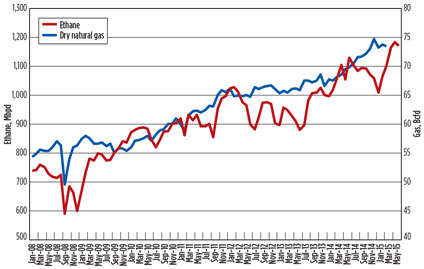

Changing NGL landscape. The development of shale reserves has also resulted in substantial growth in domestic NGL production. The most pronounced increase has been in ethane, which typically represents more than 40% of the total NGL in the raw natural gas stream by volume. Fig. 2 shows the substantial increase in both natural gas and ethane production. Average ethane production from US gas plants from 2008 to early 2015 increased by 59%, from 702 MMbpd to 1,116 MMbpd.

|

|

Fig. 2. Historical US natural gas and ethane production volumes. Sources: |

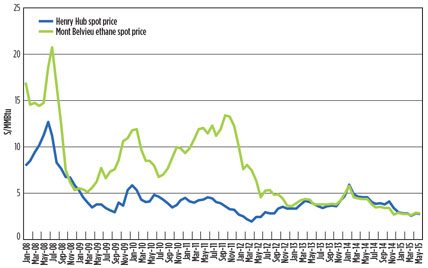

As shown in Fig. 3, although natural gas prices have declined considerably, ethane prices have fallen much more as production volumes of both have ramped up. Since early 2013, ethane has traded at or even below relative parity with natural gas on a Btu basis.

|

|

Fig. 3. Historical natural gas and ethane prices. Source: Bloomberg. |

The demand response has been to open more markets for the same product. Natural gas use has increased in power generation, and major new projects are underway for the large-scale export of natural gas and light NGL. In response to the low-ethane-price environment, a number of new ethane cracking facilities have been announced.

GTL technology. In addition to these traditional demand responses, renewed attention to new and innovative uses for natural gas has come into focus. For nearly a century, engineers and scientists have sought to convert natural gas into higher-value products, such as transportation fuels. The shale gas revolution has highlighted the importance of such efforts, particularly as geopolitical concerns over supply and growing worldwide demand have kept the ratio between crude oil and natural gas prices elevated.

Today’s world-scale GTL technology is based on the Fischer-Tropsch (FT) pathway. FT GTL is an indirect approach using high-temperature steam to reform natural gas to a syngas intermediate (a high-energy mixture of hydrogen and carbon monoxide), followed by conversion via the FT process to hydrocarbon products. The syngas intermediate is typically produced from methane, limiting the potential use of light NGL. The hydrocarbon products that result have a broad product distribution, typically ranging from C1 to C40, which includes desirable high-cetane, low-sulfur diesel and saturated straight-chain waxes.

The complexity of FT products requires significant additional refining and separations, leading to additional capital and operating costs. Furthermore, many of the high-value co-products, such as waxes, have very small market sizes. This creates compounding effects of higher capital costs for coproduct recovery and marketing, further complicating business models and adding commercial risk.

Historically, commercial FT deployments have been characterized by large-scale facilities aimed at diesel production. A number of new companies are pursuing small-scale FT-GTL projects by focusing on technology solutions to address capital intensity, operating costs and product slate complexity. These approaches are enabled by process intensification and other advances, but the fundamental chemistry of syngas production and FT synthesis remains in place.

A new chemistry for gas conversion. Advances in catalyst technology have enabled the direct conversion of natural gas into high-value commodity chemicals and transportation fuels. These solutions address many of the historical challenges associated with existing GTL solutions.

One solution is a proprietary oxidative coupling of methane (OCM) technology. While the benefits of OCM have been known since the early 1980s, past efforts did not result in a viable catalyst with the performance needed for commercialization. These catalysts, while at times achieving promising yield and selectivity, were hampered by very high operating temperatures, low activities and short lifetimes on the order of hours to days.

However, a combination of new innovations in catalyst development and high-throughput screening techniques has recently led to the development of a unique catalyst to enable OCM to be commercialized. In OCM, methane and oxygen react exothermically over a catalyst to produce ethylene, water and heat. In addition, the technology can enable a cofeed of ethane for conversion into ethylene, thus providing feedstock flexibility.

The OCM ethylene stream can then be converted into liquid fuels in a second step, called ethylene-to-liquids (ETL). In ETL, the ethylene is oligomerized over a catalyst to selectively produce a targeted product, such as gasoline. Overall, the result is a simpler process, lower capital costs, greater feedstock flexibility and a more marketable product slate.

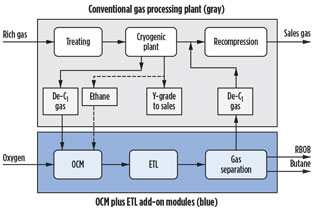

Midstream gas processing plant configurations. An example integration of the OCM and ETL processes in an existing or conventional gas processing plant is shown in Fig. 4. Gas processing plants receive NGL-rich natural gas, remove impurities, extract the NGL by expanding the gas to the demethanizer tower pressure, and then recompress the residue gas to sales pipeline pressure.

|

|

Fig. 4. Flow diagram and integration scheme for midstream |

Additionally, gas processing plants are capable of producing ethane with a deethanizer tower. An integrated OCM process takes advantage of the low-pressure demethanizer tower gas and available ethane, converting a portion of these streams to ethylene, heat and water. If the gas processing plant is located near existing downstream ethylene infrastructure, then the dilute ethylene stream produced by the OCM process can be purified by conventional methods into chemical-grade ethylene and sold to derivative chemical producers. In all other locations, the ETL process converts the ethylene to fuels, such as RBOB and butane, which are recovered in a simplified gas separation unit. The remaining non-condensed gas is returned to the gas processing plant for recompression utilizing existing equipment. This integrated method converts methane and ethane into valuable long-chain hydrocarbons.

An integrated OCM-plus-ETL facility can be scaled to align with existing infrastructure, leveraging unit operation, feedstock and product compatibility. This integration enables a relatively modest capital investment. For example, a modular facility is designed to accommodate a 200-billion-Btu-per-day (BBtupd) inlet feed of residue gas from an existing processing plant and to maximize ethane intake. Such a facility can convert approximately 12 BBtupd of the gas and 5.6 Mbpd of ethane into approximately 3.6 Mbpd of gasoline and butane. Excess heat for the host processing plant has a capital outlay of approximately $250 MM. Even at present prices, this would result in a gross margin of more than $45 MM/yr, with significant upside as crude oil prices continue to recover.

An added benefit of the OCM-plus-ETL pathway from natural gas and ethane to transportation fuels is a lower environmental footprint. Since the OCM process builds longer-chain hydrocarbons as opposed to conventional refinery processes that require energy to break molecules apart, environmental emissions are significantly reduced. For instance, the OCM-plus-ETL process provides lower greenhouse gas, NOx, particulate and SOx emissions, and it yields cleaner fuel products with near-zero-sulfur content compared to petroleum-derived fuels.

Takeaway. OCM technology is a solution for changing natural gas and ethane supply dynamics. It presents an attractive path to a more natural-gas-centric means of energy production in terms of capital intensity, product slate and value uplift.

Growth in the gas processing industry has been revolutionized by shale gas, but that success has created new challenges with depressed natural gas and ethane prices. Midstream companies that are able to convert methane and ethane into longer-chain, higher-valued hydrocarbons will be better able to compete for business and enjoy superior profitability.

The midstream industry has a history of technical innovation to address pricing challenges, including plant modularization and low-cost cryogenics. Now, advanced process technologies can catalyze the next generation of growth by creating real product value for the midstream industry. GP

|

Jeff Wood is the CFO of Siluria Technologies, which is pioneering the commercial production of fuels and chemicals from natural gas. He is focused on the company’s financing strategies and on external communications. Prior to joining Siluria, Mr. Wood spent 14 years focused on the midstream industry with Eagle Rock Energy Partners and as an investment banker with Lehman Brothers. Mr. Wood holds a BA degree from Baylor University and an MBA degree from the University of Chicago Booth School of Business.

|

Richard Black is Siluria’s executive vice president for midstream, responsible for commercializing OCM and ELT technology in the midstream industry. Prior to joining Siluria, Mr. Black was the principal of Blackhawk Energy Consultants. He began his career with ARCO/Vastar Resources in various engineering, operations and supervisory roles. He then joined BP America, leading the company’s Deepwater Development Pipeline commercial organization, prior to forming Blackhawk in 2003. He holds a BS degree in mechanical engineering from Oklahoma State University.

Comments