Western Canada welcomes expanding gas supply, processing capacity

J. Stell, Contributing Writer

Gas processing plant utilization is fairly steady in Canada, despite oil price levels that have impacted propane and ethane values. When oil prices bounce back to more typical levels, where the value of oil lifts prices for propane and butane, then gas processing will become more economical, according to Bill Gwozd, senior vice president for energy consulting firm Solomon Associates.

“When oil prices were down in the $40/bbl range, the low price definitely had an adverse impact on gas processing; however, in western Canada, where 98% of all Canadian gas processing takes place, the overall gas supply really hasn’t diminished during the past year,” Gwozd said. “Therefore, gas processing utilization and capacities haven’t really changed. What is changing is the location of the gas processing requirements.”

The gas processing utilization in the eastern part of Western Canada is shrinking, according to Gwozd: “Gas volumes are declining, and the long-term outlook for the eastern part of western Canada is for continued declines. However, on the western portion, the long-term outlook is actually for growth. In fact, so much growth is expected that the overall supply for Canada will actually grow.”

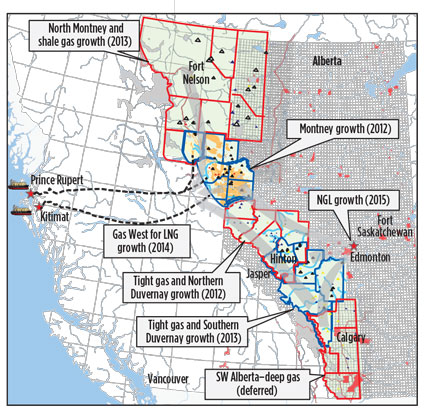

Doubling gas production. Gwozd said the supply could increase to the point of doubling today’s estimated 13-Bcfd volume of gas. As a result, the gas process options and opportunities will also double. For example, to serve proposed Canadian West Coast LNG projects, new gas supply from the Montney and Duvernay shale plays (Fig. 1) will be required.

|

|

Fig. 1. Map of Montney and Duvernay shale gas production areas, courtesy of |

Recently, Pacific NorthWest LNG, led by Malaysia’s Petronas, confirmed its intent to invest an initial $12 B to produce and ship Canadian natural gas to Asia. To support the facility, TransCanada Corp. plans to build an associated pipeline through the province’s north at a cost of more than $5 B to link shale gas fields to the liquefaction terminal. In June, the Petronas-led consortium said it would proceed with the LNG export project in British Columbia, subject to final approvals and agreements with various stakeholders. Its partners—investors from China, Japan, India and Brunei—have agreed to long-term supply contracts.

“As we reported in our ‘Montney supply infrastructure study,’ the Montney formation carries pockets of liquids-rich gas. Our ‘Duvernay supply infrastructure study’ also shows strong pockets of liquids-rich gas. This large volume of gas, which can be measured in billions of cubic feet, will require new grassroots gas processing plants,” Gwozd said. “The two studies show the optimized locations of where those plants will be required.”

Specifically, treating, conditioning and processing will be needed in some regions that have high hydrogen sulfide content in the produced gas. Elsewhere, such as in the Horn River basin area, gas contains 12% carbon dioxide that must be processed down to 2%. Meanwhile, the super-rich Duvernay shale carries liquid volumes of more than 100 bbl/MMcf of gas.

“That is so much liquid, the producers could call those liquid wells, with propane, butane and condensate, rather than gas wells,” Gwozd said.

Economical JVs. Gwozd suggested that, in a break from the past, operators should no longer build their own processing plant with capacity to serve only their production. In the past, these practices were necessary because gas volumes per well were not as prolific. Therefore, small, scattered gas plants were built in far-flung production areas to serve specific producers.

However, today’s gas wells are far more prolific, with large volumes of gas produced from each well due to horizontal drilling and multistage fracturing, which results in “pinpoint” gas supply with 100 times more productivity. Tying in production from a group of “super wells” would be much more productive.

“By studying entire regions, the processing can be optimized by building only one or two large facilities to serve multiple producers in each region,” Gwozd said. “Many times, one big plant is less costly than two standalone plants.”

For example, one study suggested that a US$700,000 spend, as opposed to a US$500,000 investment, will buy double the capacity at half the unit cost. This strategy would drive operating costs down, reduce the capital needed for overall processing, and reduce regulatory costs and burdens, as well as better serve future LNG export projects at the turn of the next decade.

“In a lower oil and gas price environment, the opportunity for producers to drive costs down without impacting production is essential,” Gwozd asserted. “We look at everything, and determine what makes the best economic sense as if the region had a single owner. The best plan is to group together gathering systems into one common processing facility, and to also use common takeaway pipelines vs. smaller ones.”

Opportunity exists for operators to use these best practices at the start of the development of gathering and gas processing systems to serve the new Montney and Duvernay plays, which will mitigate the upward spiral of costs. Operators should form JVs to build large plants that can save on capital costs and also capture the efficiencies of large-scale projects, Gwozd suggested.

LNG challenges. Such large-scale plants would also be needed to process gas before it is sent to LNG plants, but several planned LNG facilities in Canada appear to be delayed.

In June, the International Energy Agency (IEA) reported that British Columbia is unlikely to develop three LNG plants that the provincial government had hoped to see in operation by 2020.

“Prospects for LNG projects have deteriorated, and no plant is expected to be operational over the time horizon of this report,” stated the IEA. “Proceeding with such large-cost items is challenging under any market condition, but the plunge in oil prices will certainly make companies think twice before pushing ahead … further curtailment seems likely when judging from the pipeline of new projects.”

The Oxford Institute for Economic Studies agreed, stating, “Despite large volumes of shale gas and government hype over the industry, the study found that changing energy markets, global price volatility, increased competition, and LNG cost overruns have dramatically changed the demand picture for high-risk and capital-intensive LNG projects around the world.”

Yet, if and when such LNG facilities are built, the need for gas pre-processing will re-emerge.

New processing capacity. Even without large LNG demand, new processing capacity is needed, and various construction projects are underway in Canada.

For example, Alberta-based Pembina Pipeline Corp., one of the largest gas processing and transportation companies in Canada, is expanding its Redwater fractionation and storage (RFS) facility projects. With RFS 2, Pembina will essentially be twinning the company’s existing 73-Mbpd ethane-plus fractionator in Redwater to address a portion of the anticipated shortfall in fractionation capacity within the Fort Saskatchewan, Alberta area. Pembina expects RFS 2, which is 97% contracted, to be in service in 4Q 2015 at an estimated cost of $415 MM.

Also, Pembina plans to construct a new RFS 3 plant, which will be a 55-Mbpd propane-plus fractionator at Pembina’s existing Redwater fractionation and storage complex. The plant will be underpinned by long-term take-or-pay contracts with multiple producers. Pembina expects RFS 3 to cost about $400 MM and, subject to regulatory and environmental approval, it will come into service in 3Q 2017.

Meanwhile, at yearend 2014, the company completed its new shallow-cut gas plant, the Musreau 2 facility, along with associated NGL and gas gathering pipelines near its existing Musreau facility (Fig. 2) in west-central Alberta. The facility was placed into service ahead of its original in-service date of 1Q 2015. Musreau 2, which is expected to cost an estimated $110 MM, is underpinned by long-term contracts with area producers for 100% of the facility’s capacity.

|

|

Fig. 2. Pembina Pipeline Corp. recently completed NGL and gas gathering |

The plant is designed to extract propane-plus (C3+) hydrocarbons and is expected to process 100 MMcfd of gas with an estimated yield of 4.2 Mbpd of NGL for transportation on Pembina’s pipelines. The company expects that volumes from the Musreau 2 facility will further support its expansions to its Peace and Northern pipeline systems.

Also, Pembina’s plans for a new Saturn 2 enhanced liquids-extraction facility are underway. The planning will leverage engineering work that is already completed for the original Saturn 1 facility (Fig. 3). Pembina expects that the project could be in service by late 2015 at an estimated capital cost of about $170 MM.

|

|

Fig. 3. Pembina plans to build a Saturn 2 enhanced-liquids-extraction facility, |

The agreement with a third-party underpinning Saturn 2 is a firm-service contract for 130 MMcfd (about 65% of the facility’s total capacity) for a term of 10 years. Based on 100% capacity, Saturn 2 is expected to extract an estimated 13 Mbpd of NGL that will be transported on the same pipeline lateral that Pembina constructed for its Saturn 1 facility.

Delayed construction. Not all new capacity plans are on track for completion. Low oil and gas prices continue to plague producers and, subsequently, gas plant operators.

For example, Bellatrix Exploration Ltd. recently reported that it will cut its already-reduced 2015 capital budget by a further $100 MM, dropping it by 25% to $300 MM, and scaling back its production growth plan. The Calgary-based company has decided to delay Phase 2 of a gas plant expansion by approximately six months, to 4Q 2016, due to low resource prices. The company’s remaining budget was spent primarily to complete Phase 1 construction of the 110-MMcfd plant, which was completed ahead of schedule and within 3% of cost estimates.

The company is reducing its 2015 average production guidance range to the equivalent of between 47 Mbpd and 48 Mbpd, which is still 23% more than its 2014 average daily production.

Gas processing M&A. In addition to operators’ changing newbuild and expansion plans, oil and gas price volatility is driving various merger and acquisition (M&A) deals.

In an interest-acquisition deal, Tidewater Midstream and Infrastructure Ltd. is paying $180 MM in cash and stock for a 63% stake in Blaze Energy’s West Pembina field gas plant and related pipelines in central Alberta. The deal includes $170 MM in cash and $10 MM in Tidewater shares valued at $1.35/unit. The plant has an operating capacity of 185 MMcfd.

Also, at the beginning of 2015, Keyera Corp. closed an acquisition of a 70.79% ownership interest in the Ricinus deep-cut gas plant in west-central Alberta for a purchase price of $65 MM. Upon closing, Keyera became operator of the facility.

Previously, in late 2014, the company became a 60% owner in the Zeta Creek gas plant that is under construction by Velvet Energy in the West Pembina area of Alberta. Keyera will be the operator of the plant, which has a planned capacity of 54 MMcfd of sweet gas.

In late 2014, Calgary-based Encana Corp. sold a package of gas pipeline and processing assets in Western Canada’s Montney region to Veresen Inc. and US private equity giant KKR & Co. LP. Encana said it would use the $412 MM in proceeds to develop its Montney assets.

In conclusion, Canadian producers and operators alike are advised to plan carefully for increasing gas production growth, despite the present slump in prices and production, when considering new and expanded gas processing capacities and future M&A activities. GP

|

Jeannie Stell is an award-winning freelance writer and editor focused on the upstream, midstream and downstream energy industry. Her articles have been published in several languages and referenced in white papers, and her photographs have been featured on industry magazine covers and in feature editorials. Ms. Stell is the founder of Energy Ink, and can be reached at jstell@energyink.biz.

Comments