The Bakken shale’s good news for gas processors

J. Stell, Contributing Writer

As unconventional oil and gas production in North Dakota’s (ND’s) Bakken shale play tops 1 Bcfd amid falling crude oil prices, some upstream developers show early indications of moving their focus away from oil and toward more natural gas—which is good news for gas processors.

ND regulations now require reduced gas flaring and more oil conditioning. Effective April 1, new regulations require oil producers to gradually step down gas flaring at oil wells until no more than 10% of all gas is flared by 2020, and producers are making inroads on the regulations. During 2014, ND cut flaring from 36% to 24%. At present, approximately 7% of the state’s wells are not connected to a gas pipeline. However, ND’s flaring reductions are a pale comparison to Wyoming’s success, where less than 2% of produced natural gas is flared, or Alaska, which flares only 0.32% of its production.

Additionally, new regulations for crude oil conditioning standards now require well operators to separate more gas from oil, in the forms of propane, butane and pentane, to reduce oil vapor pressure to make oil safe for transportation. Vapor pressure of all oil at the point of sale or transport must measure no more than 13.7 psi. The rules will require more gas processing capacity to separate gas and liquid hydrocarbons.

This scenario will lead to less gas flaring and more derived associated natural gas, which is a good environment for gas processors. Meanwhile, new technologies targeted for Bakken production could bring portable mini-plants to wellsites to capture, compress and refrigerate methane to –261°C, converting it to LNG at the wellsite.

Bakken gas processors are not significantly reducing their CAPEX plans for gathering and processing, as compared to the way in which upstream operators are reducing spending on drilling and completions. The following sections detail ongoing and upcoming processing and expansion activities by midstream companies active in the Bakken shale.

B&A Global Energy. A small company based in Tulsa, Oklahoma, B&A Global Energy recently acquired the rights to Energy Capturing Operating System (ECOS), a portable gas processing module that can be placed at a wellsite to capture and process methane gas into LNG. The company plans to install the technology in the Bakken after testing it in Asia.

B&A will bring the portable plants to wellsites where natural gas is being flared. The ECOS unit will capture, separate, compress and refrigerate gas to –261°F. According to B&A Global, the process eliminates the need to flare gas released during shale production. The LNG can be stored in specialized tank batteries and trucked away from the site in cryogenic tankers. When a wellsite is no longer flaring enough gas to be economically viable, the system can be moved, like a drill rig, to the next site.

Greyrock Energy wants to process associated Bakken gas into diesel. The company has developed, tested and commercialized a GTL system that can turn gas into low-sulfur diesel fuel without expensive refining equipment. Gas is processed into syngas and then converted into diesel by a catalytic process. The company is discussing with Bakken producers the use of ethane, propane, butane and condensate in the process.

Ironically, the downturn in oil prices has increased the company’s business flow. According to Greyrock, low oil prices and upstream capex reductions have driven activity in early 2015 to outpace all of its business in 2014. Since NGL prices have fallen alongside those of natural gas, the input costs are lower, the company reported.

Kinder Morgan acquired Hiland Partners in January in a deal worth approximately $3 B, including $1 B in debt. The deal included oil gathering and transportation pipelines, as well as gas gathering and processing systems for the Bakken formation in ND and Montana (MT).

The Bakken gathering system in eastern MT gathers, compresses, dehydrates and processes natural gas, and fractionates NGL. This system includes the Bakken processing plant, three compressor stations and one fractionation facility.

Oasis Petroleum Inc. is considering the formation of a master limited partnership to build, own and operate a $200-MM gas processing plant. The company, which operates only in the Bakken shale, plans to process gas from the Wild Basin during the next two years. The project will include some oil gathering lines and saltwater distribution lines. If built, the gas processing plant would be completed in 2017.

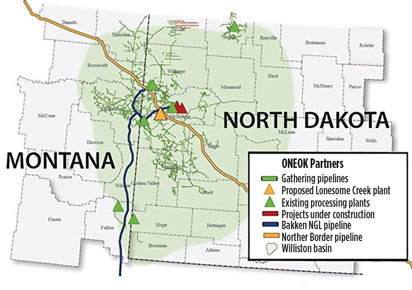

Oneok Partners operates several gas processing plants, gathering lines and pipelines in the Bakken shale, and has plans to add more (Fig. 1). The company has proposed a gas processing plant in McKenzie County, ND, and has submitted an application for the Demicks Lake gas processing plant.

|

|

Fig. 1. ONEOK Partners’ existing and proposed operations in the Bakken shale. |

The Demicks Lake project would consist of two cryogenic turboexpander processing units, each with a capacity of 200 MMcfd. The plant would produce propane, butane and natural gasoline, as well as methane, ethane and carbon dioxide. NGL products would be transferred to onsite storage tanks and into a pipeline network. The project, with a $642-MM price tag, would be built on 160 acres near Watford City, ND.

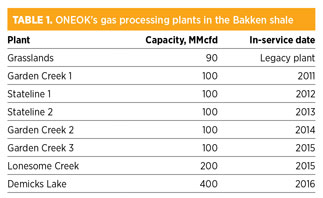

The plant was originally slated for completion in mid-2016. However, Oneok recently put on hold both the Demicks Lake and McKenzie County projects due to a projected slowdown in Bakken production. The company’s 2015 capital expenditures have been revised downward from a previous guidance range of $2.6 B–$3 B to a range of $1 B–$1.4 B. Since 2010, Oneok has invested more than $4 B in midstream infrastructure in the Williston basin. Table 1 shows Oneok’s operating and planned plants in the Bakken shale.

|

As an alternative, the company plans to increase field compression to take advantage of increased processing capacity at its three Garden Creek and two Stateline plants. Along with Lonesome Creek, that additional processing capacity is expected to come online by the end of 2015. The 300 MMcfd of capacity gained as a result of the additional compression activity is expected to help meet flaring targets of 15% by January 1, 2016.

With an estimated 750 wells yet to be completed in ND, Oneok expects its 2015 gas gathering volumes in the Williston basin to increase by 39% over 2014, which is only 3% less than previous projections. GP

Comments