Improve economics with GTL integration into oil sands operations

E. Salehi, S. Save, W. Nel and G. Almquist, Hatch Ltd., Calgary, Alberta, Canada

At the beginning of the last decade, a wave of interest in GTL was driven by environmental awareness and peak oil predictions. As a result, many GTL projects were announced worldwide, of which three were finally constructed and are operating in Qatar (Shell’s Pearl GTL and Qatar Petroleum and Sasol’s Oryx GTL), and one in Nigeria (Chevron’s Escravos GTL). At present, GTL once again looks promising.

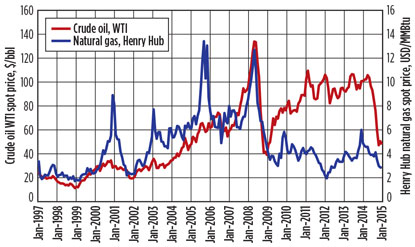

Renewed interest in GTL is due mainly to new developments in shale gas production and the spread between oil and natural gas prices, particularly in North America (NA). Fig. 1 depicts the historical trend of WTI crude oil and Henry Hub natural gas prices since 1997.

|

|

Fig. 1. Historical trend of oil and natural gas prices in NA. Source: US EIA. |

The spread between oil and gas prices, which is the main driver for GTL economics, has recently narrowed due to an oversupply of shale oil and a sharp drop in crude oil prices. However, referring to recent EIA projections, the oil-to-gas price ratio is forecast to remain at for the foreseeable future almost double the average historical value of this ratio before the shale gas discoveries of 2009.

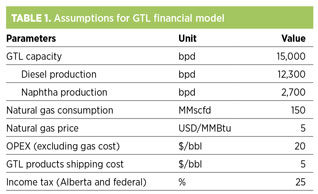

Standalone GTL economics. Economic modeling was conducted to evaluate the viability of a generic Fischer-Tropsch (FT)-based GTL plant in Alberta, Canada. Table 1 shows the assumptions made to run the financial model for a GTL plant in Alberta. The GTL process in this case has a total production capacity of 15 Mbpd of diesel and naphtha.

|

Although the oil-to-gas price ratio is the main driver affecting GTL economics, the ratio between GTL product prices and natural gas prices plays a more important role in the economic viability of GTL. Fig. 2 shows historical wholesale prices for diesel in three locations in Canada—Calgary and Edmonton in Alberta, and Whitehorse in Yukon—vs. WTI and Brent crude oil prices. It appears that the spread between crude oil and diesel prices is widening, particularly in NA, due to two main reasons:

|

|

Fig. 2. Historical diesel prices in Alberta and Yukon vs. crude oil price. |

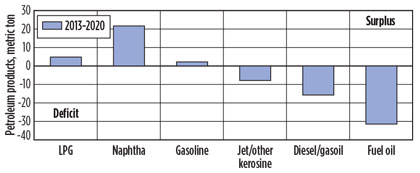

- Global market growth in favor of diesel use. Diesel fuel burns more efficiently and has a smaller environmental footprint. A recent study by Wood Mackenzie predicts that, by the end of this decade, there will be a deficit in middle distillates, while light distillates could see a surplus (Fig. 3).

- Shale oil is rich in gasoline. The recent rise in crude oil production in NA comes primarily from light US shale oil, which yields more gasoline than diesel.

|

|

Fig. 3. Global change in petroleum product balances, 2013–2020. |

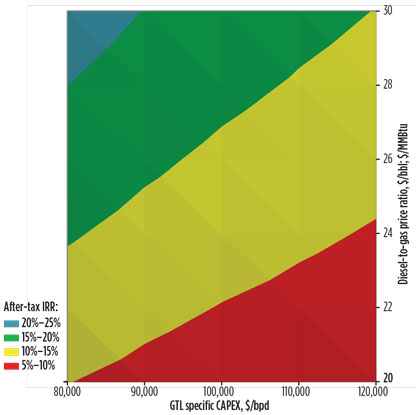

Due to the high volatility in commodity prices, a fixed price was assumed for natural gas in the economic model. A sensitivity analysis was conducted to evaluate the impact of the diesel-to-gas price ratio vs. CAPEX on the economic viability of GTL (Fig. 4).

|

|

Fig. 4. Sensitivity analysis for GTL economics. |

GTL challenges and opportunities. A number of challenges and opportunities for GTL project developers must be investigated thoroughly at the front-end-loading studies to improve GTL economics.

Novel technology and flowsheet optimization. Selecting an appropriate GTL technology is a significant challenge that requires vast knowledge and experience. There are only two licensors with proven GTL technologies at the commercial scale: Sasol and Shell. Neither company licenses its proprietary GTL technology.

Other GTL technology licensors operate pilot and/or demonstration plants with a capacity range of less than 1 bpd to 1 Mbpd. Although these technologies have not been proven at the commercial scale, there is room for further optimization.

Novel microchannel GTL technologies yield higher diesel selectivity and lower tail gas compared to conventional GTL technologies. At the same time, they require a smaller footprint and lower CAPEX and consume less natural gas.

The combination of these factors gives microchannel GTL stronger economics compared to conventional GTL. Considering recent advancements in emerging mini-GTL and microchannel GTL technologies, the bottleneck to improve small-scale GTL economics is not the FT unit, but rather selecting an appropriate syngas technology at the front end of the GTL process. The syngas unit contributes up to 50% of the total GTL plant cost, and conventional technologies, like autothermal reforming (ATR), lose significant economies of scale at smaller capacities.

However, a small-scale GTL plant could have competitive economics compared to larger-scale GTL if cutting-edge, compact syngas technologies, such as selective/non-selective membrane partial oxidation, are integrated.

Product slate optimization. GTL is a complex process that first combines and then breaks up chains of atoms to produce a broad range of saleable hydrocarbon products, including waxes, base oils, normal paraffins, ultra-clean diesel and jet fuels, and paraffinic naphtha.

Considering the limited and competitive market for waxes and base oils and the fast-growing market for clean fuels, GTL diesel is the most promising GTL product. By targeting the fuel market, close to 80% high-cetane ultra-clean diesel yield is achievable in the GTL process. The balance of the products is mostly naphtha with a minor portion of LPG.

An extensive market study on GTL products would be necessary to define the optimized product slate for a specific project. For example, where the market price of naphtha is not far from the diesel price, maximizing diesel production might not be the most economical solution.

To maximize diesel production, the FT reactor is designed for a low temperature of 200°C–250°C. By slightly increasing the design temperature of the FT reactor, the naphtha yield is increased in lieu of a diesel yield reduction. However, the higher design temperature of the FT reactor allows for a smaller reactor size and, consequently, reduced total GTL plant CAPEX.

Utilizing flare gas. Globally, considerable volumes of associated natural gas are flared or vented to facilitate oil production. According to the World Bank, approximately 5 Tcf/yr of natural gas are flared, excluding the large amount of associated gas that is injected back into oil reservoirs.

Where the associated gas alternatives are to flare it off or inject it back underground, the negotiated gas price is nil or even negative. Aside from the role GTL can play to reduce flaring and greenhouse gas emissions, the low-cost associated gas feedstock will significantly increase the economic viability of GTL, considering the fact that gas feedstock cost is the largest contributor to the total cost of 1 bbl of GTL product.

Recently developed GTL technologies are targeting small-scale GTL plants that could be used as a viable solution to prevent gas flaring and reduce GHG emissions while converting negative-value gas to high-value liquid hydrocarbons.

In the case of offshore gas flaring, the mini-GTL plants can be designed without the upgrading stage at the back end. Using this concept, the GTL liquid product can be mixed with the produced oil pool from the offshore field. The mixed pool would then be shipped to the refineries to convert them to saleable products.

Economies of scale. Large-size GTL plants benefit from economies of scale. However, at the same time, the project risks—i.e., changing oil-to-gas price ratios, and cost and schedule overruns—will be more significant.

On the other hand, smaller-scale plants are faster to build, have fewer execution risks and allow the developer to enjoy the present market situation. Developers could use lessons learned from the first projects to install the next plants at lower costs.

Plant location. The GTL plant location is a function of proximity to cheap feedstock markets and growing GTL product markets, as well as CAPEX, OPEX and the taxation system. To emphasize the importance of site selection, Table 2 compares two locations in NA that have the highest oil and gas activities: the US Gulf Coast (USGC) and Western Canada.

|

The average price of natural gas, diesel and naphtha over the lifetime of the plant; total installed cost (TIC); and taxes for Western Canada were normalized against those of USGC. As shown, Western Canada has the advantage of higher prices for GTL products and lower prices for feedstock, as well as a tax advantage.

Western Canada’s vast natural gas resources are considered stranded, and there is no large market for them. The US, historically, has been the destination market for Canadian natural gas; this scenario has changed recently due to shale gas recovery in NA. Western Canada’s natural gas [Alberta Energy Co. (AECO)] is priced at a $0.50/MMBtu–$1/MMBtu discount to US natural gas (Henry Hub), although this price gap will be corrected slightly by proposed LNG projects in British Columbia.

There is also a significant growing market for clean diesel in Alberta’s open-pit mining oil sands. With a compound annual growth rate (CAGR) of above 5% for diesel demand in the last two decades, Alberta has the highest rank in NA.

High demand for diesel, combined with relatively flat refinery capacity, has made Alberta the most lucrative market for diesel. At the same time, growing Alberta oil sands activities require more diluent to move heavy produced bitumen from oil sands to market.

Aside from domestic production, more than 100 Mbpd of condensate (about 35% of total condensate demand) is imported from the US to the Canadian oil sands market through the Enbridge pipeline. There are more pipeline projects under construction to ship US condensate to Canada since Canada’s condensate production cannot keep up with demand. According to the Canadian Energy Research Institute (CERI), Canadian demand for condensate is expected to approach 700 Mbpd by 2020.

On the other side, the USGC enjoys milder weather conditions and a lower labor cost, which can result in an up-to-30% reduction in total installed cost. However, the impact of weather and labor can be reduced by a reasonable level of in-shop modularization and onsite module assembly. Given these factors, the GTL economics of Western Canada are comparable to those of the USGC, or higher, depending on the total installed cost.

Modularization. The project CAPEX and schedule can be significantly reduced by modularization. The modules can be built in lower-cost labor markets and transported to the site for installation, rather than completed using stickbuilt construction. A modularization study should be conducted at the early stages of the project to capture modularization benefits in the plant design.

The main challenge of the modularization concept is to meet the limit of transportable modules from low-cost centers to the plant site. This challenge would be more apparent for site locations far from coastal areas. Both the US and Canada are continuously working to increase the maximum allowable module sizes for transportation. In Canada, Alberta has established a high-load corridor from south to north to facilitate the shipment of large-size equipment and modules.

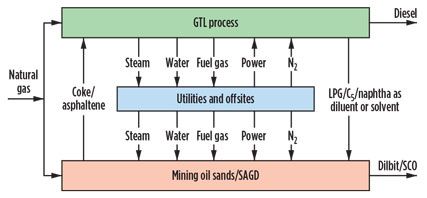

GTL integration with oil sands. There are significant synergies between the GTL process and the oil sands extraction process. Oil sands extraction is very energy-intensive compared to conventional oil production, and it requires a significant amount of water. Depending on the depth of the reservoir, open-pit mining or an in-situ technology like steam-assisted gravity drainage (SAGD) is used to extract bitumen from oil sands.

The GTL process is a net producer of water and pressurized steam, which can be utilized in oil sands operation. Exporting water and steam from GTL will eliminate the expensive steam-generation unit and substantially cut the water-treatment footprint in the oil sands process.

The exported steam will be injected into the reservoir in the case of SAGD operation, while, in the case of open-pit oil sands mining, it can provide a source of energy to heat process water. In addition, the GTL process will supply the fuel gas, power and nitrogen required for oil sands operation.

To summarize, the main opportunities lie in three key areas:

- The GTL facility produces a mixture of naphtha and diesel, which can replace the diluent requirements of the oil sands facility and can improve the quality of the produced dilbit

- Due to the exothermic nature of the GTL process and the fact that an excess amount of steam is typically produced, this excess energy can potentially be exported to the oil sands facility in the form of steam and/or power

- The additional integration of utility systems can be achieved, including the flare system, cooling water system, water treatment system and nitrogen supply from the GTL air separation unit for oil sands unit requirements.

Fig. 5 shows the patented integration of GTL and oil sands processes. The produced bitumen from oil sands is too viscous for pipeline transportation and must be upgraded to synthetic crude oil (SCO) or blended with a diluent. The naphtha produced from the GTL process is a perfect choice for bitumen dilution. The GTL naphtha, which has a highly paraffinic nature when blended with extracted bitumen, allows for partial upgrading of bitumen by partial precipitation of asphaltene, and it makes bitumen transportable in pipelines.

|

|

Fig. 5. Hatch-patented GTL integration with oil sands. |

Recent technologies for froth treatment, such as high-temperature froth treatment (HTFT), require a high-purity C5 solvent to improve solvent recovery from tailings with respect to environmental regulations. The upgrading unit from a GTL process can be easily tailored to produce C5 for froth/bitumen treatment, or any paraffinic diluent for bitumen dilution.

Furthermore, asphaltene and coke, as byproducts of bitumen treatment and upgrading, can be used as feedstock along with natural gas in the GTL process.

In the case of the coexistence of oil sands and coal in shallow reserves where open-pit mining is applied, the integration of oil sands operations with a GTL plant would be a viable solution to leverage coal as feedstock for the GTL process. This integration not only provides the required water, energy and diluent for the oil sands operation, but it also presents a viable and clean solution for the oil sands operator. The operator can make use of the coal rather than stockpiling it or burning it as fuel.

LPG, as a byproduct of the GTL process, can also be used as a solvent in solvent-aided bitumen extraction processes, like solvent-assisted SAGD and/or solvent-assisted in-situ oil sands operations. Overall, the synergy between GTL and oil sands extraction (in-situ or open-pit mining) saves a considerable amount of energy and CAPEX, cuts the requirement to import water and solvent/diluent, and can considerably boost the economies of the investment.

Studies show that, in the case of open-pit mining oil sands, the capital cost required for the oil sands mining combined with the bitumen upgrading could be reduced by up to 15% through integration with GTL, while cutting oil sands mining requirements for water and natural gas. In this case, a 50-Mbpd GTL facility could supply the steam, power and diluent requirement of a 100-Mbpd oil sands mining facility.

In the case of SAGD operations, a 15-Mbpd GTL facility will meet all of the steam, power, water and diluent requirements of a 15-Mbpd SAGD facility. This integration allows for a substantial cut in costly SAGD water treatment and other utilities, as well as the elimination of entire steam-generation and power-generation units in the SAGD process. An increase of 2%–3% in IRR is expected based on the elimination of the SAGD once-through steam generation alone. Additional benefits could be obtained from transportation savings for delivering diluent to the site.

Takeaway. Alberta holds huge amounts of conventional and unconventional oil and gas resources, with proven reserves of 168 Bbbl of oil sands and 355 Tcf of shale gas. GTL is not only an economically viable solution to monetize natural gas resources in landlocked Alberta, but it also can supply the diluent, energy and water needed for oil sands operations.

The integration of GTL and oil sands extraction processes would substantially trim OPEX and CAPEX for oil sands developers and boost their economics. It would also allow some oil sands players to develop and monetize their oil sands and natural gas assets simultaneously, with a much smaller environmental footprint. GP

|

Ebrahim Salehi is a chemical engineer with more than 10 years of oil and gas industry experience with operating and EPC companies. Mr. Salehi’s specific areas of expertise include natural gas monetization, conventional and unconventional oil and gas field development, and biofuels. He has been involved in the development of brownfield and greenfield projects from inception to execution, startup and operation. His strong research and development background, combined with a comprehensive understanding of the oil and gas market, has also led to the publication of several articles and patents.

|

Sanjiv Save is the director of oil and gas (hydrocarbon processing) with Hatch Ltd.’s oil and gas business unit. He has over 20 years of professional experience with both operating and consulting companies in the areas of project and business management for multidisciplinary EPC projects in the energy sector. Mr. Save’s specific areas of technical expertise include heavy oil upgrading and unconventional fossil fuels—namely oil sands, oil shale, GTL, CTL, and carbon capture and sequestration. His strong research and development background has contributed to the publication of several articles, chapters and patents.

|

Wessel Nel is a senior process engineer at Hatch Ltd., with more than 16 years of experience. Of these 16 years, 12 were dedicated to Fischer-Tropsch-related projects, including 10 years at Sasol. Mr. Nel has been the lead FT engineer on a number of Hatch’s GTL, CTL and BTL studies in recent years, and the project manager for recent GTL studies. He has developed an extensive understanding of established and upcoming GTL technologies from a broad range of licensors. Mr. Nel’s skills include conceptual to detailed process design, process simulation, flowsheet optimization, economic evaluation, and project and engineering management.

|

Greg Almquist is a chemical engineer with 29 years of experience in the oil and gas industry. The first eight years of his career were spent with Shell Canada as a process engineer at a large sour gas plant and refinery in Alberta, and the next 21 years have been in the EPCM business, fulfilling process engineering, engineering management and general management roles. Mr. Almquist’s areas of expertise include all facets of gas processing, sulfur recovery, and upstream oil and gas field development. He is the process director for oil and gas at Hatch Ltd. and is involved in a number of technology-related projects, including a planned large GTL facility.

Comments