How technology is opening up new markets for shale gas and GTL

A. Chandra, Muse, Stancil & Co., Houston, Texas

The shale revolution has been the biggest driver of change in the energy landscape in North America over the past 10 years, and it is expected to continue to be the driving force for the foreseeable future. New technologies, notably horizontal drilling and improved hydraulic fracturing techniques, have unlocked the ability to access new hydrocarbon resources.

While most of the recent press coverage has been related to the huge amount of new gas that is being produced (Fig. 1) and where this gas will be used and exported, technology may also prove to be part of the answer for finding new and larger markets for both the produced gas and for GTL products.

|

|

Fig. 1. Shale oil and gas basins in North America. |

The rapid growth of oil production has revolutionized the North American energy landscape in the past decade, changing the continent from a net energy importer to being on the verge of energy self-sufficiency. The advent of new technology has allowed for oil and gas production in new regions and has helped increase overall energy production in the US to levels that would not have been expected.

However, a large challenge to shale gas monetization lies in the sufficiency of infrastructure to deliver the products to markets where they can be consumed. Many of the shale plays, most notably the Bakken shale play, are far away from consumption centers.

The lack of infrastructure has led to the flaring of gas, with some regions flaring as much as one-third of all produced gas, as is the case in the Bakken shale play. Some of this flaring may be reduced by new technologies that will provide smaller, skid-mounted processing in close proximity to production areas, along with alternative uses for the natural gas, such as converting methane to other liquids, including diesel and LNG.

Here, new technology developments to help monetize and utilize the vast shale gas reserves in North America are discussed, with an emphasis on GTL developments.

GTL technology. The transformation of natural gas (methane) to liquids (methanol, gasoline or diesel) is not new, but technological advances now allow plants to be built on a much smaller scale than in the past. The reaction chemistry for the Fischer-Tropsch (FT) process was discovered during the 1920s by Franz Fischer and was used during World War II for the production of diesel from coal. Germany was able to meet its motor fuel demand and minimize dependency on imported crude oil.

Later, Sasol further commercialized the technology in the 1950s as South Africa sought to capitalize on the conversion of coal to liquids to utilize indigenous resources instead of imported crude oil. Natural gas became the preferred feedstock for commercial GTL operations, based on its easy conversion to synthesis gas (syngas). GTL plant operating costs decreased significantly as plants changed to this feedstock from coal.

Since the introductions of the first and second generations of FT GTL plants, technologies for the production of newer and better catalysts, along with reactor technologies, have continuously improved. The three key steps in the conversion are:

- Conversion of natural gas to syngas

- Conversion of syngas to FT wax

- The refining of FT wax into liquid petroleum products.

New technology developers have focused on increasing the carbon conversion efficiency and scale-up of the processes. The key for many of the new designs revolves around the development of new catalysts that will last longer, reactor designs that allow for heat transfer to be better managed, the automation of units and increased operability of the facility.

Historically, the FT process has been used in large-scale facilities requiring billions of dollars of investment and millions of cubic feet of natural gas as input. At present, over 265 Kbpd of liquid products can be produced from existing GTL plants, with a world-scale GTL plant capable of converting 300 MMscfd of natural gas into 30 Kbpd of diesel or gasoline (Fig. 2).

|

|

Fig. 2. Flow diagram of the GTL production process. |

While these large-scale facilities have been constructed over the past 30 years, technology developers have looked for the ability to develop much smaller (i.e., mini or micro) units to help make smaller stranded gas reserves economical to produce. The goal for many technology developers has been to commercialize technology that will help monetize much smaller volumes of gas—e.g., less than 25 MMscfd.

Some of these technology developers have targeted reductions in flared gas volumes. Newer technology concerns modular design of the facilities, allowing multiple modules to be pieced together to increase scale. A modular scheme also has the benefit of giving the owner the ability to construct the modules in a more controlled environment in the fabrication facility, along with the ability to standardize the engineering design and fabrication of the modules.

The aim has been to build the modules so that they are small enough to ship, erect and put into production much more easily than a full-scale plant. Some technology companies are even making their facilities portable, with the intent of moving them to a different location as infrastructure in one region is built out and the gas can be gathered and processed by more traditional means.

Over the last several years, the arbitrage available between natural gas prices and transportation fuels, especially in North America, has allowed technology developers to pursue these new technologies. At present, several dozen companies are pursuing the development of new technology that will provide for smaller and more cost-effective ways to produce transportation fuels from natural gas. These companies are primarily startup technology companies, and are at differing levels of commercialization, ranging from proof-of-concept to pilot plants. They have been evolving, and many have made significant progress in raising funds and proving the technology for deployment. A few of the companies are close to commercial application.

The focus of the new mini-GTL technologies also includes lowering the capital costs of the facilities. A capital cost of $100,000/bbl of production capacity has always been seen as a benchmark for the smaller-scale GTL plants. Some technology developers claim to have brought these numbers down to $60,000/bbl–$70,000/bbl of production capacity or even lower, although many of these units have not yet gone into commercial service. Plants in the range of 300 bpd to 1,000 bpd of liquids production have been developed, and, in some cases, demonstration plants are being constructed and deployed.

Another significant breakthrough in the development of GTL technology is better catalysts. At least two technology developers claim that their process directly produces transportation fuel, thereby eliminating the refining of FT wax into fuels. This is a very costly part of the GTL process, and elimination of this step greatly reduces both the capital and operating costs of the plant.

In 2014, the Global Gas Flaring Reduction Partnership, a World Bank-led initiative, updated a 2012 paper following the commercialization efforts of various mini-GTL technologies that can be used to combat the flaring of natural gas in oil production operations. The paper provides a good overview of where the companies stand in terms of commercialization efforts and status of projects. This year could prove to be a pivotal one for the commercialization of these new technologies.

Vehicular LNG. Another potential use for the large volumes of produced gas (and an area where new technology could prove useful for the development of new markets) is in the use of LNG for vehicles. Historically, LNG has been produced in large-scale baseload plants to take advantage of economies of scale. World liquefaction capacity is over 200 metric MMtpy and has grown substantially over the last decade.

LNG, which takes up 1⁄600 of the volume of natural gas in the gaseous state, is easy to transport via specially designed ships, and LNG plants are typically located with access to waterborne shipping. The LNG is often used for electrical generation in areas of the world that lack sufficient hydrocarbon resources. These plants require huge investments, typically billions of dollars, with long-term (20-year) contracts for both the feedstock and the produced LNG. The surge in produced gas in North America has led project developers to work on building liquefaction facilities in the US for the export of excess gas volumes. Many unused import facilities are being repurposed to allow for the liquefaction and export of LNG, with the Far East as the primary market for the product.

Ever-changing technology is helping to open new markets, and project developers are able to look at different pathways to move product to market. Similar to GTL, project developers are looking at opportunities to build mini-LNG plants on a much smaller scale than past projects. They have focused on small, skid-mounted units that can be erected in a short amount of time. These smaller units are designed to be in close proximity to the markets where the product will be used, instead of requiring large storage and shipping facilities. At the same time, these units require much smaller reserves and shorter contract lengths, and may have significantly lower capital costs. Many are being designed to produce 10 Mgpd of vehicular LNG, which is a sufficient size for a refueling station servicing a local area.

As with the GTL plants, technology is continually evolving, and a number of project developers are active in the industry. Building smaller plants near consumption centers allows for decreased transportation costs for the product, which, in turn, decreases the overall cost to the end user. As a result, some new markets are starting to expand due to the use of this technology and the ability to produce the LNG in smaller units. The highest potential to increase consumption of LNG has been in the vehicular fuel segment, with special emphasis on high-horsepower applications. LNG can be substituted for diesel as a transportation fuel, and several factors—including abundant natural gas, lack of infrastructure to move the gas to market and newer liquefaction technology—have combined to move vehicular LNG into the limelight.

The cost of gas liquefaction has been a large hurdle to the widespread acceptance of LNG as a fuel; therefore, the capital and operating costs of facilities are crucial. Several new technologies have been introduced and are focused on driving down the cost of liquefaction. Large players, such as Linde, Chart and Dresser-Rand, have entered this new market, along with many smaller players.

Estimates for capital costs range widely, with one engineering and construction company showing a total installed cost of under $15 MM for an LNG facility designed to liquefy 10 MMscfd of gas. This company offers a standard design that can be built in various sizes. Such “off-the-shelf” plants can allow for rapid deployment of technology, and they can prove useful for areas where gas collection infrastructure will require time to be built. The technology for the processes varies considerably, and several novel approaches to liquefaction have been suggested, including the use of nitrogen as the refrigerant.

LNG is in the early stages of wider acceptance as a transportation fuel. It has been evaluated for use in long-haul trucks, trains and marine applications. In North America, an LNG fueling network has started to take hold and is growing. The increasing use of LNG is being driven by fleet operators and demand from shale drilling operations. The high cost and decreased availability of diesel fuel in many of the active shale drilling regions in the US have allowed oil companies and rig operators to evaluate alternative fuels for their operations. Both compressed natural gas (CNG) and LNG have been evaluated by a number of companies.

With recent advances in both fuel tank and engine technology, many of the safety and operational concerns about LNG have been overcome, allowing for a significant expansion of LNG as vehicle fuel. While the LNG-fueled fleet in North America and the number of refueling spots are still very small in comparison to those of gasoline and diesel, the number of retailers is growing.

Bitumen mining. While the enlargement of the natural gas fuels market is important, another corollary to the production boom is that much of the produced gas from shale plays is rich in NGL. The large increase in NGL may be negative for some parts of the industry, but it has proven to be positive for Canadian bitumen production.

Bitumen is an unconventional petroleum deposit that is dense and extremely viscous, and that has an API gravity of 10° or lower. Bitumen is too thick to flow, and it will not flow unless it is heated or diluted with lighter hydrocarbons. Total proven reserves of bitumen are over 100 B bbl, and it is estimated that Canada has 70% of these deposits. While bitumen mining has been ongoing for several decades, recent advances in technology, coupled with higher oil prices, have enabled extraction and processing to grow. Blended bitumen typically contains about 30% diluent and 70% bitumen. The Canadian Association of Petroleum Producers (CAPP) estimates that Canadian bitumen production will increase to over 4 MMbpd by 2025 (Fig. 3).

|

|

Fig. 3. Forecast Canadian bitumen production through 2025. |

This level of production will drive a large increase in demand for diluent (Fig. 4). Before the shale boom, bitumen producers were considering the import of naphtha, condensate or other light hydrocarbons to meet the needs for their production operations. The pentanes-plus hydrocarbon stream derived from gas processing, commonly known as natural gasoline, can be used for diluent. Demand for diluent in 2025 is expected to be over 1 MMbpd, more than double today’s needs.

|

|

Fig. 4. Projected demand for diluent through 2025. |

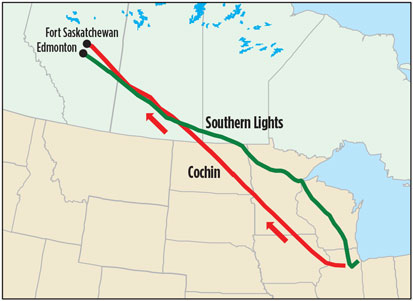

At present, two pipeline systems move diluent from the US to Canada to meet this demand (Fig. 5). The Cochin pipeline is operated by Kinder Morgan and has a capacity of 95 Mbpd, while the Southern Lights pipeline, operated by Enbridge, has a capacity of 180 Mbpd. The Southern Lights conduit is planned to be expanded to 275 Mbpd in 2016. The diluent is transported to Edmonton and Fort Saskatchewan in Canada, where it is mixed with the bitumen to enable flow of the combined product. The combined stream is then shipped via pipeline to refineries, where the diluent is separated and eventually recycled.

|

|

Fig. 5. Two pipeline systems move diluent from the US to Canada. |

Takeaway. Many of these technologies have been under development for years, and it appears that the time may be right for some of them to experience major breakthroughs.

The recent combination of available feedstock and appropriate economics makes this an exciting time in gas processing. The shale revolution has brought about large volumes of gas that must find a home, and small-scale GTL and vehicle LNG may provide the ability to absorb much of the natural gas glut.

These emerging markets, and the availability of technologies to access them economically, show that the energy industry continues to evolve and find new solutions for North America’s energy needs. GP

|

Ajey Chandra is the managing director of the Houston office of Muse, Stancil & Co., where he also leads the midstream practice area for the firm. He has 28 years of experience in various facets of the midstream industry, including operations, engineering, business development, management and consulting. He has had several long-term assignments overseas, including Europe and Southeast Asia. His operating and management experience includes work at Amoco, Hess and NextEra Energy Resources. Mr. Chandra holds a BS in chemical engineering from Texas A&M University and an MBA from the University of Houston, and he is a registered professional engineer in Texas.

Comments