Marcellus-Utica gas processing builds, despite oil price slump

J. Stell, Contributing Editor

Oil prices have fallen by more than 50% since the June 2014 high of $107.20/bbl, prompting many upstream and oilfield-services companies to slash their 2015 budgets. BHP Billiton plans to reduce its number of drilling rigs by 40%. BP plans to cut mid-level manager positions in the company’s production, refining and corporate sectors in the US and UK, in addition to its recent $43 B of global divestments. Shell Oil, Apache Corp. and ConocoPhillips also plan to reduce their staff. In the oilfield-services sector, Schlumberger and Baker Hughes will cut a combined 16,000 employees, and FMC Technologies is projected to cut 2,000 employees to reduce costs.

In the midstream space, pipeline operators and gas processors plan to cut expenses to align operations with reduced upstream activities. For example, DCP Midstream, one of the largest NGL producers and marketers in the US, plans to reduce its workforce by 20%, close the company’s Oklahoma City office, and reduce headcounts in Tulsa and Midland by moving some operations to its Denver headquarters and Houston regional office. Also, Enable Midstream Partners LP plans to reduce its companywide workforce by 10% during 2015.

Despite the grim outlook for oil-directed drilling, US natural gas production rose by 11% in October 2014, according to Gulf Publishing Company’s World Oil data. Nationally, a slight increase in the number of gas-directed rigs suggests that some operators are finding natural gas drilling to be an economical alternative to liquids drilling. Some of the oil-to-gas switching is taking place in the Barnett, Eagle Ford, and Williston shale basins, while others appear to be gas rig starts or restarts in the Fayetteville and Marcellus shale plays.

On the market side, US electric companies consumed record amounts of natural gas to generate power in January, as low prices made it more economical to burn gas instead of coal, which also bodes well for increased natural gas production. Power generators consumed an average 23.1 Bcfd of gas in January, which is a 1% increase from the 20.5 Bcfd in January 2014, which represents the most gas consumed by the power sector during any January on record since at least 1973, according to Thomson Reuters.

In the Northeast, home to the Marcellus and Utica shale plays, seasonal natural gas demand remains robust, although it has fallen slightly since the severe winter of 2013–2014, when New York’s power grid gas demand reached record levels in January 2014, although it continues to be sufficient to support the region’s gas production.

Pipeline projects. Meanwhile, moving gas from Marcellus-Utica gas production areas to demand markets will be further supported by the recently announced Constitution Pipeline. The 124-mi pipeline received approval from the Federal Energy Regulatory Commission, so developers are expected to break ground in 2015. The $700-MM project is a joint project of Williams Partners LP (operator), Cabot Oil and Gas Corp., Southwestern Energy, Piedmont Natural Gas and WGL Holdings Inc.

The Constitution Pipeline will transport up to 650,000 dekatherms/day of Marcellus gas through the northeastern part of Pennsylvania to an interconnection near Albany, New York, and will connect to Iroquois Gas Transmission’s system to move gas through Connecticut and across the Long Island Sound, before ending at a station in Hunts Point north of New York City.

If needed, the pipeline can be linked with Kinder Morgan’s Tennessee Gas Pipeline to transport Marcellus gas to New York and Boston. Kinder Morgan has proposed a $6-B Northeast Energy Direct system that could bring up to 2.2 Bcfd into New England, with operations slated to begin in 2018. Overall, approximately 20 regional pipeline expansion projects have been publicly announced, according to the Northeast Gas Association, a regional trade association comprising distribution and transmission companies.

Other major proposed Northeast transportation projects include PennEast Pipeline Co.’s 100-mi pipeline from the Marcellus region to a Transco interconnection in New Jersey, and Williams’ Diamond East project for 1 Bcfd of new capacity from the Marcellus to a station along the Transcontinental System’s line in New Jersey.

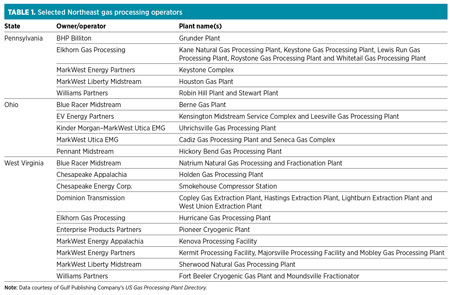

Overall, gas processing operators in the Marcellus and Utica plays (Table 1) continue to find sufficient demand to expand their operations through asset acquisition and organic growth strategies.

|

EmberClear. The company is developing a GTL facility in South Heidelberg, Pennsylvania, adjacent to the Sunoco Logistics storage facility and close to existing natural gas production from the Marcellus shale. Additionally, the company plans to develop two power projects in the area. The GTL plant will produce 4 Mtpd of methanol and will be able to convert it into 14 Mbpd of gasoline and LPG.

A dedicated 7-mi spur will connect the project site to existing interstate pipelines carrying natural gas from the Marcellus shale. The project will sell its gasoline into the local Northeast markets under a long-term agreement. The project site has well-established infrastructure with rail and port access, as well as a gasoline pipeline option to connect to a regional distribution center. Construction is expected to begin on the plant in 2015. The total cost of the GTL facility is likely to reach nearly $1 B.

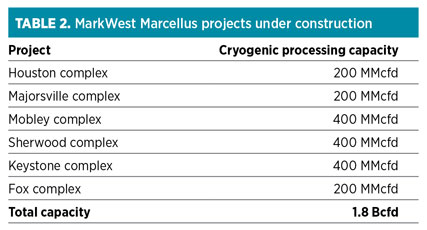

MarkWest Energy Partners. The company plans to construct a sixth processing complex in the Marcellus shale. The Fox facility will be developed in response to demand generated by Range Resources Corp.’s rapidly growing rich gas production in the area. The complex will initially consist of Fox 1, a 200-MMcfd processing plant and an associated deethanization facility scheduled to start up in the first quarter of 2016. Propane and heavier NGL recovered at the Fox complex will be transported to MarkWest’s Houston complex for fractionation.

The company also plans a major expansion at its Keystone complex in Butler County, Pennsylvania, to support production from the Marcellus and Upper Devonian formations. The expansion, driven by recent commitments by Rex Energy Corp. and EdgeMarc Energy, will include construction of the Bluestone 3 and 4 facilities, both with 200 MMcfd of capacity. The new capacity will begin operations during the fourth quarter of 2015 and the second quarter of 2016, respectively.

The expansion includes 40 Mbpd of additional deethanization capacity and more than 20 Mbpd of additional propane and heavier NGL fractionation capacity. The Keystone complex includes the Bluestone processing and fractionation complex and the Sarsen processing facility, which, when combined, provide 210 MMcfd of processing capacity and 26.5 Mbpd of fractionation capability.

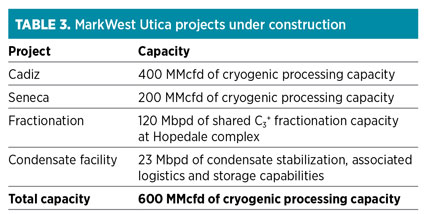

In total, MarkWest plans 1.8 Bcfd of new processing capacity for Marcellus-sourced gas and 600 MMcfd of new capacity in the Utica (Tables 2 and 3).

|

|

NiSource Inc. In late 2014, NiSource, which has assets in the Utica shale play via its co-owned company, Pennant Midstream, announced its intention to separate its gas pipeline and related businesses into a stand-alone, publicly traded company. The transaction will result in two energy infrastructure companies: NiSource Inc., a fully regulated natural gas and electric utility company, and Columbia Pipeline Group Inc., a pure-play natural gas pipeline, midstream and storage company. The separation is expected to be finalized in mid-2015. At present, NiSource Midstream Services LLC operates Pennant, which is jointly owned by Harvest Pipeline (an affiliate of Hilcorp) and NiSource.

Also in late 2014, Pennant Midstream’s 200-MMcfd Hickory Bend cryogenic natural gas processing plant in the Utica shale at New Middletown, Ohio began operations (Fig. 1). The plant’s gathering system includes 55 mi of wet gas gathering pipelines that can deliver more than 600 MMcfd. Going forward, Pennant plans to prepare areas for two additional plants at Hickory Bend.

|

|

Fig. 1. In late 2014, Pennant Midstream’s 200-MMcfd Hickory Bend cryogenic |

The gas plant’s output of NGL will be transported via a 38-mi pipeline and existing infrastructure to Utica East Ohio’s Harrison County, Ohio fractionator. The initial 200-MMcfd plant is estimated to cost more than $350 MM.

Royal Dutch Shell. In the second quarter of 2015, a 200-MMcfd cryogenic gas plant owned by Three Rivers Midstream is expected to begin operations to serve producers in the Marcellus region in northwestern Pennsylvania. Royal Dutch Shell and Williams Partners formed Three Rivers Midstream in 2013 to provide wet gas handling infrastructure and dry gas infrastructure for Marcellus-Utica shale wells.

Three Rivers Midstream signed a long-term, fee-based, dedicated gathering and processing agreement for Shell’s production in the area, which includes approximately 275,000 dedicated acres. The JV will serve other producers in the liquids-rich areas of northeast Ohio in addition to northwestern Pennsylvania.

The new gas processing complex will expand as Three Rivers’ business grows, and it can be connected to two major developments in Pennsylvania—Shell’s proposed ethylene cracker in Beaver County and the proposed Williams-Boardwalk JV to develop the Bluegrass Pipeline system to deliver NGL to the Gulf Coast.

The proposed Bluegrass Pipeline is expected to be in service in late 2015. Williams owns most of Three Rivers Midstream and operates the assets, while Shell has the right to invest capital and increase its ownership before mid-2015.

Williams Partners. In February, Williams Partners and Access Midstream Partners merged. The merger combines Access Midstream’s expertise in gathering and processing with Williams’ transportation capabilities. As a result, Williams Partners increased its footprint in natural gas pipelines, including the Transco, Northwest and Gulfstream systems, making it the nation’s largest and fastest-growing pipeline system. Its gathering and processing assets include large-scale positions in major shale and unconventional producing areas, including the Marcellus and Utica shale regions.

In the Marcellus, Access Midstream owned and operated 10 gathering systems with 823 mi of pipeline in northern Pennsylvania, southwestern Pennsylvania and the northwestern panhandle of West Virginia. Average gross throughput for the Marcellus shale assets was 2.212 Bcfd. The delivery points of the system consisted of plants, storage facilities and pipelines owned by Williams Partners, Central New York Oil & Gas, Columbia Gas Transmission, MarkWest Energy Partners, NiSource Midstream, PVR Partners LP and Tennessee Gas Pipeline.

|

|

Fig. 2. Utica East Ohio’s Harrison County, Ohio fractionator will process NGL |

Access Midstream’s Utica assets included a wet gas gathering system, four lean gas gathering systems, and a JV that owned two gas processing trains. The operations are primarily located in northeastern Ohio and include 265 mi of pipeline, with average throughput of 0.267 Bcfd. The major delivery points are Dominion Transmission and Utica East Ohio Midstream.

Northeast’s midstream future. The number of new construction and expansion projects underway in the Northeast indicates that, despite the ongoing slump in energy prices, the energy-hungry Northeast continues to provide impetus to upstream producers and to midstream gas gatherers and processors for continued activity in 2015 and beyond. GP

|

Jeannie Stell is an award-winning freelance writer and editor focused on the upstream, midstream and downstream energy industry. Her articles have been published in several languages and referenced in white papers, and her photographs have been featured on industry magazine covers and in feature editorials. Ms. Stell is the founder of Energy Ink, and can be reached at jstell@energyink.biz.

Comments