US shale plays undergo ‘Darwinian’ adjustments

J. Stell, Contributing Writer

At year-end 2014, oil and gas supply and demand were slightly out of balance, but the resulting drop in oil prices—which saw a decrease of nearly 50% at one point—was mostly a reaction to projections of future oversupply, according to Keith King, managing director at Dallas-based Moyes & Co.

Nonetheless, King says energy executives know that if low prices persist, many oil and gas projects will not be viable, which could impact long-term supply. This impact, in turn, would reduce the need for gas processing. In fact, Mr. King expects that smaller budgets will lead to the reigning in of production growth during the coming year. Supporting that projection, Reuters reported a 40% drop in overall drilling permits in November.

“Over the past six months, we have seen a dramatic plunge in the price of oil,” says Mr. King. “We have explored the extent to which fundamental factors vs. less rational behavior have driven this price movement. The fundamentals strongly suggest that $60/bbl is an unreasonable and unsustainable price.”

As a result of the price drop, overall drilling activity has fallen and some energy companies are considering layoffs, according to Bill Herbert, an analyst at Simmons & Co. “The industry is going through a Darwinian adjustment,” Herbert says. “The pressures of the marketplace will dictate that these companies adjust their businesses accordingly. The easiest way to do that, frankly, is to reduce head count.”

Specifically, BP, Halliburton, Marathon, ConocoPhillips and Apache plan upstream layoffs or spending cuts in 2015. Such upstream cuts will affect both midstream and downstream activities.

EAGLE FORD SHALE ACTIVITY

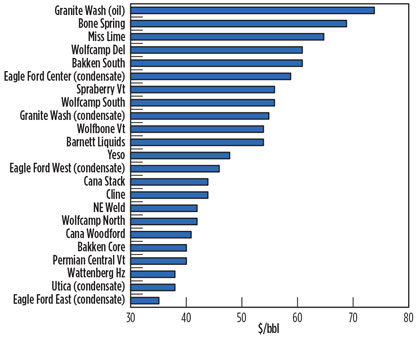

In the US, shale oil and gas plays experience significant variance in breakeven prices, which will drive managers’ plans for continued development.

“For example, the Haynesville is all gas and is generally more expensive than the current gas price,” explains Mr. King. “Conversely, the Eagle Ford is generally better off than the Bakken because it does not have transportation cost as high as the Bakken.”

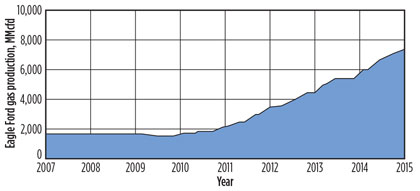

Fig. 1 shows breakeven prices for US shale oil plays. The Eagle Ford breakeven price varies widely between locations within the play, with the eastern side being the lowest-cost US shale play. As a result, activity continues in the play for both producers and gas processors (Fig. 2). Although most midstream operators began their expansion drives in 2013 and 2014, some projects are ongoing or will begin in 2015. Following are details on the companies active in the Eagle Ford shale play and their operations.

|

|

Fig. 1. From the Granite Wash to the Eagle Ford, breakeven prices for |

|

|

Fig. 2. Natural gas production from the Eagle Ford shale play reached 6 Bcfd |

Atlas Pipeline Partners LP. In October 2014, Atlas announced that the partnership had entered into a definitive agreement to be acquired this year by Targa Resources Partners LP in a transaction valued at $7.7 B. Atlas acquired Teak Midstream in 2014 for $1 B, which included interests in two Eagle Ford gas plants with a combined capacity of 400 MMcfd. Overall, Atlas owns and operates 17 gas processing plants, 18 gas treating facilities and approximately 11,200 mi of active, intrastate gas gathering pipelines.

Energy Transfer Partners LP. In November 2014, Energy Transfer Partners (ETP) announced additional long-term gas gathering and processing agreements with producers in the Eagle Ford and Eaglebine production areas. To support those agreements, ETP began construction of two new cryogenic gas processing plants and additional gas gathering pipelines.

The first project is the company’s planned East Texas facility, a 200-MMcfd cryogenic gas processing plant that will be built east of its La Grange plant and is expected to be in service by the fourth quarter of 2015. The second is the REM Eagle Ford Plant 2, a new, 200-MMcfd cryogenic gas processing plant in the Eagle Ford production area that is expected to be online by June. This plant will be fully subscribed once it is online. It will deliver residue gas into ETP’s Houston Pipeline Co. intrastate pipeline system and NGL into Lone Star NGL LLC’s pipeline system.

By the end of 2015, ETP expects to have in service approximately 1.8 Bcfd of cryogenic processing capacity in the Eagle Ford and Eaglebine plays in south and southeast Texas, with expected NGL recovery of 250 Mbpd.

The associated Volunteer pipeline, to be completed in late 2015, will deliver rich gas to the East Texas plant for processing, and the resulting NGL and residue gas will be delivered to Lone Star NGL LLC’s pipeline and ETP’s Southeast Bossier 42-in. gas pipeline, respectively. The East Texas plant, REM Eagle Ford Plant 2 and Volunteer Pipeline projects are estimated to cost between $375 MM and $410 MM.

Navitas Midstream Partners LLC. In Texas, Navitas Midstream plans to build a gathering and processing system in the northern Eagle Ford shale. The new pipeline and processing plant, dubbed the La Bahia system, will include a 20-in. gathering line running from Brazos County to a new processing plant in Grimes County.

When completed in mid-2015, the cryogenic processing plant will have a capacity of approximately 120 MMcfd. Navitas was founded in 2013 by executives of Copano Energy after Copano was sold to Kinder Morgan for $3.9 B.

Pioneer Natural Resources Co. In November, Pioneer announced plans to divest its 50.1% share of the Eagle Ford Shale Midstream (EFSM) business. Reliance Holding USA Inc., which owns the remaining 49.9% of EFS, and also plans to divest its share in a joint process with Pioneer.

EFSM consists of 10 central gathering plants and approximately 460 mi of pipeline. The system gathers and separates produced condensate from produced gas. It also stabilizes the condensate, where necessary, and treats the gas.

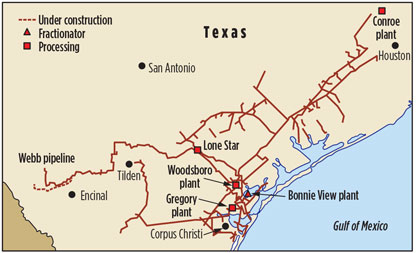

Southcross Energy Partners LP. TexStar Midstream Services LP and Southcross Energy LLC (the owner of the general partner of Southcross Energy Partners LP) have combined. TexStar was a privately held gas gathering and processing partnership operating in the Eagle Ford shale. As a result, Southcross acquired rich gas system assets formerly owned by TexStar, including a 300-MMcfd gas processing facility and more than 230 mi of rich gas and residue gas pipelines (Fig. 3).

|

|

Fig. 3. After merging with TexStar Midstream Services LP, Southcross Energy |

Southcross’ acquisition of the rich gas system assets creates a substantial Eagle Ford-focused midstream operation with four gas processing plants, two fractionation facilities and approximately 3,000 mi of pipelines (Fig. 4).

|

|

Fig. 4. Southcross Energy completed construction |

HAYNESVILLE SHALE ACTIVITY

The Eagle Ford shale’s neighbor, the Haynesville shale play, has seen a downturn in recent years—although, at its heyday in June 2008, when natural gas prices soared to $12.69/Mcf, the Haynesville play was under furious development. Eventually, the drill rig count topped out with about 250 rigs working the 9,000-acre play. As recently as 2012, it was known as the “largest single unconventional play in terms of marketed natural gas production,” according to the Independent Petroleum Association of America.

However, since the discovery of the Eagle Ford play and renewed interest in the Permian Basin, the Haynesville shale play has lost some of its luster. Rig counts have been trending downward during the past few years because, compared to other shale plays, the Haynesville shale is deeper, more expensive to drill, and lacks the wealth of oil and valuable NGL found elsewhere.

At present, upstream operators continue to drill the play, mostly to maintain held-by-production leases in case gas prices, technology and production efficiencies improve the economics of the play. Gas processors can realize acceptable economics with existing assets.

In the Haynesville play, a few new facilities are planned or under construction by midstream operators. Going forward, when new LNG export capacities come online in the US, the Haynesville shale could experience a resurgence if the expanding LNG market causes gas prices to rise.

Azure Midstream Energy LLC. Azure Midstream Energy started up its 10-MMcfd Fairway gas processing plant in San Augustine County, Texas in May to serve James Lime rich gas production from the Haynesville shale area. The facility, which includes two 5-MMcfd freon refrigeration plants, will recover NGL and return residue gas to Azure’s East Texas gathering system for delivery to interconnections with pipelines operated by Gulf South, CenterPoint Energy Gas Transmission, and Natural Gas Pipeline Co. of America.

NGL recovered at the Fairway plant will be moved by truck to fractionation sites in East Texas; South Louisiana; or Mont Belvieu, Texas. In addition to the Fairway plant, Azure Midstream manages approximately 1,300 mi of pipelines, 16,000 hp of compression capacity, 2.4 Bcf of gas treating, and gas throughput of more than 1.1 Bcfd.

DCP Midstream Partners LP. To serve Haynesville producers, DCP Midstream acquired the Crossroads processing plant and associated gathering system from Penn Virginia Resource Partners. The $63-MM Crossroads system in Harrison County, Texas includes 8 mi of gas gathering pipeline, an 80-MMcfd cryogenic processing plant, approximately 20 mi of NGL pipeline and a 50% ownership in an 11-mi residue gas pipeline. The acquisition was meant to expand the company’s existing East Texas system and processing capabilities.

Enbridge Energy Partners LP. Enbridge plans to construct a 150-MMcfd cryogenic processing plant near Beckville in Panola County, Texas. The addition of the Beckville plant will expand the company’s processing capacity to approximately 820 MMcfd in the Cotton Valley and Haynesville shale regions.

The East Texas Beckville plant project, with an estimated price tag of $140 MM, will be built in the productive rich gas Cotton Valley play and will interconnect with existing NGL infrastructure in the area. Construction of the Beckville plant and associated facilities is expected to be in service by early 2015.

Altogether, the company’s East Texas system, which serves Haynesville gas production, includes an average capacity of 885 MMcfd, 3,900 mi of pipeline, seven processing plants, 11 treating plants and one fractionation facility.

EnLink Midstream Partners LP. EnLink was formed in 2014 when Devon Energy agreed to combine substantially all of its midstream assets with Crosstex Energy. The company owns the Plaquemine gas processing plant in Iberville County, Louisiana (Fig. 5), which processes Haynesville gas, along with gas from other plays.

|

|

Fig. 5. EnLink Midstream owns the Plaquemine gas processing plant in Iberville |

In September, EnLink completed an NGL project that includes a 100-Mbpd fractionator next to the company’s Plaquemine plant. The expansion is part of the recently completed second phase of the Cajun-Sibon NGL project, which included the addition of 50 Mbpd of capacity to the Cajun-Sibon pipeline. The new capacity connects supply pipelines in East Texas to EnLink Midstream’s gas processing facility in Eunice, Louisiana, and adds 90 mi of NGL pipeline connecting the Eunice and Plaquemine facilities. The 2-Bcfd gathering and transmission pipeline system consists of approximately 2,100 mi of transmission pipelines to transport Haynesville shale gas in northern Louisiana to the company’s processing plants in southern Louisiana.

EnLink’s midstream assets include processing facilities with a total processing capacity of about 335 MMcfd and fractionation facilities with a total capacity of 10.8 Mbpd. The Haynesville shale, Austin Chalk, Tuscaloosa Marine shale and Miocene/Wilcox plays are served by this system.

In Louisiana, EnLink has six gas processing plants with 2.5 Bcfd of processing capacity and 10.8 Mbpd of liquids production from those plants. Altogether, EnLink Midstream owns and operates approximately 7,300 mi of gathering and transportation pipelines, 12 processing plants with 3.3 Bcfd of net processing capacity and six fractionators with 180 Mbpd of net fractionation capacity, as well as barge and rail terminals, storage capacities and a crude oil trucking fleet.

MarkWest Energy Partners LP. MarkWest’s East Texas operations are located in Panola, Harrison, and Rusk counties and serve the Haynesville shale area. The company has 400 MMcfd of processing capacity at its Carthage facilities in East Texas (Fig. 6), which support liquids-rich gas production from the Haynesville shale and Cotton Valley formation. MarkWest planned to install another 120-MMcfd processing plant in Panola, scheduled for startup in late 2014.

|

|

Fig. 6. MarkWest has 400 MMcfd of processing capacity at its Carthage facilities |

Overall, the company’s area midstream system consists of low- and high-pressure gas gathering pipelines, compressor stations, various gas processing facilities and an NGL pipeline. MarkWest has more than 200,000 prospective Haynesville acres dedicated to its East Texas system.

Marlin Midstream Partners LP. Marlin owns and operates two cryogenic processing plants with a design capacity of 220 MMcfd. It also owns an NGL pipeline with 10 Mbpd of takeaway capacity and 65 mi of gathering lines, including the 54-mi, 100-MMcfd Lake Murvaul gathering system that crosses Panola and Rusk counties, and the 11-mi Oak Hill Lateral with a capacity of 100 MMcfd. The Panola County assets primarily serve the Cotton Valley Sands and Haynesville shale plays.

Regency Energy Partners LP. Regency Energy, now owned by Energy Transfer Equity, plans to build a new, $260-MM gas processing plant and NGL pipeline at its Dubberly facility in Webster Parish. The projects include a 200-MMcfd processing plant to be connected to Regency’s recently completed Dubberly gathering trunkline. Regency will also build a 160-mi NGL pipeline from Dubberly for delivery to fractionation facilities. The pipeline will have an initial capacity of 25 Mbpd and will be expandable with additional pump stations. These projects are expected to be completed in 2015.

Altogether, Regency’s North Louisiana assets dehydrate, compress, treat, gather, process and transport natural gas and NGL from the Cotton Valley formation, the Haynesville and Bossier shales and the Smackover formation. Specifically, the North Louisiana assets include the Dubach and Lisbon processing plants, the Elm grove and Dubberly refrigeration plants, the Dubach/Calhoun/Lisbon gathering system, the Logansport gathering system, and the Logansport and Sharon gas treating plants.

Waskom Gas Processing LLC. Owned by CenterPoint Energy and operated by CenterPoint Energy Field Services, Waskcom holds a plant in Harrison County, Texas and is capable of processing up to 320 MMcfd. The company also holds a 14.5-Mbpd fractionation plant and a 75-MMcfd gathering system.

Waskom provides several takeaway options for natural gas, including the company’s CenterPoint Energy Gas Transmission pipeline and access to its pipeline that originates in Carthage, Texas and delivers NGL to Perryville, Missouri. The Waskom railroad loading facility provides access to NGL markets.

THE LNG EFFECT

The new wave of planned LNG export terminals will likely increase gas prices and promote further development of the Haynesville-Bossier shale play, along with other US unconventional and conventional gas resources.

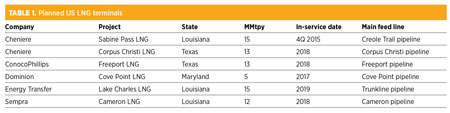

Nearly 30 LNG projects have been proposed to export natural gas from the Lower 48, but only six of those are likely to reach fruition, according to industry insiders (see Table 1). If all of the projects are completed, then total LNG exports could reach 73 MMtpy by 2019.

THE FUTURE OF US SHALE GAS PROCESSING

Despite possible lower levels of upstream activity in some US shale plays, gas processing operators continue to find value in the industry. Most operators have firm capacity commitments, have hedged their production and have service contracts (as opposed to percent-of-proceeds agreements) in place to ensure profitable operations.

If natural gas demand increases due to the expectation for future LNG exports, possible gas-supported transportation technologies or a likely increase in demand from refining and petrochemical companies, then shale plays such as the Eagle Ford and Haynesville will continue to reward gas processing operators with favorable margins.

Meanwhile, as oil prices recover, NGL prices are expected to increase slightly (albeit slowly), barring another wave of deep-freeze winter weather that would abruptly increase demand and prices. Should NGL prices remain depressed, industry insiders predict that drilling activity will continue to slow. GP

|

Jeannie Stell is an award-winning freelance writer and editor focused on the upstream, midstream and downstream energy industry. Her articles have been published in several languages and referenced in white papers by Microsoft and Iranian National Oil Co., and her photographs have been featured on industry magazine covers and in feature editorials. Ms. Stell is the founder of Energy Ink and can be reached at jstell@energyink.biz.

Comments