Marcellus and Utica shales attract more gas processing infrastructure

J. Stell, Contributing Writer

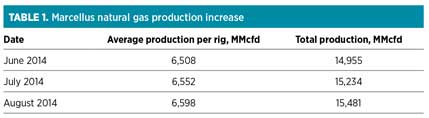

Of all the US states containing shale plays, Pennsylvania and West Virginia have reported the largest net increases in natural gas proven reserves. There, gas production continues to increase, driven by the continued development of the Marcellus shale play. The Marcellus became the largest US shale gas play in 2012, and it continues to hold that designation based on proven reserves (see Table 1).

Gas production from the Marcellus shale, now supplemented with follow-on supply from the Utica shale, is creating the need for more processing capacity to extract and fractionate NGL to move the hydrocarbons throughout the region, and between the producing areas and areas of rising demand in the Gulf Coast region and elsewhere.

Going forward, Northeast gas production will continue to rise, despite low prices, due to enhanced drilling technology. According to a recent drilling production report published by the US Energy Information Administration (EIA), a Marcellus shale well completed in April can be expected to yield over 6 MMcfd more of gas than a well completed in that formation in 2007.

Specifically, gas production from the Marcellus and Utica shales is projected to grow to 34 Bcfd by 2035, compared to 25 Bcfd projected in the first quarter of 2014, according to ICF International. Since Utica wells produce more gas than initially expected, gas production growth from these wells is expected to be much greater.

Wet gas production. Output of wet gas from the region is expected to be about 5 Bcfd by the end of 2016, with some industry professionals projecting wet gas production to be even higher because the produced gas is richer than initially expected, and because gas producers continue to move into Ohio’s associated Utica play. Also, by the end of 2016, production of NGL from the Marcellus and Utica shales is expected to reach at least 650 Mbpd, marking an all-time high.

By 2017, the Marcellus shale play is expected to supply about 9% of all US NGL, and the Utica is expected to provide about 5%. However, these projected yields depend on adequate gas processing plant capacities. As a result, more gas processing facility construction and expansions will be required. Some construction is already underway, and more is planned in the future.

Access Midstream. In the Utica shale play, Access Midstream Partners LP holds a leading asset position with a vertically integrated system, including its Utica East Ohio (UEO) midstream services complex, its Utica Gas Services (UGS) group, and Cardinal Gas Services group.

In May, Access Midstream announced its plan for a major expansion of the UEO complex. When completed, the expansion will increase UEO’s nameplate capacity to 1 Bcfd and its processing capacity to more than 1.1 Bcfd. UEO is a joint venture (JV) owned by Access Midstream (49%), M3 Midstream LLC (30%) and EV Energy Partners LP (21%).

The additional capacity is needed to meet new commitments to Access Midstream’s existing customers, including Chesapeake Energy Corp., Total Gas & Power North America, and Enervest Ltd., as well as its newest customer, American Energy-Utica LLC, which is an affiliate of American Energy Partners LP. These new commitments are expected to increase UEO’s ultimate throughput by 70% over existing commitment levels.

The UEO complex will provide gathering, compression and dehydration services for American Energy-Utica. The long-term agreement between UEO and American Energy-Utica includes a 145,000-acre area of mutual interest, installation of approximately 50 mi of gathering pipeline, and compression services.

The UEO expansion will include the construction of a second processing train at the Leesville, Ohio facility and the extension of an existing high-pressure pipeline from UEO’s Harrison Hub (Fig. 1) to Cardinal Gas Services’ Archer compression facility in Harrison County. Additional services will be added at Harrison Hub, including downstream liquids interconnections and expanded propane and butane storage. When completed, the UEO system will have a fractionation capacity of 135 Mbpd and NGL storage of 870 Mbbl, including 450 Mbbl of propane, 300 Mbbl of butane and 120 Mbbl of natural gasoline.

|

|

Fig. 1. Access Midstream’s UEO expansion will include the extension of a |

Access Midstream is also a 66% owner and operator of Cardinal Gas Services, and it owns 100% of Utica Gas Services. The company operates five gathering systems in the Utica play. In the Marcellus shale, Access provides gathering and compression services by operating 10 gas gathering systems and more than 800 mi of pipeline. In both the Utica and Marcellus shales, Access Compression, a wholly owned subsidiary of Access Midstream, provides compression services totaling nearly 200,000 hp.

Not surprisingly, the company’s rich portfolio has drawn the interest of a potential major suitor for the assets. In June, Access Midstream confirmed that Williams Companies Inc. plans to acquire all of the interests in both Access Midstream Partners LP and the partnership’s general partner, Access Midstream Partners GP LLC, which is owned by Global Infrastructure Partners 2. If this transaction is completed, Williams will own and control the partnership’s general partner. As a second possible option, Williams has proposed a merger of Access and Williams.

Blue Racer Midstream. Formed in December 2012, Blue Racer Midstream is a JV between Caiman Energy 2 LLC and Dominion Transmission Inc. With midstream assets in the heart of the Utica shale and a robust expansion plan in place, Blue Racer’s services include natural gas gathering, compression, treating, processing and transportation; condensate handling; and the fractionation, storage, transportation and marketing of NGL.

Earlier this year, Blue Racer completed Natrium 2 (Fig. 2), a 200-MMcfd expansion to its Natrium gas processing facility located in Marshall County, West Virginia. The expansion complements the original Natrium 1 gas processing plant and brings the overall nameplate processing capacity at the Natrium complex to 400 MMcfd.

|

|

Fig. 2. Blue Racer Midstream plans to expand its assets in the Utica shale play. |

In addition to the expanded Natrium processing capacity, Blue Racer is continuing to build out its Berne processing complex, located in Monroe County, Ohio. The Berne site is designed to accommodate three 200-MMcfd cryogenic processing units. The company expects to commission the first 200-MMcfd processing unit at Berne later this year. Together, the Natrium and Berne facilities are large enough to enable Blue Racer to process 1 Bcfd of gas.

Existing fractionation capacity at Blue Racer’s Natrium facility is 46 Mbpd. It will serve the processing expansions at Natrium and the first 200 MMcfd of processed volumes at Berne. Fractionation capacity at Natrium will be expanded up to 126 Mbpd by March 2015, providing increased ethane recovery capabilities and accommodating future NGL volume growth from the further expansion of processing capacity at Berne.

Also, a 30-mi Y-grade pipeline will carry processed liquids from the Berne complex to Blue Racer’s Natrium facility for fractionation. NGL is currently transported from Natrium to downstream markets via rail, truck and pipeline. The addition of barging, via the Ohio River, is under development and will make the Natrium complex the only fractionation facility to offer barge service to Utica producers.

Blue Racer’s ethane pipeline provides direct access to the Enterprise ATEX Pipeline. Additional pipeline access out of Natrium will provide connectivity to Sunoco’s Mariner East and Mariner West pipelines and Enterprise Products Partners’ TEPPCO Pipeline. Blue Racer is actively pursuing interconnects to other long-haul NGL pipelines.

The company has also approved expansions of the gas markets accessible to its supersystem. In addition to existing interconnections with Dominion Transmission Inc. and Dominion East Ohio, Blue Racer is establishing new pipeline interconnections with Texas Eastern Transmission and the Rockies Express Pipeline.

MarkWest Energy Partners LP. MarkWest continues to expand its major presence in the Marcellus and Utica plays. The company operates a processing and fractionation complex in Washington County, Pennsylvania, among other facilities. The complex includes three processing plants with 355 MMcfd of gas and 98 Mbpd of fractionation capacity for ethane and heavier fractions.

In the Utica play, MarkWest Utica EMG LLC is in startup mode for its third cryogenic processing plant at the Seneca complex in Noble County, Ohio. The 200-MMcfd Seneca 3 plant will increase total processing capacity at the complex to 600 MMcfd. MarkWest Utica EMG continues to expand capacity at the Seneca complex and will complete a fourth 200-MMcfd plant in the second quarter of 2015.

In addition to the Seneca complex, MarkWest Utica EMG’s Cadiz complex in Harrison County, Ohio also continues to grow. MarkWest Utica EMG recently completed a 40-Mbpd de-ethanization facility at the Cadiz complex. This new facility will provide MarkWest Utica EMG’s producer customers with the ability to meet residue gas quality specifications and downstream ethane pipeline commitments. Ethane produced at the new Cadiz facility will be delivered to the ATEX pipeline. In addition, during the third quarter of 2014, the Cadiz 2 plant will become operational and increase total cryogenic processing capacity at the Cadiz complex to 325 MMcfd.

Overall, MarkWest has completed 25 major infrastructure projects in the past two years, totaling more than 3 Bcfd of processing capacity and nearly 200 Mbpd of fractionation capacity to support producers’ midstream requirements in the Marcellus and Utica shales. During the second half of 2014, the partnership will complete five additional projects in the Northeast and is constructing eight more projects that are scheduled to begin operations in 2015 and beyond.

Nisource Midstream has entered the Utica shale gas processing arena with a $375 MM investment. The company’s facilities include a cryogenic processing plant, known as the Pennant Hickory Bend plant, in Mahoning County, Ohio, and 60 mi of wet gas gathering pipelines and takeaway capacity spread throughout northeastern Ohio and western Pennsylvania.

The company, which will operate the system, plans significant expansions, depending on the ongoing wet gas production sourced from the play. In fact, according to a company spokesperson, the company is “very excited about the development of the Utica play,” and is “making a long-term investment in midstream infrastructure in Ohio and Pennsylvania that, in the end, could equal over $1 B.”

Williams Partners is making progress on its Susquehanna Supply Hub in northeastern Pennsylvania, a major natural gas supply hub that is being built to serve gas producers in northeastern Pennsylvania. The system has a gathering inlet capacity of approximately 1 Bcfd and is connected to three major interstate gas pipeline systems.

The company’s Ohio Valley Midstream system in northern West Virginia, southwestern Pennsylvania and eastern Ohio is sited in the NGL-rich heart of the Marcellus play. Assets include a gathering system, one existing processing plant and another plant in the works. The first facility, Fort Beeler (Fig. 3), is a cryogenic plant in West Virginia with 520 MMcfd of capacity. The second, planned facility is Oak Grove, a cryogenic plant that will have 400 MMcfd of capacity.

|

|

Fig. 3. In West Virginia, Williams Partners owns the Fort Beeler cryogenic gas |

The company’s Moundsville fractionation facility in West Virginia began operations with 42 Mbpd of capacity, and another 30 Mbpd was added this year. Its 40-Mbpd deethanizer facility at Oak Grove, along with a 50-mi ethane pipeline, was completed earlier this year.

Elsewhere, Williams’ Laurel Mountain Midstream JV in southwestern Pennsylvania includes nearly 1,400 mi of pipeline with an average throughput of 200 MMcfd. Williams Partners owns 51% of Laurel Mountain Midstream and operates it. Chevron Corp. is the JV partner and owns the remaining 49%. By 2015, Williams Partners expects to be gathering 5 Bcfd of gas in the Marcellus shale.

Including these gas processing projects, the gas-rich northeastern US will continue to attract upstream, midstream and downstream operators into the plays, along with their associated service and supply companies, for the foreseeable future. GP

|

Jeannie Stell is an award-winning freelance writer and editor focused on the upstream, midstream and downstream energy industry. Her articles have been published in several languages and referenced in white papers by Microsoft and Iranian National Oil Co., and her photographs have been featured on industry magazine covers and in feature editorials. Ms. Stell is the founder of Energy Ink, and can be reached at jstell@energyink.biz.

Comments