Combine gas and coal feedstocks to displace high-cost oil

A. Abazajian, WorleyParsons, Houston, Texas; V. Vaysman, WorleyParsons,

Philadelphia, Pennsylvania; and P. B. Ivanov, RiCoal Ltd., Moscow, Russia

Over the last decade, the price of crude oil has increased substantially. Oil is now much more expensive on an energy-equivalent basis than other hydrocarbon feedstocks—e.g., natural gas and coal. Consequently, one of the phenomena taking place around the world is the substitution of crude oil-derived products with those derived from natural gas or coal.

However, the substitution of crude oil with natural gas and coal runs into problems of basic mass balance, molecular size and species, and activation energy, which raises the capital intensity of the conversion plants. Large economies of scale are used to address high capital intensity; however, this in itself leads to fewer technology applications and higher project risk. A solution is proposed to use a combination of natural gas and coal feedstocks to solve various technology application problems.

Demand substitution

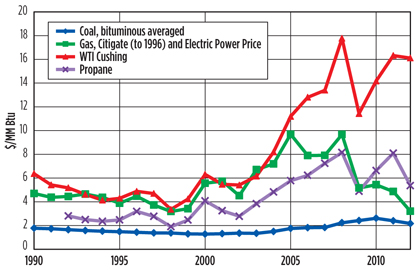

Sometime around 2003, the prices of global energy feedstock (i.e., crude oil, natural gas and coal) began increasing significantly above their multiyear averages. Then, starting in 2005, for the first time in modern history, crude oil prices on an energy-equivalent basis left natural gas and coal prices behind, and began increasing disproportionately (Fig. 1).

|

|

Fig. 1. Past feedstock prices in constant 2011 dollars. Source: US EIA. |

Perturbations caused by the sustained high price of crude oil and by the difference in feedstock prices are continuing to roll through the global economy. Industries closely related to oil production—transportation, refining, petrochemical and power generation—are especially impacted. One of the outcomes of sustained high crude prices and high differentials from other forms of energy is “demand substitution,” which occurs when a crude oil derivative is substituted by a product from an alternative energy or feedstock source.

Examples of crude oil demand substitution are many and varied:

- Plug-in hybrid-drive vehicles or all-electric cars substitute some or all of crude-derived gasoline or diesel with electricity

- CNG public transportation or heavy-duty vehicles, such as the Los Angeles Metro bus fleet or refuse truck fleets in many municipalities

- LNG-powered trucks

- Use of sugarcane-derived ethanol as a gasoline additive in Brazil or coal-derived methanol in China

- Use of vegetable- or animal-derived biodiesel.

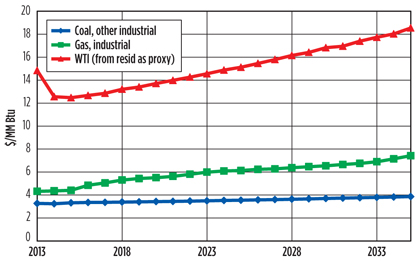

The differences in the price levels per unit of energy for crude oil and other sources are projected to continue (Fig. 2).

|

|

Fig. 2. Projected feedstock prices in constant 2011 dollars. Source: US EIA. |

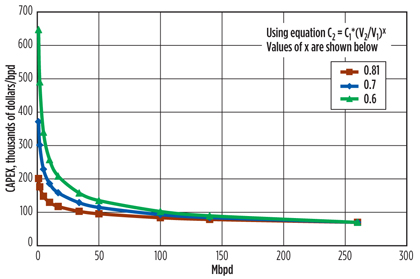

In addition to the fuel substitution at the final consumer, as in the examples above, demand substitution is prompting large-scale substitution of feedstocks for industrial and pre-consumer petrochemical products further upstream to either coal (for example, as in China, as shown in Table 1) or natural gas (as seen in the US).

China does not have much natural gas, but it possesses abundant coal reserves. The US shale revolution also owes its success to high crude oil prices and the subsequent substitution of crude oil by NGL. Shale gas is costly to produce relative to conventional gas production; however, some of it contains relatively high amounts of NGL that are sold at, or close to, crude oil prices. The development and production of shale gas is made possible by the high prices commanded for the NGL that are co-produced with the natural gas (Fig. 1).

Although the substitution of crude oil feedstock with coal or natural gas is attractive from the viewpoint of an economic driving force, this substitution is technically challenging and results in high capital and operating costs.

Feedstock substitution challenges

The substitution of crude oil feedstock with either coal or natural gas is challenged by three basic technical principles. The first principle is mass balance. Most hydrocarbon products (e.g., gasoline, ethylene glycol, polyethylene, lubricants, diesel and others) have approximately 1:1 hydrogen-to-carbon molar ratio (H2:C, or 2:1 atomic ratio). For example, n-butane is a common component of crudes and NGL, and, among other uses, is often blended into gasoline. Its H2:C molar ratio is 1.25.

Crude oil’s H2:C ratio is also approximately 1, depending on the crude composition. Therefore, the conversion of crude oil to these products typically features high-yield, carbon-efficient processes. Coal’s H2:C ratio is much lower, typically from approximately 0.2 to 0.8. To make up the missing hydrogen from coal, the produced synthesis gas intermediate must be reacted with water in a water/gas shift reaction, as shown in Eq. 1:

CO + H2O → CO2 + H2(1)

However, the water/gas shift reaction is inefficient on a mass basis. Since CO2 is not a useful product in most cases, the yield of a useful hydrogen product is theoretically approximately 7.1% on a mass basis, meaning that the majority of the products is vented as greenhouse gas.

Conversion of natural gas to hydrocarbon products also suffers from a mass balance problem, although it is less acute. In the case of natural gas, the H2:C ratio is approximately 2, depending on the heavier hydrocarbon content of the gas, so, theoretically, there is an excess of hydrogen in methane.

Methane can be converted to synthesis gas by partial oxidation (reaction with oxygen), steam-methane reforming (reaction with water) or autothermal reforming (reaction with oxygen and water). Depending on the method chosen, the H2:C ratio of the resulting synthesis gas can be from approximately 2:1 to approximately 3:1.

The second principle is molecule size and species. A portion of most crude oils is roughly the same size and contains the same molecules of chemical species as the major products made from it (e.g., straight-run gasoline and diesel, normal paraffins, LPG, naphtha, microcrystalline and paraffin waxes). The only process needed is physical separation (pipestill, vacuum still, solvent dewaxing, etc.). Other products (e.g., reformed naphtha or hydrotreated diesels) undergo low overall conversion reaction steps to chemically change some of the species of the stream. However, natural gas, which is mostly methane, is a much smaller molecule and a different chemical species than most hydrocarbon products.

Coal consists of much larger polynuclear aromatic compounds, which are very different from most hydrocarbon products. Both natural gas and coal must undergo full-conversion chemical reactions to be made into the many products derived from crude oil by physical separation or low-conversion reaction. As expected, physical separations and low-conversion reactions during the refining process are less expensive in terms of capital and operating expenses when compared to full chemical conversion.

The third principle is activation energy. Methane is a remarkably stable molecule. Activation of methane to enable its conversion to hydrocarbon products is highly energy-intensive, consuming as much as 30% to 50% of the feedstock. Coal is also a physically and chemically stable substance consisting of polyaromatic molecules agglomerated into solids that are difficult to break down into useful components, typically requiring solids processing followed by gasification.

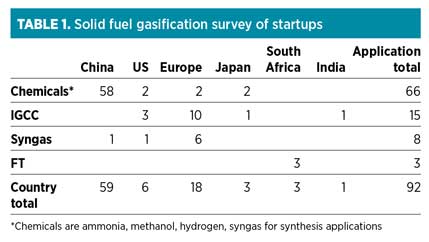

Commercial solutions to these fundamental challenges are highly capital-intensive, especially in the case of coal, which is both difficult to process and activate, and disadvantaged in terms of a mass balance and the necessity for full conversion. As Table 1 illustrates, capital cost intensity of coal gasification has not prevented many projects from being implemented. However, in most cases, the strategic considerations of a nation-state or an energy major, or very low capital cost, or both, are required to overcome the high capital cost intensity of such projects.

The capital expense (i.e., CAPEX) of coal gasification, natural gas reforming or partial oxidation processes are highly sensitive to economies of scale, as are all hydrocarbon processes. The higher the CAPEX intensity of a process, the more sensitivity to economies of scale it exhibits. Fig. 3 shows a theoretical example of the impact of economies of scale on capital cost intensity for a GTL process. Since coal gasification and natural gas reforming are both highly CAPEX-intensive, economies of scale drive these plants to very large sizes to achieve an attractive return on investment.

|

|

Fig. 3. GTL capital cost economies of scale. |

In Fig. 3, the three curves shown illustrate typical economies of scale for oil and gas, refining and petrochemical investment. Plants that consist of a single train or line of cylindrical mass transfer and reaction equipment have a lower economies-of-scale exponent (e.g., 0.6) while plants where the increased capacity is gained by adding parallel equipment lines have a higher exponent (e.g., 0.81). Single-train plants that have a considerable amount of heat transfer and filtration equipment, which usually scale up in a linear manner, tend to fall somewhere in the middle with regard to exponent number.

While providing acceptable returns, the pursuit of economies of scale creates two other mutually related problems:

- The supply of coal or natural gas to support these mammoth projects must also be appropriately large. Using the example of crude oil substitution by natural gas via the GTL technology, a 100-Mbpd GTL plant requires approximately 1 Bscfd of natural gas and committed recoverable reserves of at least 7.5 Tscf for an assumed plant life of 20 years. According to publically available sources, there are only 125 fields in the world with at least that much recoverable reserves. There is a much lower number of fields with adequate reserves that are also uncommitted to other uses, that belong to a manageable number of owners, that are available at a low enough price to justify GTL, that are able to locally host a major construction project, and that are not challenged by the expense and logistics of bringing in large equipment.

- As the value of absolute investment and the value of feedstock contracts increases, so does project risk. So far, only very large companies and nation-states have been able to manage the project risk: Shell Oil, Shell Oil in partnership with Qatar, Sasol with the help of South Africa, Sasol in partnership with Qatar, and Petro SA of South Africa.

Proposed improvement

A consideration of mass balance suggests combining coal and natural gas feedstocks. Since coal composition is hydrogen deficient, and since natural gas composition has excess hydrogen when compared to product fuels, a simplistic conclusion would be to combine them in an appropriate ratio as to give the needed 1:1 ratio of H2 to C in the hydrocarbon product. The highly carbon-inefficient water/gas shift reaction can be avoided, thereby improving carbon utilization of the process and reducing CO2 emissions.

Existing commercial processes to combine natural gas molecules into larger products, and to break down and change the nature of the coal molecule, involve the formation of synthesis gas as an intermediate. Some products (such as methanol) incorporate the basic material balance of synthesis gas into their molecular formulas. However, most hydrocarbon products, fuels, polymers, etc., cannot incorporate the oxygen molecule (which, in those processes, is rejected as water), thereby consuming a mole of hydrogen in the process.

In many processes that convert natural gas or coal into hydrocarbon products (such as GTL, MTO, MTG), the final product requires a 1:1 H2:C ratio, and an intermediate product requires an approximate H2:C ratio of 2:1. This ratio can be achieved by autothermal reforming of natural gas, or by a combination of steam reforming of natural gas and oxygen-fed gasification of coal. In both cases, an expensive air separation unit is required.

One of the logical outcomes of this consideration is that the products that incorporate oxygen in the molecular structure of the final product are advantaged. The other is that using a combination of coal and gas can achieve the desired higher H2:C ratio with somewhat higher capital cost due to coal gasification, which may be offset by the lower cost of the coal feedstock, depending on relative costs of the coal and gas feedstocks.

Combining natural gas and coal feedstocks may also provide a partial solution to the problem of scale brought on by the high cost of activation and deep conversion of gas and coal. Natural gas must be supplied by a pipeline; therefore, the location of the facility using natural gas as feedstock is limited to the practical and economic length of a pipeline.

However, coal can be transported long (even intercontinental) distances, although access to a port facility is important. Therefore, a facility using gas and coal as feedstocks can be located near a relatively smaller gas field, or it can secure a relatively small natural gas supply contract and buy coal on the open market to supply part of its production. It would be reasonable to expect that the capital cost of a combined feedstock facility would be between the higher capital cost of a coal-fed plant and the lower capital cost of a natural gas-fed plant.

A number of countries and regions in the world have large coal and gas supplies. These include the US, Canada, Russia, parts of China, Sub-Saharan Africa, Australia and Indonesia. Since coal can be waterborne, it can also be shipped in from overseas to a gas-rich location.

Case studies

The concept of the combined coal and gas feedstocks is illustrated in two case studies, one at a RiCoal Ltd. plant in Russia and the other at Petro SA’s Mossel Bay GTL facility in South Africa.

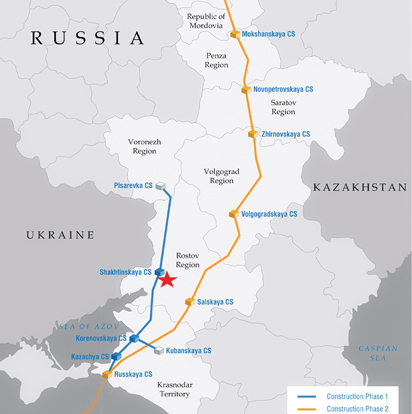

RiCoal complex. Recently, a WorleyParsons JV in Russia, InterRAO-WorleyParsons, conducted a feasibility study for RiCoal Ltd., contemplating a 1,800-Mtpy methanol and derivatives complex in Rostov, Russia. Rostov province is located in the far southwestern corner of Russia, with barge shipping access to the Azov Sea, and through it to the Black Sea and the Mediterranean, as well as to most of European Russia through the Volga-Don river network. The geographical location of the proposed complex (Fig. 4) is an advantage when compared to other large, land-locked petrochemical complexes in Russia.

|

|

Fig. 4. The geographical location of the proposed RiCoal Ltd. complex in Russia, |

Rostov-on-Don, the capital of the province, is one of the largest industrial and distribution centers in European Russia. It has an additional advantage of access to ice-free waterways year-round. The province encompasses a part of the Donetsk coal basin, which extends into eastern Ukraine. Much of the region’s heritage economy dating back to the Soviet Union is related to coal mining, which the regional government is keen to support for political reasons.

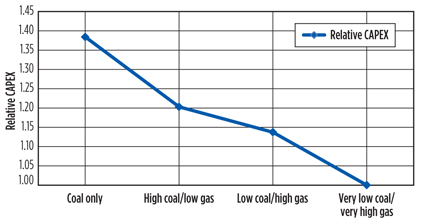

Although the region does not have any natural gas production, major natural gas trunklines supplying the Blue Stream export route (existing pipeline route ringing the Black Sea) and the South Stream export route (being constructed to supply south-central Europe) run through the region. RiCoal Ltd., a project owner with industrial roots in Rostov province, formulated a major energy project involving coal feedstock to attract the interest of the regional government and compete with global gas-based suppliers. A number of various coal and gas combinations were investigated, although some were considered in more detail than others. The results are shown in Fig. 5.

|

|

Fig. 5. Relative CAPEX at different coal/gas combinations for the planned RiCoal plant. |

The “coal-only” case in Fig. 6 is self-explanatory. Coal is the only feedstock used for the plant production and power demand. The “high-coal/low-gas” case involved the use of slurry-fed gasification, with some inherent water/gas shift and a coal-fed power island. The “low-coal/high-gas” case uses a gas-fed power island, a modified gasification process to reduce the amount of shift, and a changed product slate to incorporate more hydrogen in the product. The “very-low-coal/very-high-gas” case eliminates coal gasification altogether, but keeps the coal-fed power island. Due to the region-specific requirements, the capital cost of a natural gas-only plant was not calculated in this exercise. However, the capital cost of the “very-low-coal/very-high-gas option” above is very close to the capital cost of a natural gas-only plant.

|

|

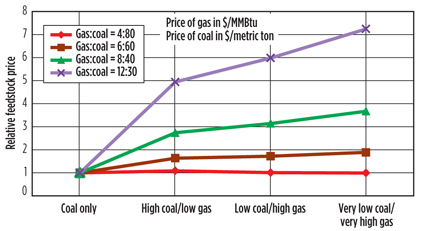

Fig. 6. Relative blended feedstock price for different gas/coal combinations for |

Clearly, the use of coal increases the cost of the plant. Depending on the relative costs of the coal and gas, lower feedstock costs may partially or fully offset the capital cost increase.

When gas is relatively cheap and coal is relatively expensive, the increased investment to include coal gasification equipment will not be justified by lower raw material prices alone. There must be additional strategic, political, sovereign or other long-term considerations.

However, in locations where natural gas is relatively expensive and coal is relatively cheap, combined coal/gas feedstocks may be well justified. Although gas is cheap in absolute terms in the US at this time, coal is also inexpensive, and the relative price of the two fuels places the generic US coal/gas combination curve just above the 6:60 curve in Fig. 6, signifying that the coal/gas feedstock combination may be competitive in the US, especially for inland facilities located far from natural gas pipeline networks.

Mossel Bay. The Mossel Bay GTL plant was started up in 1992 with three circulating fluidized-bed (CFB) reactors, using fused-iron catalyst licensed to Petro SA by Sasol. Although the nominal capacity of each CFB reactor has been quoted as 10 Mbpd, the nominal capacity of the overall facility also has been quoted as 22.5 Mbpd. In contrast to the Sasol facilities in Sasolburg and Secunda, the feedstock for the Mossel Bay facility is natural gas from the nearby offshore E-M and F-A fields.

Recently, reports in the press indicate that Petro SA is concerned about adequate supplies of natural gas to supply the operation because the offshore gas field supplying the facility is depleting. According to the press reports, the company is considering a number of options, including importing LNG, intensifying exploration activities for additional gas reservoirs, or shutting down the facility altogether.

To conserve the feedstock, the GTL plant is reported to be operating at 50% of its nameplate capacity. The Mossel Bay GTL plant’s dilemma illustrates the aforementioned scale issue. However, South Africa also has significant supplies of coal and is home to large coal-to-liquids (CTL) plants operated by Sasol. It is possible that Petro SA could consider the implementation of partial coal feedstock as cost-effective or otherwise justifiable.

Takeaway

Combining coal and gas feedstocks for large fuel and petrochemical projects would seem to confer the considerable benefits of lowering project risk and potentially allowing a greater number of projects to go forward. Also, if the coal-to-gas price ratio is favorable, then the combination may reduce the combined cost of the feedstock, which may offset the increased capital cost of the facility when compared to a gas-fed facility. When compared to a coal-fed facility, the combination will decrease the capital cost of the plant at the expense of higher feedstock costs. Depending on the coal-to-gas ratio, this may be justified.

Considering the increasing production of shale gas, the US may have an exceptional opportunity to combine lower-cost natural gas with the use of large coal resources to continue the process of crude oil demand substitution. GP

|

Armen Abazajian has over 25 years of experience in design, technology development and plant engineering. His expertise in alternative fuels and chemicals includes gasification, Fischer-Tropsch synthesis, methanol, MTG, MTO and olefin oligomers. Mr. Abazajian also led a new olefin disproportionation technology development effort. He has authored a number of articles and presented industry conferences. He also has over 20 inventions, 12 of which have been patented. Mr. Abazajian is a graduate of the University of Houston.

|

Vladimir Vaysman has 35 years of engineering experience, including 17 years with WorleyParsons. His major responsibilities include technical management of feasibility and systems comparison studies that consider the application and performance of novel emissions control and gasification technologies, including recent experience in systems comparison studies and technology assessments of postcombustion, oxycombustion and precombustion carbon-capture systems. Mr. Vaysman has held several project management and engineering positions with chemical equipment and industrial boiler manufacturers. He is a licensed professional engineer and a certified project management professional. He has

a bachelor’s degree in mechanical engineering.

Pavel Borisovich Ivanov, general manager of RiCoal Ltd., has over 20 years of experience in general and technical management roles in the production and processing of polymers, as well as in Donets basin coal mine production. Prior to his management activities, Dr. Ivanov worked in research in the area of radiation physics at Rostov State University, where he also received his PhD in physics.

Comments