Uruguay finds floating regasification solution to LNG growth

M. Nogarin, Contributing Writer

Uruguay is quickly becoming the second-largest importer of LNG in South America after Chile, with the opening of its new floating storage and regasification unit (FSRU) near Punta Sayago, and its growing exports of natural gas.

The dynamics of energy policy in the region show the tendency to invest vast amounts of capital in technology to promote economic development. This trend not only increases economic profitability, but it also decreases dependence on oil imports in favor of more environmentally friendly natural gas.

New FSRU is an economic boon

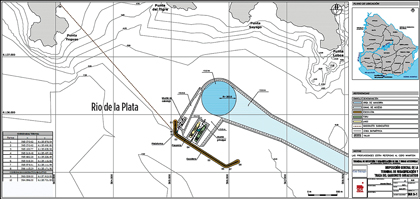

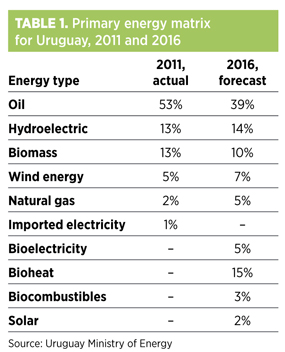

Construction of the new LNG regasification plant, GNL del Plata (Fig. 1), is the first step in Uruguay’s energy policy to 2030. The goal is to achieve energy self-sufficiency over the next decade by increasing Uruguay’s energy matrix to include 50% non-subsidized renewable energies, and by decreasing oil imports (Table 1). The GNL del Plata regasification plant, which required an investment of $1.1 billion (B), will generate 10 million cubic meters per day (MMcmd) of natural gas. Half of this volume will be used for internal consumption, and the rest will be exported.

|

|

Fig. 1. General map of the new FSRU vessel. Image courtesy of Gas Sayago. |

Several direct economic benefits will be gained from the new regasification plant:

- A decrease in the cost of generating electricity by substituting natural gas for gasoline

- Increased profits for Uruguayan oil company ANCAP for transportation and distribution of natural gas

- A decrease in the price of natural gas for domestic users, both residential and commercial

- Increased revenue for the government.

At the beginning of October 2013, GDF Suez signed a build, own, operate and transfer (BOOT) contract for 15 years with Gas Sayago SA—a partnership of ANCAP and national electric company UTE—to provide shipping and receiving services for the LNG, as well as storage and regasification services.

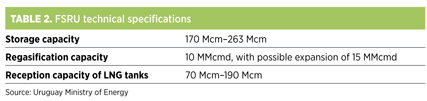

GDF Suez began construction of the FSRU in January. The plant has an area of 345 m in length by 55 m in width, which will allow a storage capacity of 263 thousand cm (Mcm) and a regasification capacity of 10 MMcmd. Regasification capacity can be later expanded to 15 MMcmd (Table 2).

The regasification plant will be anchored 4 km off the coast of Montevideo (Fig. 2). The LNG terminal will have the capacity to receive ships up to 218 Mcm through an access channel being dredged by Administración Nacional de Puertos.

|

|

Fig. 2. Marine port of Montevideo. Photo courtesy of Universidad de la República. |

Project progress

Until the new FSRU is delivered at the end of 2016, the GDF Suez ship Neptune (Fig. 3) will be used for the temporary regasification of LNG, which will allow commercial activities to begin at the terminal in 2015.

|

|

Fig. 3. GDF Suez’s FSRU vessel, Neptune. Photo courtesy of Höegh LNG. |

The other components of the new terminal are a receiving unit for the storage and regasification of LNG, an underwater gas pipeline that will unload gas to the onshore terminal, the gas transfer station, and a pipeline that will move the gas to the junction with the already existing Cruz del Sur gas pipeline, which connects to Argentina.

The connecting gas pipeline from the regasification plant to the Cruz del Sur pipeline has two parts, one under water and one on land. The first part will be buried beneath the sea floor from the terminal at Punta Yeguas and cover a distance of 2.3 km. From Punta Yeguas, the land portion will travel 13 km, have a diameter of 24 in. and connect with the existing gas pipeline of Cruz del Sur. The overland portion of the gas pipeline will be buried in its entirety, except at two points: the transfer and metering station, and the pressure-regulating station.

The LNG project (Fig. 4) also includes construction of the breakwater and loading docks, which, at the end of the 15-year contract with GDF Suez, will become property of UTE and ANCAP. Sayago Gas will rent and operate these facilities and the regasification tanker ship for another five years, with the option to extend the contract for an additional five years.

|

|

Fig. 4. Three-dimensional computer rendering of the GNL del Plata FSRU. Image |

GDF Suez is also obligated to build mooring and unloading docks, as well as a protective breakwater. The company will charge an annual fee of $120 MM for the use of its FSRU and for operation of the plant.

Project specifications

The major providers of LNG in the Atlantic region are Uruguay, Nigeria, Equatorial Guinea, Angola and Trinidad and Tobago. However, Marta Jara, the general manager of Sayago Gas, does not discount buying LNG from Middle Eastern producers such as Qatar, Yemen, Abu Dhabi, Libya, Algeria, Egypt and other countries.

Major domestic demand for natural gas will come from electricity-generating companies. Gas will complement other renewable energy sources being developed in Uruguay in accordance with Uruguay’s energy matrix plan to 2030.

To meet these goals, a combined-cycle turbine will be used, which burns gas and produces electricity, and also uses the generated heat to create water vapor that will move a third turbine, which will also produce electricity. Additional demand will come from the residential, industrial and commercial markets. Natural gas will also be used in the transportation market to move passengers and cargo, on land as well as by water. These secondary markets have been unable to develop in the past due to the scarcity of natural gas in the country. Uruguay’s total gas consumption should increase to 4.6 MMcmd, which means there will be an excess of 5 MMcmd available for export markets.

According to the preliminary business plan drafted by the Ministry of Energy of Uruguay, the excess gas will be sold to Argentina. The latter country’s energy matrix depends on natural gas, which accounts for 51% of its energy consumption. Natural gas can be delivered to Argentina by two methods: The excess gas can be shipped through the Cruz del Sur gas pipeline, or the excess capacity of the plant can be made available to Argentina to process its own LNG. The second option would increase the total volume of LNG Argentina processes at its regasification installations in Bahia Blanca and Escobar.

At the end of April, a commission made up of representatives of the three companies began work to reach a final agreement by the end of the year. Ancap, Uruguay’s national oil monopoly, foresees two possible outcomes. YPF can use 20% of the capacity of the regasification plant, which is the low-range and worst-case scenario. The income generated for Ancap during the useful life of the plant would be $126 MM, from selling excess capacity during eight months of the year until 2024. A more optimistic scenario is for YPF to sell excess capacity during 12 months of the year, which would generate an income of $571 MM for Uruguay over the useful life of the regasification plant.

The economic benefits for national electric company UTE, by substituting natural gas for gasoline, would be a savings of $826 MM to $1.059 B. Ancap will also reap savings of $155 MM and generate tax revenue of $105 MM.

Regasification operations

Once the LNG ship reaches the regasification terminal, the LNG is transferred via pump to the FSRU. The facility contains a regasification unit to convert LNG to its gaseous state. The regasification facility sources water from the Rio de la Plata. There is a large difference in temperature between the LNG, which is stored at −162°C, and the river water. The process by which heat is exchanged never allows the LNG to come into direct contact with the river water.

The water, which cools during the process of regasification, is returned to the river at a distance from the degasification facility, so as not to affect the overall temperature of the river. The returned water recovers its temperature rapidly. During peak demand, one LNG ship will arrive every month and will be docked while the LNG is offloaded over a period of 24 hours. GP

Comments