Planning small-scale LNG? Manage engineering risk to maximize returns

E. H. Rodriguez, OnQuest Inc., San Dimas, California

The attractiveness of natural gas as a principal source of fuel for a range of uses is predicated on several factors. Principal among these factors is readily available supply. The twin technological breakthroughs of reliable horizontal drilling and hydraulic fracturing have meant that fields formerly considered too costly to exploit are now economically viable. In turn, plentiful supply drives down prices.

Geopolitical factors also play a role. Given turbulence in major oil-producing nations worldwide, from Iraq and Iran to Venezuela and Nigeria, the appetite for a domestic source of high-horsepower fuel has only increased.

Another driver is environmental—from increasingly stringent regulation on coal-fired power plants to public concerns about nuclear power, greenhouse gases and air quality. In the US, opposition to crude oil from Canadian oil sands has become a concern for producers on that front as well. Natural gas exploration and production are not without environmental impacts. However, technology advances and environmental regulations suggest that these can be controlled.

The most important driver for continued reliance on US shale gas as a fuel source is its plentiful supply and its discounted cost when compared to crude oil. At high-volume use in high-horsepower applications, this cost differential reaches hundreds of thousands of dollars per year.

Opportunity for purpose-built plants. Developers of natural gas fields, prospective investors in natural gas liquefaction, and commercial buyers of LNG may wish that enormous supplies of methane were always located within reach of existing transportation, and/or in close proximity to prospective buyers. Unfortunately, this is not always the case.

Domestic LNG supply and consumption are both constrained by a lack of transportation infrastructure. Building larger-scale plants and infrastructure is costly and presents imposing regulatory challenges. To be transported safely and cost-effectively, natural gas is reduced in volume using cryogenic technology. Moving large volumes of supply to consumers is expensive, and requires refrigerated pipelines (which are impractical), massive fleets of LNG tanker-trucks, rail cars and/or barges.

This challenge translates into opportunity for investors in purpose-built facilities. Building processing capacity and the necessary infrastructure to deliver LNG to customers where they need the fuel is critical. Smaller, purpose-built, dedicated LNG production facilities—so-called mini- and micro-LNG plants—can be constructed close enough to natural gas supply and closer to customers that need energy.

The rise of the micro-plant. Large LNG infrastructure projects—offshore platforms, production facilities, terminals and pipelines—cost billions of dollars. They entail complex and sometimes politically fragile coalitions of exploration and production (E&P) companies, government entities and lenders. Almost always, the engineering contractor is billing time and materials (T&M) on a project that could take a decade from conception to commissioning.

Because of their size, smaller-scale LNG plants present an attractive economic proposition, if construction budgets are well managed (Fig. 1). Developers of smaller LNG facilities typically plan to spend between $50 million and $200 million upfront. Most are already familiar with the technologies available to purify and liquefy natural gas; frequently, they have already selected one and secured a site for the facility by the time they commit to an engineering contractor. Most likely, they already know where they can sell the LNG once it is processed, and may even have a contract. Developers will also have forecast capital costs and return on investment (ROI).

|

|

Fig. 1. Smaller LNG plants present attractive economics, if budgets and |

Investors and facility owners interested in developing purpose-built micro-scale and small-scale LNG plants for transportation fuel requirements or for high-horsepower uses in oil or gas production must forecast profitability to establish their return on invested capital (ROIC). They need to assure equity partners and lenders of adequate returns.

Planning for success. Forecasts of financial returns are typically based on assessing initial capital costs for the requisite technology, and include the anticipated cost of design, engineering, procurement and construction for so-called “balance-of-plant” construction of the processing facility.

Other parameters for financial modeling include estimates of facility operating costs, including projections of feedstock prices (or futures contracts), personnel costs for operators, facility maintenance, and a forecast of the price for LNG that the investor has either contracted for or reasonably expects to command in the market.

Understanding the engineering and technical risks inherent in building smaller-scale LNG facilities is critical. Anything that interferes with projected profitability must be carefully assessed and accounted for in cost models; the same is applicable to LNG process plant construction.

For smaller LNG plants, economic feasibility analyses typically forecast onstream production within 18 to 20 months, and a ROI in year three. Developers must still mitigate any risk to achieving projects on schedule and on budget; the plant must begin operating as soon as possible. On smaller LNG projects, a 3% or 5% cost overrun on construction, a six- or nine-month permitting process, or a holdup in the fabrication of key equipment can seriously squeeze profitability. These are just a few of the critical factors that can affect timelines for completion and costs.

Economic forecasts may miss key engineering complexities and other considerations. Variables include the attributes of the proposed site and its proximity to feedstock and utilities, engineering alternatives for various plant functions, the prevailing regulations and environmental requirements in the specific jurisdiction, health and safety considerations and others.

LNG production: Gauging execution risk. LNG development projects share a similar project planning profile to other hydrocarbon and chemical processing facilities. These include specific site requirements, health and safety considerations, permitting requirements, transportation infrastructure, the availability of key utilities, and air and wastewater treatment.

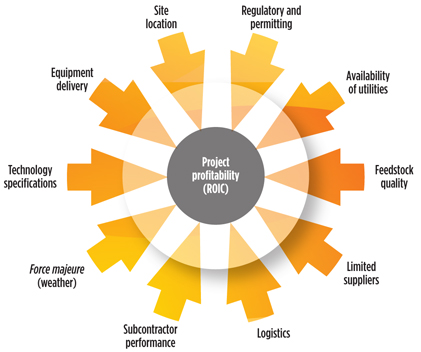

Often overlooked in financial models, however, is a range of engineering and associated project risks that can affect near-term profitability. The range of these challenges is depicted in Fig. 2. Natural gas treatment facilities present their own technical challenges. Available cryogenic technologies have different ranges of processing capacity and energy requirements; these can alter design parameters and operating costs based on production volume.

|

|

Fig. 2. Forecasting risk: A model for LNG development projects. |

Other variables include the volume and purity of methane gas supply. They include the challenge of separating, processing and storing NGL, along with managing their sale and transport.

New and emerging environmental factors. Methane is a greenhouse gas more potent than CO2, and its emission has recently become a significant environmental concern. Controlling emissions during production and transportation is becoming more important.

Challenges also arise during plant construction, due to unforeseen design modifications, scope changes, inaccurate or incomplete materials specifications, the incompatibility of key process components, and the execution risks inherent to any technology construction project. All of these risks interfere with timely project completion and can affect the timeline for ROI.

Modeling risks to manage outcomes. A comprehensive technology project risk assessment can give investors a clearer forecast of total installed cost, infrastructure requirements, and operating and utility requirements in advance of breaking ground. This allows for a more accurate financial model and ROI assessment, including the liquefaction technology selected and balance-of-plant costs. It also allows investors to model ROI under different circumstances, from best-case scenarios to higher-risk ones.

Developers and investors should consider adopting a risk model (Fig. 2) that identifies potential hurdles to timely, on-budget completion. In partnership with their technology provider and engineering contractor, they can then articulate a strategy for managing each of those risks based on key factors: criticality (i.e., relative importance to realizing the project on time), severity (i.e., the financial impact and/or “cost-to-cure”) and likelihood (which depends on an informed estimate of possible incidence). Importantly, the coincidence of two or more risks during the balance of plant design, engineering, and construction can contribute to a complex interplay of factors that affect project schedules.

Financial planners and analysts can build sophisticated predictive models that will forecast profitability and cash flows based on multiple operating and market base-cases. Developers and investors know how to project ROI based on feedstock and process costs. However, variables that affect project cost and timeline for construction are often overlooked during the early stages of a feasibility analysis.

Those variables can be identified, examined and frequently quantified; they can be plotted on a timeline that identifies which risks belong to which phase. As shown in Fig. 3, most of these risks belong to the earliest planning stages, with the second-highest number occurring in the construction phase. With sufficient planning in advance of groundbreaking, many of these risks can be mitigated or even eliminated.

|

|

Fig. 3. LNG project timeline with risks by phase. |

The experience and qualifications of the engineering partner on an LNG production facility are key factors in circumventing certain types of financial risk. For smaller-scale facilities, a developer can cap or contain costs relating to risks in the design, engineering, procurement and construction (EPC) phases of the project by involving the engineering partner to address these risks during the development phase, and by agreeing to terms with a provider willing to work for a predetermined fixed fee.

A typical micro-LNG plant will require 18 to 20 months for engineering, procurement and construction up through commissioning, or four to six months after receiving the key piece of process equipment.

Procurement is critical—from specifications, to fabrication, to delivery. The critical activities are chiefly based on acquiring specific equipment to the necessary specifications:

- Brazed aluminum heat exchanger required for the cold box

- Refrigeration compressor(s)

- Turboexpander.

Delivery and/or onsite construction of the LNG storage tank(s) may also be on the critical path to completion, depending on source limitations.

In some states, an air permit can be obtained in parallel with design engineering. In others, securing a permit can add 8 to 12 months prior to the start of engineering/procurement. Construction will take 7 to 10 months, depending on the plant size, location and whether work can continue throughout the winter.

Variables affecting project cost. Following are some details on variables that can affect construction cost and impact short-term ROI.

Natural gas supply. Several factors come into play immediately in considering the most fundamental decision—plant location. The principal factors are the source of supply and the planned or contracted demand. LNG plants require a reliable natural gas feed, delivered at a volume and pressure capable of meeting full production capacity. Reviewing the design of proposed delivery systems for the feedstock is imperative. Low natural gas pressure may require a compressor, which adds significantly to the capital outlay and facility operating cost. Normally, natural gas is supplied by a local gas provider, with supply contracted before the plant is built.

Adjacent gas processing facility. Sometimes, locating an LNG plant near a gas processing facility can offer substantial capital cost savings. Being able to rely on a supply of leaner feed gas can eliminate propane—and, therefore, the need for a separate depropanizer unit—and it can lessen the need to remove heavy ends (such as ethane) in the gas. It can also simplify feed gas handling, and it can simplify pretreatment by eliminating the amine system in cases with low levels of carbon dioxide (CO2) in the feed.

However, the potential capital cost savings realized by co-locating the LNG facility adjacent to a gas processing facility may be offset by the higher cost of feed gas from that supplier, because of the requirement that the gas be treated more extensively before it arrives at the LNG facility.

A more viable option may be to sweeten the gas at the new facility once it arrives onsite, and to return the LNG heavy ends (i.e., ethane and heavier NGL) to the gas processing facility. This eliminates the need for the planned facility to handle and store NGL, and to have the corresponding loading system. Since ethane and NGL can also be used as fuel, it creates another potential source of revenue for the developer.

Natural gas demand. On the demand side, the plant should be strategically located with respect to proposed or contracted markets, to reduce transportation cost. This means considering how the LNG will be delivered to buyers: The type of tractor used, the tractor/trailer storage location, whether the tractor needs to return to home base in a day, and whether to use company-owned tractor-trailers or contract for bulk delivery.

In undertaking economic modeling, owners and developers must account for the contracted costs of transportation. Piping the LNG is not practical, as it requires expensive insulated piping. Sometimes, however, transportation and customer delivery are still being debated during the engineering feasibility stage, affecting the length of planning time, decisions about facility size, transportation infrastructure, and applications for local and county permits.

Plant size. Another factor often determined in advance—but, on occasion, without full consideration of the engineering demands of building a plant—is the size of the property required. The size will depend on the capacity of the plant to be built, and should take into account any requirements for berms surrounding LNG storage; LNG loading, including tanker staging and parking; standalone fire-prevention equipment; and other site safety provisions, such as overflow retention impoundments. The site must also be large enough to meet the offsets to property boundaries resulting from gas dispersion and radiation studies.

Plant developers also need to consider whether demand forecasts allow for later expansion. Economies of scale dictate that a larger plant is more cost-effective than multiple smaller ones, but the initial installation of a larger plant may not be the best economic option due to available markets for LNG, investment constraints (cash/financing) and the impact on operating efficiency of running a plant at less than its designed capacity.

Local community and taxation. Preferably, developers will want to locate new LNG facilities in areas where petrochemical facilities have already been permitted and approved, and/or in communities or regions already familiar with gas processing and even cryogenic processing. Local building departments and agencies, as well as fire departments, will have more experience in permitting and inspecting such facilities, and a shallower learning curve facilitates faster decision-making.

Municipalities that derive tax revenues from these types of facilities should be of particular interest. From the standpoint of taxation, these are friendlier than others and, furthermore, likely far less hostile from a regulatory point of view. Some may provide tax-increment financing (TIF), or other financial incentives, to encourage development and job creation. Developers will want to investigate such economic development zones for industry.

Utilities requirements. Reviewing utilities available at the site—and road access to the site—should also be included in upfront analysis.

Water. Water is required for some process uses in all LNG production facilities. For certain processes, usage is high, and at least some percentage of supply needs to meet particular degrees of cleanliness and chemical composition. Consumption is highest in plants with cooling towers. Water may also be needed for firefighting use, based on regulatory requirements.

Water can be provided by a local utility, from a well specifically drilled for the LNG plant use, or from a neighboring property. Local regulations control the drilling of wells and, in some cases, may not allow it due to contracted obligations on the water table, existing demand or environmental regulation. In many jurisdictions, wastewater treatment requirements also must be considered.

Electrical. Power is normally provided by a local utility, but it can be generated onsite if necessary. In one recent LNG facility construction project, the available electrical power supply was sufficient for continuing operations, although it was inadequate for the initial demand load required to start the compressor’s electric motor. The solution meant specifying a variable frequency drive to allow use of available power, without needing to add new electrical supply lines from the municipal power supplier—a cost that would have been passed on to the developer.

The extent of an LNG plant owner’s investment in power-line and gas-supply pipeline extensions will depend on negotiating terms with local suppliers. Accounting for the costs of electrical power supply will be important to calculating ROI.

Sewer. Sewers are not a necessity for an LNG plant, but ready access to a municipal system makes disposal of wastewater from water treatment and control-room facilities simpler and less costly. If the proposed design includes cooling towers, the cooling tower blowdown will be the largest waste stream. The volume and flowrate of the waste stream is directly proportional to concentration cycles in the cooling tower, and it is affected by the quality of available water. Wastewater from the gas purification system is the second-largest stream.

Both waste streams will have a higher concentration of total dissolved solids (TDS) than the available water source. Depending on that concentration and the water quality of the waste stream, local regulations may allow discharge into storm-water ponds or injection into the ground. In a worst-case scenario, water may have to be piped or trucked offsite. In this case, a process design that calls for the use of a cooling tower would not be cost-effective, and an alternative design should be considered.

Highway access and condition. Once an LNG plant is up and running, tanker-truck traffic places continual demand on transport infrastructure: roads, bridges, and viaducts. At an LNG plant producing 100,000 gallons per day (gpd), operators can expect 10 to 14 tanker trucks to arrive at the facility, load, and leave on a daily basis. A fully loaded tanker weighs 65,000 lb to 80,000 lb; this means significant stresses on roadways and bridges.

Especially in less-developed rural areas, infrastructure may not be able to sustain this continual loading. Securing an operating or use permit from the local municipality or county may require the LNG plant owner to invest in road upgrades or maintain a budget for yearly maintenance. The closer the facility is to major highways, the smaller this investment could be.

Layout and process design variables. Examining variables that can affect a project’s cost and the timeline for successful completion is not a linear or sequential process. Instead, engineering feasibility reviews inform the developer/owner’s financial planning, modeling should be performed during the first few months of design development, and the technical risk model should be used as a reference and be updated as work continues.

By preparing a layout and site plan, developers and their engineering consultants can use them as a basis/input for the modeling; the results offer management guidance about whether design changes are required. Once changes are implemented, the models can be adjusted to confirm compliance with standards and regulations.

Determining what cryogenic process will be optimal—nitrogen cycle, mixed-refrigerant, or another process—is a vitally important early decision. However, process design is also the single-largest variable in ongoing operations cost. The purity, supply volume and pressure at which the feed gas supply is delivered are critical. Often, pretreatment processes are necessary, and, in some circumstances, source pressure needs to be adjusted with the supplier to deliver the requisite volume.

Other considerations also affect design, construction and permitting time, as outlined below.

Cooling system. Process cooling can be accomplished via evaporative coolers (cooling towers) or air coolers. A typical air cooling system uses a bank of centrally located air coolers to cool a water/glycol stream that is used to provide cooling to all users. Alternatively or in combination, air coolers can be used to directly cool the process stream (Fig. 4).

|

|

Fig. 4. Cryogenics technology and plant cooling systems are major components |

Air coolers are easier to secure permits for and do not require water makeup or handling purge waste streams. Water cooling, using evaporative coolers such as cooling towers, provides more efficient cooling but requires makeup water supply and disposal of purge streams. Given the scarcity of water in many of the regions where natural gas is sourced and processed, it can be difficult to secure permits for systems with high water consumption.

Evaporative coolers may also emit contaminants into the atmosphere and may require an air emissions permit. In addition, operating an evaporative water cooling system requires operators to budget for chemical additives and keep close watch on water chemistry.

Process heat. Process heating is required for the amine reboiler and for regenerating the adsorption capacity of the molecular sieve(s). Both fuel-based and electric heat are technically feasible, but heating requirements differ based on plant size and production method.

For larger systems, developers should consider a central fuel-fired hot oil heating system, although a fire tube or hot oil heater may create emissions that, in turn, pose permitting challenges. For other systems, developers can plan on a feed gas-supplied fire tube or electric heating. The installed cost of an electric heating system is higher, but it is simpler to operate and maintain and easier to permit.

Process water. Water is required for the amine system that removes hydrogen sulfide and carbon dioxide from the feed gas, and to supply makeup water to the evaporative cooler system. The extent of water treatment required is a function of the quality of the feed water. Possible treatment can include water softening, reverse osmosis or demineralization.

Nitrogen supply. Nitrogen is used for purging and makeup in nitrogen-based cryogenic liquefaction systems. Nitrogen can be transported to the plant by tanker truck, and it can be stored in liquid form at pressure, or it can be generated onsite using a nitrogen generator. Some plants do both, allowing operators to supplement supplies based on the nitrogen consumption of the plant.

Operation and maintenance access. An LNG plant resembles a small gas processing plant more than it does a petrochemical refinery unit, and the plant’s footprint is typically limited to reduce overall cost. Equipment is packaged and erected on skids to the maximum extent possible, and interconnecting pipe is run along pipe sleepers, which require stiles for operator access/mobility within the plant. This means access to equipment is often limited to one of its sides. Maintenance considerations are not too different from those at natural gas plants: For example, providing access to a crane for the removal of heavy equipment (e.g., compressors), and providing an area that allows operators to pull tubes from heat exchangers.

Pressure drop. Feed gas travels from pretreatment to liquefaction to storage to loading. The longer the lines, the greater the pressure drop, which, in turn, affects power consumption and correlates to operating cost. Engineering design must, therefore, strive for the optimal balance between compactness and efficiency on one hand, and access and safety considerations on the other.

Of particular importance in LNG plants are the net positive suction head (NPSH) requirements for the LNG line between the storage tanks and the loading pump, and the goal of minimizing expensive cryogenic lines from cold box to storage and from storage to loading.

LNG storage tank. Storage requirements will be derived from the specific objective of the plant’s construction: To whom the LNG will be sold and supplied, and with what frequency the customer plans to order it. Some plans call for peakshaving, which demands a higher capacity for long-term storage as well as proportionally larger valving, pumping and offloading capacity. For storage capacity of greater than 500,000 gal, a single flat-bottomed tank may be more cost-effective and require a smaller footprint than multiple “bullet”-type freestanding tanks.

Regulatory and environmental considerations. A number of permitting considerations also exist for developers and owners. Air permitting and wastewater treatment requirements differ significantly by jurisdiction, with some states and regions being more attractive to industry than others. Proposed developers and facility owners should conduct a preliminary site review, and the engineering and financial feasibility study should acknowledge and address the specific requirements for new construction and/or any proposed expansion. Owners/developers will want their legal and/or environmental advisors to determine which agency will take the lead on permitting in their jurisdiction, and will want early on to establish a list of permits they will require.

NFPA and DOT requirements. Depending on a plant’s proposed capacity, both National Fluid Power Association 59A and Department of Transportation Code of Federal Regulations Title 49, Part 193, have standards and regulations for its design. Both require gas dispersion and radiation studies to verify that conditions comply with regulations and consider terrain, ambient conditions, wind patterns and equipment arrangement to determine gas concentration and radiation levels at a property’s fenceline. The single most common reason for increasing the size of the property is the result of these studies.

Emergency egress. Any engineering firm undertaking EPC scope for an LNG facility must consider how to ensure safety for operating personnel while servicing different processing units, as well as to anticipate regulatory requirements. Although spacing requirements established by OSHA will be incorporated into the design, other factors may increase a plant’s required footprint. For example, the local fire department may require a perimeter road for access/egress. These and other factors could affect project cost.

Storm-water retention. State and local requirements dictate how storm water is to be handled. Runoff is typically collected in retention ponds and released in a controlled manner consistent with county requirements. Depending on the size of the required retention basin, this may affect property size.

LNG firefighting. Fighting an LNG fire is unique and not normally understood by most fire departments. As with many chemical fires, water is not the preferred method of extinguishing an LNG fire; instead, using water on a burning LNG pool is actively dangerous, because it increases the rate of vaporization of the LNG. Counter-intuitively, therefore, it has the opposite effect of feeding the fire rather than extinguishing it. Most nitrogen-based gas liquefaction plants do not have firewater systems. However, the property owner may still be required to obtain the approval of the local fire department.

Firewater tank. In the event a fire system is mandated and a supply of firewater is not available, a dedicated firewater tank with pumps will be required. The tank will be sized during the development of the fire prevention and control plan. As with storm-water retention ponds, the need for a firewater tank may affect the required size of the property.

Emergency power systems. Emergency power should, at minimum, allow the plant to safely shut down. Backup power can be an independent power feed (not typical) or an electric generator designed to provide power to control systems and for emergency lighting. The generator can be fueled by diesel or feed gas. Both fuel sources have benefits and drawbacks. An owner may want to include the LNG pump and instrument air compressor loads in the emergency circuit to allow truck loading to continue during power outages.

Instrument air. Instrument air (I/A) options depend on owner reliability requirements and operating standards. In a typical design, the I/A system is provided with a 100% backup system. Alternatives include providing backup I/A using available nitrogen, and using nitrogen for all I/A needs and eliminating the I/A system.

Other safety features. Plants will always require some system for fire detection and suppression, including ultraviolet and infrared sensors for detection, monitoring equipment to detect combustible gases, smoke detectors, manual fire alarms, security cameras and a system to shut the plant’s processes down, if necessary.

Other requirements include fire control of ignition sources (inspection, work permits, hot work permits, lockout/tagout, training); spill control, including drainage systems specifically to manage an LNG excursion; building sprinkler systems; an electrical control room; and fire suppression systems, such as halon.

A note about expansion. If an owner/developer is seeking to build a smaller plant and considering adding capacity in the future, the engineering firm should be tasked with determining the minimum space that will be sufficient to accommodate new liquefaction trains. If an expansion is highly probable, the owner may want to consider pre-investment in some areas to reduce the overall cost.

Pre-investment ideas include sizing the equipment to handle future capacity, such as:

- A larger feed gas line, with appropriate instrumentation and valving

- A larger-capacity inlet power line, including power disconnect and transformers

- Available volume and pressure at the source of the water supply line

- Allowances for an expanded instrument air system

- Capacity of the water treatment system

- Ability to generate sufficient emergency power for a larger configuration

- Flare sized for future capacity.

At the Clean Energy LNG facility completed in 2010 at Boron in the Mojave Desert in California, the plant’s modular design allowed for replication of certain systems for a third liquefaction train alongside the original two trains. This required awareness of the costs for construction at project inception, as well as an understanding of the implications of adding a third train on all of the plant’s utilities, systems, power demands, and permit applications.

Takeaway. In summary, many variables and practical considerations affect project execution risk in developing a small- to mid-sized LNG plant. While managing financial risk falls strictly within the purview of the developer/investor, technical and engineering risks can impact financial projections, and must be factored in.

In conducting feasibility analyses, risks can be identified before project inception, costs can be anticipated and/or funds reserved for contingencies, and, importantly, certain types of risks can be addressed and eliminated. It is important to remember, however, that these variables do not occur sequentially; each should be considered concurrently, as part of an engineering study that helps the economic analysis team to model outcomes based on different selections.

Investors looking to realize returns from LNG developments will, therefore, want to look to process engineering contractors with an established project management approach, a holistic awareness of various risks that can affect profitability, and the ability to develop accurate cost estimates before breaking ground on new projects. Such a provider should be able to impart experience in process design; in mechanical, civil, and electrical engineering and other technical disciplines; in materials supply and technology procurement; and in the construction and operation of similar process plants.

Advance design planning helps ensure successful execution, and total installed cost can be better predicted once variables are assessed. As the project moves forward, the developer’s and engineering firm’s integrated business and project execution risk model can be used as a baseline for monitoring and addressing risk and cost on an ongoing basis. In this way, a turnkey EPC provider can protect investors’ and developers’ ROIs. GP

|

Eduardo H. Rodriguez, vice president of process operations for OnQuest Inc., joined the company in June 2002. He has over 32 years of experience in the environmental, chemical, petrochemical and water treatment industries. Mr. Rodriguez attended Arizona State University, followed by California State Polytechnic University (Pomona), where he received his BSc degree in chemical engineering in 1980. Immediately after graduating, he joined Lawrence-Allison and Associates West Inc., which was purchased by KTI Corp. in 1981. In 1995, he completed the Construction Management Program at Texas A&M University. Mr. Rodriguez has been a registered professional chemical engineer in California since 1983. He also holds a contractor’s license in the state of Louisiana.

Comments