Diversification drives North American gas processing M&A activity

J. Stell, Contributing Writer

This decade’s dramatic growth of gas resources from what used to be considered “unconventional” sources—shale, mostly—makes one issue perfectly clear: the increasing need for new, long-lived infrastructure. New gas processing facilities and systems have become an energy industry priority. As a result, gas processing owners and operators are looking for growth through geographical and asset diversification to serve their exploration and production (E&P) customers and to attract and retain investors.

To that end, a number of mergers and acquisitions (M&A) deals have come to fruition during the past 12 months, and the trend is expected to continue, according to midstream industry guru Kenny Feng, president and CEO of investment consultancy Alerian. The company provides market information designed to help investors make decisions about master limited partnership (MLP) investments and energy infrastructure projects. At present, Alerian has more than $17 billion (B) directly tied to the Alerian Index Series through exchange-traded products, delta one notes, and separately managed accounts.

“We expect interest in gas processing MLP M&A activity to continue,” says Feng (Fig. 1). “The factor which may temper that would be a function of bid-ask spread, as sellers seek to take advantage of valuations above the historical average and buyers seek to be disciplined in their capital deployment. That might reduce the likelihood of a lot of deals getting done, but, as far as interest level, I would say it is fairly high.”

|

|

Fig. 1. Kenny Feng, president and CEO of Alerian, |

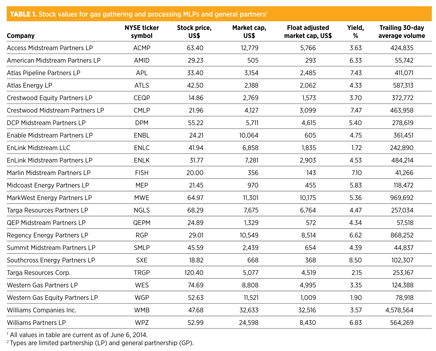

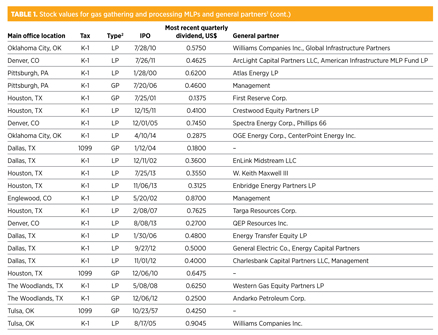

The new wave of deals is driven primarily from a market standpoint and is based on publicly held MLPs, he explains. The activity is fueled by the MLP investor market, which is showing value that comes from economies of scale, and which is being rewarded by the market through premium valuation (Table 1).

“Players that have scale and exposure to multiple basins are being rewarded by the markets, both from a financing perspective, through cheaper debt, and from an investor perspective, due to liquidity in the equity,” Feng says. “That will be something that may drive more of those conversations.”

Crosstex–Devon merger. One of the more significant mergers of 2014 occurred on March 10, when Crosstex Energy Inc. officially merged its assets with the midstream assets of Devon Energy Corp. creating a new company called Enlink Midstream LLC (Fig. 2). Both Enlink Midstream and its MLP, Enlink Midstream Partners, are now trading on the New York Stock Exchange (NYSE).

|

|

Fig. 2. Crosstex Energy Inc. merged its assets with Devon Energy Corp., creating |

To complete the merger, Crosstex and Devon combined their gathering, processing, fractionation, transportation and logistics assets in the Permian, the Cana and Arkoma Woodford basins, and in the Barnett, Eagle Ford, Haynesville, Utica and Marcellus shale plays. The assets include 7,300 miles (mi) of gathering and transportation pipelines, 12 processing plants, six fractionators, barge and rail terminals, product storage facilities, wastewater disposal wells and a crude oil truck fleet.

Almost immediately, the new entity launched plans to build a 35-mi, 12-inch-diameter pipeline to carry natural gas out of the Permian basin. Although the merger is a recent event, it has been a long time coming, says Feng.

“Crosstex attempted to get a transaction done with Devon two previous times, and the third time was the charm. Crosstex had a relationship with Devon on the producer side. Certainly, Devon had its own midstream footprint before it was transformed into EnLink, but the deal was driven by the fact that the companies had a previous relationship.”

Feng and the analysts at Alerian have seen a similar level of interest across other platforms, such as Williams Companies taking a general partnership into Access Midstream, which was formerly a Chesapeake business.

Williams Companies. Last year, Williams completed its investment in previously privately held Access Midstream Partners GP LLC, with a total of $2.25 B (including transaction costs) for the company’s investments in the Access Midstream entities (Fig. 3). That amount was reduced from the previously reported amount of $2.4 B, primarily due to Access Midstream’s capital-raising activities and closing adjustments. The deal gave Williams a 50% interest in Access Midstream’s general partner, which includes a 2% interest in Access Midstream and incentive distribution rights.

|

|

Fig. 3. Williams Companies, which owns the Willow |

The deal followed Williams’ separation into two standalone, publicly traded corporations in early 2012. The company’s former exploration and production business, WPX Energy Inc., began trading on the NYSE on January 3. The spinoff was completed with the distribution of one share of WPX Energy common stock for every three shares of Williams’ common stock.

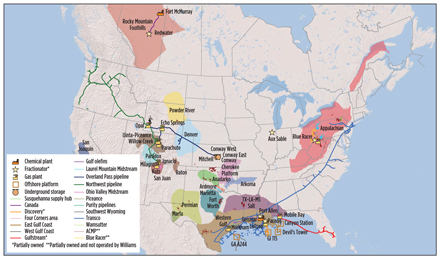

Today, Williams Partners owns and operates gas processing and pipeline assets across Texas, Louisiana, Mississippi, offshore Gulf of Mexico, Alabama, Georgia, South Carolina, North Carolina, Virginia, Maryland, Delaware, Pennsylvania, New Jersey, New York, New Mexico, Colorado, Utah, Wyoming, Idaho, Oregon and Washington. Its NGL and petrochemical services segment extracts, fractionates, treats, stores and sells propane, propylene, n-butane, isobutene, butylene and condensate to users in the energy and petrochemical industries. The company’s Access Midstream Partners segment provides gas gathering, treating and compression services to multiple producers.

“We are seeing a lot more of this type of activity because the investor market is rewarding those companies that have diversified geographic risk, as well as a diversified exposure to multiple producers,” Feng explains. “That’s why we think that interest in M&A activity is at an accelerated level.”

Regency Energy–PVR acquisition. Like Williams, risk diversification is a major theme of the recent slate of M&A activity. For example, Regency Energy Partners LP recently took the philosophy to the next level when it acquired crude and water gathering assets, then a fellow midstream company, and it now plans to acquire Eagle Rock Energy’s assets.

First, on February 3, Regency Energy Partners LP announced that it had closed its acquisition of the midstream unit of Hoover Energy Partners LP for a combination of cash and Regency common units. Regency issued more than 4 million (MM) Regency common units to Hoover and funded the cash portion of the consideration with borrowings under Regency’s revolving credit facility.

The acquisition adds to Regency’s footprint in the Delaware basin in West Texas and expands its suite of producer services by adding crude and water-gathering services in one of Regency’s core operating regions. The Hoover assets are connected to Regency’s existing Permian basin rich gas system.

Then, on March 21, Regency Energy and PVR Partners LP completed their merger, which makes Regency one of the largest independent gas gathering and processing MLPs in the country. The deal created a fully integrated midstream partnership platform by expanding Regency’s network of gas pipelines and processing plants in the Granite Wash shale in the Mid-Continent and adding a strong footprint in the Marcellus and Utica shales in the Appalachia basin, as well as coal and natural resource properties in the Appalachian, Illinois and San Juan basins.

Lastly, on May 27, Regency announced that it is conducting an exchange offer and consent solicitation for its pending acquisition of Eagle Rock’s midstream business. Regency’s general partner is owned by Energy Transfer Equity LP.

“Kelcy Warren of Energy Transfer has long been a proponent of growth through acquisitions, as evidenced by the Regency–PVR transaction,” says Feng. “At the Energy Transfer Equity LP level, investors in the stock now own general partner interests in a number of MLPs, including Regency, Energy Transfer Partners LP, Sunoco Logistics Partners LP, and an LNG MLP that will be filed later this year.”

The MLP market is undergoing bifurcation, where investor interest is in low-yield names with multi-year visibility to double-digit distribution growth through asset drop-downs on the one hand, and high-yield, low-growth value names on the other hand. Regency is one of the few MLPs with an above-average yield and visibility to above-average growth, explains Feng.

“Income-oriented investors will be attracted to Regency’s above-average yield, and distribution growth is expected to be comparable to the industry average. If management is able to integrate the newly acquired assets well over the next several quarters, then concerns about execution risk should decrease and investor interest should grow.”

Philosophy and financial position. Each company’s M&A strategy will depend on its unique situation, Feng says. The factors that are likely to determine interest in deal-making are a company’s management team, its growth philosophy, and what it needs to do to continue its forward momentum.

“A higher-growth company, like Access Midstream, for example, at least at the LP level, might be less inclined to do acquisitions because they already have a significant growth platform organically. They are not looking for ways to move the needle from an idle position, so to speak,” says Feng.

While management philosophy is a significant driver of M&A activity, equally important is the strength of the company’s underlying business, says Feng. If a particular company’s distribution growth is going to be muted over the near term, it might have to acquire a higher-growth platform from a third party to get that distribution growth number back into a place where it will interest investors.

The third significant factor that drives M&A activity is the basin issue, says Feng. “If a company is not in a particular basin, it will probably need to acquire, to think about M&A activity, to get a foot in the door. That’s what we saw with the Williams–Caiman deal several years ago.”

The same holds true for the Castleton–Anadarko asset deal, which gave Castleton a larger footprint in a significant market.

Williams–Caiman acquisition. In 2012, Williams Partners spent $2.5 B to acquire Caiman Energy’s wholly owned subsidiary, Caiman Eastern Midstream LLC. Williams funded the purchase price of the acquisition with a combination of $1.78 B in cash and the issuance to Caiman of approximately 11.8 MM Williams Partners common units valued at approximately $720 MM.

Williams made an additional investment in Williams Partners of $1 B to facilitate the acquisition, and it purchased 16.3 MM Williams Partners limited partner units. The company also agreed to temporarily waive the general partner incentive distributions through 2013, with respect to the limited partner units to be issued to Caiman and Williams, and it completed the acquisition in the second quarter of 2012.

The acquisition provided Williams with a significant footprint and growth potential in the liquids-rich portion of the Marcellus shale. Caiman Eastern Midstream was an independent gathering and processing business in West Virginia, Pennsylvania and Ohio that included a gathering system, two processing facilities and a fractionator.

Immediately after the sale, Williams began planning expansions to the gathering system, processing facilities and the fractionator, and it also planned an ethane pipeline. At the time of the transaction, the assets were anchored by long-term contracted commitments, including 236,000 dedicated gathering acres from 10 producers in West Virginia, Ohio and Pennsylvania, and processing commitments in place of 100 MMcfd (Fig. 4).

|

|

Fig. 4. Williams Partners continues to grow its US asset base. |

Castleton–Anadarko asset acquisition. While many gas processors consider geographical diversification, other companies consider portfolio diversification to be attractive to investors and to the M&A market. One example is Castleton Commodities International LLC (CCI), which has a highly diversified energy portfolio. Castleton was formerly called Louis Dreyfus Highbridge Energy.

In May, the privately held US commodities merchant acquired a gas processing plant in Kirtland, New Mexico, and about 225 mi of gas gathering pipelines. The seller was Anadarko Petroleum Corp. The San Juan plant has a capacity of 75 MMcfd and can process sour gas and recover NGL through its 20-MMcfd cryogenic processing unit. About 150 mi of its 225 mi of gathering pipelines connect into CCI’s existing Lisbon gas plant. The acquisition was a logical expansion of the company’s existing upstream and midstream assets in Colorado, Utah and New Mexico.

Elsewhere, the company owns the Cyrus River terminal on the Big Sandy River in Kenova, West Virginia, which is a blending terminal where 5 million tons per year (MMtpy) of coal are aggregated, stored and blended to higher specifications, and then loaded on barges and trucks. The facility has over 1 MM tons of surface storage and a fleet capacity of 13 barges. It can load one barge per hour, and can load 50 (and unload 340) trucks per day. Castleton also owns the Slones Branch terminal in Pike County, Kentucky, which is another coal-blending terminal with a capacity of 3 MMtpy of coal. The terminal can load 110 to 135 car unit trains in four hours.

In addition to gas processing and coal, Castleton has interests in power generation. It owns the Wichita Falls cogeneration plant, a 77-megawatt (MW) electric-power-generation facility that supplies power to the Electric Reliability Council of Texas (ERCOT) market during periods of peak demand and/or supply volatility. It also owns the Rensselaer cogeneration plant near Albany, New York, which is an 80-MW combined-cycle electric power-generation facility that interconnects to the New York Independent System Operator (NYISO) in Zone F. Just north of New York City, Castleton owns Roseton, a 1,210-MW facility capable of running on both natural gas and fuel oil. The facility supplies power to the NYISO Zone G market.

In its upstream portfolio, Castleton has Paradox basin upstream and midstream assets in the Four Corners region of Utah and Colorado. The assets consist of 180 oil and gas wells and 150,000 net acres in mineral leases, as well as a midstream gas processing facility and a 262-mi gas gathering system. The company’s Robinson’s Bend field is in the Black Warrior basin in Tuscaloosa County, Alabama, and includes more than 500 gas wells and about 44,400 net acres in mineral leases.

QEP asset dropdown. Yet, not all gas processing M&A is via unrelated companies. Often, parent companies and general partners drop down assets into their associated MLPs. Recently, QEP Midstream Partners LP acquired 40% of the outstanding membership interest in Green River Processing LLC for $230 MM from QEP Field Services Co., a wholly owned subsidiary of QEP Resources Inc. The transaction represented the partnership’s first acquisition following its initial public offering (IPO) in August 2013.

Green River Processing owns four processing plants with total processing capacity of 890 MMcfd and a fractionation capacity of 15,000 bpd. The system includes interconnections to six interstate natural gas pipelines and direct pipeline access to the Mont Belvieu and Conway NGL markets. In 2013, total inlet volumes for Green River Processing were 201 MMBtu, of which 65% were processed under fee-based processing agreements and 35% were processed under keep-whole processing agreements.

“QEP Midstream Partners is in a unique place,” says Feng. “The formation of the company itself was driven by shareholder interest in enhancing the value of the parent through the isolation of midstream assets from the rest of the company’s base business. We’ve also seen that on the refining side, where several refiners have recently created their own logistics subsidiary MLPs, such as PBF Logistics LP, MPLX LP, or Phillips 66 Partners LP.”

The same is true for QEP, he says, which is an E&P company with a significantly sized midstream subsidiary, QEP Field Services. “It’s just the reverse of what Williams Companies did,” explains Feng. “In Williams’ case, they spun off their E&P subsidiary, WPX Energy, and WMB became a pure-play general partner. The same thing is happening with QEP, except in reverse.” The remaining entity is QEP, the E&P company, and it will spin off the field services business, which will retain the general partnership interest in the subsidiary QEPM.

“This speaks to a trend that began many years ago at a measured pace but is now accelerating, which is that energy companies with a non-midstream-base business that have midstream assets are isolating those assets to enhance value at the parent company, either due to shareholder activities or to an internal review of how to drive the company’s valuation higher,” says Feng.

North American renaissance. Even as M&A players eye other US companies and their assets on the market, many of those same companies are looking across the border for deals that might be a good fit in their portfolios, or for potential buyers of unwanted companies and assets, or for sellers. According to Feng, this trend will, and should, continue.

“We launched an energy infrastructure index in 2013 that includes both Canadian and US names from a benchmarking standpoint,” he says. “The reason we did that is really because we think more and more people are realizing how integrated are the US and Canadian stories. The industry talks a lot about the US energy renaissance, but what we really mean to say is the North American renaissance.”

Feng sees an interconnectivity of energy synergies across the border, and says the issues that affect the energy industry in one country will noticeably affect the interests of the other.

“We are really starting to see that now. MLPs are taking an interest in assets across the border because they realize that there is a knowledge base from owning US assets that helps them in Canada, as opposed to buying assets on a completely different continent. For the US and Canada, there is a lot of overlap in terms of how the dynamics of one affect the other. So, whether it is Keyera Corp. or the Canadian companies in general, I think we will continue to see that.”

Keyera–Whitecap. On March 17 of this year, Keyera Corp. entered into an agreement with Whitecap Resources Inc. to acquire ownership interests in processing assets in west-central Alberta, Canada, and in the associated oil and gas reserves for $113 MM. Whitecap initially acquired the assets as part of a larger transaction.

As part of the agreement, Keyera will acquire an 85% ownership interest in the West Pembina 6-28 gas plant (known as the Cynthia gas plant); varying ownership interests in certain oil batteries, compressors and gathering pipelines associated with the Cynthia gas plant; and a 4.6% ownership interest in the Bigoray gas plant. These acquisitions will bring Keyera’s ownership in the facility to 100%. Keyera will also gain some Nisku reserves that are presently tied into the Cynthia and Bigoray gas plants.

The Cynthia gas plant has a licensed capacity of 78 MMcfd and is located in west-central Alberta, near Keyera’s Pembina North, Brazeau North and Bigoray gas plants. The plant has a turboexpander capable of extracting a deep cut of ethane-rich NGL (C2+ mix) from the raw gas stream. The plant also has an acid gas injection facility that enables it to handle sour gas. Current throughput is 46 MMcfd and is largely made up of associated gas and NGL from Nisku oil production in the area.

“Keyera’s business is principally in Canada, but they have dabbled a bit on the US side as well,” says Feng. “They are going to be very choosey if they make a bigger splash in the US market. If a US company is going across the border the other way, it’s the same idea. US companies are not going to want to put a lot of resources at that level of geographic distance unless they find something that really makes strategic sense.”

Centrica–QPI. Elsewhere in Canada, a Canadian-to-Canadian swap occurred as CQ Energy Canada Partnership (CQE), the joint venture between Centrica and Qatar Petroleum International (QPI), agreed to acquire a package of natural gas assets in the Foothills region of Alberta from Shell Canada Energy for $45 MM. As part of the transaction, Shell will receive CQE’s interest in the Burnt Timber gas processing plant and its interest in the Waterton undeveloped lands in southwest Alberta. CQE estimates that the assets to be acquired have proven plus probable reserves of 90 Bcfe and will increase the partnership’s production in the region by approximately 24 MMcfed.

Future of M&A. With selective M&A activity taking place between the US and Canada, can Mexico’s companies and assets be far behind the deal flow? Maybe, says Feng.

“Mexico is a more recent part of the conversation, because its energy reforms have only taken place over the course of the past year. We could see US companies engage in strategic transactions with Pemex, the Mexican state-owned petroleum company, or they could go in and bid for projects on their own. You may see bigger names like Kinder Morgan, for example, choose the latter route. From a macro standpoint, we will continue to see a lot more integration across the continent in a way that hasn’t been as much the case until recent years,” Feng says.

To what does all this deal activity speak? It’s obviously just an interest in midstream in general, says Feng. “Whether it’s gas processing or other parts of the midstream value chain, I think it speaks to the fact that investors can participate in the energy renaissance beyond just the producers.

“The shale plays are driving interest in midstream. There are some who prefer investing in the higher-risk, higher-reward upstream companies. However, there are other energy investors that are looking for a balance of income and growth. An investment in the midstream sub-sector, generally speaking, is exactly that, and it’s a way to participate in the long-term buildout of North American energy infrastructure. The companies also see that the production boom is expected to last for many years, and that’s contributing to M&A interest,” Feng explains.

“Interest in energy infrastructure grew at a slow and steady rate for the first 20 years after the Tax Reform Act of 1986,” says Feng. “But, given historical returns, the energy renaissance and interest in yield and real assets, midstream is no longer an emerging asset class.” GP

Comments