Bakken midstream developments offer solution to flaring

J. Stell, Contributing Writer

The Bakken oil and gas formation occupies more than 200,000 square miles of the Williston Basin under parts of Montana and North Dakota in the US, and throughout Saskatchewan and Manitoba in Canada. Its name comes from Henry Bakken, a farmer in Tioga, North Dakota, who owned the land where the formation was initially discovered.

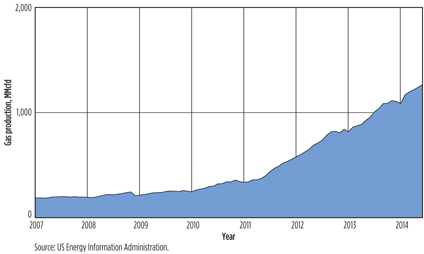

Gas output from the Bakken shale has been rising since the early years of the last decade (Fig. 1). Today, the prolific play produces more than 1 billion cubic feet per day (Bcfd) of natural gas. Much of that production is associated gas brought to the surface along with 1 million barrels per day (bpd) of oil production. As of the first quarter of 2014, natural gas near Watford City, North Dakota was trading near $3/thousand cubic feet (Mcf), compared to triple-digit oil prices. Industry insiders predict a 40% increase in gas produced from the Bakken shale by the end of 2015.

|

|

Fig. 1. Gas production in the Bakken shale. |

State legislation favors flaring. At present, gathering lines, processing plants and transportation pipelines built to serve the Bakken play have not kept pace with production, so nearly 36% of the natural gas produced is legally flared. According to North Dakota state regulations, producers can flare gas for one year without paying taxes or royalties, and they can ask for an extension on that period due to the economic hardship of connecting the well to a gas pipeline. After one year (or whenever the extension ends), producers can continue flaring, but they are responsible for the same taxes and royalties they would have paid if the flared gas had gone to market.

Fortunately, midstream constructors and operators are moving into the play to develop needed infrastructure, which can greatly reduce flaring. For example, a report by the North Dakota Pipeline Authority shows that at least one county in the Bakken area was able to reduce its flaring by about 62% from December 2008 to December 2009, with the addition of two new gas processing facilities and the expansion of associated gas gathering systems.

Task force to mandate greater gas capture. Furthermore, in January 2014, the North Dakota Petroleum Council (NDPC) formed an oil industry task force representing hundreds of companies in North Dakota, and pledged to support the industry’s efforts to significantly reduce natural gas flaring in the state’s Bakken oil fields.

“We recognize that natural gas is an efficient, clean and valuable resource, and that’s why the industry has invested more than $6 B in new pipelines, processing plants and other infrastructure to move it from the wellhead to the marketplace,” said Terry Kovacevich, NDPC chairman and regional vice president for Marathon Oil, in a public statement. “We have to remember that the Bakken is still a very young play, and this is just one factor in why production has outpaced our ability to build the infrastructure needed. Furthermore, the Bakken is unlike any other play in the world and requires solutions specifically tailored to its geology, climate, landscape and resources.”

The task force reported to the North Dakota Industrial Commission, the state regulator, that the industry plans to increase the percentage of gas captured to 85%, up from 70%, within two years; and to further reduce flaring to 90% by the end of the decade. According to the plan, stricter regulations could require producers to formulate gas capture plans before filing for a drilling permit. Failure to submit a plan could result in the denial or suspension of new drilling permits, and existing wells could be required to restrict production.

Also, the task force has asked the state of North Dakota to support the rapid buildout of pipelines and electrical transmission infrastructure by issuing property tax credits, production tax credits, low-interest loans and incentives for increased local industrial use of gas for fuels, petrochemicals and fertilizers.

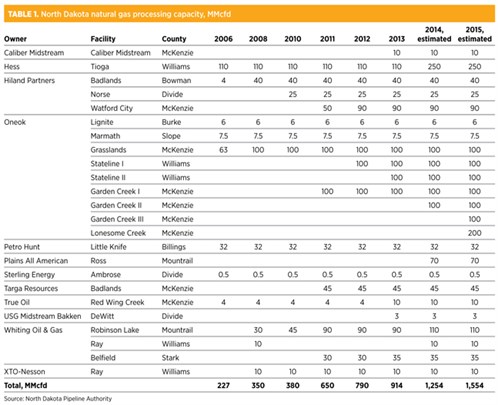

In addition to reducing natural gas flaring, the play will require new gas processing capacity to handle the abundance of natural gas liquids (NGL) produced. Presently, the play produces more than 300,000 bpd of NGL, and production is expected to continue to increase through 2017. A number of companies are expanding their midstream operations and infrastructure services in the Bakken region. Table 1 shows natural gas processing capacity from 2006 to 2013, and estimated totals for 2014 and 2015, for companies operating in the shale play.

Bayhurst Energy Services Corp. The SaskEnergy subsidiary plans to participate with Mistral Midstream Inc. in building a facility to process gas transported on SaskEnergy’s natural gas system from the Bakken formation in southeast Saskatchewan.

The $72-million (MM) facility, which will be built near Viewfield, Saskatchewan, is a straddle plant that will recover NGL to be marketed to commercial and industrial customers. Once processed, the gas will be compressed and reinjected into the transmission pipeline. Construction of the facility will begin in 2014, and the plant is expected to be operational in early 2015.

Hess Corp. The company is transitioning to its expanded Tioga gas processing plant. The expanded plant will be able to process up to 250 MMcfd of natural gas, up from a maximum capacity of approximately 110 MMcfd.

The expansion will give Hess enough capacity to process all of its natural gas, as well as to meet the company’s future needs and to process gas produced by other companies. Hess planned to begin selling gas from the expanded plant in March 2014, after severe winter weather delayed the project from an initial expected completion date of late 2013.

In addition to expanding its processing capacity, Hess aims to reduce its Bakken gas flaring to below 10% by 2017. Justin Kringstad, director of the North Dakota Pipeline Authority, says projects such as the Hess expansion are crucial to reduce flaring, although the state needs additional gas gathering and transmission infrastructure to significantly curb the practice.

Oneok Partners LP. Oneok, the largest independent operator of gas gathering and processing facilities in the Williston Basin, plans to invest up to $780 MM by the second quarter of 2016 to serve Bakken producers. New projects include the partnership’s sixth and largest natural gas processing plant to be built since 2010 in North Dakota, and a second expansion of a Bakken NGL pipeline.

The new 200-MMcfd gas processing facility—named the Lonesome Creek plant—and related infrastructure will be constructed in McKenzie County, North Dakota. The plant is expected to cost up to $390 MM. When completed, it will be the partnership’s largest natural gas processing plant in North Dakota and will increase the partnership’s processing capacity in the state to about 800 MMcfd. Oneok will have seven gas plants in the region after the Lonesome Creek facility is completed.

Oneok will also finish a second expansion of its 600-mile Bakken NGL pipeline, which will increase the pipeline’s capacity to 160 Mbpd from 135 Mbpd and cost about $100 MM. The pipeline expansion will move NGL from the Lonesome Creek plant to Oneok’s Mid-continent NGL infrastructure, and it is expected to be completed by the end of 2015.

Presently, the Bakken NGL pipeline is undergoing a 135-Mbpd expansion to increase capacity from its original capacity of 60 Mbpd. This previously announced expansion is expected to be completed in the third quarter of 2014.

Future NGL output. According to some industry reports, NGL production could rise to more than 300 Mbpd by 2018. As a result, North Dakota gas production is expected to outpace infrastructure development during the next several years. At present, most of the NGL produced are exported from the region via truck or train.

In the future, as more gas processing capacity is installed in the region, the Bakken shale’s gas producers, processors and end users hope to reduce the need for gas flaring and move more valuable natural gas and NGL to market. GP

|

Jeannie Stell is an award-winning writer and editor focused on the upstream, midstream and downstream energy industry. Her articles have been published in several languages and referenced in white papers by Microsoft and Iranian National Oil Co., and her photographs have been featured on industry magazine covers and in feature editorials. Ms. Stell is the founder of Energy Ink and can be reached at jstell@energyink.biz.

Comments