NGL forecasting is essential for successful operators and investors

B. SIMMONS, Genscape Inc., Houston, Texas

Energy executives have an unyielding thirst for fundamental data, and they seek ongoing analysis to confidently make critical business decisions.

Producers must decide where to expand their production capacity. Midstream companies must decide where to expand infrastructure. Service companies must know where those buildouts are likely to be needed. Investors must know which companies and energy commodities are likely to be most profitable, while commercial bankers must be able to assess risk. In all of these scenarios, having timely and trustworthy forecasting data means the difference between success and failure.

To determine the precision, timeliness and comprehensiveness of any natural gas liquids (NGL) forecasts, we need to ask:

- How, where and with what frequency are the data gathered?

- Are the models used to examine the data producing results that are replicable and confirmable?

- Do the forecasters analyzing the results have industry experience?

NGL forecasts should be based on models that are both created and analyzed by individuals with industry experience in developing oil and gas wells and energy production, as well as experience in investing and trading energy commodities and derivatives. A trend spotted by an investor or trader may not be apparent to someone on the production or pipeline side, and vice versa.

NGL forecasts must then be confirmed by data from various sources for development and calibration purposes, which is necessary to provide important information for strategic planning of future operations. These data sources include information from state agencies, the US Energy Information Administration (EIA), natural gas pipeline data scrapes, midstream and producer reports, and third-party proprietary natural gas and oil forecast reports.

Methodology and components

Moreover, forecast models must examine metrics related to producer activity, natural gas and oil production growth, infrastructure growth and constraints, economics, and gallons of NGL per million cubic feet (MMcf) of natural gas produced. These measures are used to develop detailed forecasts for each NGL component, which are then measured against EIA Petroleum Administration for Defense Districts (PADDs) data for comparison.

For example, a South Texas NGL forecast is likely to reveal details on the Eagle Ford shale play, which requires ongoing production growth and new processing capacity coming online to allow for the recovery of liquids. As NGL production increases, bottlenecks can occur in fractionation and takeaway pipeline infrastructure, so the forecasts on where and when those constraints will occur should be included to facilitate project planning work.

Industry trends

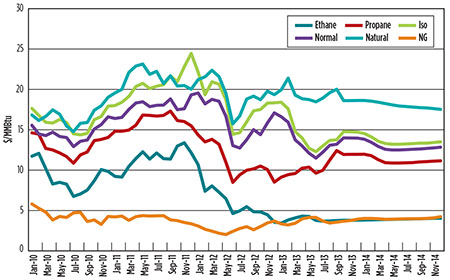

There are a number of trends to watch for in 2014 and beyond. It is known that a certain amount of ethane is recovered from gas production as part of natural gas processing. However, the amount of ethane recovered is a moving target because it can be impacted by economics, quality specifications related to natural gas, and changes to contract structures.

Processors across the board are turning to more fee-based and percent-of-proceeds contracts instead of keep-whole contracts, which reduces their exposure to commodity risk. This trend will likely continue in the future and could have an impact on the amount of ethane recovered, even when it is uneconomical to do so.

Another trend impacting ethane rejection is the British thermal unit (Btu) content of the natural gas pipeline system. Btu content has been trending higher due to producer activity in liquids-rich shale plays and a lack of gas processing and NGL takeaway capacity, and is close to the maximum amount allowed. This is a trend that is being closely monitored to understand the impact as new infrastructure comes online.

Genscape Inc.’s NGL forecast estimates that economical ethane rejection could be as high as 300 thousand barrels per day (Mbpd) by late 2014. This reflects an increase in gas processing capacity and the limitations of the US natural gas pipeline system, with maximum ethane rejection through 2014 due to market forces.

Snapshot forecast for 2014

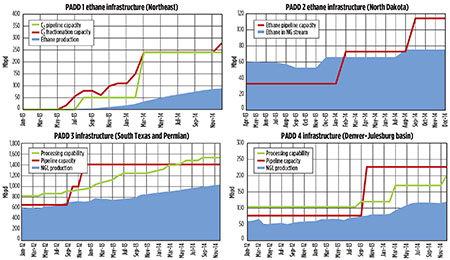

Overall, NGL production will increase significantly next year as new infrastructure ramps up (Fig. 1). Specifically, an additional 479 Mbpd is expected in 2014, even though some processors will conduct full ethane rejection throughout the year.

|

|

Fig. 1. US NGL produced from wet gas shale plays continues to drive gas processing capacity expansions. |

Despite rejection, an increase of approximately 160 Mbpd of ethane production will stem from new infrastructure coming online. Ethane supply will simply grow, but not at the same rate as other liquid components, as long as recovery incentives continue to remain negative.

By the end of 2014, approximately 3.1 million bbl of NGL will be produced from gas processing, with a concurrent increase in liquid components. The bulk of the growth, which encompasses an expected increase of 194 Mbpd in 2014, will be in PADD 3, mainly driven by growth in South Texas and the Permian basin. The northeastern US (PADD 1) production will increase by 173 Mbpd.

In summary, 2014 production will be greater than 2013 throughout most of the continental US (Fig. 2):

- PADD 1: Production in the Northeast will increase by 173 Mbpd

- PADD 2: Production in Oklahoma, Kansas, and North Dakota will increase by 76 Mbpd

- PADD 3: Production in Texas and nearby states will increase by 194 Mbpd

- PADD 4: Production in Colorado’s Denver-Julesburg Basin will increase by 36 Mbpd

- PADD 5: Production is expected to be unchanged.

|

|

Fig. 2. All US PADD districts experienced a boom in gas processing and pipeline expansions in 2013. |

Most notably, throughout the US, an increase of 200 Mbpd will come from new infrastructure capacity related to fractionation and pipeline takeaway by the start of 2014.

Takeaway

Gas processing industry stakeholders who do not access robust NGL forecasts risk loss of efficiencies in their planning, construction, expansion and investment decisions.

Large-cap companies will be wise to compare their in-house produced NGL forecast data with third-party providers. Mid-cap and small-cap companies that lack personnel with forecast-specific skills, or the time to collect and analyze publically available information, will benefit from third-party NGL forecast providers that can fill the gap between the cost of in-house personnel and the cost of making decisions without proper intelligence and analysis. GP

|

BOB SIMMONS is the product manager for natural gas liquids at Genscape Inc. He has 15 years of experience in various roles within the NGL and gas industry, and has spent the past eight years involved in NGL supply and demand analysis. In his tenure at Genscape, Mr. Simmons has developed the NGL production forecast product suite that is related to gas processing. He holds a BS degree from Washburn University.

Comments