Make purity profits from Y-grade

P. COOPERMAN, Triple Point Technology, Westport, New York

Y-grade, or raw mix, provides an excellent opportunity for companies to profit by fractionating and selling Y-grade purity products, but the path to success is an arduous one. Midstream players in the natural gas liquids (NGL) market will encounter challenges, although technology solutions are available to mitigate risk and manage the complete lifecycle of Y-grade, from gathering to purity product selling.

Improvements in drilling and hydraulic fracturing techniques across the US have reshaped the landscape of energy markets. Abundant supplies of natural gas and crude oil have been recovered from shale rock and tight sands, along with large amounts of associated byproducts. In most industries, this would have a negative connotation; however, this is not the case for natural gas and crude oil. In fact, well operators have relocated their rigs to intentionally drill for wet gas and hydrocarbon-heavy crude to produce higher volumes of valuable Y-grade byproduct.

Producers have attracted more midstream participants that hope to capitalize on a growing supply of Y-grade. As an aggregate of several purity products, one barrel (bbl) of Y-grade is valued by what its components are worth. In its natural state, Y-grade has no dedicated market or known use. It must undergo processing before its true value is realized. Fractionation yields varying amounts of NGL—ethane (C2), propane (C3), isobutane (IC4), butane (NC4) and natural gasoline (C5+)—and each have their own uses and dedicated markets.

Succeeding in midstream markets means properly managing the complete lifecycle from the time Y-grade is purchased to the time each purity product is sold. Bringing NGL to market requires physical and financial contract management, while navigating an extremely complex supply chain. It is also necessary to monitor five highly volatile markets to accurately determine the value of an initial purchase and forecasted selling prices.

Risks are everywhere when dealing with NGLs. Technology is the best means of turning Y-grade into purity profit, as it provides the tools needed to overcome the challenges that exist in these markets.

Growth opportunity

The existing infrastructure for gathering, processing and transporting Y-grade in the US limits the majority of Y-grade gathering and NGL production to the middle of the country. Formations in the Eagle Ford shale, the Texas side of the Granite Wash shale, and crude plays in the Anadarko and Permian basins are positioned in regions with access to pipelines that can transport Y-grade to fractionation plants located along the Gulf Coast—namely in Mont Belvieu, Texas.

Once fractionation occurs, individual NGLs can be distributed by vessel or pipeline. However, even producers in these sought-after areas are not without risks, such as plant shutdowns (even planned closures) and pipeline maintenance schedules that may delay processing and delivery of purity products.

Other regions in the country are limited by a lack of fractionation facilities and pipelines capable of handling Y-grade or NGL. Some companies utilize methods designed for transporting liquefied natural gas (LNG); however, most natural gas and crude oil producers simply inject Y-grade back into drill sites until they have an economical means of transporting or fractionating it. Relief is coming, according to recent industry news. Numerous companies have made commitments to develop infrastructure throughout the country. In the Marcellus region, Sunoco Inc. is one of several companies that has announced projects aimed at repurposing pipelines and bringing dormant facilities back online to fractionate NGLs and take advantage of the Y-grade opportunity.

Petrochemical companies and refineries are also investing in expansion projects and in building new facilities to take advantage of the growing NGL supply. These industries use NGL as feedstock and are expected to have a positive impact on demand as their facilities come online. Increasing demand, along with improved transportation and infrastructure for gas processing, create greater opportunity for midstream participants (Fig. 1).

|

|

Fig. 1. Increasing demand, along with improved transportation and infrastructure for processing, create greater opportunity for midstream participants. |

Logistics

Managing a supply chain begins with accurately plotting the projected physical movement of Y-grade from gathering points to fractionation facilities, and estimating the costs associated with doing so. As infrastructure changes and more participants enter the market, optimizing available pipelines and fractionation facilities becomes increasingly difficult. Creating a visual representation of potential transport routes is valuable because it promotes quick decision-making and helps participants avoid obstacles that may create supply interruptions. Once Y-grade goes through fractionation, the challenge increases fivefold. For example, ethane and pentane have entirely different transportation requirements.

Supply chain management plays a large role in a participant’s ability to succeed in the NGL market because every Y-grade acquisition must be tied to a contract of sale and a delivery schedule for each purity product. Keeping track of the location, processing phase, volume, and purity of each NGL, along each stage of the supply chain, allows for advanced planning. It also creates opportunities to blend different supply stocks to ensure that end-product quality is optimized to meet contractual commitments, reduce settlement fees and increase profits.

Purchase pricing

Once midstream participants determine an optimal supply chain process, they then must determine a fair purchase price for Y-grade. Valuation requires monitoring a minimum of five NGL markets; with each market comes volatility. Different end uses drive demand, which can severely impact the sale price of each purity product.

Participants must track individual price movements through price index data. NGL prices are given in dollars per gallon, and Y-grade is sold by the barrel, so calculations must be made at each turn to convert prices into like units. Relying on spreadsheets, manual data and calculations puts midstream players at risk of making transcription errors, which could quickly turn a perceived profitable transaction into a loss.

Contract considerations

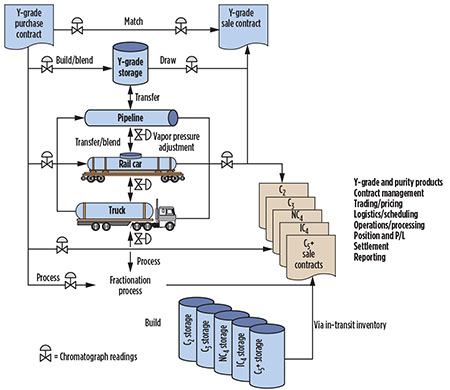

Contracts are a vital part of managing risk associated with commodity trading. When dealing with NGL midstream transactions, the concentrations, quality and volume of each NGL must be examined. Fig. 2 shows a high-level overview of the Y-grade-to-NGL lifecycle for a single Y-grade purchase.

|

|

Fig. 2. Overview of the Y-grade-to-NGL lifecycle for a single Y-grade purchase. |

Sample testing occurs throughout the processing, transport and fractionation of every batch of Y-grade, until end products are delivered. These readings amount to a constant stream of information that must be properly tracked and recorded. When discrepancies exist between agreed-upon values and actual samples, settlements must be made. The data that must be gathered for a single purchase of Y-grade can be overwhelming to manage manually. Participants expecting to rely on spreadsheets and manual calculations to succeed in midstream markets are likely to fail, and should instead consider using software to significantly improve the likelihood of profiting in the challenging midstream markets.

Managing risk with ERM

The financial and physical risks that exist in the NGL midstream market require the use of advanced technology to manage the complexities of purchasing Y-grade and navigating the process of converting and marketing it as purity products. As traders recognize the importance of quickly interpreting complex data from multiple sources, they must tackle several key challenges to promote smart trading decisions and maximize profits:

- Minimize supply chain risk with advanced physical contract handling; manage quantities traded and scheduled at an aggregate level, with pricing, cashflow position, and mark-to-market/fair-value accounting based on individual components.

- Optimize purchase allocation of Y-grade purchases to meet sale obligations.

- Mitigate enterprise risk through optimizing fractionation (based on long positions) to determine the ideal inventory of individual components by integrating physical and financial instruments, optimizing cross-commodity and foreign exchange hedging strategies, and by rapidly identifying arbitrage opportunities across markets and products.

- Track inventory handling and movements with clearly labeled visual displays of all activity, industry-recognized visual cues, and advanced reporting capabilities.

- Model ideal blending scenarios to maximize profit by determining the best blending scenario across all contracts. This can be done through an analysis of each purity product supply stock mapped back to contract delivery and minimum purity requirements.

- Handle comprehensive and reliable units of measure (UOMs) and cross-conversions that support quantities traded and scheduled in volumetric UOMs, potentially converted to mass UOMs; but, more importantly, supporting energy-equivalent positions for hedging, consolidated gas portfolio reporting and frac spread calculations.

An ideal approach to these challenges involves using an enterprise risk-management (ERM) system. A system that integrates with price indexes, manages both physical and financial contracts, and optimizes the complete supply chain, from Y-grade to the sale of NGLs, can provide midstream market participants with the tools they need for success.

Advancing with technology

The growing NGL market offers a unique opportunity to profit from byproducts. To succeed in the midstream market, participants must be both flexible and knowledgeable. The NGL midstream market mandates that participants hone their expertise in several subjects related to physical and financial contract handling, supply chain management, and trade optimization. Technology is crucial to profiting in the Y-grade-to-NGL marketplace. ERM software enables users to accurately monitor and calculate risk while enabling smarter trading and supply chain decisions.

Companies that rely on processes or systems that operate in silos are taking unnecessary risks and exposing themselves to major losses. Integration and cooperation are vital when optimizing midstream NGL activity. Furthermore, mitigating risk with advanced energy-trading and risk-management systems is the best method of averting costly mistakes and oversights, and achieving success in the market. GP

|

PETER COOPERMAN is a marketing specialist at Triple Point Technology, a provider of on-premise and in-cloud commodity management. He has always held an interest in commodities markets, and now focuses on the energy industry. Prior to working for Triple Point, Mr. Cooperman headed solutions marketing and software product management at a global technology provider. He graduated from Binghamton University in New York with a

bachelor’s degree in economics.

Comments