Gas-driven hydraulic fracturing and drilling cut costs, reduce environmental impact

P. KULKARNI, Editor, World Oil

Shale gas production has increased in the US to such an extent that the Henry Hub natural gas price fell as low as $1.95 per thousand cubic feet (Mcf) in April 2012. While the price rose to $4.17/Mcf by April 2013, the US Energy Information Administration's most optimistic projection suggests a ceiling of $8/Mcf, at least until December 2014.1 This price range allows natural gas to compete effectively against oil, coal and diesel as a clean, cost-effective fuel.

The low price projection has encouraged several utilities to switch to gas-driven electric power generation and prompted downstream operators to launch new petrochemical projects that use natural gas as a feedstock. Gas producers, such as Chesapeake Energy and Apache, are calling for the development of a liquefied natural gas (LNG) fueling network for truck fleets and a compressed natural gas (CNG) fueling infrastructure for automobiles.

If it makes sense to use low-cost natural gas for downstream and consumer sectors, why not use gas where it is being produced—upstream oil and gas fields? An entire industry segment is emerging to use wellhead gas or gas from utilities in several of its forms—liquefied petroleum gas (LPG), CNG and LNG—for both fracturing and drilling operations. Within the last five years, engine manufacturers have introduced dual-fuel systems, LNG suppliers are creating supply networks, drilling contractors are deploying gas-driven drilling rigs, and oilfield service companies are embracing CNG or gas-driven hydraulic fracturing units (Fig. 1). One technology startup has developed a high-pressure gas-injection system for gas-driven engines.

|

|

Fig. 1. Drilling rig with LNG storage and regasification units in the foreground. Photo courtesy of Prometheus Energy Group. |

PRIME MOVER OPTIONS

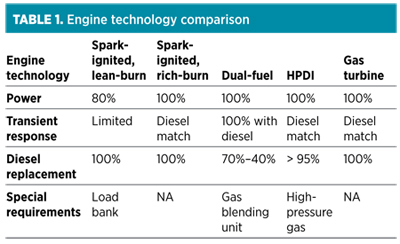

The key component of gas-driven drilling or fracturing operations is a prime mover in the form of either an engine or a turbine. As a substitute for compression-ignition diesel (CID) engines, several types of gas-driven prime movers are available for upstream applications, including spark-ignited natural gas (SING) engines with either lean-burning or rich-burning capabilities, along with high-pressure direct-injection engines and a gas turbine (Table 1).

Cat 3512 C (HD) engine with DGB retrofit kit

Caterpillar Global Petroleum has introduced a dynamic gas-blending (DGB) kit designed for gas-driven engines. The kit allows for substitution of diesel fuel with natural gas during high-pressure pumping associated with hydraulic fracturing. According to Caterpillar, the system can be run with CNG, LNG or field gas with a heating value between 850 Btu and 1,250 Btu, while meeting US Environmental Protection Agency (EPA) Tier 2 emissions requirements. The system is capable of achieving fuel substitution at various speeds and loads over the full operating range and will automatically adjust to changes in gas quality without the need for recalibration during and between jobs.2

GE Jenbacher J320 and Cat 3216LE gas engines

These are lean-burning engines suitable for drilling operations. A resistive load bank is necessary to maintain a steady condition for transient high-power requirements such as tripping. Energy is released as heat by the load bank when not required. When increased load is required, the load bank is taken off in 100-kilowatt increments. This load bank management is accomplished automatically by a load-management system. By maintaining a constant load over 60%, it is possible to further reduce emissions. Ensign Drilling is working with KRW Technologies to develop a battery storage system.3 The uninterruptible power supply ensures constant electrical power despite variations in field gas flowrate and methane content.

GE Waukesha VHP L7044GSI gas engine

This is a 100% natural gas-fired, rich-burning engine. Compared to other spark-ignited, lean-burning engines, rich-burning engines operate at lower cylinder pressures, providing longer operational times between oil changes, top-end overhauls and complete overhauls.

Westport HPDI natural gas engine

Westport Innovations Inc. has developed an LNG-fueling system with high-pressure direct-injection (HPDI) natural gas engine technology. The company has a joint venture with Cummins and collaborations with several other manufacturers, such as Caterpillar and Wärtsilä, to implement HPDI fuel systems on large, high-speed engines in the 1,000–4,000 brake horsepower (bhp) range. An HPDI system uses diesel fuel for engine startup and a high-pressure gas stream to achieve an overall diesel substitution rate of 95%.

GE TM2500+ aeroderivative gas turbine

In Canada, GE's trailer-mounted gas turbine is being used by Evolution Well Services for hydraulic fracturing demonstration projects in Alberta and British Columbia. The gas turbine is connected to a Brush 170ER generator to provide 30.688 megawatts (MW) at 60 Hz or 26.19 MW at 50 Hz. The turbine is capable of operating on either natural gas or liquid distillate fuels.

GAS-DRIVEN FRACTURING

Just one fracturing services company, Halliburton, purchases 100 million gallons per year (MMgpy) of diesel to fuel its fracturing fleet. To reduce this massive diesel fuel usage and consequent environmental impact, operator Apache Energy is working with engine manufacturer Caterpillar and fracturing services companies Halliburton and Schlumberger to introduce DGB conversion kits for engines that drive fracture-stimulation pumps.4

Schlumberger is using wellhead gas to power up to eight stimulation pumps for Apache and Encana in Canada. Over 300 jobs were completed by March 2013 with an average 40% of diesel replacement. For Apache alone, Schlumberger is providing 10 pumps with a total of 20,000 horsepower (hp) CNG-fueled fracturing power. Halliburton is providing 12 pumps with 24,000 hp, fueled by LNG.

For a well in the Stiles Ranch field in the Granite Wash play in Texas, Apache required three days to fracture a well. The use of DGB enabled Apache to use 60% gas and 40% diesel. The diesel was priced at $3.60/gal, and the field gas was priced at $5/Mcf. Performing the job using 100% diesel would have required 31,200 gal at a cost of $112,320. Dual-fuel usage cost Apache a total of $61,253 for 12,480 gal of diesel and $4,500 for onsite gas processing. Based on such results, Chesapeake Energy is planning to convert its entire fracturing fleet to run on LNG to reduce diesel fuel consumption by 350,000 gal per day (gpd) and achieve annual savings of about $230 MM.

To complement its gas-driven engines, Caterpillar has introduced Cat WS223, a 2,250-bhp triplex well-stimulation (hydraulic fracturing) pump, as well as the Cat WS255, a 2,500-bhp quintuplex well-stimulation pump.

GAS-DRIVEN DRILLING

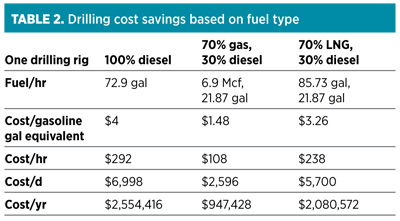

Using natural gas for driving drilling operations can lead to significant cost savings, depending on the type of fuel used (Table 2). Conversion to a gas turbine-driven generator can cost up to $1.5 MM per rig. On the other hand, conversion to a dual-fuel engine-generator set costs approximately $800,000.

Multi-engine technology demonstration

Encana Oil & Gas is one of the operators of the Jonah field in the Green River basin in Wyoming. The area is leased from the US federal government. In 2006, Encana set in motion plans to drill 3,100 infill wells when regulators raised the issue of air quality. Encana brought in Ensign Drilling and other vendors to conduct a technology demonstration involving six different types of gas-powered engines, including lean-burning, rich-burning and dual-fuel systems.5

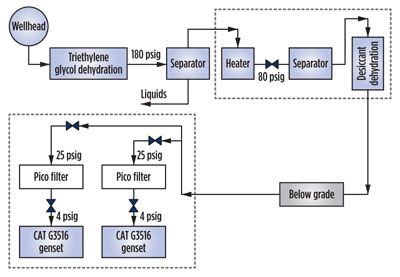

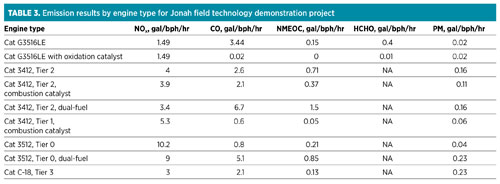

Fig. 2 shows a schematic of the wellhead gas treating system built at a cost of $75,000. Table 3 lists the emissions reductions achieved by the demonstration project. Subsequently, another demonstration project was undertaken in the Wind River basin, where treated gas supply was available as opposed to variations in wellhead gas composition that occurred while drilling in the Jonah field, when the rig was moved from one location to another. With a consistent gas supply, there was no need to make frequent engine adjustments.

|

| Fig. 2. Gas turbine-driven fracturing spread. Photo courtesy of Evolution Well Services. |

|

|

Fig. 3. Jonah field gas drilling scheme. Source: SPE 140357. |

LNG-driven drilling

In 2010, Prometheus Energy Group, Encana and Ensign Drilling worked together to repower two diesel-fueled drilling rigs with natural gas-dedicated engines. As part of this project, Prometheus Energy designed, built and commissioned LNG mobile storage and vaporization equipment and provided the LNG fuel for the project. This dedicated LNG fuel application was the first of its kind.

In the absence of field gas, LNG proved to be a practical solution for Encana's drilling needs, offering cost savings, diesel-like mobility and an onsite fuel reserve. After successfully testing the LNG storage and vaporization system, the units were readied for operation in the Haynesville shale play in northern Louisiana. The project enabled Encana to realize significant fuel savings vs. a drilling rig burning diesel, while also reducing nitrogen oxide (NOx) and particulate matter (PM) emissions by as much as 25%. Noble Energy ran a pilot program with two LNG-powered drilling rigs in the DJ Basin. Based on successful results, Noble plans to operate as many as seven LNG-driven rigs by late 2013. In late 2012, Marcellus operator Seneca Resources and Ensign Drilling installed two of GE's Jenbacher gas engines to power the first two LNG drilling rigs in the region. Powering a drilling rig with natural gas instead of diesel enabled Seneca to achieve 60% lower fuel costs and 25% fewer combustion emissions.

This mobile LNG solution is being used for drilling operations in 11 different plays across the US, including Eagle Ford, Barnett, Wattenberg and Monterey.

Drilling with a rich-burning engine generator

In a parallel development, Antero Resources and drilling contractor Patterson-UTI Drilling have installed gas-fired, rich-burning engines to drill in a Marcellus well near Harrison County, West Virginia. The drilling rig uses rich-burning GE Waukesha VHP L7044GSI engines. These engines can be powered by local fuel sources in the Appalachian Basin, including dry field gas, pipeline gas, LNG and propane. The engines use nonselective catalyst-reduction technology to achieve lower NOx, CO2 and volatile organic compound (VOC) emissions values than those achieved with lean-burning engines. The rich-burning gas engines also produce substantially less methane than traditional options. Since the EPA requires the inclusion of both CO2 and methane in carbon calculations, rich-burning engines deliver a better greenhouse gas profile.

INFRASTRUCTURE CHALLENGES

The shift away from diesel-driven rigs will require considerable infrastructure development to deliver natural gas fuel to remote drilling locations. Wellhead gas can be used easily at producing wells, but no such gas supply is available during wildcat drilling operations. In addition, disruptions can occur in the use of wellhead gas in case of shut-ins due to production difficulties.

If LNG is used, LNG plants or fuel depots could be located at a considerable distance. For example, Chesapeake Energy's oil fields in western Oklahoma are located 500 miles away from an LNG plant. As a solution, Chesapeake plans to set up its own LNG plants to produce about 100,000 gpd of LNG at a cost of approximately $30 MM–$50 MM.

If the demand for gas-driven drilling and fracturing continues, there will be economic and environmental incentives in place for the development of LNG-fueling and CNG-fueling networks to support oil and gas fields throughout North America, with possible extensions to international locations over the next decade. GP

LITERATURE CITED

1US Energy Information Agency, “Short-term energy outlook,” May 7, 2013.

2Henin, E., “Dual-fuel progress in reliability and performance for the oil and gas market,” SPE/IADC Drilling Conference in Amsterdam, The Netherlands, March 2012.

3Thompson, R. et al., “Energy storage for natural gas-fueled electric drilling rigs,” SPE/IADC Drilling Conference in Amsterdam, The Netherlands, March 2013.

4Bahorich, M., “Bi-fuel frac,” Oilfield Breakfast Forum, Houston, Texas, March 2013.

5Hill, D. G. et al., “Natural gas as a fuel in drilling operations—Analysis, testing and implementation,” SPE/IADC Drilling Conference in Amsterdam, The Netherlands, March 2011.

PRAMOD KULKARNI is the editor of World Oil. He has over 25 years of experience in writing and editing focused on oil and gas. Mr. Kulkarni earned a BS degree in electrical engineering from Utah State University, an MA degree in journalism from the University of Iowa, and an MBA degree from the University of Houston. He is a member of the US Society of Petroleum Engineers and the Society of Exploration Geophysicists.

Comments