Robust growth drives North America RNG market to 604 MMft3d capacity in 2025

- Wood Mackenzie projects capacity to increase 70 MMft3d in 2025 after record growth in 2024

- Development prices remain high

- Resource potential for RNG could exceed 7.8 Bft3d by 2050

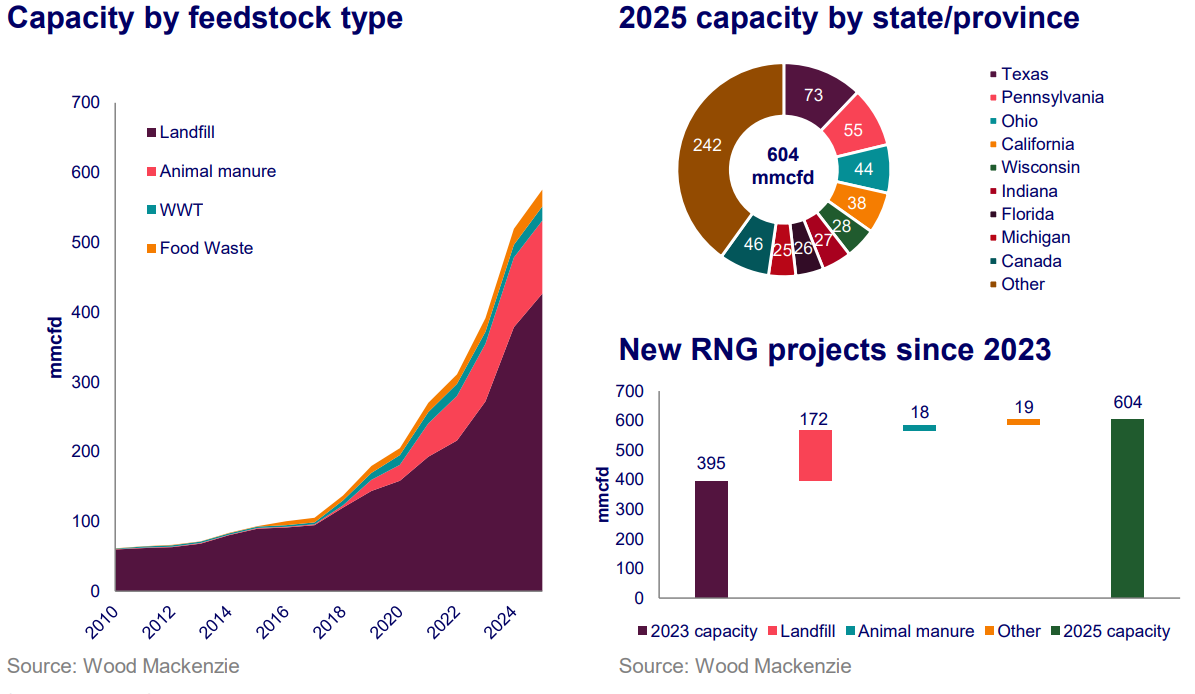

The North America renewable natural gas (RNG) market has demonstrated robust growth, expanding 35% since 2023 and adding a record 139 MMft3d in 2024, according to a recent analysis from Wood Mackenzie.

The report, “Biomethane (RNG) market report: North America,” from Wood Mackenzie’s biomethane/renewable natural gas service projects the market to add another 70 MMft3d in 2025, bringing total capacity to 604 MMft3d. The transportation sector consumes more than half of RNG production.

Texas leads all states in the US, with 73 MMft3d of activity, followed by Pennsylvania (55 MMft3d) and Ohio (44 MMft3d). Canada currently has 46 MMft3d of activity. Since 2023, M&A activity featured Enbridge's $1.2-B acquisition of Morrow Renewables, major investments from Ares, Goldman Sachs and Stonepeak ($400 MM into Clean Energy Fuels), a TotalEnergies-Vanguard joint venture, and asset acquisitions by Vitol, Apollo, and Sagepoint Energy.

“Market participants have shown their confidence in the future of RNG through increased M&A activity,” said Natalia Patterson, senior research analyst at Wood Mackenzie. “We forecast RNG production to grow across all types of feedstock and the resource potential for RNG could exceed 7.8 Bft3d by 2050.”

RNG development prices remain high. Despite robust growth, RNG still faces some challenges, particularly with project development costs.

“High costs will remain an obstacle for new participants entering the market and extended tax incentives will be a key to continued growth of RNG development,” said Patterson.

Clarity on federal subsidies as well as unlocking demand outside of the transportation sector, mainly through voluntary markets driven by utility and corporate decarbonization targets, would be key for the market’s future potential, added Patterson.

“As more states embrace RNG as part of their decarbonization strategy, more clarity on future policy development would also help stabilize prices for environmental attributes (EAs) and boost confidence in the RNG sector’s long-term viability,” said Patterson.

Related News

Related News

- ExxonMobil halts 1-Bft3d blue hydrogen project in Texas

- Aramco and Yokogawa commission multiple autonomous control AI agents at Fadhili gas plant

- Ukraine will resume gas imports via Transbalkan route in November

- Mitsubishi to inject $260 MM into Brunei LNG project

- Freeport LNG (U.S.) on track to take in more natgas on Thursday after unit outage

Comments