Gas Processing News

Egyptian firm to buy $15 B of Israeli natural gas

An Egyptian company will buy $15 B of Israeli natural gas, as announced in two 10-yr agreements, a major deal that Israel hopes will strengthen diplomatic ties.

The partners in Israel’s Tamar and Leviathan offshore gas fields said they would supply the private Egyptian firm Dolphinus Holdings with around 64 Bm3 of gas over a decade. Half of the supply will come from each field, and the proceeds will be shared equally.

Israel’s Prime Minister, Benjamin Netanyahu, said the agreements would “…strengthen our economy (and) strengthen regional ties.” Israel’s energy minister, Yuval Steinitz, called it the most significant export deal with Egypt since the neighbors signed their historic peace treaty in 1979.

Israel’s Delek Group Ltd. and Texas-based Noble Energy Inc. have led both gas projects. Leviathan, located about 80 mi (130 km) west of Haifa, was discovered in December 2010 and is scheduled to start producing by the end of 2019. Exports from Tamar, which began production in 2013, are expected to start sometime between the second half of 2020 and the end of 2021.

Delek characterized Dolphinus as a natural gas trading company that plans to supply large industrial and commercial consumers in Egypt. It added that Egypt had amended regulations to allow private groups to import gas. The companies did not specify when supplies to Egypt would start, and the delivery method has yet to be settled.

Egyptian Petroleum Minister Tarek El Molla told the private Egyptian television channel ON E that outstanding disputes would need to be resolved before the deal could be finalized. Molla’s comments refer to Egypt’s challenge to a 2015 ruling by the International Chamber of Commerce ordering Egypt to pay $2 B in compensation, after a deal to export gas to Israel, via pipeline, collapsed in 2012 due to months of attacks by insurgents on Egypt’s Sinai peninsula.

BP energy outlook: Gas demand increase through switching

In its 2018 Energy Outlook, BP sees natural gas growing strongly, supported by broad demand, marked increases in low-cost supplies, and the continuing expansion in LNG supplies increasing the global availability of gas.

In BP’s “evolving transition” scenario, natural gas growth is supported by a number of factors: increasing levels of industrialization and power demand (particularly in emerging Asia and Africa); continued coal-to-gas switching (especially in China); and the increasing availability of low-cost supplies (in North America and the Middle East).

The US and the Middle East (Qatar and Iran) will contribute more than half of the incremental production. By 2040, the US is expected to account for almost 25% of global gas production, ahead of both the Middle East and the CIS (each accounting for around 20%).

Global LNG supplies more than double over the Outlook, with approximately 40% of that expansion occurring over the next 5 yr.

The sustained growth in global LNG supplies will greatly increase the availability of gas around the world, with LNG volumes overtaking inter-regional pipeline shipments in the early 2020s.

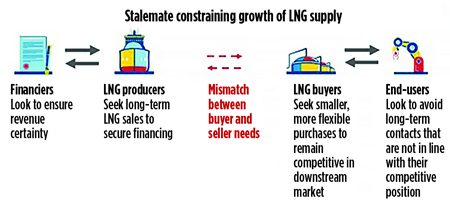

LNG market needs $200-B investment to meet demand

In its 2018 LNG Outlook, Royal Dutch Shell forecast that more than $200 B of investment in LNG is needed to meet a boom in demand by 2030.

The LNG market is set to continue its rapid expansion into 2020 as facilities approved for construction in the first half of the decade come online. The new developments are expected to easily meet sharp growth in LNG consumption.

While LNG demand is expected to expand from 293 MMtpy in 2017 to approximately 500 MMtpy by 2030, supplies are seen slipping to 300 MMtpy due to a lack of new projects and natural declines in existing production.

Anadarko announces Mozambique LNG agreement

Anadarko announced that Mozambique LNG1 Co. Pte. Ltd., the jointly-owned sales entity of the Mozambique Area 1 co-venturers, has entered into a long-term LNG sale and purchase agreement (SPA) with Électricité de France SA (EDF). The offtake agreement calls for the supply of 1.2 MMtpy of LNG for a term of 15 yr.

The Anadarko-operated Mozambique LNG project will be Mozambique’s first onshore LNG development, initially consisting of two LNG trains with a total nameplate capacity of 12.88 MMtpy. The project will support the development of the Golfinho/Atum fields.

AGA to host Young Professionals Program at 2018 WGC

The American Gas Association (AGA) will host a Young Professionals Program during the 27th annual World Gas Conference (WGC), to be held June 25–29 in Washington DC.

The program provides an excellent opportunity for promising young professionals in the energy sector to learn from top leaders in the natural gas industry and network with their peers from around the world.

The agenda will include engaging panel discussions on critical industry issues, such as preparing for an evolving career, recruiting the next generation of industry leaders, and global perspectives on the future of natural gas.

Additionally, participants will benefit from access to the WGC exhibition hall, where will they will have the opportunity for one-on-one interactions with exhibitors from across the globe.

To date, the following speakers have confirmed their participation:

• David Carroll, President, International Gas Union

• Daniel Yergin, Vice Chairman, IHS Markit

• Ryan Lance, Chairman and Chief Executive Officer, ConocoPhillips.

Dominion’s Cove Point LNG begins operations

On March 9, the Dominion Energy Cove Point LNG facility in Maryland exported its first LNG cargo during its final stage of commissioning. The cargo was loaded on Royal Dutch Shell’s LNG carrier, Gemmata, which has a capacity of 3 Bft3. Its destination and buyer were not reported. The Federal Energy Regulatory Committee (FERC) granted approval for Cove Point to officially begin commercial operations on March 5.

Cove Point has a design capacity to liquefy up to 0.75 Bft3d of natural gas. The gas is sourced from the high-producing Marcellus and Utica shale plays. Cove Point is the only LNG export facility on the US East Coast and the second export facility operating in the Lower 48 states after Sabine Pass in Louisiana, which began commercial operations in 2016.

Southern Gas Corridor to Europe touts energy security

The fourth ministerial meeting of the Southern Gas Corridor (SGC) advisory council was recently held in Baku, Azerbaijan.

European Commission (EC) Vice President for Energy Union, Maros Sefcovic, said that the EU is ready to discuss Iran’s wish to join the SGC with all partners of the project. Sefcovic further noted that for Iranian gas to be delivered to Europe, necessary infrastructures should be provided in the country.

The SGC is an initiative of the EC for natural gas supply from the Caspian and Middle Eastern regions to Europe. The goals of the SGC are to reduce Europe’s dependency on Russian gas and add diverse sources of energy supply.

The route from Azerbaijan to Europe consists of the South Caucasus Pipeline, the Trans-Anatolian Pipeline and the Trans-Adriatic Pipeline. The total investment of this route is estimated at $45 B.

Novatek looks to Saudi Aramco for Arctic LNG-2

Russia’s Novatek is interested in Saudi Aramco joining the Arctic LNG-2 plant as a partner, according to the Russian gas producer’s head, Leonid Mikhelson. The interest highlights the growing ties between Russia and Saudi Arabia. Without disclosing details, Novatek—which is Russia’s largest non-state natural gas producer—and Saudi Aramco said that they have signed a memorandum on cooperation. Both countries have been instrumental in implementing a global pact on cutting oil production by almost 1.8 MMbpd. Novatek plans to launch its second LNG project in the nearby Gydan peninsula in 2022–2023.

Comments