Gas Processing News

B. ANDREW, Technical Editor

FSRU for Indian shipowner

GTT received an order from South Korean shipyard Hyundai Heavy Industries for a new floating storage and regasification unit (FSRU). The FSRU has been contracted by Triumph Offshore, a subsidiary of Indian shipowner Swan Energy. The delivery of the vessel is scheduled for late 2019.

GTT will design the LNG integrated tanks, which will have a total capacity of 180 Mm3. The tanks will be equipped with the membrane containment system Mark III, a sea-proven technology developed by GTT. The insulation system has been used to equip more than 140 vessels that are still in service.

Elliott Group integrates EIC Cryo

Effective October 12, 2017, the Cryodynamics Division of Ebara International Corp. (EIC Cryo) is integrated with Elliott Group. The integration of EIC Cryo, including relocation of manufacturing and test facilities into Elliott Group, is scheduled to take place over the next 24 mos. EIC Cryo will continue to operate under that name and will become one of four business units within Elliott Group.

Elliott Group (based in Jeannette, Pennsylvania) is a wholly owned subsidiary of Ebara Corp. (headquartered in Tokyo, Japan) and a global provider of turbomachinery and related services. The integration is intended to further strengthen the companies’ positions in LNG markets.

In addition to sharing the same corporate parent, the two businesses serve many of the same markets and customers. The synergies from the integration will enable them to support their customers more efficiently with integrated product options.

Russia delays China pipeline

Gazprom has postponed completion of the Power of Siberia pipeline to China until 2024 from 2022. However, Gazprom still plans to send initial deliveries of gas to China via the pipeline in late 2019. Peak supplies through the conduit, which has seen ballooning investment costs, are estimated at 38 Bm3y.

LNG trade through South China Sea

|

The South China Sea is an important trade route for Malaysia and Qatar. The two LNG exporters collectively accounted for more than 60% of total South China Sea LNG volumes in 2016. Almost half of Qatar’s global LNG shipments traveled through the South China Sea in 2016. All of Malaysia’s LNG exports pass through the South China Sea, as the country’s one LNG export complex lies on the South China Sea coast.

Several other LNG exporters use South China Sea trade routes to reach LNG importers. In 2016, Oman, Brunei and the UAE each shipped between 84% and 100% of their total LNG export volumes through the South China Sea.

Other LNG exporters in the region, such as Australia and Indonesia, make greater use of alternative trade routes to reach LNG markets. In 2016, only 23% of Australia’s total LNG exports and 29% of Indonesian LNG exports were shipped by way of the South China Sea. The remainder of the two countries’ LNG exports passed to the east of the Philippines and Taiwan, avoiding the South China Sea on the way to customers in Japan, South Korea and northern China.

The four LNG importers with the largest volumes passing through the South China Sea are Japan, South Korea, China and Taiwan. The four countries collectively accounted for 94% of total LNG volumes going through the South China Sea in 2016. Japan is the world’s largest LNG importer, and slightly more than half

of its LNG imports in 2016 were shipped by way of the South China Sea. Similarly, around two-thirds of the LNG imported by South Korea—the world’s second-largest LNG importer—was shipped through the South China Sea last year.

More than two-thirds of China’s LNG imports and more than 90% of Taiwan’s LNG imports passed through the South China Sea in 2016. Total imports of LNG to China have more than doubled over the past 5 yr, from 0.56 Tcf in 2011 to 1.2 Tcf in 2016. However, more than half of the growth in China’s LNG imports were volumes that went to northern ports without transiting the South China Sea. The US Energy Information Administration projects that China will surpass South Korea as the world’s second-largest LNG importer by 2018 and nearly match Japan’s LNG import volume by 2040.

FSRBs gain traction for LNG

|

As an attractively priced fuel that can be easily transported, LNG enables profitable business in areas that are difficult to reach. Installations that power, for example, mines or production facilities in remote locations,

with no access to pipelines, can ship in LNG to ensure sufficient electricity for their operations.

Initiating LNG-based energy production takes some time, as it involves permitting processes as well as infrastructure construction. However, solutions that enable faster market access are rising in popularity. Floating storage and regasification barges (FSRBs) are moveable installations that can be put in place and started up much faster than land-based facilities. They are ideal for projects with clearly defined time frames. An FSRB can provide necessary infrastructure while a permanent, land-based installation is being built.

In shipping as well as in energy production, the availability of fuel is a key concern. So far, the growth of the LNG market has been constrained by insufficient terminal and/or regasification infrastructure in strategic locations. However, port operators are now seeing the advantages of offering LNG services and investing in terminals that serve local industry and energy production, as well as the shipping industry. An LNG terminal also attracts ship traffic to a port, as vessels need to refuel. By bringing in cruise ships, it can even boost local tourism.

In many regions around the world, the need to implement strategies to increase gas supplies to meet demand for electricity and gas peak demand is already on the agenda. Wärtsilä recently achieved mechanical completion at the Tornio Manga LNG terminal in Northern Finland, an area with harsh weather conditions. When in commercial operation, the LNG terminal will serve shipping and road transportation companies, power and heat utilities, as well as other industrial and mining companies, while creating a diversified fuel market and enabling energy growth in northern Europe.

Global view of gas in maps and charts

|

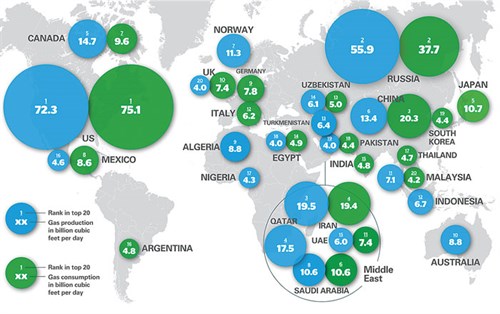

Which countries are the world’s largest producers and consumers of natural gas? Which countries relied on LNG imports in 2016? How much gas might be extracted in the future? BP recently examined how the fastest-growing hydrocarbon fuel will help meet global energy needs in the future.

While the US retained its position as both number-one natural gas producer and consumer in 2016, its production fell (by 2.5%) for the first time since the shale gas revolution began in earnest in the mid-2000s, caused by falls in gas and oil prices.

Outside the US, gas consumption in Europe rose strongly in 2016 (by 6%), helped by both the increasing competitiveness of gas relative to coal and weakness in European nuclear and renewable energy.

The Middle East and China both recorded strong increases in consumption, aided by improving infrastructure and availability of gas. The largest declines were seen in Russia (3.2%) and Brazil (12.5%). On the supply side, Australian production saw a 25.2% increase as several

new LNG facilities came onstream.

Turkmenistan may send gas to Europe through Russia

|

Turkmenistan may ship natural gas to Eastern Europe through Russia, as Russia has stopped buying gas from the Central Asian nation. Russia’s import halt has effectively left Turkmenistan with China as the sole buyer of its gas, which has put a strain on Turkmenistan’s economy.

Turkmenistan has north-running pipelines that it has used to export gas to Russia and CIS countries in the past. If the country can strike mutually acceptable deals with buyer and transit nations, then the existing pipelines can be utilized to transport Turkmenistan’s gas to Eastern Europe and the CIS.

Turkmenistan produces approximately 70 Bm3y of gas; Russia purchased up to 40 Bm3y of the supply, until 2016. Last year, Turkmenistan exported just 37.3 Bm3 of gas, of which 29.4 Bm3 was sent to China.

AG&P to develop LNG import terminal at Indian port

|

Philippines-based Atlantic, Gulf and Pacific Company (AG&P) has signed

an exclusivity agreement with Karaikal Port Pvt Ltd. (KPPL) to develop

an LNG import terminal at the port, including LNG sourcing and supply.

AG&P has also executed exclusivity with PPN Power to supply LNG.

The Karaikal Port is a deepwater facility located on the east coast of India. As part of the port’s expansion beyond commercial cargoes, it allocated

an area within its existing breakwater to develop an LNG terminal to serve power, industrial and other customers in the region. The port received its environmental approval for this

LNG terminal development in May 2017.

The development of AG&P’s LNG import terminal at Karaikal Port will complement Indian Oil’s under-construction LNG terminal at Ennore, 300 km to the north, and will provide wider gas accessibility to Puducherry and Tamil Nadu.

It will serve the heavily industrialized region of central Tamil Nadu, which has major manufacturing clusters for the fertilizer, cement, steel, textile, leather, sugar and garment industries located within its 300-km catchment area. In addition, it will serve the gas-fired power industry and multiple other demand centers

via pipeline and/or the city gas distribution network.

Shell expands marine LNG network

Shell Trading (US) Co. has finalized a long-term charter agreement with Q-LNG Transport LLC for an LNG bunker barge with the capacity to carry 4,000 m3 of LNG fuel. As the first of its kind to be based in the US, the ocean-going LNG bunker barge will supply LNG to marine customers along the southern East Coast of the US and support growing cruise line demand for LNG marine fuel.

The LNG bunker barge will be owned and built by Q-LNG Transport, and operated by Harvey Gulf International Marine LLC. With its pioneering design and delivery capabilities, the LNG bunker barge will be highly efficient and maneuverable. It will also feature an innovative transfer system enabling it to load LNG from big or small terminals and bunker a variety of customers.

More shipowners and operators are choosing cleaner-burning LNG fuel over traditional marine fuels to respond to sulfur and nitrogen oxide emissions regulations, including the International Maritime Organization (IMO) decision to implement a global 0.5% sulfur cap for bunker fuel in 2020.

Comments