The new GTL: Small-scale technology will propel GTL ahead

S. Golan, CEO, Primus Green Energy, Hillsborough, New Jersey

The unlocking of shale gas reserves through horizontal drilling and hydraulic fracturing has stimulated interest in the oil and gas industry in GTL technologies. These technologies theoretically allow producers to transform the US’ newfound abundance of natural gas (for which prices have declined by approximately 70% over the past six years) into valuable transportation fuels.

The interest is “theoretical” only because initial interest in GTL technologies is apt to fade in the face of the perceived expense, inefficiency and general impracticability. This reputation has come about because of the huge expense of GTL plants using the Fischer-Tropsch (FT) technology, such as Shell’s Pearl facility in Qatar, which is said to have a final cost of $24 B—billions more than originally anticipated.

This expense has meant that only a handful of GTL plants are using the FT technology worldwide. Shell was the pioneer, opening the world’s first commercial-scale GTL plant in Bintulu, Malaysia, in 1993. In 2007, South African energy giant Sasol opened its flagship Oryx plant in Qatar, its first outside of South Africa, which produces more than 32 Mbpd.

Large-scale GTL fails to get US ‘green card.’ While the US’ abundance of natural gas has attracted interest from Sasol and Shell, both companies have strayed from their initial plans to construct GTL plants on US soil, largely due to plummeting oil prices.

Shell has dropped its plans to build a $20-B plant on the Gulf Coast, while Sasol has shelved plans for an $11-B Gulf Coast project. Hopes for job and economic growth from the massive projects suffered major setbacks in December 2013 and January 2015, when Shell and Sasol made their respective announcements.

If either company is seeking confirmation that it has made the right decision, it need only look at Chevron’s 33-Mbpd Escravos plant in Nigeria, which came online this past September. The numbers are not pretty: The project was completed nine years behind schedule and, although the initial cost estimate was $1.7 B, the final construction costs totaled nearly $10 B.

Technology flexibility essential for GTL success. This rocky history has led to increased skepticism about the economic viability of large-scale GTL plants. Those who dismiss GTL, however, should keep in mind that: (1) FT isn’t the only GTL technology; (2) not all GTL technologies should be tarred with the FT brush; and (3) GTL remains an attractive option, especially given the combination of abundant, cheap natural gas and a high demand for liquid fuels.

|

|

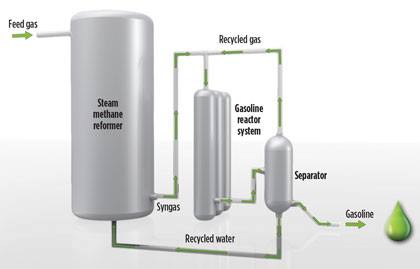

Fig. 1. Flow diagram of the STG+ process. |

Primus Green Energy has developed a GTL technology, STG+, which is economical at scales that are orders of magnitude smaller than FT-based plants (Fig. 1). In addition to mid-size GTL plants producing about 2 Mbpd, the STG+ technology can be used in modular units producing as little as 500 bpd that can be deployed onsite at oil and gas fields (Fig. 2).

|

|

Fig. 2. Primus Green Energy’s 100-Mgpy demonstration plant in Hillsborough, |

The low cost and high efficiency of STG+ is expected to lead to the development of a thriving domestic GTL industry that will allow oil and gas companies to leverage the low cost of natural gas, even with the recent plummet in oil prices. The cost of gasoline produced at STG+ plants is still competitive with the cost of fuel produced from oil, when STG+ uses market-rate pipeline natural gas as a feedstock, due to the technology’s advantages over competing GTL processes.

Perhaps more importantly, however, the market for the STG+ technology is insulated from crude oil price drops because of the strong demand for solutions to the problem of associated gas. Oil and gas companies can use STG+ in situations where the natural gas byproduct of oil production is flared because no pipeline infrastructure exists to move it to market, and at smaller gas fields where scale and lack of pipeline access are limiting factors. Less than 10% of the world’s gas fields are large enough to sustain even a 10-Mbpd GTL facility, much less a 140-Mbpd facility, such as the Pearl plant.

With a GTL technology that is economically viable at the 2-Mbpd scale, the GTL potential of 40% of the world’s gas fields could be unlocked.

Advantages of small-scale GTL. Why can STG+ perform efficiently and cost-effectively while FT cannot? The trouble with FT is twofold: It produces a synthetic crude oil that must be further refined before end use, and it yields primarily diesel and lubricants—not gasoline, the desirable end product.

While some companies are now trying to use FT on a smaller scale, including for both mid-size plants and modular units, the two-step synthesis and refining process is an inherent limitation that adds considerably to the expense.

By contrast, STG+ uses a continuous, gas-phase single-loop process that is more efficient than FT. A hydrocarbon gas feedstock goes in one end, and a single product—gasoline—comes out the other.

Moreover, the STG+ process produces a high-quality end product, which contains fewer impurities because it is synthesized rather than extracted from the ground. The gasoline produced through STG+ meets all ASTM standards, as well as the US Environmental Protection Agency’s proposed Tier 3 standards for sulfur content.

Another advantage of the STG+ technology is the range of end products. In addition to gasoline, Primus’ systems can yield diluent or methanol, depending on market demand and customer needs. In flared gas applications, customers may also choose the option of producing a liquid fuel that is miscible in crude oil and can be added to the crude produced at the wellhead for easy transportation offsite.

Finally, the fuels produced through the STG+ process are competitive in price with fuels produced from crude oil when crude is selling at $55/bbl, a figure that includes market-rate feedstock cost. Even with today’s historically low price of oil, the STG+ process can profitably produce high-quality gasoline.

On the path to commercialization. STG+ is now available commercially, and groundbreakings for the first plants are planned for this year in North America and Eurasia.

By transforming the US’ vast domestic resources of natural gas into valuable transportation fuels, GTL can increase energy independence, stimulate the economy and reduce greenhouse gas emissions.

However, it is important to recognize that these benefits are not true of all GTL technologies. While FT may be the grandfather of GTL, the massive capital investment required renders it impractical in most situations.

With STG+, it is possible to unlock the advantages of GTL with low-cost, high-efficiency plants that do not require multibillion-dollar capital investments. GP

|

Sam Golan, CEO of Primus Green Energy, is a seasoned general manager with experience as a hands-on executive, leading multinational engineering, project management and manufacturing software companies from the entrepreneurial stage to an established market presence. He served as the general manager of Cimatron Israel and Cimatron Technologies in North America. He also co-founded and managed Smart Team, a PLM company acquired by Dassault Systems SA. Mr. Golan holds a BA degree in economics and business administration.

Comments