Business Trends

J. THOMAS, Atlantic, Gulf and Pacific Co., Jakarta, Indonesia

Indonesia, home to 260 MM people on 14,000 islands across a vast archipelago, is estimated to become the seventh-largest economy in the world by 2030, with such growth expected to boost the nation’s energy consumption by 80% from present levels.1 This energy imperative has triggered public and private sector initiatives in Indonesia to bolster an appropriate portfolio of new energy supplies, and to invest in the needed infrastructure to bring progressive, sustainable energy supplies to even the remotest parts of Indonesia.

|

|

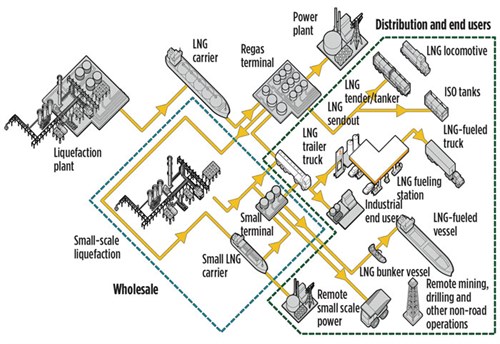

FIG. 1. Asia’s fast-growing gas markets need a well-functioning LNG supply chain. Source: International Gas Union. |

Essential to such plans is the need to increase the presence of natural gas within Indonesia’s energy mix, as gas accounts for just 15% of total energy consumption at present. However, uncertainty exists regarding how alternative energy sources, such as LNG, can fulfill the growing and geographically distributed nature of Indonesia’s energy needs in the near-total absence of the transport, storage, break-bulk and regasification supply chain infrastructure that must be developed to ensure uninterrupted supply of LNG and gas (Fig. 1). In short, Indonesia needs sustainable and affordable LNG distribution networks. Break-bulk locations and smaller receiving terminals will play critical roles in these networks, alongside Indonesia’s existing major onshore LNG hubs of Tangguh, Donggi-Senoro and Bontang; its West Java, Lampung and Bali Benoa floating assets; and its Arun receiving terminal.

The country anticipates surplus domestic gas and LNG supplies until at least 2020. Concerted resource-use planning between the public and private sectors is needed to establish an effective and well-functioning gas supply chain. The implementation of such a chain would increase LNG availability across Indonesia to match the widespread availability of diesel and other oil-based distillates.

The pivotal role of public policy. In 2006, Indonesia signed a presidential decree to cut the economy’s dependence on petroleum and to promote natural gas use for the diversification of its energy sources. Additionally, with the Paris Accord of 2012, the government is proactively focusing on cutting carbon emissions, with the use of LNG as a cleaner-burning transition fuel being a critical part of this initiative.

Indonesian public policy also aims to deliver more benefits from the nation’s vast and geographically dispersed minerals and metals resources through increased public and private sector ownership of such resources, banning the export of unprocessed ores and developing value-added refining. In parallel, there has been active encouragement of LNG and gas as fuel in place of diesel in captive power installations. These installations serve Indonesia’s generally remote and off-grid mine and refinery locations.

Commencing with the Law on Mineral and Coal Mining No. 4 of 2009, and culminating in the January 2014 ban on the export of all unrefined metal ores, the government’s resolve to conserve non-renewable resources—unless they contribute in a broader way to the national economy—has been demonstrated as of September 2017. These conservation measures will foster the growth of domestic downstream industries, like smelters, and help the country reduce the imports required to satisfy rising domestic demand for metals.

Investments in domestic minerals and metals processing capacity and the energy supply chains to support this processing have commenced, following the January 2014 raw ore export ban. The founding of the Bantaeng Industrial Park on the nickel-rich island of Sulawesi is a case in point. Since its creation, the Bantaeng Industrial Park has attracted domestic and foreign investment in nickel smelters, and has spurred the demand for reliable power generation capable of catering to the fluctuating load requirements of electric arc furnaces. Today, the region needs more reliable and sustainable installed capacity with a reserve margin beyond that which is presently available.

|

|

FIG. 2. AG&P will deliver LNG to smaller power companies and stranded industrial customers by developing LNG receiving terminals and the associated supply chain infrastructure. |

The groundwork to establish the energy supply chain infrastructure to cater to the captive power requirements of the Bantaeng Industrial Park nickel smelters and other industrial tenants is already underway. This infrastructure will ensure that LNG supplies reach South Sulawesi and adjoining regions in an uninterrupted manner (Fig. 2).

With Indonesia’s major onshore gas pipeline networks largely limited to the islands of Java and Sumatra, and power generation across the country largely based on diesel, there is an inherent need to build LNG receiving, storage and break-bulk terminals across many of Indonesia’s 33 provinces, including Sulawesi. An estimated investment of $8 B is required, and the private sector will play a major role in unlocking the transnational LNG ecosystem envisaged by the government.

When opportunity comes knocking. While the need for the private sector to step in is established and accepted, the prevailing abundance of LNG supplies and the sustained low LNG pricing environment present an opportunity for Indonesia. The country may be able to improve the cost-effectiveness of its power generation and the competitiveness of several local industries by swapping oil and distillates with LNG and gas as primary fuel sources.

Companies must begin investing in projects to help build an LNG supply chain infrastructure across Indonesia for gas transmission, distribution and storage. Although the capital expenditures in this process are substantial, the transition could be made a reality with a consortium of Indonesia’s public and private sectors with perceptive international finance and technical partners. This idea is the focus for Philippines-based Atlantic, Gulf and Pacific Co. (AG&P). AG&P has taken the first step to establish a supply chain to serve local, off-grid customers across the Indonesian archipelago via standardized designs and solutions that integrate maritime and onshore LNG transport, storage, break-bulk and regasification assets.

LNG import terminal in Sulawesi. The desire to develop an ecosystem for LNG in Indonesia prompted a heads of agreement to be signed in August 2017 with PT Energi Nusantara Merah Putih (ENMP). Under the agreement, AG&P and ENMP will jointly develop an integrated LNG receiving and regasification terminal and a combined-cycle power plant to serve the anchor nickel smelter tenants of the Bantaeng Industrial Park and nearby industries.

|

|

FIG. 3. AG&P’s unique design for a standardized 125-MMsft3d onshore regasification terminal is built modularly, significantly reducing cost and construction time. |

AG&P’s terminal design includes an FSU with a storage capacity of at least 125 Mm3, and onshore regasification facilities comprising trains of modular skids of 125 MMsft3d (Fig. 3). When complete, the integrated facility will provide power to a 3,000-hectare industrial park where nine nickel smelters will operate, making it a major center for Indonesia’s nickel export industry. In addition to nickel smelters, the park will have a small refinery. Other industrial customers are located across central and eastern Indonesia.

Beyond Sulawesi. Projects like the South Sulawesi LNG import terminal are laying the groundwork to establish Indonesia as a leader in the use of LNG as a fuel, not only for energy, but also as a catalyst for value-added industrial development. With new contracts for LNG offtake becoming more flexible, options are being added for Indonesian industries to adopt LNG in their investment plans. LNG traders are developing new markets and pricing trends, which stand to nurture Indonesia’s LNG market. Indonesia is already embracing regional two-tier pricing formulas that allow resales.

The country is poised to lead the adoption of LNG as a fuel in Southeast Asia. Standardized and modularized approaches will help create the LNG transport, storage, regasification and break-bulk supply chain infrastructure necessary for the transformation of Indonesia’s energy landscape and economy.

A holistic approach will be required to develop the supply chains that Indonesia’s LNG market requires to attain its full potential. To this end, the government and the private sector must deepen their collaboration. AG&P is ready to support this generational shift in energy distribution. GP

|

Julian Thomas is the Vice President of Corporate at Atlantic, Gulf and Pacific Co. (AG&P), based in Indonesia. With more than 30 yr of experience in marine engineering, he joined AG&P in January 2012 to represent the company in Australia. He also oversaw AG&P’s interests in the turnkey charter of the 16-Mt construction pontoon, Hydro Deck 1, to client JKC Australia Pty Ltd., the onshore EPC to the Ichthys LNG project in Darwin, Australia. Since July 2016, Mr. Thomas has been based in Jakarta, supporting Indonesian clients of AG&P’s LNG transport, storage, regasification and floating power solutions, and interfacing with AG&P’s Indonesian partner, Risco Energy. Mr. Thomas graduated from Griffith University in Brisbane, Australia with degrees in accountancy and Asian studies, the latter with majors in Indonesian economy and language.

Comments